What is a Closing Entry?

A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and prepare those accounts for the new accounting period. Closing entries are the accounting mechanism that move any profit or loss for the month into the equity accounts. Closing entries are done as one of the final steps in the accounting cycle.

What is the Accounting Cycle?

The Accounting Cycle is the framework used to organize, record, and report financial transactions for a business or organization on a monthly schedule. The steps of the Accounting Cycle are:

- Identify Transactions

- Record Transactions

- Post Transactions to the General Ledger

- Create Unadjusted Trial Balance

- Record Adjusting Entries

- Create Adjusted Trial Balance

- Create Financial Statements

- Record Closing Entries

- Create Post-Closing Trial Balance

These steps are based on manual “green ledger sheet” accounting. Because most accounting is done using accounting software, much of this work goes on behind the scenes. Identifying and Recording Transactions and Recording Adjusting Entries are still necessary because that is the original data on which all the other steps are completed.

For more details on the Accounting Cycle, watch this video:

Why are Closing Entries Necessary?

Closing Entries were necessary using a manual accounting system in order to return the balances in temporary accounts to zero at the end of the accounting cycle. Temporary accounts act like a scoreboard in accounting. Each month is a game. Score is kept for that game. At the end of the game, the scoreboard is returned to zero to get ready for the next game. In accounting terms, closing entries reset the accounts to zero to get ready for the next accounting cycle.

If closing entries weren’t completed, it would make creating Financial Statements difficult. Financial Statements are based on periods of time: a month, a quarter, a year. Closing entries draw a line to signify one accounting period has ended and another one has begun.

Because most accounting is done now using accounting software, Closing Entries happen behind the scenes. If an Income Statement or Balance Sheet is needed for a particular month, the report is generated by specifying the dates of the information required. Closing Entries are not needed with accounting software because the work of the Closing Entries is done behind the scenes.

For accounting students, it is important that the process is understood for two reasons:

- Understanding the process helps to understand the software and use it more effectively.

- An understanding of Closing Entries is needed for future accounting classes.

What is the Difference Between Permanent and Temporary Accounts?

In accounting, permanent accounts (also called Real accounts) are accounts with balances that carry over from one accounting period to another. Temporary accounts (also called Nominal accounts) are accounts that zeroed out after each accounting period.

Permanent accounts:

Temporary accounts:

What Accounts Get Closed Using Closing Entries?

All Temporary accounts (Revenues, Expenses, and Owner’s Draw accounts) are closed each month using Closing Entries. Accounts with debit balances are credited. Accounts with credit balances are debited. This brings the account balances for Revenue, Expenses, and Owner’s Draw to a zero balance moving into the new accounting period.

Where Do the Amounts for the Closing Entries Come From?

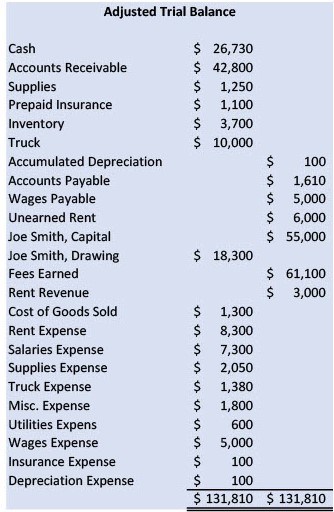

The amounts for the closing entries come from the Adjusted Trial Balance. The accounts are listed in order of the type of account (asset, liabilities, equity, revenue, and expenses.)

Here is a sample Adjusted Trial Balance to illustrate how to do Closing Entries:

The accounts that will be closed start with Joe Smith, Drawing and continue to the end of the Expense accounts. There are two revenue accounts to be closed, and ten expense accounts. When the closing entries are done, the only accounts that will have balances remaining are the permanent accounts: Assets, Liabilities, and Equity.

Two Methods for Closing Entries

Accounting textbooks use one of two methods to close accounts:

- Closing directly to Equity

- Closing using the Income Summary account

The purpose is the same, to move profit off the Income Statement and into the Equity section of the Balance Sheet.

The accounting textbook being used is the determining factor for which method is used. If your textbook uses an account called Income Summary, use the Closing Using Income Summary section. Otherwise, use the Closing Directly to Equity section.

