A Chart of Accounts is a listing of the accounts a company uses to categorize transactions. The accounts are the buckets of information a business needs to track. A Chart of Accounts is specific to the individual business and what is important for that business to track. A Chart of Accounts lists accounts of the same type together for organizing and simplicity.

What are the Five Account Types in a Chart of Accounts?

The accounts in a Chart of Accounts are broken into five broad categories:

What are the Account Types in QuickBooks?

Accounting software like QuickBooks uses additional account types to signify to the software that specific features are needed. For example, choosing an account type called “Bank” signifies to the software that bank feeds and account reconciliation features are needed.

In addition to the five main types of accounts listed above, accounting software also uses these types of accounts:

- Bank (an asset account)

- Accounts Receivable (an asset account)

- Fixed Asset (an asset account)

- Accounts Payable (a liability account)

- Credit Card (a liability account)

- Loan or Long Term Liability (liability accounts)

- Cost of Goods Sold (an expense account)

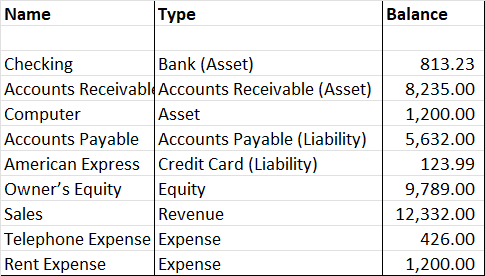

What is an Example of a Chart of Accounts?

The following chart shows a sample Chart of Accounts from accounting software.

For more information about Chart of Accounts, watch this video:

-

How Do Journal Entries Work in Accounting?

Journal entries are one of the most fundamental and essential concepts in accounting. A journal entry is a record of a transaction that affects a company’s financial statements. Journal entries

-

What is a Statement of Shareholders’ Equity?

The Statement of Shareholders’ Equity is one of the four major financial statements. The function of the Statement of Shareholders’ Equity is to show changes in the value of equity

-

Accounting for Notes Receivable | Accounting Student Guide

What is a Note Receivable? A note receivable is formal payment agreement between two or more people or entities. It is a promissory note that specifies: Who the note is

-

How to Post Journal Entries to the Ledger

When a Journal Entry is made to record a transaction, that Journal Entry is then entered (posted) in the accounts being impacted. For example, when rent is paid, in the

-

What is the Accounting Equation?

Before you can understand debits and credits, you’ll need a little background on the structure of accounting. It all starts with the Accounting Equation. The Accounting Equation is the foundation

-

What is Owner’s Draw (Owner’s Withdrawal) in Accounting?

Owner’s Draw or Owner’s Withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Business owners may use