A Balance Sheet is one of the major financial statements. It shows the value of a company’s assets as compared to the company’s liabilities. The Balance Sheet is a snapshot of a business’s financial position at any point in time. It lists accounts pertaining to ownership or equity of the business and shows whether the owner’s value in the business is increasing or decreasing.

What are the Balance Sheet Accounts?

The accounts listed on the Balance Sheet are:

These accounts are referred to as Permanent Accounts, accounts that will continue to have balances from month to month.

For a better understanding of Permanent and Temporary accounts, visit this article on Accounting How To:

Why is the Balance Sheet Important?

The Balance Sheet provides a picture of the financial condition of the company, particularly in regards to:

- The company’s ability to pay its bills (liquidity).

- How much debt the company has compared to its assets (solvency).

- Whether the owners’ investment in the business is increasing or decreasing in value.

Combining with the company’s Income Statement (also called the Profit and Loss Statement), the Balance Sheet shows the profitability of the company over time.

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible item such as a copyright or trademark. Assets have a normal debit balance. Assets are listed on the Balance Sheet. Other examples of Assets include Cash, Accounts Receivable, Inventory, Prepaid Expenses, Equipment, and Buildings.

What are Some Examples of Assets?

This table shows a list of common assets businesses use to track the resources owned by the business.

| Cash | Petty Cash |

| Cash Equivalents | Trading Securities |

| Accounts Receivable | Notes Receivable |

| Rent Receivable | Inventory |

| Merchandise Inventory | Raw Materials Inventory |

| Work in Process Inventory | Finished Goods Inventory |

| Prepaid Expenses | Prepaid Rent |

| Prepaid Insurance | Other Current Assets |

| Property, Plant, and Equipment | Fixed Assets |

| Vehicles | Equipment |

| Building | Bonds Receivable |

| Patent | Copyright |

| Trademark | Franchise |

| Goodwill | Land |

What are the Types of Assets?

Assets are divided into two broad groups:

- Current Assets

- Non-current or Long-term Assets

Current Assets are considered to be short-term assets (less than a year). Non-current assets are long-term assets expected to be held for a longer (more than a year) period of time.

Below are examples of assets classified as Current Assets (short-term assets):

| Cash | Petty Cash |

| Cash Equivalents | Trading Securities |

| Accounts Receivable | Notes Receivable |

| Rent Receivable | Inventory |

| Merchandise Inventory | Raw Materials Inventory |

| Work in Process Inventory | Finished Goods Inventory |

| Prepaid Expenses | Prepaid Rent |

| Prepaid Insurance | Other Current Assets |

Non-current or Long-term Assets are assets a company purchases with the intent to own the asset over a period longer than one year, and to use the asset to create value for the company.

Below are examples of assets classified as Non-current Assets (long-term assets):

