A T-account is a simplified or informal version of an account used to show increases and decreases in recording business transactions. It is called a T-Account because it is shaped like the letter T. The left side of the T-Account is the debit side. The right side of the T-account is the credit side.

What are the 3 Parts of a T-Account?

An account has three parts:

- A title that matches an account name in the Chart of Accounts of a business.

- A space to record increases in an account.

- A space to record decreases in an account.

How is a T-Account Used in Accounting?

A T-Account is a way of organizing transactions in an easily understood and visually show the increases and decreases in accounts. Each business transaction is broken into parts with each part being assigned to an account. A determination is made using the rules of debit and credit whether the accounts are increasing or decreasing and on which side of the account (debit or credit) the partial transaction should be recorded.

It is a staple of accounting education due to its simple and visual approach for demonstrating increases and decreases in double-entry accounting. Accountants sometimes use T-Accounts to visually plan out a complicated journal entry.

Increases and decreases to accounts are based on the accounting rules of Normal Balances. To learn more about Normal Balances, read this article:

T-Account Example Problems

The following transactions are typical transactions from accounting textbooks. Each transaction is broken into its parts with clear explanations.

| On June 1 of the current year, Joe Smith established a business to manage rental property. He completed the following transactions during June: |

| 1. Opened a business bank account with a deposit of $55,000 from personal funds. |

| 2. Purchased office supplies on account, $3,300. |

| 3. Received cash from fees earned for managing rental property, $18,300. |

| 4. Paid rent on office and equipment for the month, $8,300. |

| 5. Paid creditors on account, $2,290. |

| 6. Billed customers for fees earned for managing rental property, $30,800. |

| 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800. |

| 8. Paid office salaries, $7,300. |

| 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050. |

| 10. Withdrew cash for personal use, $13,800. |

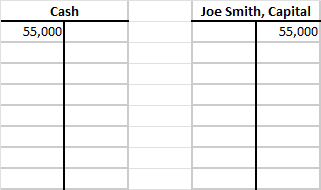

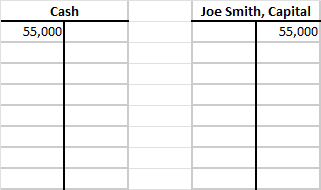

Transaction 1:

Opened a business bank account with a deposit of $55,000 from personal funds.

Analysis:

When a business owner opens a business, they are turning personal funds into business funds. The business now owes that investment back to the business owner. To put it differently, the funds represent the owner’s equity in the business and are recorded in an account called “Owner’s Name, Equity” or “Owner’s Name, Capital”. The funds become a business asset recorded in the company’s books under an account called “Cash”.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Joe Smith, Capital has the account type of Equity. Equity has a normal credit balance. To increase an equity account, credit it.

In the Cash T-Account, the $55,000 deposit to the bank account goes on the left (debit) side of the account because cash is increasing.

In the Joe Smith, Capital T-Account, the $55,000 deposit goes on the right (credit) side of the account because equity is increasing.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| +55,000 | = | 0 | + | +55,000 |

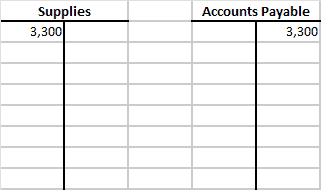

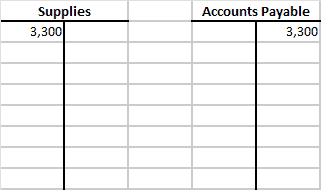

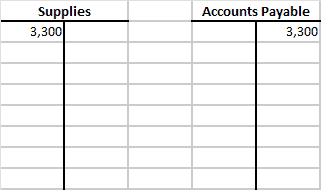

Transaction 2:

Purchased office supplies on account, $3,300.

Analysis:

Whenever an accounting textbook transaction using the phrase “on account”, it means no money has changed hands. Purchases on account mean that the goods have been received but payment will be made later. When a payment is owed, we record it in a liability account called “Accounts Payable.”

“Supplies” is a tricky part of this transaction. Accounting textbooks use two accounts with the word “Supplies”– Supplies (an asset), (sometimes called Supplies Asset), and Supplies Expense. Supplies (the asset) works like an inventory account. You hold the supplies in an inventory until they are used. When supplies are used, they are moved from the asset account into the expense account.

What to Debit and What to Credit:

Supplies (the asset) has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Accounts Payable has the account type of Liability. A Liability has a normal credit balance. To increase a liability account, credit it.

