Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number of shares available in the market. Treasury Stock is recorded in the corporations records in an account called Treasury Stock.

What Type of Account is Treasury Stock?

Treasury Stock is a contra-equity account. It reduces the value of shareholders’ equity by purchasing the shares and removing them from ownership by shareholders. Because it is a contra-equity account, Treasury Stock has a normal debit balance. It increases on the debit side and decreases on the credit side.

Why Isn’t Treasury Stock an Asset?

When an individual purchases stock in a company, it is an Asset that can be sold at a gain or a loss. That stock includes voting rights and the right to receive dividends. Because of accounting rules, when a corporation purchases its own stock, it cannot sell it at a gain or a loss. It doesn’t include voting rights or the right to receive dividends. Treasury Stock is part of the equity of a corporation.

What Financial Statement Shows Treasury Stock?

Treasury Stock is listed on the Balance Sheet in the Equity section.

Why Would a Company Purchase Treasury Stock?

Corporations purchase Treasury Stock for strategic reasons including:

- To support the market price of the company’s stock. Fewer shares outstanding may lead to an increased market price.

- To fight off a hostile takeover. Fewer shares are available to be purchased by shareholders intent on gaining control of the company.

- To use as employee incentives. Employees may be allowed to purchase shares at a lower than market cost.

- To use as executive incentives. Executives compensation packages may include shares in the company.

- To use as bonuses for employees.

- To use as dividends to shareholders in a stock dividend.

Does Treasury Stock Have Voting Rights?

Treasury Stock has no voting rights. Common Stock is the only type of stock that typically has voting rights.

Does Treasury Stock Receive Dividends?

Treasury Stock is not eligible for dividends. Only stocks held by investors in the corporation are eligible.

Treasury Stock Accounting Transactions

Journal Entry to Record Purchase of Treasury Stock

When Treasury Stock is purchased by the corporation it is generally recorded using the Cost Method. Let’s say a corporation purchases 1,000 shares for $50 each. The journal entry to record the purchase would be:

| Treasury Stock | 50,000 | |

| Cash | 50,000 |

Journal Entry to Record Sale of Treasury Stock for Higher Than Cost

When Treasury Stock is sold by the corporation, the Cost Method is used to calculate the reduction in Treasury Stock. Any additional amount received above cost is tracked using an account called Paid-in Capital from Sale of Treasury Stock. Let’s say a corporation sells 600 shares for $60 each. The journal entry to record the sale would be:

| Cash (600 shares at $60) | 36,000 | |

| Treasury Stock (600 shares at $50 cost) | 30,000 | |

| Paid-in Capital from Sale of Treasury Stock (600 shares at $10) | 6,000 |

Journal Entry to Record Sale of Treasury Stock for Lower Than Cost

When Treasury Stock is sold by the corporation, the Cost Method is used to calculate the reduction in Treasury Stock. If the Treasury Stock is sold for less than cost, this amount is tracked using Paid-in Capital from Sale of Treasury Stock. When sold below cost, it decreases the amount in Paid-in Capital. Let’s say a corporation sells 400 shares for $40 each. The journal entry to record the sale would be:

| Cash (400 shares at $40) | 16,000 | |

| Paid-in Capital from Sale of Treasury Stock (400 shares at $10) | 4,000 | |

| Treasury Stock (400 shares at $50 cost) | 20,000 |

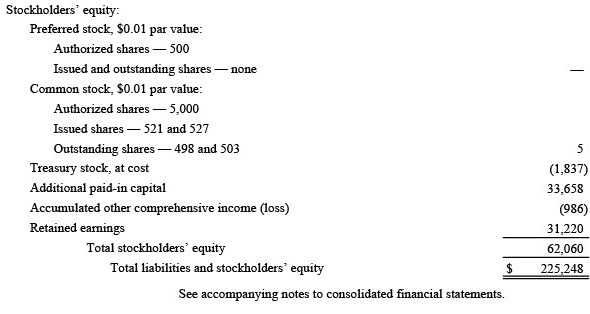

Example of Treasury Stock on the Balance Sheet

For an overview of Treasury Stock, watch this video:

For more information about stock transactions, and step-by-step instructions for journal entries, check out this Accounting Student Guide:

-

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

What is Stockholders’ Equity?

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital

-

What is Paid in Capital?

What is Contributed or Paid-in Capital? Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or

-

What are Dividends? | Accounting Student Guide

What is a Dividend? A Dividend is a payout of earnings by a corporation to its stockholders. Dividends can be cash dividends or stock dividends. A dividend is paid per

-

What are Stock Splits?

A stock split occurs when a corporation’s board of directors decides to divide one share of stock into multiple shares. For example, a two-for-one stock split means that one share