In a business, Net Income is the difference between Revenue and Expenses. When the difference is positive (revenues are greater than expenses), the business has a profit or Net Income. When the difference is negative (expenses are greater than revenues), the business has a loss or Net Loss.

What is the Difference Between Gross Profit and Net Income?

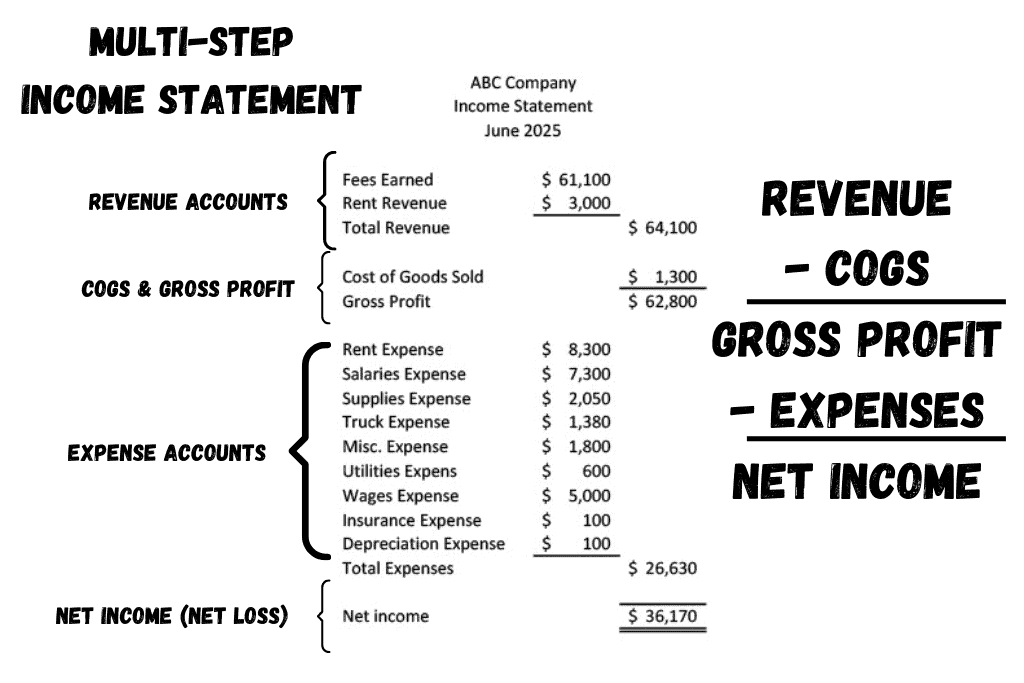

Gross Profit is the difference between what a product or service is sold for (selling price or Revenue) and what it costs the company to make or purchase products for sale to customers (Cost of Good Sold.) Net Income is the difference between Gross Profit and the Operating Expenses of a business.

For example, the following company has Revenues of $64,100 and Cost of Goods Sold of $1,300. The difference between the two is Gross Profit. [$64,100 – $1,300 = $62,800] Gross Profit measures the profitability of the product or service being sold to customers. It ignores all the other expenses involved in running a business.

Those other expenses are listed below Gross Profit and represent all the general operating costs of running a business. When total of all the operating expenses are subtracted from Gross Profit, this gives the Net Income or Profit for the business during that period of time.

Gross Profit = Revenue – Cost of Goods Sold

Net Income = Gross Profit – Expenses

What Does Net Income Mean?

When a company has Net Income, it means the company is operating at a profit (revenue is greater than expenses.) When a company has a Net Loss, it means the company is operating at a loss (expenses are greater than revenue.)

-

How Do Journal Entries Work in Accounting?

Journal entries are one of the most fundamental and essential concepts in accounting. A journal entry is a record of a transaction that affects a company’s financial statements. Journal entries

-

What is Managerial Accounting?

Managerial Accounting is a specific branch of accounting designed to support business managers and owners by providing data to help the company with strategic planning, measuring company performance, evaluating results,

-

What is a Statement of Owner’s Equity

The Statement of Owner’s Equity is one of the four major financial statements. The function of the Statement of Owner’s Equity is to show changes in the value of equity

-

What is a Statement of Shareholders’ Equity?

The Statement of Shareholders’ Equity is one of the four major financial statements. The function of the Statement of Shareholders’ Equity is to show changes in the value of equity

-

How to Post Journal Entries to the Ledger

When a Journal Entry is made to record a transaction, that Journal Entry is then entered (posted) in the accounts being impacted. For example, when rent is paid, in the

-

What is the Accounting Equation?

Before you can understand debits and credits, you’ll need a little background on the structure of accounting. It all starts with the Accounting Equation. The Accounting Equation is the foundation