What is a Financial Statement?

Financial Statements are a set of reports summarizing the activities of a business or organization. Much like a series of x-rays shows different views of an injured ankle, each one of the major financial statements shows a different view of a business. Taken together, those pictures of the business provide valuable information about the performance of a business.

Why are Financial Statements Important?

Financial Statements provide important financial information about the performance of the business or organization. The reliability of the information reported is critical because users of Financial Statements use the information in a variety of ways including:

- Making decisions about the future of the company

- Determining if the company can meets its debt obligations

- Whether the company is profitable

- Deciding on company strategies and tactics.

- Tracking growth.

- Monitoring return on investment

- Analyzing value of stock

- Allocating resources

- Investing in capital projects or equipment

Who Uses Financial Statements?

Users of Financial Statements and financial information may be either internal users (people in the organization) or external users (people outside of the organization) and may include:

- Company executives and managers

- Owners

- Banks

- Vendors and suppliers

- Outside accountants

- Investors

- Market analysts.

- Shareholders

- Government agencies

- Rating agencies

- Unions

- Major customers

- Employees

- Competitors

What are the Four Major Financial Statements?

The four major financial statements are:

- Income Statement (Profit and Loss Statement)

- Statement of Owner’s Equity (or Statement of Shareholders’ Equity or Retained Earnings)

- Balance Sheet

- Statement of Cash Flows

A fifth financial statement sometimes included in this list is the Statement of Comprehensive Income.

How are Financial Statements Prepared?

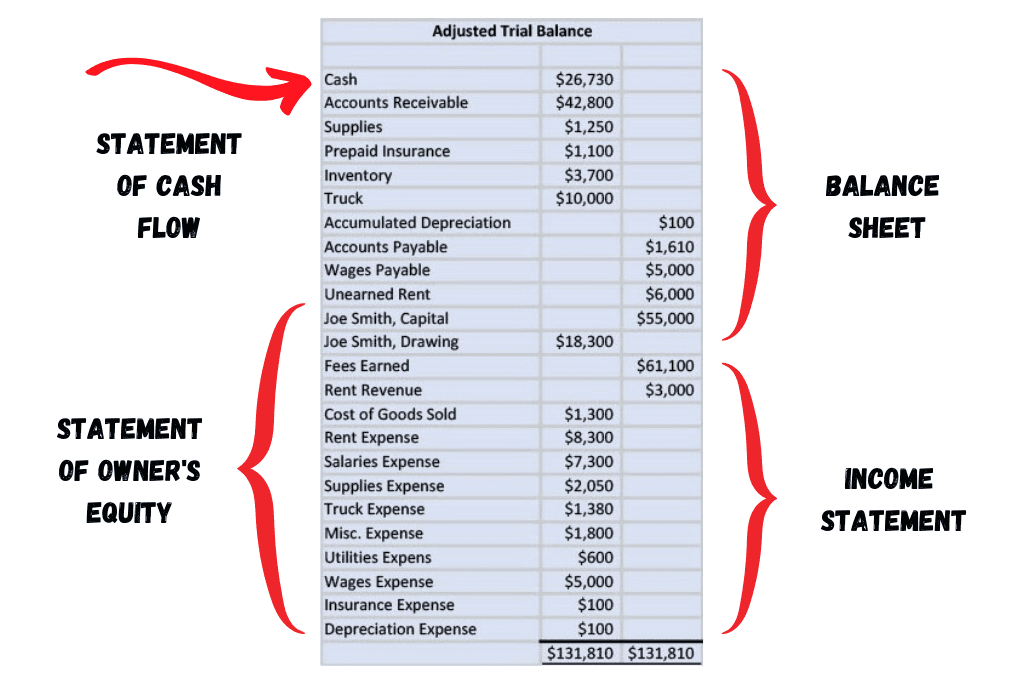

Before Financial Statements can be prepared, all transactions and adjustments for the accounting period need to be verified and finalized. Once this is done, the company produces an Adjusted Trial Balance. The Adjusted Trial Balance is a report that lists all the accounts in the Chart of Accounts with the balance for each. The Adjusted Trial Balance is the basis for preparing Financial Statements.