| Property, Plant, and Equipment | Fixed Assets |

| Vehicles | Equipment |

| Building | Bonds Receivable |

| Patent | Copyright |

| Trademark | Franchise |

| Goodwill | Land |

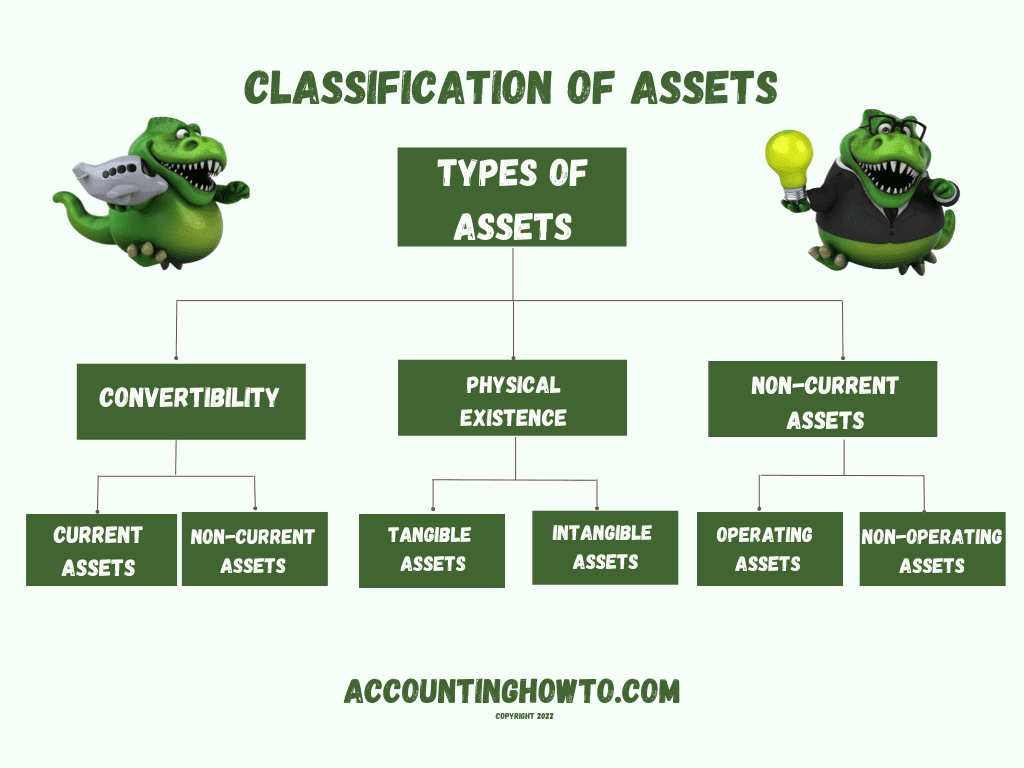

How are Assets Classified?

Assets can be divided into sub-categories based on the intended use of the asset. Will the asset be used in the day-to-day operations or the business or is it an asset being held as an investment? Assets can be categorized based on whether it is a physical (tangible) item like a truck or an intangible item like a copyright. This chart shows the classification of different asset types:

For more about Assets, watch the video below:

What is the Difference Between Current Assets and Fixed Assets?

A Current Asset is defined as an asset that is already cash or is expected to be converted to cash in one year or less (an operating cycle.) Examples of current assets are Cash, Petty Cash, Accounts Receivable, Inventory, Short-term Notes Receivable. These assets are converted into cash through the normal business operations cycle. For example, Inventory is converted into Accounts Receivable when it is sold. Accounts Receivable is converted into Cash when customers of the business pay the invoice.

For more about Current Assets, watch this video:

A Fixed Asset is a long-term asset (or non-current asset), one that a business will hold for longer than a year. These are permanent, tangible items the business intends to own long-term (more than a year). Examples of Fixed Assets are Vehicles, Buildings, Equipment. These Fixed Assets may be referred to as Property, Plant, and Equipment assets or PP&E. They are used in normal business operations. Fixed Assets depreciate over time.

