A Fixed Asset is an asset purchased or manufactured by a business with the intent to use the asset for a longer period of time. The purpose of Fixed Asset is to produce income (revenue) for the business. Fixed Assets are tangible, meaning they have physical form. Fixed Assets are also known as Property, Plant, and Equipment (PP&E) assets or long-term assets.

Some examples of Fixed Assets are:

- Land

- Vehicles

- Buildings

- Equipment

- Office furniture

- Computer Servers

- Factories

Fixed Assets are listed in the Asset section of the Balance Sheet, beneath Current Assets. Fixed Assets (with the exception of Land) are depreciated over time.

To learn more about Assets, watch this video:

What is the Journal Entry to Add a New Fixed Asset?

A new Fixed Asset (in accounting class) is done using a Journal Entry. The asset is added to the books by either setting up a new Asset account (for example, 2020 Ford F350) or by adding the Asset to a group of similar Assets in an existing Asset account (for example, Vehicles.) The method of payment is recorded in the same entry. For example, Cash is credited or Loan Payable is credited.

Let’s look at a couple of examples.

Example 1: Terrance Inc. purchases a new 2020 Ford F350 for $60,000 cash.

| 2020 Ford F350 | 60,000 | |

| Cash | 60,000 |

Or, if Terrance Inc. groups all its vehicles into one account called Vehicles, the entry would be:

| Vehicles | 60,000 | |

| Cash | 60,000 |

Example 2: Terrance Inc. purchases a new 2020 Ford F350 for $20,000 cash with the remainder financed by a loan from ABC Bank.

| 2020 Ford F350 (or Vehicles) | 60,000 | |

| Cash | 20,000 | |

| Loan Payable-ABC Bank | 40,000 |

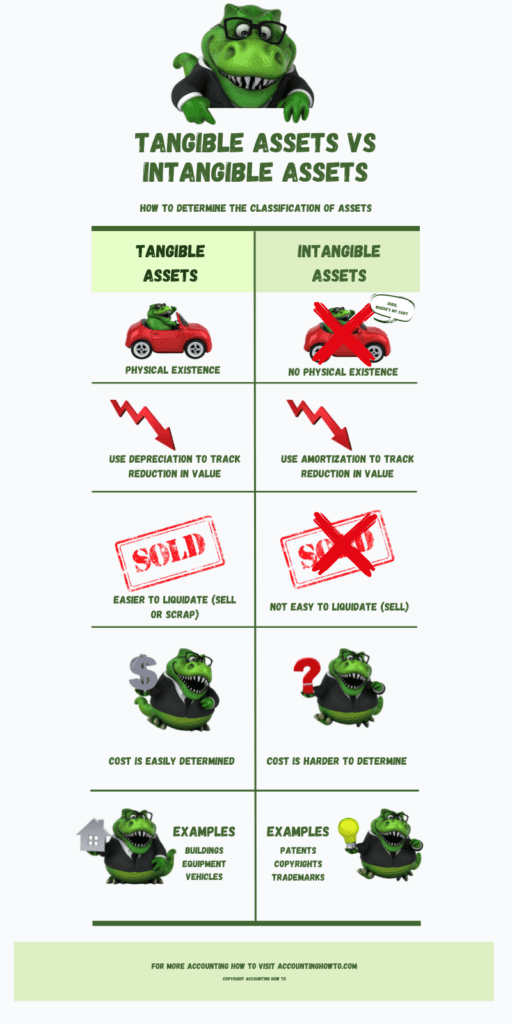

What is the Difference Between Fixed Assets and Intangible Assets?

A Fixed Assets is a tangible asset, it has a physical form. An Intangible Asset does not have a physical form. Examples of Fixed Assets are vehicles, buildings, and equipment. Examples of Intangible Assets are Copyrights, Trademarks, and Patents. Both Fixed Assets and Intangible Assets are classified as noncurrent assets (also known as long-term assets), meaning a company owns and uses them for a period of more than a year.

To learn more about intangible assets, watch this video:

To learn more about how assets are reported on the balance sheet, watch this video:

-

How Do Journal Entries Work in Accounting?

Journal entries are one of the most fundamental and essential concepts in accounting. A journal entry is a record of a transaction that affects a company’s financial statements. Journal entries

-

What is a Statement of Owner’s Equity

The Statement of Owner’s Equity is one of the four major financial statements. The function of the Statement of Owner’s Equity is to show changes in the value of equity

-

What is a Statement of Shareholders’ Equity?

The Statement of Shareholders’ Equity is one of the four major financial statements. The function of the Statement of Shareholders’ Equity is to show changes in the value of equity

-

Accounting for Notes Receivable | Accounting Student Guide

What is a Note Receivable? A note receivable is formal payment agreement between two or more people or entities. It is a promissory note that specifies: Who the note is

-

How to Post Journal Entries to the Ledger

When a Journal Entry is made to record a transaction, that Journal Entry is then entered (posted) in the accounts being impacted. For example, when rent is paid, in the

-

What is the Accounting Equation?

Before you can understand debits and credits, you’ll need a little background on the structure of accounting. It all starts with the Accounting Equation. The Accounting Equation is the foundation