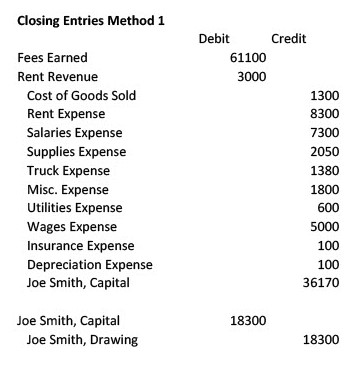

Method 1: Closing Directly to Equity

When using the direct-to-equity method of closing entries, one closing journal entry is done that:

- Debits each revenue account.

- Credits each expense account.

- Credits each dividend account.

- Debits or credits the Capital or Retained Earnings account.

Journal Entries for Closing Directly to Equity

The sample company has two revenue accounts with credit balances:

| Fees Earned | 61,100 | |

| Rent Revenue | 3,000 |

Closing Entry Step 1: Debit each revenue account.

| Fees Earned | 61,100 | |

| Rent Revenue | 3,000 |

The sample company has ten expense accounts with debit balances:

| Cost of Goods Sold | 1,300 | |

| Rent Expense | 8,300 | |

| Salaries Expense | 7,300 | |

| Supplies Expense | 2,050 | |

| Truck Expense | 1,380 | |

| Misc. Expense | 1,800 | |

| Utilities Expense | 600 | |

| Wages Expense | 5,000 | |

| Insurance Expense | 100 | |

| Depreciation Expense | 100 |

Closing Entry Step 2: Credit each expense account.

| Cost of Goods Sold | 1,300 | |

| Rent Expense | 8,300 | |

| Salaries Expense | 7,300 | |

| Supplies Expense | 2,050 | |

| Truck Expense | 1,380 | |

| Misc. Expense | 1,800 | |

| Utilities Expense | 600 | |

| Wages Expense | 5,000 | |

| Insurance Expense | 100 | |

| Depreciation Expense | 100 |

Closing Entry Step 3: Close profit or loss to Capital (or Retained Earnings) account

Revenue – Expenses = Profit, Profit increases Capital or Retained Earnings (credit)

Revenue – Expenses = Loss, Loss decreases Capital or Retained Earnings (debit)

In the sample company Revenue – Expenses = $36,170 profit. Profit increases Capital (Equity). Capital (Equity) increases on the credit side.

| Joe Smith, Capital | 36,170 |

If the result has been a loss, losses decrease Capital. Capital decreases on the debit side.

| Joe Smith, Capital | 36,170 |

Closing Entry Step 4: Close Drawing or Dividends account to Capital.

When an owner takes Capital back out of the business through a drawing account, Capital decreases. The Joe Smith, Drawing account has a debit balance of $18,300. This reduces Capital. To close the drawing account to Capital, debit Capital to reduce it, credit Drawing to close it.

| Joe Smith, Capital | 18,300 | |

| Joe Smith, Drawing | 18,300 |

Here is the entire Closing Entry for closing directly to Equity. (Note: some textbooks may use accounts called Equity or Capital or Retained Earnings. The accounts work the same. Use the account name provided by the textbook.):

If the result has been a loss, losses decrease Capital. Debit capital, credit Income Summary.

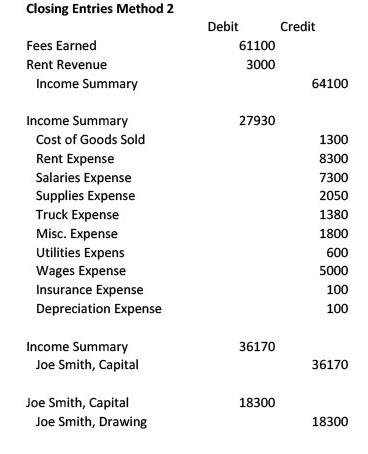

Closing Entry Step 4: Close Drawing or Dividends account to Capital.

Joe Smith, Drawing account has a debit balance of $18,300. This reduces Capital. To close the drawing account to Capital, debit Capital to reduce it, credit Drawing to close it.

