A long-term liability is an obligation by a business or organization to repay funds borrowed. The repayment of that obligation is spread over more than one year (operating cycle). Examples of long-term liabilities are mortgages, bonds payable, and vehicle loans. Long-term liability accounts have a normal credit balance. They increase on the credit side and decrease on the debit side. Long-term liabilities are often called long-term debt.

What is the Difference Between a Long-term Liability and a Current (Short-term) Liability?

A long-term liability has a repayment schedule that has payments due more than one year in the future. A current liability is paid within one year.

For more knowledge about Current Liabilities, watch this video:

What are some Examples of Long-term Liabilities?

Long-term liabilities include:

| Mortgage Payable | Pension Liabilities |

| Notes Payable | Deferred Tax Liabilities |

| Bonds Payable | Capital Leases |

| Customer Deposits (if carried into future years) | Deferred Compensation |

| Deferred Revenue (if carried into future years) | Post-retirement Healthcare Liabilities |

Accounting for Long-term Liabilities

When a company or organization takes on a new liability, it needs to be entered as a liability. Some typical transactions for accounting for Long-term Liabilities are listed below.

Adding a New Long-term Liabilities to the Books

Purchase of an Asset: a company purchases a vehicle (Fixed Asset) for $40,000, financing $30,000 for 5 years at an interest rate of 5%, and paying the remaining $10,000 in cash. The journal entry to record the new asset, new loan, and reduction in cash is:

| Vehicle | 40,000 | |

| Vehicle Loan | 30,000 | |

| Cash | 10,000 |

Issuing a Bond: a company issues a bond for $200,000 at face value. (For more information about bonds, read this article: https://accountinghowto.com/bonds-payable.) The journal entry to record the new liability and the increase in cash is:

| Cash | 200,000 | |

| Bond Payable | 200,000 |

Making payments of a Long-term Liability

When a company or organization takes on debt, each debt has its own payment schedule and interest rate. When a payment is made, the principal (a portion of the loan amount) is tracked separately from the interest portion of the loan.

As an example, let’s say the vehicle loan had monthly payments of $500 including $50 of interest. The journal entry to record the payment is:

| Vehicle Loan | 450 | |

| Interest Expense | 50 | |

| Cash | 500 |

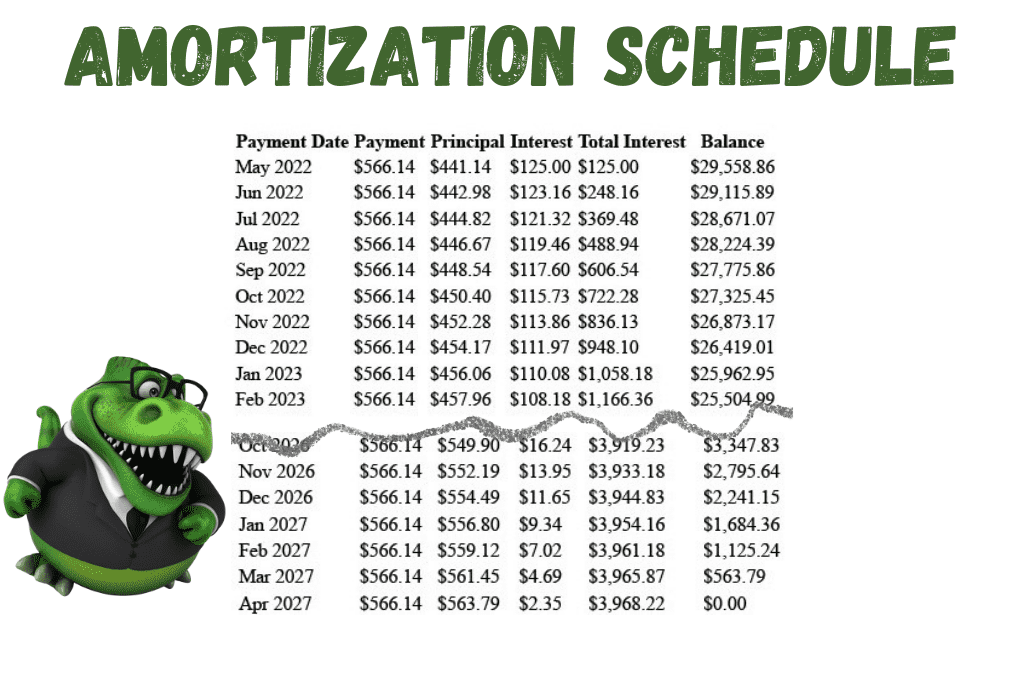

Most loans are set up for more interest to be paid in the early years of a loan, with decreasing interest amounts as the loan progresses. This interest payment structure is detailed in an amortization schedule.

What is an Amortization Schedule?

An amortization schedule breaks the payments on a loan into principal payments and interest payments.

Here is a sample amortization schedule for the Vehicle loan:

The amortization schedule shows the decreasing amount of interest as each payment is made, and the decrease in the principal balance. In the 60th month of the loan (5 years x 12 payments), the principal balance reaches zero and the loan is paid in full.

Using the amortizations schedule, principal and interest payments can be easily tracked and recorded each time a payment on the loan is due.