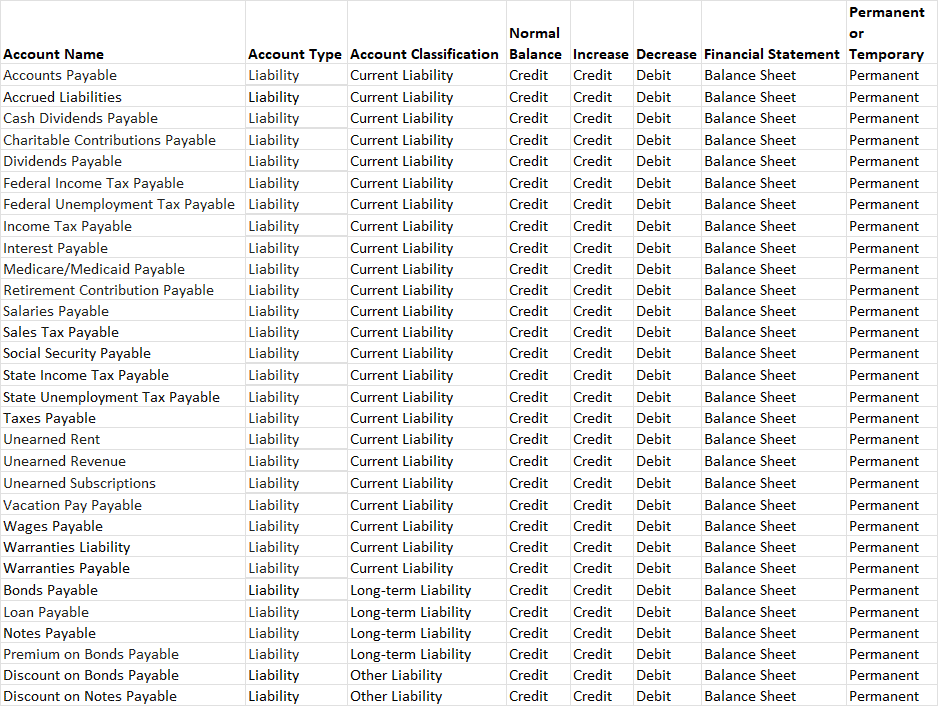

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a liability for a business is Accounts Payable. The obligation may be short-term, paid within a year, or long-term, paid over multiple years. Liabilities have a normal credit balance. Liabilities are listed on the Balance Sheet. Other examples of liabilities include Notes Payable, Mortgage Payable, Salaries Payable, Unearned Rent, and Unearned Revenue.

What are Some Examples of Liabilities?

This table shows a list of common liabilities businesses use to track the amounts owed by the business.

| Accounts Payable | Payroll Taxes Payable |

| Accrued Liabilities | Customer Deposits |

| Accrued Wages | Unearned Revenue |

| Wages Payable | Unearned Rent |

| Salaries Payable | Sales Tax Payable |

| Interest Payable | Deferred Revenue |

| Note Payable–short-term | Current Portion of Long-term Debt |

| Bonds Payable | Mortgage Payable |

| Note Payable–long-term | Pension Liability |

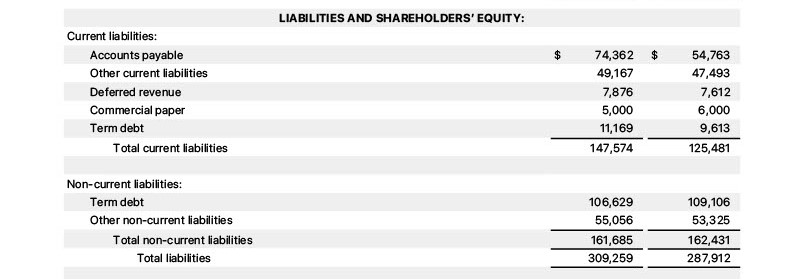

What are the Types of Liabilities?

Liabilities are divided into two broad groups:

- Current Liabilities

- Non-current or Long-term Liabilities

Current Liabilities are considered to be short-term liabilities (less than a year). Non-current liabilities are long-term liabilities expected to be paid over a period longer than one year.

Below are examples of liabilities classified as Current Liabilities (short-term liabilities):

| Accounts Payable | Payroll Taxes Payable |

| Accrued Liabilities | Customer Deposits |

| Accrued Wages | Unearned Revenue |

| Wages Payable | Unearned Rent |

| Salaries Payable | Sales Tax Payable |

| Interest Payable | Deferred Revenue |

| Note Payable–short-term | Current Portion of Long-term Debt |

Below are examples of liabilities classified as Non-current Liabilities (long-term liabilities):

| Bonds Payable | Mortgage Payable |

| Note Payable–long-term | Pension Liability |

What is the Difference Between Current Liabilities and Long-term Liabilities?

A Current Liability is defined as a liability that is one that is expected to be paid within in one year or less (an operating cycle.)

For more in depth information about Current Liabilities, watch this video:

A Long-term Liability is defined as a liability that is expected to be paid more than one year (multiple operating cycles.)

How are Liabilities Listed on the Balance Sheet

On the Balance Sheet, liabilities are generally listed in order of when payment is due, from shortest term to longest term. For example, Accounts Payable is expected to be paid with about 30 days, a 90-day Note Payable is expected to be paid in 90 days, and a five-year car loan is expected to be paid off over a period of five years. Liabilities are categorized on the Balance Sheet as Current or Long-term Liabilities.

