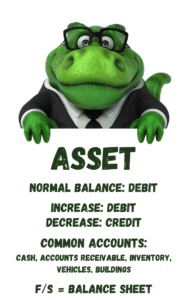

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible item such as a copyright or trademark. Assets have a normal debit balance. Assets are listed on the Balance Sheet. Other examples of Assets include Cash, Accounts Receivable, Inventory, Prepaid Expenses, Equipment, and Buildings.

What are Some Examples of Assets?

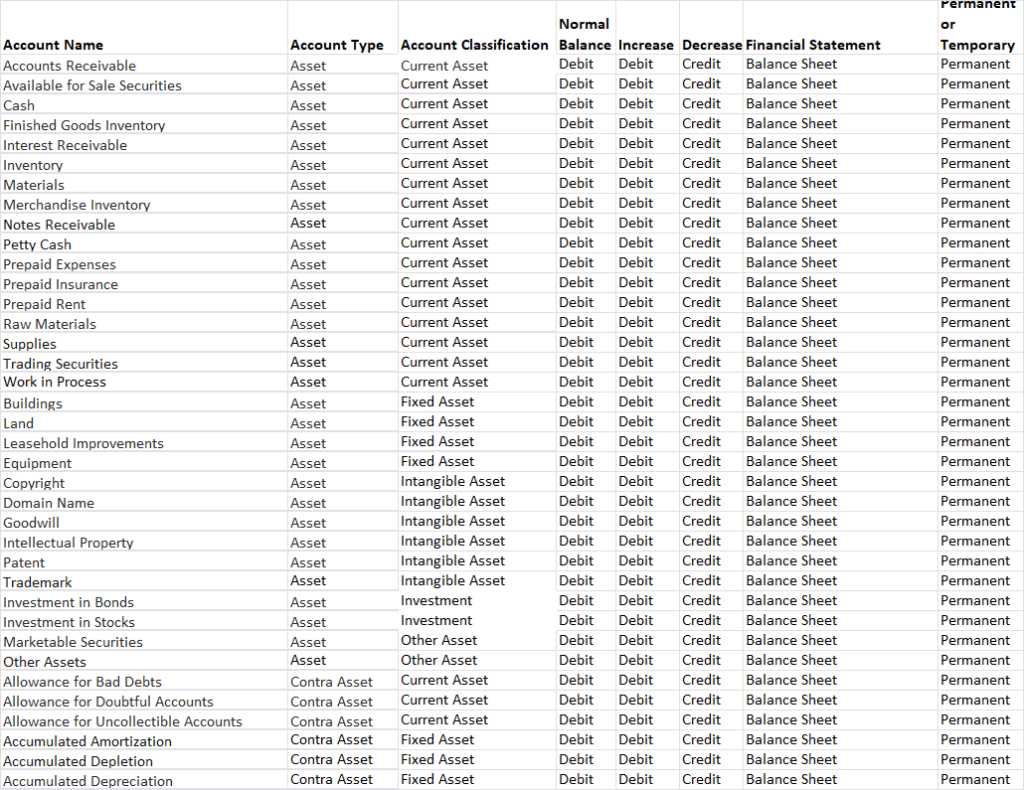

This table shows a list of common assets businesses use to track the resources owned by the business.

What are the Types of Assets?

Assets are divided into two broad groups:

- Current Assets

- Non-current or Long-term Assets

Current Assets are considered to be short-term assets (less than a year). Non-current assets are long-term assets expected to be held for a longer (more than a year) period of time.

Below are examples of assets classified as Current Assets (short-term assets):

| Cash | Petty Cash |

| Cash Equivalents | Trading Securities |

| Accounts Receivable | Notes Receivable |

| Rent Receivable | Inventory |

| Merchandise Inventory | Raw Materials Inventory |

| Work in Process Inventory | Finished Goods Inventory |

| Prepaid Expenses | Prepaid Rent |

| Prepaid Insurance | Other Current Assets |

Below are examples of assets classified as Non-current Assets (long-term assets):