In the Supplies T-Account, the $3,300 purchase of supplies goes on the left (debit) side of the account because Supplies is increasing.

In the Accounts Payable T-Account, the $3,300 deposit goes on the right (credit) side of the account because the liability is increasing.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| +3,300 | = | +3,300 | + | +0 |

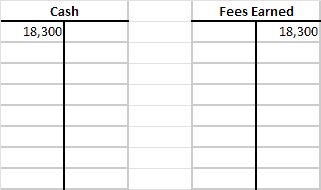

Transaction 3:

Received cash from fees earned for managing rental property, $18,300.

Analysis:

When a business sells to its customers, it receives cash either “now” or “later”. If cash is being received at the time of the sale, the textbook will specify “received cash” to indicate that. If the textbook says “on account”, it means that cash will come later. When cash will be received later the account we use to track what the business will be receiving later is Accounts Receivable. In this case, we received the cash at the time of the sale.

When a business sells something to its customers, the business has Revenue. The name of the revenue account is specific to the business. For example, this business could call its revenue account: Fees Earned, Management Fees, Rental Property Management Fees, Revenue, or a hundred other names. Always refer to the company’s Chart of Accounts for the official name of the revenue account. For this business, our revenue account is called Fees Earned.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Fees Earned has the account type of Revenue. A Revenue account has a normal credit balance. To increase a revenue account, credit it.

In the Cash T-Account, the $18,300 receipt of cash goes on the left (debit) side of the account because Cash is increasing.

In the Fees Earned T-Account, the $18,300 revenue goes on the right (credit) side of the account because the revenue is increasing.

Impact on the Accounting Equation:

Note: Revenue increases equity. A business with revenue is more valuable than a business without revenue.

| Assets | = | Liabilities | + | Equity |

| +18,300 | = | 0 | + | +18,300 |

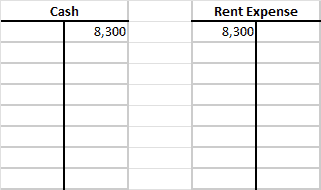

Transaction 4:

Paid rent on office and equipment for the month, $8,300.

Analysis:

When a business has expenses, it pays out cash either “now” or “later”. If cash is being paid at the time of the purchase, the textbook will specify “paid” to indicate that. If the textbook says “on account”, it means that cash will go out later. When cash will be paid later the account we use to track what the business will be paying later is Accounts Payable. In this case, we paid the cash.

When a business purchases something, it is either assigned to an Asset account (purchase of a piece of equipment or a vehicle) or an Expense account (utilities, employee wages, insurance.)

Always refer to the company’s Chart of Accounts for the official name of the expense accounts. In accounting, the name must always match exactly for accuracy and clarity. For example, Supplies and Supplies Expense are two different accounts. Insurance could be Prepaid Insurance or Insurance Expense.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, cash is decreasing so we credit it.

The expense account we will use for the rent we paid is Rent Expense. An Expense account has a normal debit balance. To increase an expense account, debit it.

In the Cash T-Account, the $8,300 payment of cash goes on the right (credit) side of the account because Cash is decreasing.

In the Rent Expense T-Account, the $8,300 deposit goes on the left (debit) side of the account because the expense is increasing.

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such business exists!)

| Assets | = | Liabilities | + | Equity |

| -8,300 | = | 0 | + | -8,300 |

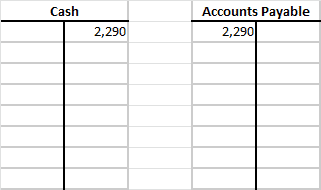

Transaction 5:

Paid creditors on account, $2,290.

Analysis:

In Transaction 2, we purchased Supplies on account. We said:

Whenever an accounting textbook transaction using the phrase “on account”, it means no money has changed hands. Purchases on account mean that the goods have been received but payment will be made later. When a payment is owed, we record it in a liability account called “Accounts Payable.”

In Transaction 5, we are now going to pay part of this bill. We know it is a partial payment because the original transaction was for $3,300 and we are paying only $2,290. When you pay a bill, your cash decreases and the amount you owe (liability) decreases (you owe less).

Once the transaction is posted to the account, we will have a balance due to the vendor of $1,010 [$3,300 – $2,290 = $1,010] which will be paid later.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To decrease an asset, credit it.

Accounts Payable has the account type of Liability. A Liability has a normal credit balance. To decrease a liability account, debit it.

In the Cash T-Account, the $2,290 payment goes on the right (credit) side of the account because Cash is decreasing.