On the Balance Sheet, the liabilities would be listed:

| Liabilities |

| Current Liabilities |

| Accounts Payable |

| Note Payable-short term |

| Long-term Liabilities |

| Car Loan |

| Total Liabilities |

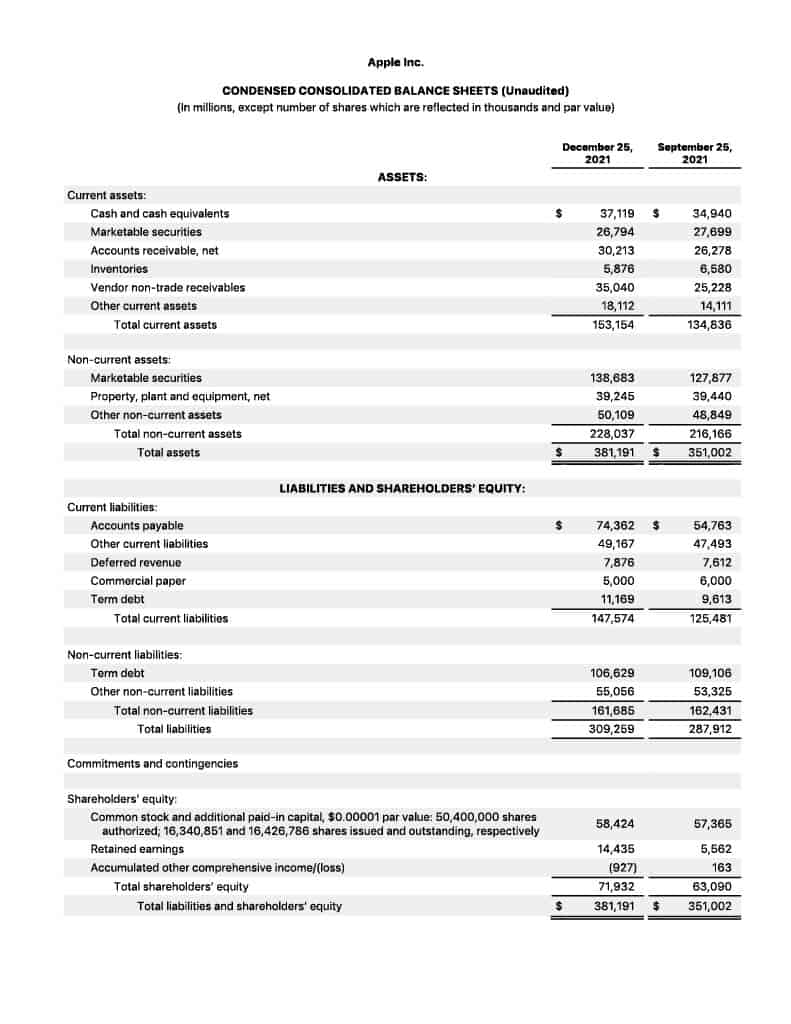

Here is an example of the liability section of the Balance Sheet from Apple:

Chart of Account Listing for Typical Liability Accounts:

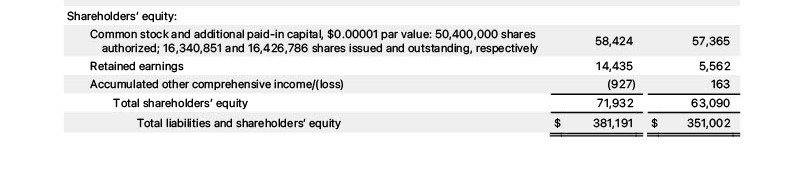

What is Equity?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit side and decreases on the debit side. Equity is listed on the Balance Sheet. Changes to Equity are calculated on the Statement of Owner’s Equity or Statement of Shareholders’ Equity or Statement of Retained Earnings. Examples of Equity accounts are Owner’s Equity, Stockholders’ Equity, Shareholders’ Equity, and Common Stock.

What are Some Examples of Equity Accounts?

This table shows a list of common liabilities businesses use to track the amounts owed by the business.

| Common Stock | Retained Earnings |

| Preferred Stock | Additional Paid in Capital |

| Owner’s Name, Equity or Capital | Partner’s Name, Equity or Capital |

| Member’s Name, Equity or Capital | Unrealized Gains |

| Owner’s Name, Distribution | Owner’s Name, Withdrawals or Drawing |

| Dividends | Member’s Name, Distribution |

| Treasury Stock | Unrealized Losses |

What Accounts are Used to Record Increases in Equity?

