What is a Trial Balance?

A Trial Balance is a report used after transactions are posted to accounts to check whether debits equal credits. The Trial Balance takes the balances from T-Accounts or account ledgers and records them in worksheet form. The columns are added, and if debits and credits have been recorded for each transaction, the debit column will equal the credit column.

What is the Difference Between a Balance Sheet and a Trial Balance?

A Trial Balance is a worksheet that checks to make sure all debits equal all credits for all accounts. A Balance Sheet is a summary report of the financial health of the business, showing the balances in some accounts: Assets, Liabilities, and Equity.

To learn more about Financial Statements, like the Balance Sheet, check out this article:

What are the 3 Types of Trial Balances?

Trial Balances are completed at three points during the accounting cycle to check that debits equal credits.

- Unadjusted Trial Balance–the initial Trial Balance is completed when all regular accounting transactions (invoices, bills, payroll) have been completed for the month.

- Adjusted Trial Balance–the Adjusted Trial Balance is completed after Adjusting Entries are completed and posted to the accounts. This checks to make sure debits equal credits after the account balances were updated by adjusting journal entries.

- Post Closing Trial Balance–the Post-Closing Trial Balance is completed after Closing Entries are completed and posted to the accounts. This checks to make sure debits equal credits after the account balances were updated by closing journal entries. The balances in the Post-Closing Trial Balance are the beginning balances for the new month.

To complete a Trial Balance, our account balances from the company’s T-Accounts or Ledgers are transferred to the report.

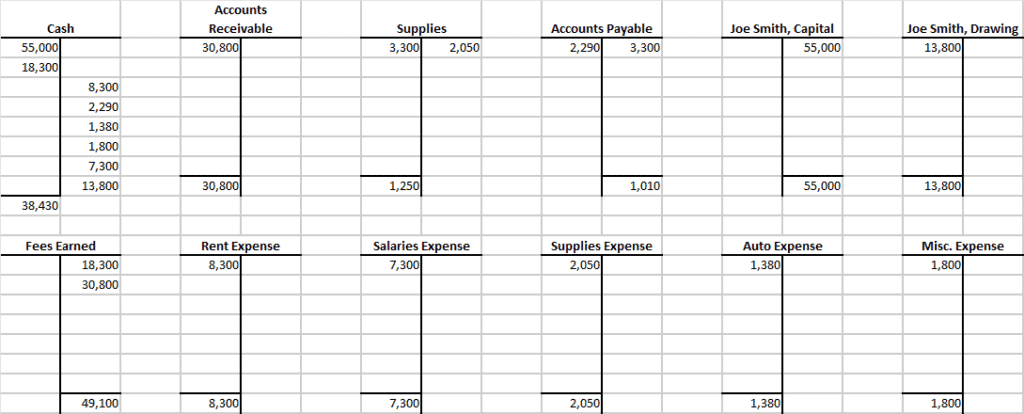

The following is an example of what the balances look like in T-Accounts:

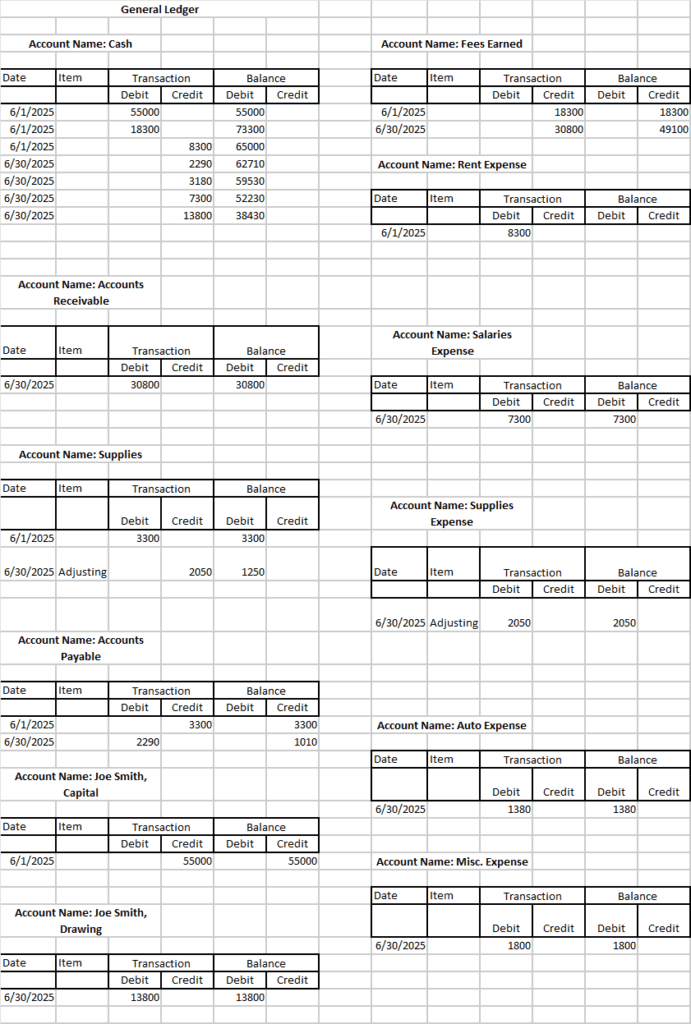

The following is an example of what the balances look like in a Ledger:

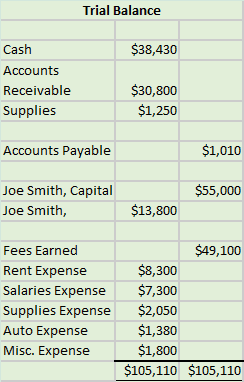

Debit balances are entered in the debit column. Credit balances are entered in the credit column. For example, the Cash account has a debit balance of $38,430. This is listed on the Trial Balance next to the account name, in the debit (left) column. When all the account balances are entered, the two columns are added up. The total debits should equal the total credits.

Example of a Trial Balance

What to Do if the Trial Balance Doesn’t Balance?

The purpose of a Trial Balance is to catch errors before moving on through the accounting process. If the Trial Balance doesn’t balance, it means there is an error. The best way to uncover the error is to walk backwards through the work. Take these steps:

- Re-add the columns in the Trial Balance. Sometimes, it’s just an adding mistake.

- Check each individual balance against the T-Account balance. Is the amount correct? Are debit balances in the T-Account or ledger transferred to the debit column of the Trial Balance?

- If the balances are transferred correctly, go to the individual T-Accounts or Ledger and re-check the balance.

- If those balances are all correct, then the problem is in the original transaction entries. Take each transaction one by one to see if there is a debit for every credit.

- Hack #1–The 9 Trick: Find the difference between the debit and credit column in the Trial Balance. Is the difference evenly divisible by 9? If so, the error is likely a transposition error (you entered 450 when you meant 540.) Example: Debit column = $10,250, Credit column = $12,050 Difference between the columns $12,050 – $10,250 = $1,800. $1,800 is evenly divisible by 9. Look for an entry with a transposition.

- Hack #2–The 2 Trick: Find the difference between the debit and credit column in the Trial Balance. Is the difference evenly divisible by 2? If so, the most likely case is that a number is on the wrong side. A debit that should be a credit or a credit that should be a debit. Example: Accounts Payable balance is entered on the debit side of the Trial Balance or a transaction was entered with two debits rather than a debit and a credit.

- Hack #3–There’s No Crying in Accounting: Often the first reaction to a Trial Balance that doesn’t balance is frustration. Perhaps some weeping and wailing. It’s frustrating to get so far only to find out you don’t balance. Take a moment. Then, work back through the steps to find the problem. This is part of the checks and balances that keep accounting records accurate. Better to find out there’s a problem now, rather than getting all the way through the accounting cycle and having a bigger mess to sort out. You’ll be okay. I promise.

To learn more about Trial Balances including examples of Adjusted Trial Balances and Post-Closing Trial Balances, watch this video:

-

So You Want to Start a Nonprofit…Consider This

Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. Here are key points to consider before embarking

-

Tax Liability Accrual Explained

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with accounting

-

Nonprofit Monthly Financial Close Process Overview

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. This process ensures that financial statements are prepared, reviewed,

-

Navigating Payroll Taxes for Nonprofits: Responsibilities and Compliance

Payroll taxes are the taxes that employers withhold from their employees’ wages and are required to remit to the appropriate government agencies. They include various taxes that fund government programs,

-

Understanding Form 990: Transparency and Accountability for Nonprofits

Form 990 is a reporting document filed by tax-exempt organizations in the United States with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance,

-

Financial Disclosures for Affiliated Nonprofit Organizations

Disclosures related to revenue sharing, consolidated financial statements, noncontrolling interests, and related party transactions in the context of affiliated organizations within a nonprofit are crucial for transparency and accurate financial