In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each.

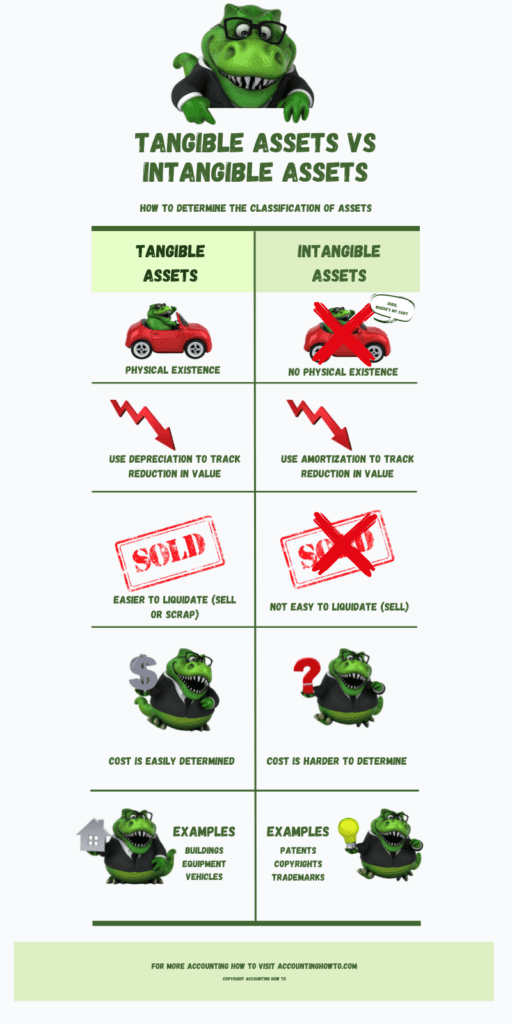

The main difference between Depreciation, Amortization, and Depletion is the type of asset the accounts are associated with. Depreciation is used to capture the reduction in value of a Fixed Asset. Amortization is used to capture the reduction in value of an Intangible Asset. Depletion is used to capture the reduction in value of Natural Resources.

What is Depreciation of a Fixed Asset?

Depreciation is an accounting method used to track the loss of value in fixed assets such as vehicles, equipment, and buildings, spreading the cost of those items over multiple years. Depreciation Expense can be calculated by different methods including Straight Line, Declining Balance, Units of Activity, or Sum of the Years Digits.

What is a Fixed Asset or Long-term Asset?

A Fixed Asset is a long-term asset (or non-current asset), one that a business will hold for longer than a year. These are permanent, tangible items the business intends to own long-term (more than a year). Examples of Fixed Assets are Vehicles, Buildings, Equipment. These Fixed Assets may be referred to as Property, Plant, and Equipment assets or PP&E. They are used in normal business operations. Fixed Assets depreciate over time.

Examples of Fixed Assets Requiring Depreciation

| Vehicles | Building Improvements extending the life of the building (i.e. new roof) |

| Equipment | Software (purchased by company) |

| Improvements to Leased Property (e.g. build outs to commercial property) | Furniture and Fixtures |

| Buildings | Computer Equipment |

For more in depth explanations of depreciation check out this article I wrote or watch this video:

What is the Journal Entry to Record Depreciation?

| Depreciation Expense | $xx | |

| Accumulated Depreciation | $xx |

What is Amortization of Intangible Assets?

Amortization has two meanings in the world of finance. One relates to loans and how interest is applied and paid on those loans. Amortize literally means “to kill.” So, as you pay down a loan, you will eventually “kill” it. The other meaning of amortization is the reduction of the cost of an intangible asset over time.

Amortization of intangible assets is similar to depreciation of fixed assets. The determined cost of the asset is expensed over the life of the asset.

Intangible Assets are items like patents, trademarks, copyrights, other intellectual property, and goodwill. These assets have value for a company and in theory that value reduces over time. In the case of a patent, a patent’s term is twenty years. A trademark’s life is ten years. The determined cost or value and the expected life of the asset are used to determine the amount of the amortization reduction for each year of the asset’s life, much like we do with depreciation on fixed assets.

Examples of Intangible Assets Requiring Amortization

| Patents | Goodwill |

| Copyrights | Customer Lists |

| Trademarks | Films |

| Import Quotas | Software (developed by company) |

How is Amortization for Intangible Assets Calculated?

The most common methods used to calculate amortization for intangible assets are:

- Straight-line–divided evenly over the life of the asset.

- Accelerated–more amortization taken in the early years of the asset.

- Units of Production–based on actual usage of the asset.

What is the Journal Entry to Record Amortization of an Intangible Asset?

The journal entry to record amortization of an intangible asset is similar to the journal entry for depreciation. The difference is we use the accounts Amortization Expense (account type: Expense) and Accumulated Amortization (account type: contra asset.)

| Amortization Expense | $xx | |

| Accumulated Amortization | $xx |

For a more in depth look at Intangible Assets and Amortization, watch this video:

What is Depletion of Natural Resources?

Depletion of Natural Resources occurs when the natural resource is used up faster than it can be replaced. Examples of natural resources include timber, minerals, and oil. In accounting, Depletion is used to track the loss of value that occurs as a resource is depleted. It is similar to depreciation for fixed assets and amortization for intangible assets.

An example of the necessity of recording depletion for natural resources can be seen when a forest is clear cut and not replanted. The original value of the asset has changed because the natural resource is depleted.

How is Depletion of Natural Resource Calculated?

Unlike Depreciation of Fixed Assets that have a specific class life, Depletion of Natural Resources is calculated based on an estimate of how much of the natural resource is available for extraction (for example: how many gallons of oil). A cost per unit amount is determined based on the purchase price of the natural resource plus costs involved with exploration and development. The costs of purchase and extraction total is divided by the estimated extraction units (gallons, pounds, board feet) to arrive at the cost per unit. Then, the number of units extracted is multiplied by the cost per unit to arrive at the depletion amount.

Examples of Natural Resources Assets Requiring Depletion

| Timber | Precious Metals |

| Coal | Gemstones |

| Oil | Films |

What is the Journal Entry to Record Depletion of Natural Resources?

| Depletion Expense | $xx | |

| Accumulated Depletion | $xx |

For a deeper understanding of Depletion, watch this video:

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

Adjusting Journal Entries | Accounting Student Guide

When all the regular day-to-day transactions of an accounting period are completed, the next step is to check on the balances of certain accounts to see if those balances need

-

What is a Contra Account?

A contra account is an account used to offset the balance in a related account. When the main account is netted against the contra account, the contra account reduces the

-

How to Calculate Straight Line Depreciation

Straight-line Depreciation is used to depreciate Fixed Assets in equal amounts over the life of the asset. The basic formula to calculate Straight-line Depreciation is: (Cost – Salvage Value) /

-

How to Calculate Declining Balance Depreciation

Declining Balance Depreciation is an accelerated cost recovery (expensing) of an asset that expenses higher amounts at the start of an assets life and declining amounts as the class life

-

How to Calculate Units of Activity or Units of Production Depreciation

Units of Activity or Units of Production depreciation method is calculated using units of use for an asset. Those units may be based on mileage, hours, or output specific to