The following Equity accounts are used to track increases in Equity:

| Common Stock | Retained Earnings |

| Preferred Stock | Additional Paid in Capital |

| Owner’s Name, Equity or Capital | Partner’s Name, Equity or Capital |

| Member’s Name, Equity or Capital | Unrealized Gains |

What Accounts are Used to Record Decreases in Equity?

The following accounts are used to track decreases in owner’s or shareholder’s equity.

| Owner’s Name, Distribution | Owner’s Name, Withdrawals or Drawing |

| Dividends | Member’s Name, Distribution |

| Treasury Stock | Unrealized Losses |

What is the Difference Between Equity and Capital?

Capital is a subcategory of equity. Capital represents an owner’s investment of assets into the business. For example, when the business started the owner contributed cash and equipment to start the business.

Equity represents the difference between Assets and Liabilities. If a business sells all of its assets and pays off all its debts (liabilities), the amount remaining is the owner’s share (equity) of the business.

A business owner’s capital increases when they invest more money or other assets into the company. A business owner’s equity increases when there are profits in the business.

Total equity includes Capital + Retained Earnings – Dividends (Withdrawals)

What is Retained Earnings?

Retained Earnings represents the cumulative profits and losses in a business net of Dividends. As a business has profits and losses over years, Retained Earnings increases or decreases as in this example:

| 2022 | 2023 | 2024 | |

| Net Income | 10,000 | 15,000 | -1,000 |

| Dividends | -100 | -200 | 0 |

| Current Year Earnings | 9,900 | 14,800 | -1,000 |

| Retained Earnings | 9,900 | 24,700 | 23,700 |

How is Equity Listed on the Balance Sheet?

On the Balance Sheet, equity is broken down by type of equity, including owner’s original investment, retained earnings, common stock, preferred stock, dividends, and treasury stock. Changes in equity are tracked on the Statement of Owner’s Equity or Statement of Shareholders’ Equity or Statement of Retained Earnings. Those amounts are then summarized on the Balance Sheet in the Equity section.

Here is an example of the equity section of the Balance Sheet from Apple:

What is a Classified Balance Sheet?

When a Balance Sheet is separated into different sections, it is called a Classified Balance Sheet. A Classified Balance Sheet gathers like accounts together in one category. For example, Cash, Accounts Receivable, and Inventory are categorized as Current Assets. Current Assets is a classification on the Balance Sheet.

Other classifications are Long-term Assets, Fixed Assets, Current Liabilities, and Long-term Liabilities. Classifications help to make a Balance Sheet easier to read and understand, and easier to compare it to Balance Sheets from other companies for analysis purposes.

For more about Classified Balance Sheets, watch this video:

Sample Balance Sheet Example

The following image shows an example of a Balance Sheet for Apple, Inc. Note the classifications used for Current and Non-current (long-term) Assets and Liabilities.

For more information and step-by-step examples of the Balance Sheet for a service business, merchandising (retail) business, and manufacturing business, check out this video:

Balance Sheet Examples

Click here for the Google Drive link for the spreadsheet referenced in the video above.

-

What is a Statement of Owner’s Equity

The Statement of Owner’s Equity is one of the four major financial statements. The function of the Statement of Owner’s Equity is to show changes in the value of equity

-

What is a Statement of Shareholders’ Equity?

The Statement of Shareholders’ Equity is one of the four major financial statements. The function of the Statement of Shareholders’ Equity is to show changes in the value of equity

-

What is the Accounting Equation?

Before you can understand debits and credits, you’ll need a little background on the structure of accounting. It all starts with the Accounting Equation. The Accounting Equation is the foundation

-

What is Owner’s Draw (Owner’s Withdrawal) in Accounting?

Owner’s Draw or Owner’s Withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Business owners may use

-

What is Double-Entry Accounting?

Double-entry Accounting is an accounting system that tracks two or more parts of every business transaction. It is based on the Accounting Equation [Assets = Liabilities + Equity]. The equation

-

What is a Trial Balance?

What is a Trial Balance? A Trial Balance is a report used after transactions are posted to accounts to check whether debits equal credits. The Trial Balance takes the balances