Owner’s Draw or Owner’s Withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Business owners may use an owner’s draw rather than taking a salary from the business. Owner’s Draw can be used by sole proprietors, partners, and members of an LLC (Limited Liability Company), but not by owners of S Corps or C Corps.

What Type of an Account is Owner’s Draw?

Owner’s Draw is an Equity account. When an owner takes an Owner’s Draw, it reduces the Owner’s Equity.

To learn more about Owner’s Equity, check out this article:

How is an Owner’s Draw Accounted For?

Let’s look at an example. A business owner, Joe Smith, opened his business this year. He initially invested $55,000 of personal funds into the business. Now, Joe wants to draw out some cash from the business.

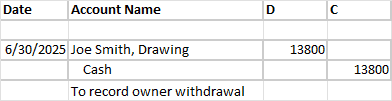

Transaction: Withdrew cash for personal use, $13,800.

Analysis:

When a business owner opens a business, they are turning personal funds into business funds. The business now owes that investment back to the business owner. To put it differently, the funds represent the owner’s equity in the business and are recorded in an account called “Owner’s Name, Equity” or “Owner’s Name, Capital”. The funds become a business asset recorded in the company’s books under an account called “Cash”.

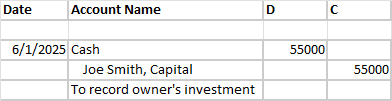

When Joe opened his business, we increased his equity this way:

Now, our business owner wants to withdraw some cash from the business for personal use. When this happens, the business owner’s equity is decreasing. He has less value in his business. Cash is decreasing, as well.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, we are decreasing cash so we credit it.

Now, we want to decrease his equity. To decrease equity we need to debit it. But, we don’t do that in Joe’s main equity account. We want to separate out what he has put into the business from what he took out of the business for several reasons (for example, taxes).

Rather than use the main equity account, we use an account specifically for tracking withdrawals by the owner. For this business, the account we use is called Joe Smith, Drawing. You may also see the account called Owner Name, Withdrawals or Owner Name, Dividends.

Joe Smith, Drawing is a sub-account of the Joe Smith, Capital account. It’s purpose is to reduce an equity account. An equity account has a normal credit balance. It increases on the credit side. In this case, we want to reduce equity so we debit the account.

The impact of this transaction is a decrease to Joe’s equity [$55,000 – $13,800 = 41,200]. If the transaction had been posted to the Joe Smith, Capital account as a debit, that is what the new balance in the account would have been. We are just using the sub-account to track withdrawals.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| -13,800 | = | 0 | + | -13,800 |

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a