Learning how to do Journal Entries is at the core of learning accounting. Following these step-by-step directions will help you understand how to do journal entries like a pro.

What is a Journal Entry in Accounting?

A Journal Entry is a method of recording increases and decreases to accounts. A journal entry details the accounts being impacted, and the debits and credits needed to record business transactions in accounting.

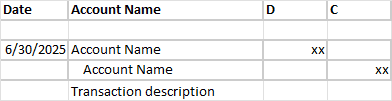

Journal Entries use a standard format to record transactions. That format includes the date of the transaction, the accounts being impacted by the transaction, columns for entering debits or credits, and a description line to enter the reason for the transaction.

In a journal entry, every debit entry must have a credit entry and the debits must always equal the credits. The credit portion of the journal entry is indented to make reading a long line of transactions easier.

The Account Name used in a journal entry must exactly match the Account Name from a company’s Chart of Accounts, an official list of accounts used by that company. For example, if the Account Name in the Chart of Accounts is Supplies Expense, the journal entry Account Name must be Supplies Expense, rather than Supplies or Supply Expense or Supplies Exp.

Examples of Accounting Transactions

To demonstrate the correct method of completing journal entries, we will use the follow sample accounting transactions commonly found in accounting textbooks:

| On June 1 of the current year, Joe Smith established a business to manage rental property. He completed the following transactions during June: |

| 1. Opened a business bank account with a deposit of $55,000 from personal funds. |

| 2. Purchased office supplies on account, $3,300. |

| 3. Received cash from fees earned for managing rental property, $18,300. |

| 4. Paid rent on office and equipment for the month, $8,300. |

| 5. Paid creditors on account, $2,290. |

| 6. Billed customers for fees earned for managing rental property, $30,800. |

| 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800. |

| 8. Paid office salaries, $7,300. |

| 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050. |

| 10.Withdrew cash for personal use, $13,800. |

Sample Accounting Transactions Step-by-step

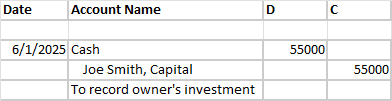

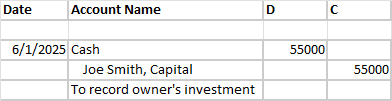

Transaction 1. Opened a business bank account with a deposit of $55,000 from personal funds.

Analysis:

When a business owner opens a business, they are turning personal funds into business funds. The business now owes that investment back to the business owner. To put it differently, the funds represent the owner’s equity in the business and are recorded in an account called “Owner’s Name, Equity” or “Owner’s Name, Capital”. The funds become a business asset recorded in the company’s books under an account called “Cash”.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Joe Smith, Capital has the account type of Equity. Equity has a normal credit balance. To increase an equity account, credit it.

In the journal entry, the $55,000 deposit to the bank account goes on the left (debit) side of the account because Cash is increasing.

In the Joe Smith, Capital, the $55,000 deposit goes on the right (credit) side of the account because equity is increasing.

(Notice there are no + or – signs. The debit or credit indicates whether the account is increasing or decreasing.)

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| +55,000 | = | 0 | + | +55,000 |

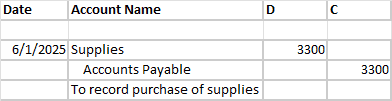

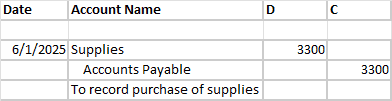

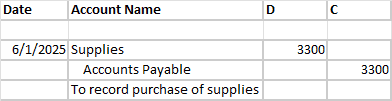

Transaction 2. Purchased office supplies on account, $3,300.

Analysis:

Whenever an accounting textbook transaction using the phrase “on account”, it means no money has changed hands. Purchases on account mean that the goods have been received but payment will be made later. When a payment is owed, we record it in a liability account called “Accounts Payable.”

“Supplies” is a tricky part of this transaction. Accounting textbooks use two accounts with the word “Supplies”– Supplies (an asset), (sometimes called Supplies Asset), and Supplies Expense. Supplies (the asset) works like an inventory account. You hold the supplies in an inventory until they are used. When supplies are used, they are moved from the asset account into the expense account.

What to Debit and What to Credit:

Supplies (the asset) has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Accounts Payable has the account type of Liability. A Liability has a normal credit balance. To increase a liability account, credit it.

In the journal entry, the $3,300 purchase of supplies goes on the left (debit) side of the account because Supplies is increasing.

In the Accounts Payable T-Account, the $3,300 deposit goes on the right (credit) side of the account because the liability is increasing.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| +3,300 | = | +3,300 | + | +0 |

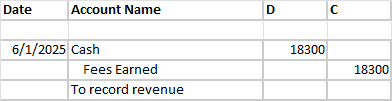

Transaction 3. Received cash from fees earned for managing rental property, $18,300.