In the Accounts Payable T-Account, the $2,290 payment goes on the left (debit) side of the account because the liability is decreasing.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| -2,290 | = | -2,290 | + | +0 |

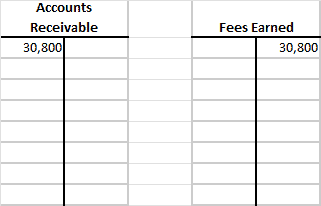

Transaction 6:

Billed customers for fees earned for managing rental property, $30,800.

Analysis:

When a business sells to its customers, it receives cash either “now” or “later”. If cash is being received at the time of the sale, the textbook will specify “received cash” to indicate that. If the textbook says “on account” or “billed”, it means that cash will come later. When cash will be received later the account we use to track what the business will be receiving later is Accounts Receivable.

When a business sells something to its customers, the business has Revenue. The name of the revenue account is specific to the business. For example, this business could call its revenue account: Fees Earned, Management Fees, Rental Property Management Fees, Revenue, or a hundred other names. Always refer to the company’s Chart of Accounts for the official name of the revenue account. For this business, our revenue account is called Fees Earned.

What to Debit and What to Credit:

Accounts Receivable has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it.

Fees Earned has the account type of Revenue. A Revenue account has a normal credit balance. To increase a revenue account, credit it.

In the Accounts Receivable T-Account, the $30,800 record of what is due to the company goes on the left (debit) side of the account because Accounts Receivable is increasing.

In the Fees Earned T-Account, the $30,800 revenue goes on the right (credit) side of the account because the revenue is increasing.

Impact on the Accounting Equation:

Note: Revenue increases equity. A business with revenue is more valuable than a business without revenue.

| Assets | = | Liabilities | + | Equity |

| +30,800 | = | 0 | + | +30,800 |

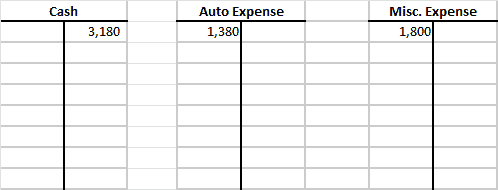

Transaction 7:

Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800.

Analysis:

When a business has expenses, it pays out cash either “now” or “later”. If cash is being paid at the time of the purchase, the textbook will specify “paid” to indicate that. If the textbook says “on account”, it means that cash will go out later. When cash will be paid later the account we use to track what the business will be paying later is Accounts Payable. In this case, we paid cash.

When a business purchases something, it is either assigned to an Asset account (purchase of a piece of equipment or a vehicle) or an Expense account (utilities, employee wages, insurance.) In this case, we are paying two different expenses: Auto Expense of $1,380 and Miscellaneous Expense of $1,800.

Always refer to the company’s Chart of Accounts for the official name of the expense accounts. In accounting, the name must always match exactly for accuracy and clarity. For example, Supplies and Supplies Expense are two different accounts. Insurance could be Prepaid Insurance or Insurance Expense.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, cash is decreasing so we credit it. Because we have two different expense accounts, we need to add together the two amounts to find the total amount of cash being paid out. [$1,380 + $1,800 = $3,180]

The expense account we are using are Auto Expense and Miscellaneous Expense. An Expense account has a normal debit balance. To increase an expense account, debit it. In this case, we debit each expense account for the amount of the expense.

In the Cash T-Account, the $3,180 payment of cash goes on the right (credit) side of the account because Cash is decreasing.

In the Auto Expense T-Account, the $1,380 expense amount goes on the left (debit) side of the account because the expense is increasing. In the Miscellaneous Expense T-Account, the $1,800 expense amount goes on the left (debit) side of the account because the expense is increasing.

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such a business exists!)

| Assets | = | Liabilities | + | Equity |

| -3,180 | = | 0 | + | -3,180 |

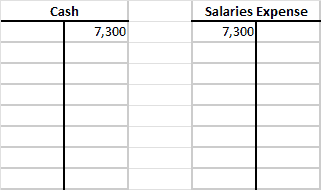

Transaction 8:

Paid office salaries, $7,300.

Analysis:

When a business has expenses, it pays out cash either “now” or “later”. If cash is being paid at the time of the purchase, the textbook will specify “paid” to indicate that. If the textbook says “on account”, it means that cash will go out later. When cash will be paid later the account we use to track what the business will be paying later for payroll is Salaries or Wages Payable. In this case, we paid cash.

When a business purchases something, it is either assigned to an Asset account (purchase of a piece of equipment or a vehicle) or an Expense account (utilities, employee wages, insurance.) When we are talking about payroll, payroll is an expense.