| Property, Plant, and Equipment | Fixed Assets |

| Vehicles | Equipment |

| Building | Bonds Receivable |

| Patent | Copyright |

| Trademark | Franchise |

| Goodwill | Land |

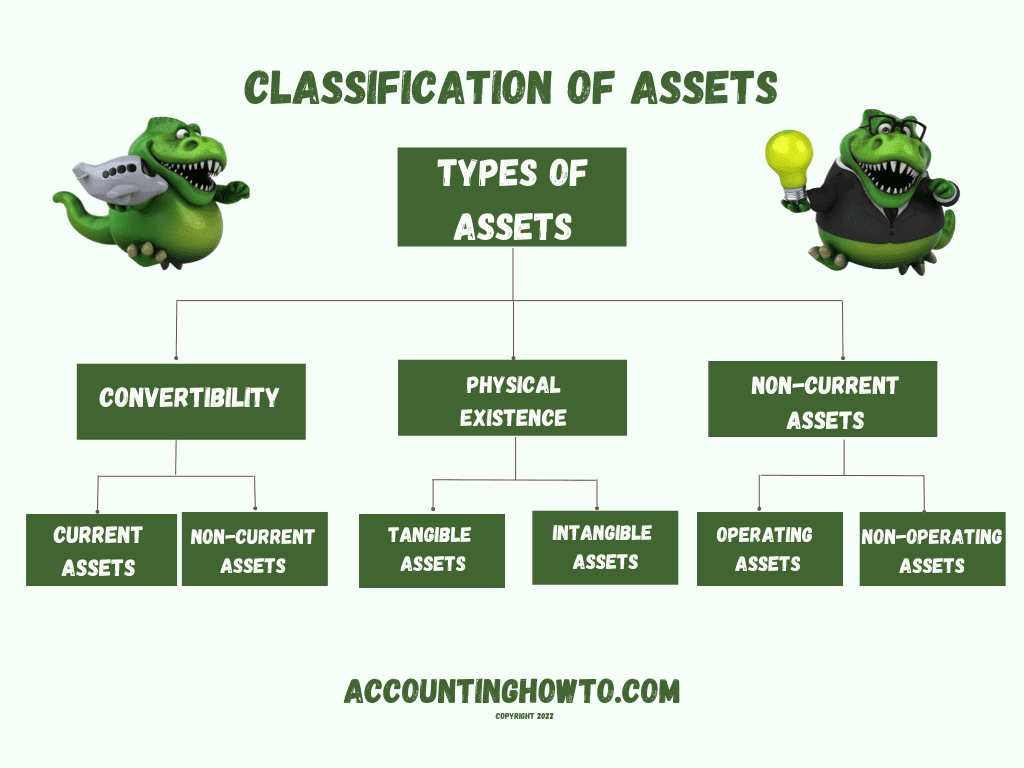

How are Assets Classified?

Assets can be divided into sub-categories based on the intended use of the asset. Will the asset be used in the day-to-day operations or the business or is it an asset being held as an investment? Assets can be categorized based on whether it is a physical (tangible) item like a truck or an intangible item like a copyright. This chart shows the classification of different asset types:

For more about Assets, watch the video below:

What is the Difference Between Current Assets and Fixed Assets?

A Current Asset is defined as an asset that is already cash or is expected to be converted to cash in one year or less (an operating cycle.) Examples of current assets are Cash, Petty Cash, Accounts Receivable, Inventory, Short-term Notes Receivable. These assets are converted into cash through the normal business operations cycle. For example, Inventory is converted into Accounts Receivable when it is sold. Accounts Receivable is converted into Cash when customers of the business pay the invoice.

A Fixed Asset is a long-term asset (or non-current asset), one that a business will hold for longer than a year. These are permanent, tangible items the business intends to own long-term (more than a year). Examples of Fixed Assets are Vehicles, Buildings, Equipment. These Fixed Assets may be referred to as Property, Plant, and Equipment assets or PP&E. They are used in normal business operations. Fixed Assets depreciate over time.

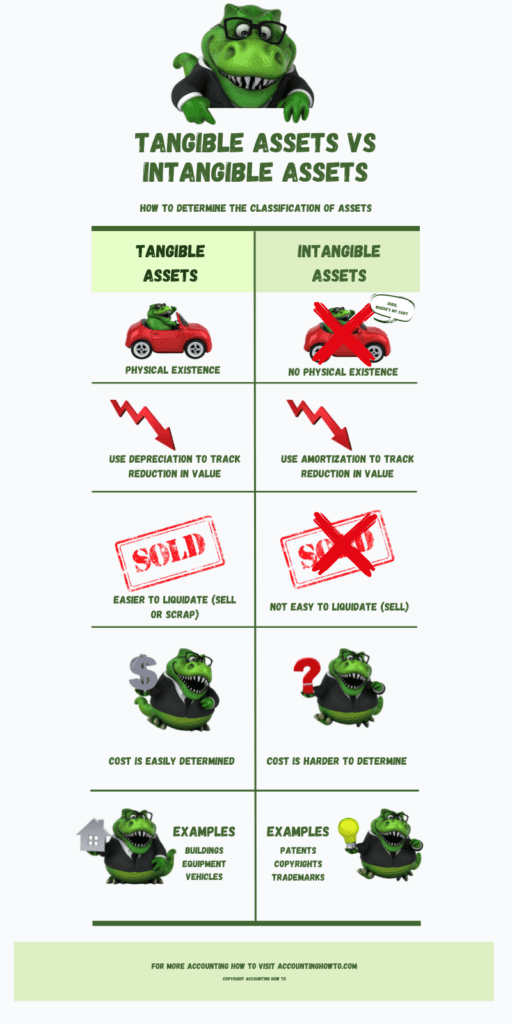

What is the difference between Tangible and Intangible Assets?

A Tangible Asset is a long-term asset (non-current asset), on that a business will hold for longer than a year. A tangible asset is an asset that has a physical presence, is expected to be used to create value for the business. Tangible Assets are usually referred to as Fixed Assets or Property, Plant, and Equipment (PP&E). Examples of Tangible Assets include vehicles, equipment, buildings, and land. Tangible Assets are generally depreciated over time (land is not depreciated.)

An Intangible Asset is a long-term asset (or non-current asset), one that a business will hold for longer than a year. Like Tangible Assets, these are permanent items a business intends to own long-term (more than a year.) The difference between Tangible Assets and Intangible Assets is that Intangible Assets are not physical assets. Examples of Intangible Assets are Copyrights, Goodwill, Trademarks, and Patents. They provide value for a business by creating a competitive advantage. Intangible Assets may lose value over time and as such they are amortized to track the reduction in value. (Amortization on an Intangible Asset is like depreciation on Fixed Assets.)

Chart of Accounts Listing for Typical Asset Accounts

For more information about Assets and how to record transactions, check out this article:

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a