Analysis:

When a business sells to its customers, it receives cash either “now” or “later”. If cash is being received at the time of the sale, the textbook will specify “received cash” to indicate that. If the textbook says “on account”, it means that cash will come later. When cash will be received later the account we use to track what the business will be receiving later is Accounts Receivable. In this case, we received the cash at the time of the sale.

When a business sells something to its customers, the business has Revenue. The name of the revenue account is specific to the business. For example, this business could call its revenue account: Fees Earned, Management Fees, Rental Property Management Fees, Revenue, or a hundred other names. Always refer to the company’s Chart of Accounts for the official name of the revenue account. For this business, our revenue account is called Fees Earned.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Fees Earned has the account type of Revenue. A Revenue account has a normal credit balance. To increase a revenue account, credit it.

In the journal entry, the $18,300 receipt of cash goes on the left (debit) side of the account because Cash is increasing.

In the Fees Earned account, the $18,300 revenue goes on the right (credit) side of the account because the revenue is increasing.

Impact on the Accounting Equation:

Note: Revenue increases equity. A business with revenue is more valuable than a business without revenue.

| Assets | = | Liabilities | + | Equity |

| +18,300 | = | 0 | + | +18,300 |

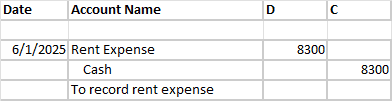

Transaction 4. Paid rent on office and equipment for the month, $8,300.

Analysis:

When a business has expenses, it pays out cash either “now” or “later”. If cash is being paid at the time of the purchase, the textbook will specify “paid” to indicate that. If the textbook says “on account”, it means that cash will go out later. When cash will be paid later the account we use to track what the business will be paying later is Accounts Payable. In this case, we paid the cash.

When a business purchases something, it is either assigned to an Asset account (purchase of a piece of equipment or a vehicle) or an Expense account (utilities, employee wages, insurance.)

Always refer to the company’s Chart of Accounts for the official name of the expense accounts. In accounting, the name must always match exactly for accuracy and clarity. For example, Supplies and Supplies Expense are two different accounts. Insurance could be Prepaid Insurance or Insurance Expense.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, cash is decreasing so we credit it.

The expense account we will use for the rent we paid is Rent Expense. An Expense account has a normal debit balance. To increase an expense account, debit it.

In the journal entry, the $8,300 payment of cash goes on the right (credit) side of the account because Cash is decreasing.

In the Rent Expense account, the $8,300 deposit goes on the left (debit) side of the account because the expense is increasing.

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such business exists!)

| Assets | = | Liabilities | + | Equity |

| -8,300 | = | 0 | + | -8,300 |

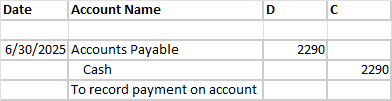

Transaction 5. Paid creditors on account, $2,290.

In Transaction 2, we purchased Supplies on account. We said:

Whenever an accounting textbook transaction using the phrase “on account”, it means no money has changed hands. Purchases on account mean that the goods have been received but payment will be made later. When a payment is owed, we record it in a liability account called “Accounts Payable.”

In Transaction 5, we are now going to pay part of this bill. We know it is a partial payment because the original transaction was for $3,300 and we are paying only $2,290. When you pay a bill, your cash decreases and the amount you owe (liability) decreases (you owe less).

Once the transaction is posted to the account, we will have a balance due to the vendor of $1,010 [$3,300 – $2,290 = $1,010] which will be paid later.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To decrease an asset, credit it.

Accounts Payable has the account type of Liability. A Liability has a normal credit balance. To decrease a liability account, debit it.

In the journal entry, the $2,290 payment goes on the right (credit) side of the account because Cash is decreasing.

In the Accounts Payable account, the $2,290 payment goes on the left (debit) side of the account because the liability is decreasing.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| -2,290 | = | -2,290 | + | +0 |

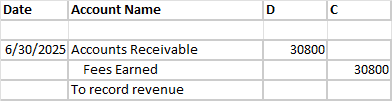

Transaction 6. Billed customers for fees earned for managing rental property, $30,800.

Analysis:

When a business sells to its customers, it receives cash either “now” or “later”. If cash is being received at the time of the sale, the textbook will specify “received cash” to indicate that. If the textbook says “on account” or “billed”, it means that cash will come later. When cash will be received later the account we use to track what the business will be receiving later is Accounts Receivable.

When a business sells something to its customers, the business has Revenue. The name of the revenue account is specific to the business. For example, this business could call its revenue account: Fees Earned, Management Fees, Rental Property Management Fees, Revenue, or a hundred other names. Always refer to the company’s Chart of Accounts for the official name of the revenue account. For this business, our revenue account is called Fees Earned.