When using accounting software the reporting process goes on behind the scenes. For the purposes of Accounting classes, the process is done manually to allow students to understand the process involved.

The Adjusted Trial Balance and Financial Statements

The Adjusted Trial Balance contains all the information needed to complete basic financial statements.

In What Order are Financial Statements Prepared?

Because the information on Financial Statements is linked, Financial Statements must be completed in a specific order. That order is:

How are Financial Statements Linked?

Information in Financial Statements is linked as follows:

The first Financial Statement to be completed is the Income Statement. Net Income from the Income Statement is needed to complete the Statement of Owner’s Equity. The balances of the Equity accounts form the Statement of Owner’s Equity are needed to complete the Equity section of the Balance Sheet. The information from the Balance Sheet is needed to complete the Statement of Cash Flows.

For more information about how Financial Statements are linked, watch this video:

What is an Income Statement or Profit & Loss Statement?

The Income Statement or Profit & Loss Statement shows Revenues, Expenses, and Net Income/Loss (Profit/Loss). It captures the total revenue a business earned in the accounting period and compares it to the total expenses incurred in earning that revenue.

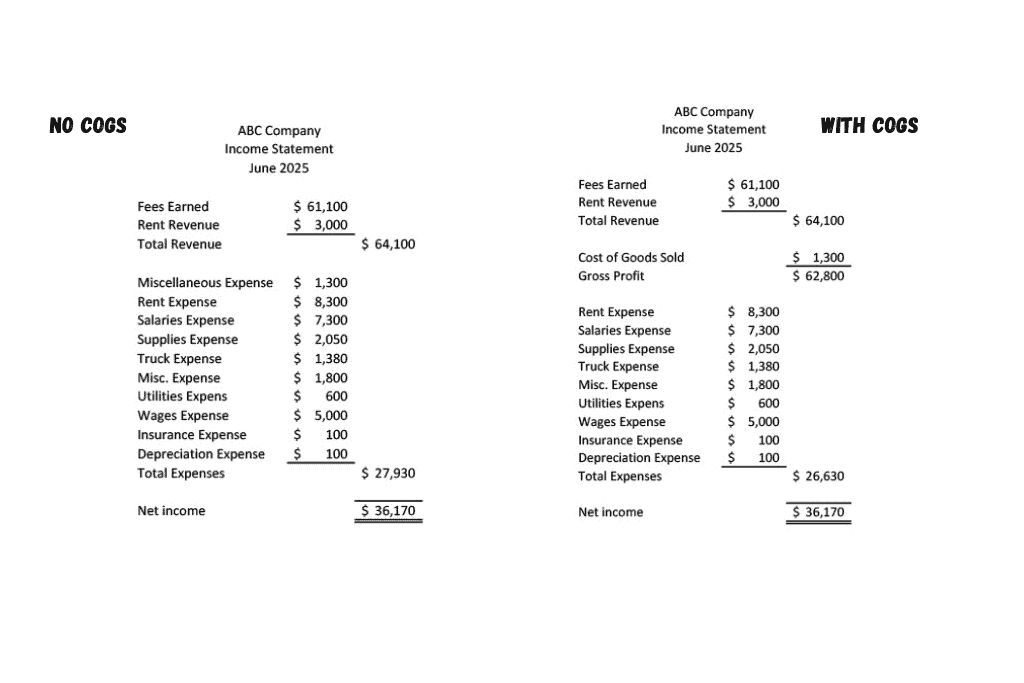

For businesses that sell or manufacture goods, an additional section is added to the Income Statement to track the cost of the goods that were sold during the accounting period.

Income Statements can be Single Step (no cost of goods section) or Multi-step (cost of goods section and additional categorization of expenses, for example Selling Expenses and Administrative Expenses.)

What Accounts are on the Income Statement?

The Types of Accounts found on an Income Statement are:

- Revenues

- Expenses

- Other income/expenses

- Gains/losses on sales of assets

What Does the Income Statement Show?