Method 2: Closing Using Income Summary

Another method used in some textbooks to create closing entries, uses a temporary account called Income Summary. Income Summary acts as a “bucket” to move amounts out of Revenue and Expenses. Income Summary is then closed out to the Capital or Equity or Retained Earnings accounts. The final step is to close the Drawing account to the Capital account.

When using the income summary method of closing entries, four closing journal entries are done as follows:

- Debit each revenue account, credit Income Summary for the total.

- Credit each expense account, debit Income Summary for the total.

- For a Profit: Debit Income Summary, Credit the Capital or Retained Earnings account. or For a Loss: Debit the Capital or Retained Earnings account, Credit Income Summary.

- Debit Capital or Retained Earnings account, credit Drawing or Dividend account, .

We’ll go through each one step-by-step.

Journal Entries for Closing Using Income Summary

Closing Entry Step 1: Debit each revenue account, credit Income Summary.

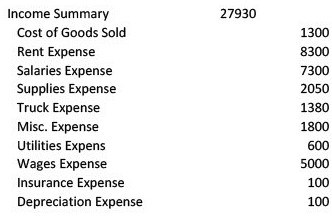

Closing Entry Step 2: Debit Income Summary, credit each expense account.

Closing Entry Step 3: Close Income Summary to Capital (or Retained Earnings) account

Revenue – Expenses = Profit, Profit increases Capital or Retained Earnings (credit)

Revenue – Expenses = Loss, Loss decreases Capital or Retained Earnings (debit)

In the sample company Revenue – Expenses = $36,170 profit. Profit increases Capital. Capital increases on the credit side.

Here is the entire Closing Entry for closing using Income Summary. (Note: some textbooks may use accounts called Equity or Capital or Retained Earnings. The accounts work the same. Use the account name provided by the textbook.):

Posting Closing Entries to the General Ledger

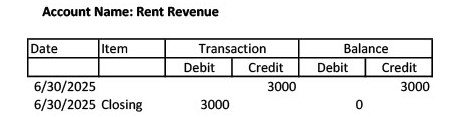

Regardless of whether a company uses the direct-to-equity method or the Income Summary method to close accounts, the next step is the same: posting to accounts.

As each line of the closing entry is posted to the individual accounts, in the item section of the ledger, a notation is added. “Closing” indicates that this was a closing entry. When the closing entries are posted, and the balances are update, the ledger will show zero balances for all revenue, expenses, and drawing accounts.

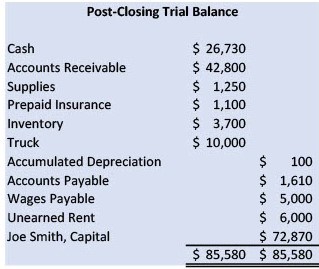

How to Create a Post-Closing Trial Balance

Once the Closing Entries are posted to the general ledger accounts and the balances updated, a final trial balance is created. The post-closing trial balance reports the final ending balances for the accounting period. Only those accounts with balances are reported: Assets, Liabilities, and Equity. The Revenue and Expense accounts have zero balances.

Here’s the post-closing trial balance from the example company:

Notice the only accounts with balances are the permanent accounts: Assets, Liabilities, and Equity. These balances are the balances that carry forward into the new month.

For more information about Closing Entries, watch this video:

Once the post-closing trial balance is completed, the accounting cycle begins again.

This article is the last of the four part series covering the first four chapters of Financial Accounting or Principles of Accounting. Access the other articles here:

-

So You Want to Start a Nonprofit…Consider This

Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. Here are key points to consider before embarking

-

Tax Liability Accrual Explained

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with accounting

-

Nonprofit Monthly Financial Close Process Overview

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. This process ensures that financial statements are prepared, reviewed,

-

Navigating Payroll Taxes for Nonprofits: Responsibilities and Compliance

Payroll taxes are the taxes that employers withhold from their employees’ wages and are required to remit to the appropriate government agencies. They include various taxes that fund government programs,

-

Understanding Form 990: Transparency and Accountability for Nonprofits

Form 990 is a reporting document filed by tax-exempt organizations in the United States with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance,

-

Financial Disclosures for Affiliated Nonprofit Organizations

Disclosures related to revenue sharing, consolidated financial statements, noncontrolling interests, and related party transactions in the context of affiliated organizations within a nonprofit are crucial for transparency and accurate financial