What to Debit and What to Credit:

Accounts Receivable has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Fees Earned has the account type of Revenue. A Revenue account has a normal credit balance. To increase a revenue account, credit it.

In the journal entry, the $30,800 record of what is due to the company goes on the left (debit) side of the account because Accounts Receivable is increasing.

In the Fees Earned account, the $30,800 revenue goes on the right (credit) side of the account because the revenue is increasing.

Impact on the Accounting Equation:

Note: Revenue increases equity. A business with revenue is more valuable than a business without revenue.

| Assets | = | Liabilities | + | Equity |

| +30,800 | = | 0 | + | +30,800 |

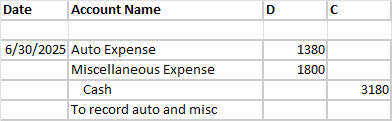

Transaction 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800.

Analysis:

When a business has expenses, it pays out cash either “now” or “later”. If cash is being paid at the time of the purchase, the textbook will specify “paid” to indicate that. If the textbook says “on account”, it means that cash will go out later. When cash will be paid later the account we use to track what the business will be paying later is Accounts Payable. In this case, we paid cash.

When a business purchases something, it is either assigned to an Asset account (purchase of a piece of equipment or a vehicle) or an Expense account (utilities, employee wages, insurance.) In this case, we are paying two different expenses: Auto Expense of $1,380 and Miscellaneous Expense of $1,800.

Always refer to the company’s Chart of Accounts for the official name of the expense accounts. In accounting, the name must always match exactly for accuracy and clarity. For example, Supplies and Supplies Expense are two different accounts. “Insurance” could be Prepaid Insurance or Insurance Expense.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, cash is decreasing so we credit it. Because we have two different expense accounts, we need to add together the two amounts to find the total amount of cash being paid out. [$1,380 + $1,800 = $3,180]

The expense account we are using are Auto Expense and Miscellaneous Expense. An Expense account has a normal debit balance. To increase an expense account, debit it. In this case, we debit each expense account for the amount of the expense.

In the journal entry, the $3,180 payment of cash goes on the right (credit) side of the account because Cash is decreasing.

In the Auto Expense account, the $1,380 expense amount goes on the left (debit) side of the account because the expense is increasing. In the Miscellaneous Expense account, the $1,800 expense amount goes on the left (debit) side of the account because the expense is increasing.

Because this journal entry has more than two accounts impacted, it is called a complex journal entry. (Look at you doing a complex journal entry! I’m so proud!)

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such a business exists!)

| Assets | = | Liabilities | + | Equity |

| -3,180 | = | 0 | + | -3,180 |

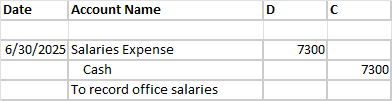

Transaction 8. Paid office salaries, $7,300.

Analysis:

When a business has expenses, it pays out cash either “now” or “later”. If cash is being paid at the time of the purchase, the textbook will specify “paid” to indicate that. If the textbook says “on account”, it means that cash will go out later. When cash will be paid later the account we use to track what the business will be paying later for payroll is Salaries or Wages Payable. In this case, we paid cash.

When a business purchases something, it is either assigned to an Asset account (purchase of a piece of equipment or a vehicle) or an Expense account (utilities, employee wages, insurance.) When we are talking about payroll, payroll is an expense.

Always refer to the company’s Chart of Accounts for the official name of the expense accounts. In accounting, the name must always match exactly for accuracy and clarity. For example, Supplies and Supplies Expense are two different accounts. Insurance could be Prepaid Insurance or Insurance Expense.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, cash is decreasing so we credit it.

The expense account we will use for the salaries we paid is Salaries Expense. An Expense account has a normal debit balance. To increase an expense account, debit it.

In the journal entry, the $7,300 payment of cash goes on the right (credit) side of the account because Cash is decreasing.

In the Salaries Expense account, the $7,300 deposit goes on the left (debit) side of the account because the expense is increasing.

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such a business exists!)

| Assets | = | Liabilities | + | Equity |

| -7,300 | = | 0 | + | -7,300 |

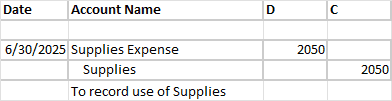

Transaction 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050.

Analysis:

This is the trickiest transaction in the group. Different accounting textbooks phrase this transaction in different ways. Here’s what we said about it in the Transaction 2:

“Supplies” is a tricky part of this transaction. Accounting textbooks use two accounts with the word “Supplies”– Supplies (an asset), (sometimes called Supplies Asset), and Supplies Expense. Supplies (the asset) works like an inventory account. You hold the supplies in an inventory until they are used. When supplies are used, they are moved from the asset account into the expense account.