Always refer to the company’s Chart of Accounts for the official name of the expense accounts. In accounting, the name must always match exactly for accuracy and clarity. For example, Supplies and Supplies Expense are two different accounts. Insurance could be Prepaid Insurance or Insurance Expense.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, cash is decreasing so we credit it.

The expense account we will use for the salaries we paid is Salaries Expense. An Expense account has a normal debit balance. To increase an expense account, debit it.

In the Cash T-Account, the $7,300 payment of cash goes on the right (credit) side of the account because Cash is decreasing.

In the Salaries Expense T-Account, the $7,300 deposit goes on the left (debit) side of the account because the expense is increasing.

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such a business exists!)

| Assets | = | Liabilities | + | Equity |

| -7,300 | = | 0 | + | -7,300 |

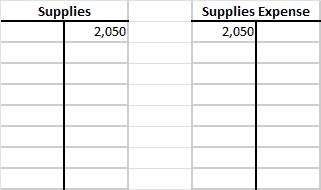

Transaction 9:

Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050.

Analysis:

This is the trickiest transaction in the group. Different accounting textbooks phrase this transaction in different ways. Here’s what we said about it in the Transaction 2:

“Supplies” is a tricky part of this transaction. Accounting textbooks use two accounts with the word “Supplies”– Supplies (an asset), (sometimes called Supplies Asset), and Supplies Expense. Supplies (the asset) works like an inventory account. You hold the supplies in an inventory until they are used. When supplies are used, they are moved from the asset account into the expense account.

In the original transaction, we recorded the purchase of supplies in the Supplies (asset) account:

During the month, we have gone to the office supply closet and taken out pens, sticky notes, and markers. Right now, our Supplies account says we have $3,300 worth of supplies in the supply closet, but this is no longer accurate.

Our job now is to determine what the balance SHOULD BE in our asset account. We want to make sure we are accurately accounting for what we have (asset) and what we used (expense).

This transaction is telling us that what we have “on hand” in our supply closet is $1,250 worth of supplies. Our Supplies (asset) account says we have $3,300. We need to reduce that number to reflect the actual value. The difference between the two is $2,050.

Where did the $2,050 worth of office supplies go? We used it up. We “expensed” it. When you use up an asset, we record the amount as an expense. We move $2,050 out of our Supplies (asset) account and into our Supplies Expense account.

What to Debit and What to Credit:

Supplies (the asset) has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. We want to decrease our balance so we credit it.

Supplies Expense has the account type of Expense. An expense has a normal debit balance. To increase an expense account, debit it.

The balance in the Supplies account will now be $1,250 [Debit of $3,300 – Credit of $2,050]

Impact on the Accounting Equation:

Note: Expenses decrease equity. A business with expenses is less valuable than a business without expenses. (Not that such a business exists!)

| Assets | = | Liabilities | + | Equity |

| -2,050 | = | 0 | + | -2050 |

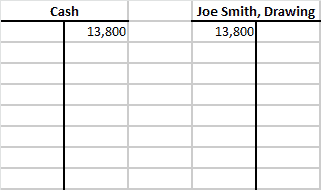

Transaction 10:

Withdrew cash for personal use, $13,800.

Analysis:

In Transaction 1, we said:

When a business owner opens a business, they are turning personal funds into business funds. The business now owes that investment back to the business owner. To put it differently, the funds represent the owner’s equity in the business and are recorded in an account called “Owner’s Name, Equity” or “Owner’s Name, Capital”. The funds become a business asset recorded in the company’s books under an account called “Cash”.

Now, our business owner wants to withdraw some cash from the business for personal use. When this happens, the business owner’s equity is decreasing. He has less value in his business. Cash is decreasing, as well.

What to Debit and What to Credit:

Cash has the account type of Asset. Assets have a normal debit balance. To increase an asset, debit it. In this case, we are decreasing cash so we credit it.

When Joe opened his business, we increased his equity this way:

Now, we want to decrease his equity. To decrease equity we need to debit it. But, we don’t do that in Joe’s main equity account. We want to separate out what he has put into the business from what he took out of the business for several reasons (for example, taxes).

Rather than use the main equity account, we use an account specifically for tracking withdrawals by the owner. For this business, the account we use is called Joe Smith, Drawing.

Joe Smith, Drawing is a sub-account of the Joe Smith, Capital account. It’s purpose is to reduce an equity account. An equity account has a normal credit balance. It increases on the credit side. In this case, we want to reduce equity so we debit the account.

