Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks other investments. Earned Capital comes from a corporation earning profits or selling assets. Earned Capital from profits in the business collect in an account called Retained Earnings.

What is the Difference Between Stockholders’ Equity and Shareholders’ Equity?

Stockholders’ Equity is also known as Shareholders’ Equity. The terms mean the same thing and are used interchangeably.

What is the Difference Between Stockholders’ Equity and Owner’s Equity

The account name of a business’ equity follows the ownership form of the business. The term Stockholders’ Equity refers to the equity of a corporation. Owner’s Equity refers to the equity of a sole proprietor. Partner’s Equity refers to the equity of a Partnership. Member’s Equity refers to the equity of a Limited Liability Company.

Is Stockholders’ Equity an Asset, Liability, Equity, Revenue, or Expense Account?

Stockholders’ Equity is an Equity account. Equity accounts have a normal credit balance. Equity increases on the credit side and decreases on the debit side. Equity is found on the Balance Sheet in the Equity section.

Understanding Stockholders’ Equity

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). To put that statement differently, stockholders’ equity is equal to the amount of asset value remaining in the business after all liabilities are settled.

Let’s look at an example. Terrance Inc. has $10,000 in Assets. It owes $8,000 in Liabilities. Stockholders’ Equity is $2,000 [$10,000 in Assets minus $8,000 in Liabilities]. Stockholders’ Equity is equal to the amount of assets over and above the amount owed on those assets.

If Asset value increases and Liabilities remain the same, Stockholders’ Equity increases.

If Asset value remains the same and Liabilities increase, Stockholders’ Equity decreases.

If Asset value remain the same and Liabilities decrease, Stockholders’ Equity increases.

Stockholders’ Equity increases or decreases based on the relationship between Assets and Liabilities.

What is Included in Stockholders’ Equity?

Stockholders’ Equity is made up of two parts:

- Contributed Capital

- Earned Capital

What is Contributed or Paid-in Capital?

Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks other investments. Contributed Capital includes:

- Outstanding Shares — Contributed Capital is increased by amounts paid into the corporation by purchases of the corporation’s stock by investors.

- Additional Paid-in Capital — Contributed Capital is increased by amounts paid into the corporation by purchases of the corporation’s stock above the par value by investors.

- Treasury Stock — Contributed Capital is decreased by the amounts spent by a corporation to buy back its own stock.

What is Earned Capital?

Earned Capital comes from a corporation earning profits or selling assets. Earned Capital from profits in the business accumulate in an account called Retained Earnings.

Is Stockholders’ Equity the Same as Retained Earnings?

Retained Earnings is a part of Stockholders’ Equity. Retained Earnings is an account used to accumulate the profits and losses of a corporation over time. Retained Earnings is Contributed Capital. Retained Earnings increases Stockholders’ Equity when the balance is positive. It decreases Stockholders’ Equity when the balance is negative.

Can Stockholders’ Equity be Negative?

Stockholders’ Equity can have a negative balance if the corporation has liabilities that exceed its assets. It is a similar situation to a consumer owing more (liability) on a house (asset) than the house is worth. This referred to as negative Net Worth.

Causes of negative Net Worth can include:

- Too much debt compared to asset value.

- Overpayment of dividends.

- Expenses too high compared to revenue.

- Purchase of Treasury Stock in excess of other equity amounts.

- Provisions made for future liabilities, for example expectation of a payment to settle a lawsuit.

Stockholders’ Equity Journal Entries

Journal Entries for Stockholders’ Equity transactions include:

- Sale of Preferred Stock

- Sale of Common Stock

- Purchase of Treasury Stock

- Sale of Treasury Stock

- Declaration of Cash Dividends

- Payment of Cash Dividends

- Declaration of Stock Dividends

- Payment of Stock Dividends

- Recording Stock Splits

- Closing Profits or Losses to Retained Earnings

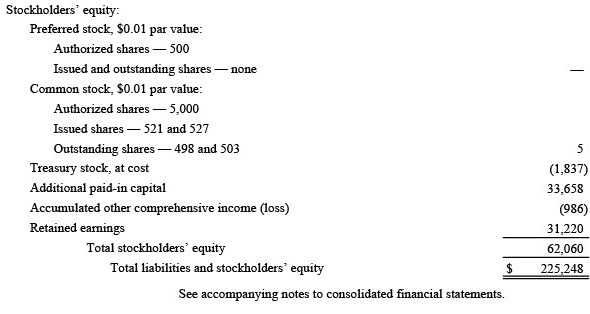

Example of Stockholders’ Equity Section of Balance Sheet

Below is an example of the Stockholders’ Equity section from an Apple corporation Balance Sheet.

For an overview of Stockholders’ Equity, watch this video:

For more about stock transactions, check out this Accounting Student Guide for step-by-step instructions:

-

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

What is Stockholders’ Equity?

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital

-

What is Paid in Capital?

What is Contributed or Paid-in Capital? Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or

-

What are Dividends? | Accounting Student Guide

What is a Dividend? A Dividend is a payout of earnings by a corporation to its stockholders. Dividends can be cash dividends or stock dividends. A dividend is paid per

-

What are Stock Splits?

A stock split occurs when a corporation’s board of directors decides to divide one share of stock into multiple shares. For example, a two-for-one stock split means that one share