In the original transaction, we recorded the purchase of supplies in the Supplies (asset) account:

During the month, we have gone to the office supply closet and taken out pens, sticky notes, and markers. Right now, our Supplies account says we have $3,300 worth of supplies in the supply closet, but this is no longer accurate.

Our job now is to determine what the balance SHOULD BE in our asset account. We want to make sure we are accurately accounting for what we have (asset) and what we used (expense).

This transaction is telling us that what we have “on hand” in our supply closet is $1,250 worth of supplies. Our Supplies (asset) account says we have $3,300. We need to reduce that number to reflect the actual value. The difference between the two is $2,050.

Where did the $2,050 worth of office supplies go? We used it up. We “expensed” it. When you use up an asset, we record the amount as an expense. We move $2,050 out of our Supplies (asset) account and into our Supplies Expense account.

What to Debit and What to Credit:

Supplies (the asset) has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. We want to decrease our balance so we credit it.

Supplies Expense has the account type of Expense. An expense has a normal debit balance. To increase an expense account, debit it.

The balance in the Supplies account will now be $1,250 [Debit of $3,300 – Credit of $2,050]

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such a business exists!)

| Assets | = | Liabilities | + | Equity |

| -2,050 | = | 0 | + | -2050 |

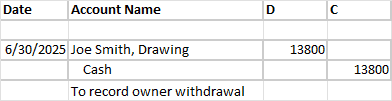

Transaction 10. Withdrew cash for personal use, $13,800.

Analysis:

In Transaction 1, we said:

When a business owner opens a business, they are turning personal funds into business funds. The business now owes that investment back to the business owner. To put it differently, the funds represent the owner’s equity in the business and are recorded in an account called “Owner’s Name, Equity” or “Owner’s Name, Capital”. The funds become a business asset recorded in the company’s books under an account called “Cash”.

Now, our business owner wants to withdraw some cash from the business for personal use. When this happens, the business owner’s equity is decreasing. He has less value in his business. Cash is decreasing, as well.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, we are decreasing cash so we credit it.

When Joe opened his business, we increased his equity this way:

Now, we want to decrease his equity. To decrease equity we need to debit it. But, we don’t do that in Joe’s main equity account. We want to separate out what he has put into the business from what he took out of the business for several reasons (for example, taxes).

Rather than use the main equity account, we use an account specifically for tracking withdrawals by the owner. For this business, the account we use is called Joe Smith, Drawing. You may also see the account called Owner Name, Withdrawals or Owner Name, Dividends.

Joe Smith, Drawing is a sub-account of the Joe Smith, Capital account. It’s purpose is to reduce an equity account. An equity account has a normal credit balance. It increases on the credit side. In this case, we want to reduce equity so we debit the account.

The impact of this transaction is a decrease to Joe’s equity [$55,000 – $13,800 = 41,200]. If the transaction had been posted to the Joe Smith, Capital account as a debit, that is what the new balance in the account would have been. We are just using the sub-account to track withdrawals.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| -13,800 | = | 0 | + | -13,800 |

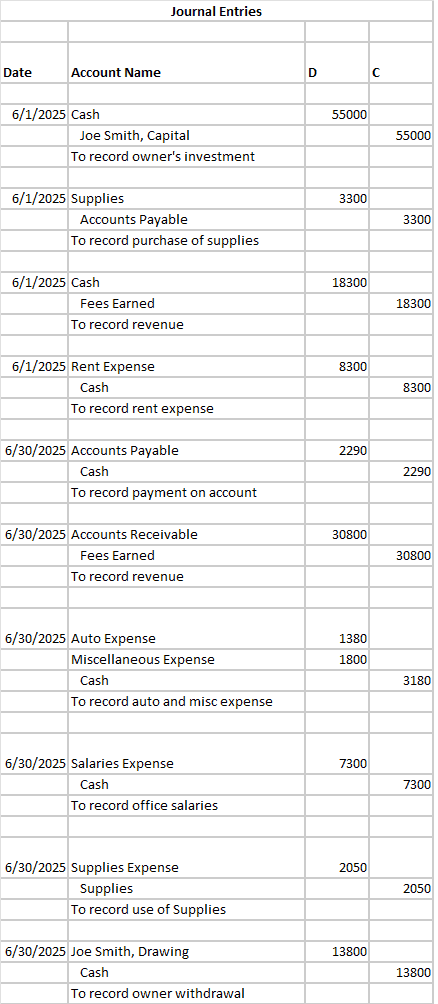

Complete Set of Journal Entries for Sample Transactions

The chart below shows the complete set of journal entries discussed in this article:

For a video walkthrough of these journal entries, watch this video:

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a