The Income Statement is the scoreboard of the business, showing the relationship between revenue and expense. When revenues are greater than expenses, the business has profit. When expenses are greater than revenue, the business has a loss. Tracking Revenue and Expenses from month to month and year to year allows for identification of problems and opportunities related to company profits.

How to Prepare an Income Statement

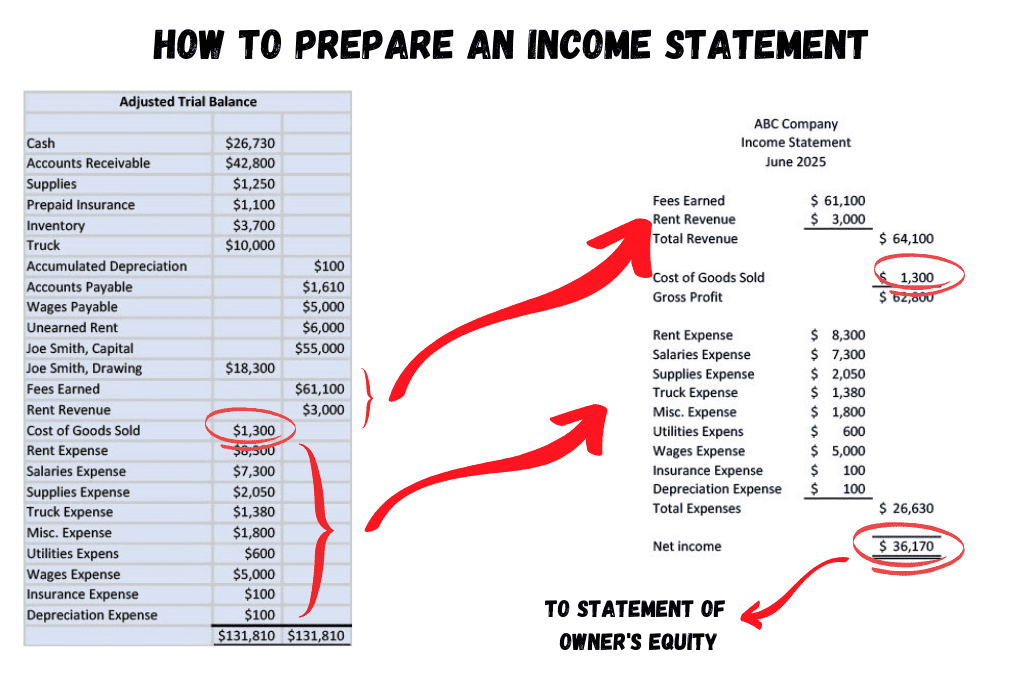

To prepare an Income Statement, follow these steps:

- Choose time period: Income Statements are usually done for a month, a quarter, and/or a year.

- Complete all regular transactions for the time period chosen.

- Complete all adjusting entries for the time period chosen.

- Create an Adjusted Trial Balance.

- On the Income Statement, add the heading to include name of the business, financial statement name, period of time covered.

- List each revenue account and its balance (use left column if more than one revenue account)

- Total the revenue accounts (use right column)

- List cost of goods sold (COGS) accounts (if used by business)

- If using cost of goods sold, add a line for Gross Profit (right column)

- List each expense account and its balance (left column)

- Total all expense accounts (right column)

- Enter Net Income (right column) using either Gross Profit – Total Expenses (companies using COGS) or Total Revenue – Total Expenses (companies not using COGS).

Example of an Income Statement

For more examples of Income Statements for different types of businesses, watch this video:

What is a Statement of Owner’s or Shareholders’ Equity?

The Statement of Owner’s Equity tracks the changes in the value of the owner’s stake in the business. The name of the statement reflects the form of ownership of a company.

| Statement of Owner’s Equity | Sole Proprietor (one owner, not incorporated) |

| Statement of Partners’ Equity | Partnership (two or more owners, not incorporated) |

| Statement of Members’ Equity | Limited Liability Company (LLC) (one or more owners, not incorporated |

| Statement of Shareholder’s Equity | Corporation or S Corporation (one or more owners, incorporated) |

| Statement of Retained Earnings | Corporation or S Corporation (one or more owners, incorporated) |

What Accounts are on the Statement of Owner’s Equity?

