What is Contributed or Paid-in Capital?

Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or other investments. Contributed Capital includes:

- Outstanding Shares — Contributed Capital is increased by amounts paid into the corporation by purchases of the corporation’s stock by investors.

- Additional Paid-in Capital — Contributed Capital is increased by amounts paid into the corporation by purchases of the corporation’s stock above the par value by investors.

- Treasury Stock — Contributed Capital is decreased by the amounts spent by a corporation to buy back its own stock.

What are Outstanding Stocks (Shares)?

Outstanding Stocks or Shares are those stocks that have been authorized and issued (sold) to stockholders. The number of shares a corporation is authorized to issue is stated in the corporation’s charter. The charter is also known as “articles of incorporation.” It lists the objectives, structure, and operations of the new corporation. When a corporation purchases back some of its issued stocks (Treasury Stock), Outstanding Stock is equal to Issued Stock less Treasury Stock. Outstanding Stock represents the number of shares still in the hands of investors (stockholders).

What is Additional Paid-in Capital?

Additional Paid-in Capital is the difference between the par value of a stock and the price a stockholder pays for that stock. If the par value of a stock is $1.00 and the investor pays $50.00 for the stock, $49.00 represents the Additional Paid-in Capital. Additional Paid-in Capital occurs when stock is purchased during the Initial Public Offering (IPO) for that stock. Additional Paid-in Capital is also called Additional Paid-in Capital in Excess of Par or APIC.

What is Par Value?

When it comes to stocks, par value is the stated value assigned to a stock by the corporation when the stock is issued. It’s usually a very small amount. It represents the absolute least price a stock can sell for. It may be a penny or a dime or a dollar.

What is the Journal Entry for Stocks Sold at Par Value?

Example: One share of Common Stock issued with a par value of $1 sells for par value.

| Cash | 1.00 | |

| Common Stock | 1.00 |

What is the Journal Entry for Stocks Sold Above Par Value?

Example: One share of Common Stock issued with a par value of $1 sells for $50.

| Cash | 50.00 | |

| Common Stock | 1.00 | |

| Additional Paid in Capital | 49.00 |

What is No-par Value Stock?

No-par Value Stock is issued without a par value being assigned. With no-par stock, stock prices are determined by how much investors are willing to pay for the stock.

What is the Journal Entry for Stocks without Par Value?

Example: One share of Common Stock issued without a par value sells for $50.

| Cash | 50.00 | |

| Common Stock | 50.00 |

For an overview of Paid-in Capital and Additional Paid-in Capital, watch this video:

For more about stock transactions, check out this Accounting Student Guide:

-

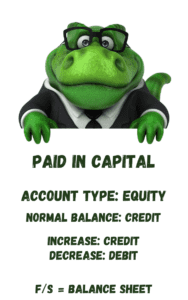

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

What is Stockholders’ Equity?

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital

-

What is Paid in Capital?

What is Contributed or Paid-in Capital? Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or

-

What are Dividends? | Accounting Student Guide

What is a Dividend? A Dividend is a payout of earnings by a corporation to its stockholders. Dividends can be cash dividends or stock dividends. A dividend is paid per

-

What are Stock Splits?

A stock split occurs when a corporation’s board of directors decides to divide one share of stock into multiple shares. For example, a two-for-one stock split means that one share