For the first payment due, the journal entry to record the principal and interest is:

| Vehicle Loan | 441.14 | |

| Interest Expense | 125.00 | |

| Cash | 566.14 |

For businesses required to follow Generally Accepted Accounting Principles (GAAP), an additional calculation is needed to separate the portion of long-term debt due in the next twelve months (operating cycle.) This portion of long-term debt is classed as a current liability rather than a long-term liability.

What is Current Portion of Long-term Debt?

Current Portion of Long-term Debt is the amount of principal due on liabilities in the next twelve months. It is separated out from the full amount of long-term liabilities to help a business understand the amount of debt payments due in the near future.

For example, if total long-term liabilities equals $20,000 and of that, $5,000 is due in the next year’s time, this debt is considered to be a Current Liability. For a deeper understanding of Current Portion of Long-term Debt, watch this video:

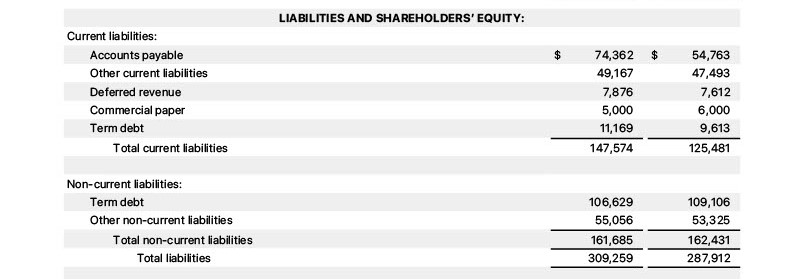

How are Liabilities Listed on the Balance Sheet

On the Balance Sheet, liabilities are generally listed in order of when payment is due, from shortest term to longest term. For example, Accounts Payable is expected to be paid with about 30 days, a 90-day Note Payable is expected to be paid in 90 days, and a five-year car loan is expected to be paid off over a period of five years. Liabilities are categorized on the Balance Sheet as Current or Long-term Liabilities.

On the Balance Sheet, the liabilities would be listed:

| Liabilities |

| Current Liabilities |

| Accounts Payable |

| Note Payable-short term |

| Long-term Liabilities |

| Car Loan |

| Total Liabilities |

Here is an example of the liability section of the Balance Sheet from Apple:

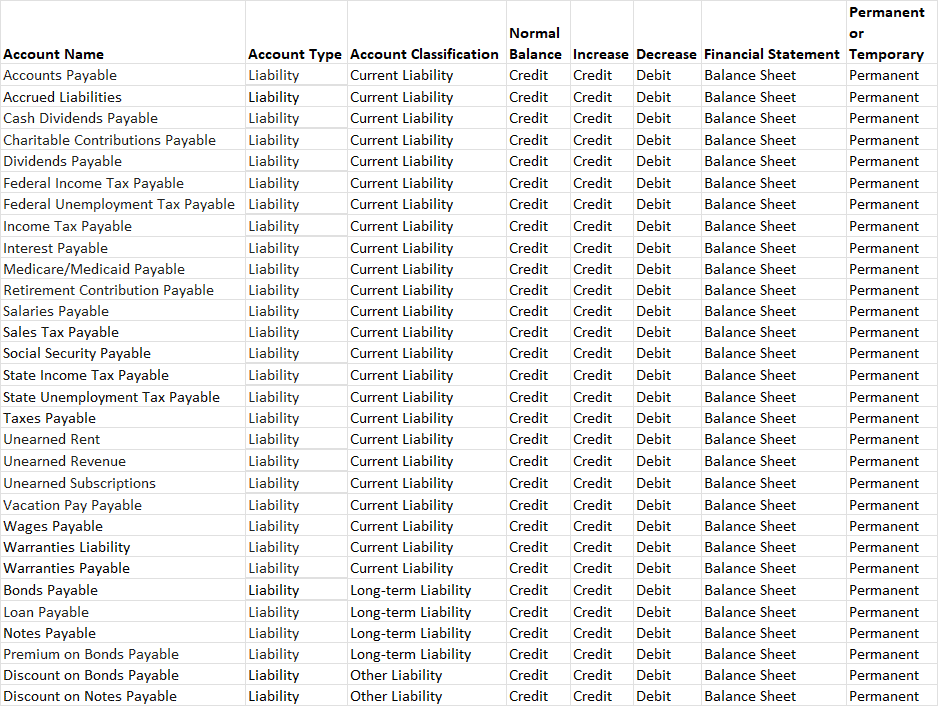

Chart of Account Listing for Typical Liability Accounts:

For more about liabilities, check out this article:

-

So You Want to Start a Nonprofit…Consider This

Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. Here are key points to consider before embarking

-

Tax Liability Accrual Explained

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with accounting

-

Nonprofit Monthly Financial Close Process Overview

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. This process ensures that financial statements are prepared, reviewed,

-

Navigating Payroll Taxes for Nonprofits: Responsibilities and Compliance

Payroll taxes are the taxes that employers withhold from their employees’ wages and are required to remit to the appropriate government agencies. They include various taxes that fund government programs,

-

Understanding Form 990: Transparency and Accountability for Nonprofits

Form 990 is a reporting document filed by tax-exempt organizations in the United States with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance,

-

Financial Disclosures for Affiliated Nonprofit Organizations

Disclosures related to revenue sharing, consolidated financial statements, noncontrolling interests, and related party transactions in the context of affiliated organizations within a nonprofit are crucial for transparency and accurate financial