Unlike the Income Statement and Balance Sheet, the Statement of Owner’s Equity or Shareholders’ Equity isn’t a listing of accounts. Instead, it is a worksheet for tracking changes in equity.

It starts with the Beginning Balance on the first day of the accounting period, adds net income or subtracts net loss, and tracks withdrawals of cash. The ending balance reflects the changes for that period of time. The ending balance flows through to the equity section of the Balance Sheet.

What Does the Statement of Owner’s Equity Show?

The Statement of Owner’s or Shareholders’ Equity shows the owners of a business whether their investment in that business is making or losing money. If the ending balance is greater than the beginning balance, value has increased for the owner(s). If the ending balance is less than the beginning balance, value has decreased for the owner(s).

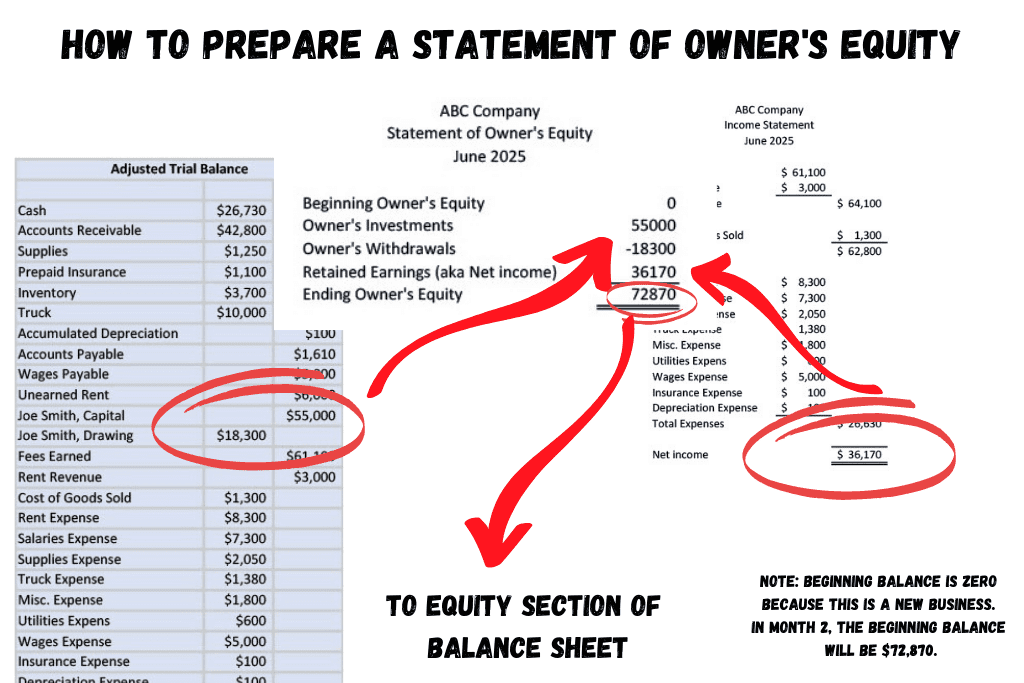

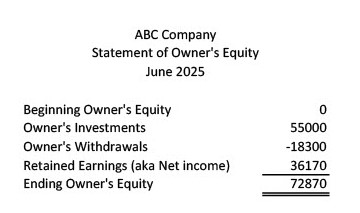

How to Prepare a Statement of Owner’s Equity

To prepare a Statement of Owner’s or Shareholders’ Equity, follow these steps:

- Complete Income Statement

- Start with the ending balance from last month. This is now the beginning balance from last month. In the example used, this is a new business. The beginning balance for a new business is zero.

- From the adjusted trial balance, add the owner investments. For the example business, this account is called Joe Smith, Capital.

- From the adjusted trial balance, subtract owner’s withdrawals. For the example business, this account is called Joe Smith, Drawing.

- From the Income Statement, add Net Income or subtract Net Loss.

- Calculate Ending Owner’s Equity. (This becomes the Beginning Owner’s Equity balance for next month.)

