A Current Asset is defined as an asset that is already cash or is expected to be converted to cash in one year or less (an operating cycle.) Examples of current assets are Cash, Petty Cash, Accounts Receivable, Inventory, Short-term Notes Receivable. These assets are converted into cash through the normal business operations cycle. For example, Inventory is converted into Accounts Receivable when it is sold. Accounts Receivable is converted into Cash when customers of the business pay the invoice.

What is the Difference Between Current Assets and Non-current Assets?

Non-current assets represent long-term (longer than a year) investments for a business. Non-current assets usually are not easily convertible to cash and the intention is for the business to hold the assets. Example of non-current assets include Land, Buildings, Vehicles, Equipment, Trademarks, Patents, Copyrights, and long-term Investments.

Where are Current Assets Reported on the Financial Statements?

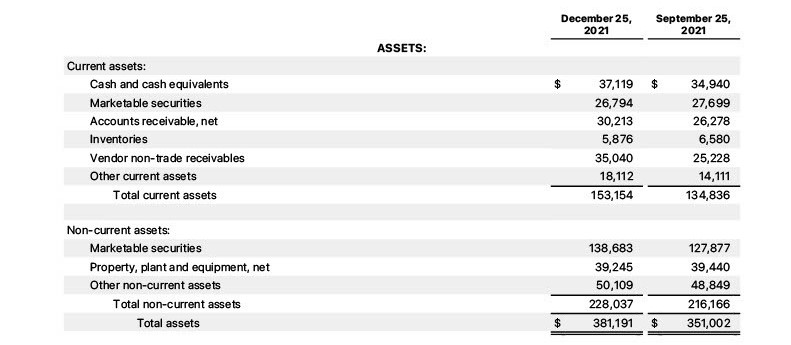

Current Assets are reported on the Balance Sheet in the Asset section. Current Assets are listed in order of liquidity (how close they are to being cash). On a classified Balance Sheet, assets are divided into categories or classifications. Non-current assets are listed after current assets.

The following image shows an example of the asset section of the Balance Sheet for Apple.

For more about Current Assets, watch this video:

-

How Do Journal Entries Work in Accounting?

Journal entries are one of the most fundamental and essential concepts in accounting. A journal entry is a record of a transaction that affects a company’s financial statements. Journal entries

-

What is a Statement of Owner’s Equity

The Statement of Owner’s Equity is one of the four major financial statements. The function of the Statement of Owner’s Equity is to show changes in the value of equity

-

What is a Statement of Shareholders’ Equity?

The Statement of Shareholders’ Equity is one of the four major financial statements. The function of the Statement of Shareholders’ Equity is to show changes in the value of equity

-

Accounting for Notes Receivable | Accounting Student Guide

What is a Note Receivable? A note receivable is formal payment agreement between two or more people or entities. It is a promissory note that specifies: Who the note is

-

How to Post Journal Entries to the Ledger

When a Journal Entry is made to record a transaction, that Journal Entry is then entered (posted) in the accounts being impacted. For example, when rent is paid, in the

-

What is the Accounting Equation?

Before you can understand debits and credits, you’ll need a little background on the structure of accounting. It all starts with the Accounting Equation. The Accounting Equation is the foundation