- The Ending Owner’s Equity balance will flow through to the Equity Section of the Balance Sheet.

Example of a Statement of Owner’s Equity

For more examples of how to prepare the Statement of Owner’s or Shareholders’ Equity, watch this video:

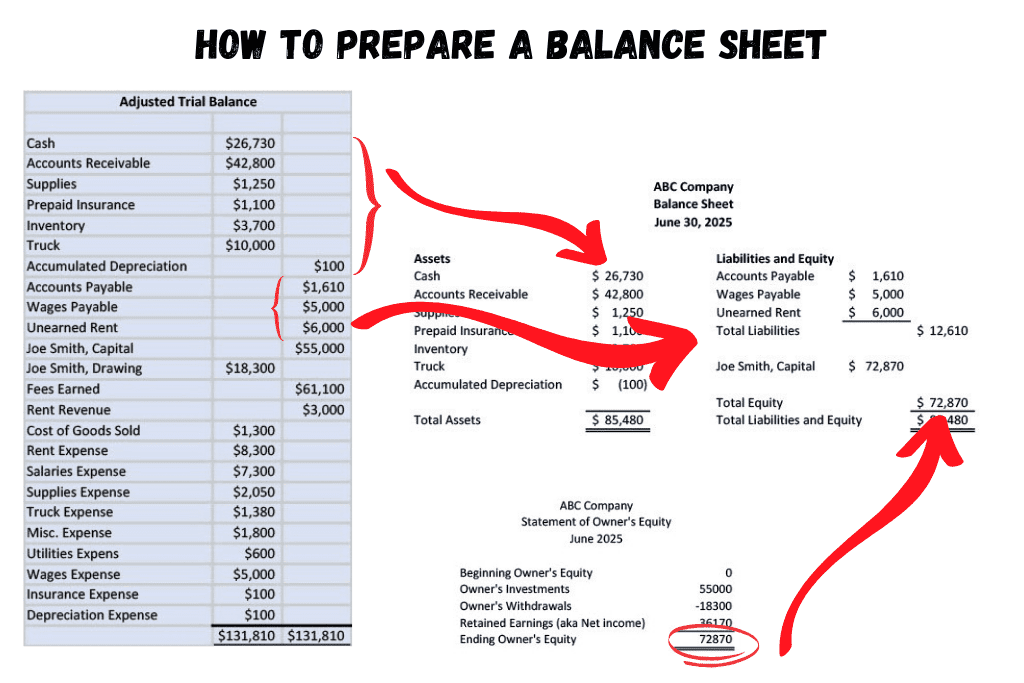

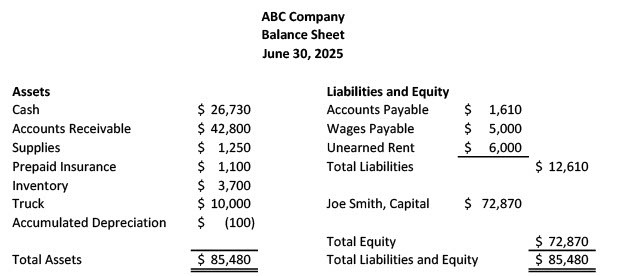

What is a Balance Sheet?

A balance sheet provides a snapshot of the balances in the asset, liability, and equity account at a given time. It is a summary of all assets, liabilities, and equity of a business. Following the Accounting Equation (Assets = Liabilities + Equity), the balance sheet lists assets on the left side and liabilities and stockholders’ equity on the right side.

What Accounts are on the Balance Sheet?

The types of accounts on the balance sheet are Assets, Liabilities, and Equity accounts. Also included are contra accounts such as Accumulated Depreciation and Allowance for Doubtful Accounts.

What Does the Balance Sheet Show?

The balance sheet shows the value of business assets, obligations the business owes (liabilities), and equity (the difference between assets and liabilities.) It shows how much money the business owner would have left over if all assets were sold and all liabilities were paid.

How to Prepare a Balance Sheet

Preparing the Balance Sheet starts with the Adjusted Trial Balance and the Statement of Owner’s Equity. From the Adjusted Trial Balance, Asset accounts and balances are listed in the left column. Liability accounts and balances are listed in the right column.

The owner’s equity amount comes from the Statement of Owner’s Equity.

The left side of the balance sheet should always equal the right side of the balance sheet. The date listed on the balance sheet is always the date of the balances, rather than an accounting period as done with the Income Statement and Statement of Owner’s Equity.

Example of a Balance Sheet

For more information and examples about Balance Sheets, watch this video:

What is the Statement of Cash Flows?

The Statement of Cash Flows shows cash inflows (sources of cash) and cash outflows (uses of cash). Sources of cash increase the cash balance. Uses of cash decreases the cash balance.

The Statement of Cash Flows categorizes cash inflows and outflows based on the activities of the business that generate cash or use cash. The categories tracked are Operating Activities, Investing Activities, and Financing Activities.

Statement of Cash Flows in the First Four Chapters of Accounting

Because preparing a statement of cash flows can be complicated, in the first four chapters of accounting textbooks it is usually only covered briefly. The following is provided to give a general overview for those instances when accounting classes or textbooks cover the material.

What Does the Statement of Cash Flows Show?

The Statement of Cash Flows provides insight on how cash is being generated and spent in a business. It demonstrates a company’s ability to:

- Generate cash from its operations (selling to customers, paying bills and payroll.)

- Increase capacity to produce more goods or deliver more services.

- Meet its short- and long-term financial obligations.

- Pay dividends to owners or stockholders.

Statement of Cash Flows: Operating Activities

Operating Activities for a business include revenues and expenses from day to day business transactions. Examples of operating activities include:

- Cash from Cash sales to customers (source).

- Cash received from Accounts Receivable accounts (sources).

- Expenses incurred in the day-to-day operation of the business: supplies, rent, payroll, electricity (use).

Statement of Cash Flows: Investing Activities

Investing Activities for a business relate to the long-term assets of a business. Examples of investing activities include:

- Purchasing a piece of equipment (use).

- Selling a piece of equipment (source).

- Purchasing investments or bonds (use).

- Selling investments or bonds (source).

Statement of Cash Flows: Financing Activities

Financing Activities relate to long-term liabilities and stockholders’ equity. Examples of financing activities include:

- Selling stock (source).

- Issuing bonds (source).

- Borrowing cash from a bank (source).

- Repaying loans (use).

- Paying maturing bonds (use).

- Purchasing Treasury Stock (use).

- Paying cash dividends (use).

How to Prepare a Statement of Cash Flows

To prepare a Statement of Cash Flows:

- Start with the cash balance at the beginning of the period.

- Calculate cash flow from Operating Activities (Sources – Uses = increase/decrease in cash)

- Calculate cash flow from Investing Activities (Sources – Uses = increase/decrease in cash)

- Calculate cash flow from Financing Activities (Sources – Uses = increase/decrease in cash)

- Calculate the ending cash balance.

- Determine the net amount of increase or decrease to the cash balance.

To learn more about the Statement of Cash Flows, watch this video:

What Do Financial Statements Tell Us?

Each Financial Statement shows a different picture of the business and how it is performing.

The Income Statement tracks profitability and growth.

The Statement of Owner’s Equity tracks the owner’s investment and return.

The Balance Sheet tracks the value of assets and solvency of the business.

The Statement of Cash Flows tracks where cash comes from and where it goes.

Taken together, and compared over months and years, a solid understanding of the health of the business is available for business owners, managers, creditors, and investors.

For more in depth understanding about what financial statements reveal about a business, check out this Accounting Student Guide:

-

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

Understanding Financial Statements | Accounting Student Guide

What is a Financial Statement? Financial Statements are a set of reports summarizing the activities of a business or organization. Much like a series of x-rays shows different views of

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

What is Stockholders’ Equity?

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital

-

What is Paid in Capital?

What is Contributed or Paid-in Capital? Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or

-

What is the Difference Between Debt Financing and Equity Financing?

When businesses needs funds to expand or grow the business, that capital can come from three sources: Funds from profits Funds from debt Funds from equity Funding business growth from