The impact of this transaction is a decrease to Joe’s equity [$55,000 – $13,800 = 41,200]. If the transaction had been posted to the Joe Smith, Capital account as a debit, that is what the new balance in the account would have been. We are just using the sub-account to track withdrawals.

Impact on the Accounting Equation:

| Assets | = | Liabilities | + | Equity |

| -13,800 | = | 0 | + | -13,800 |

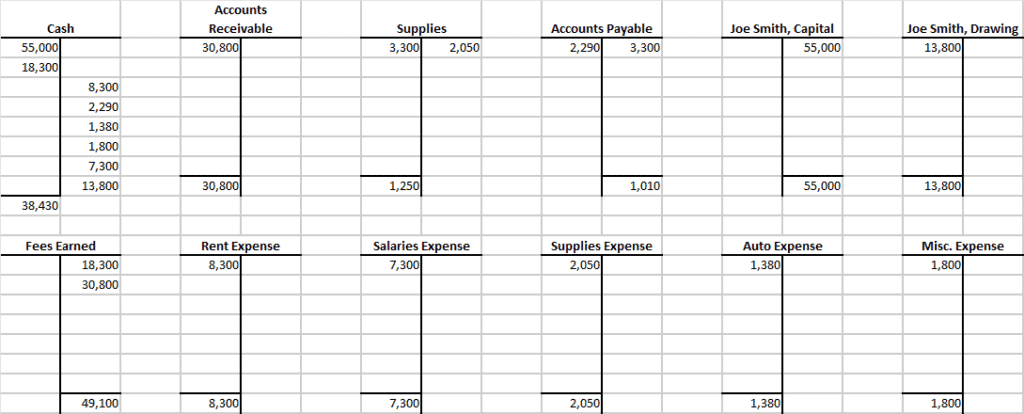

Complete T-Accounts Example

The chart below shows the complete set of T-accounts for the example transactions discussed in this article.

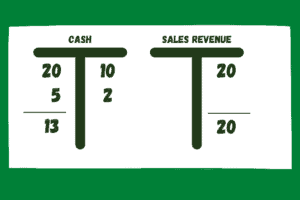

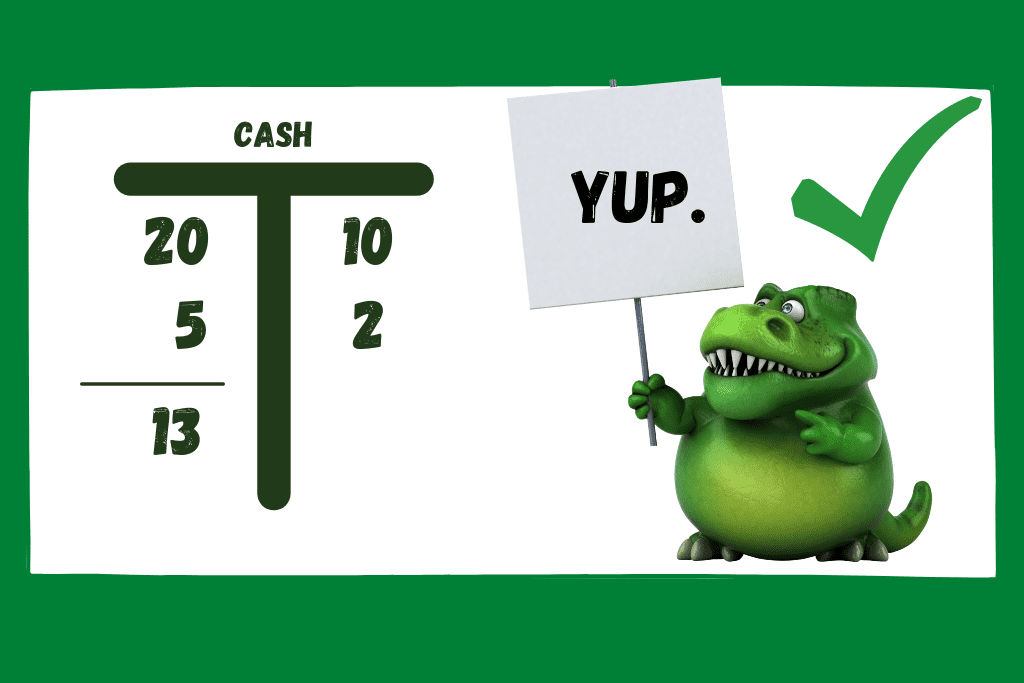

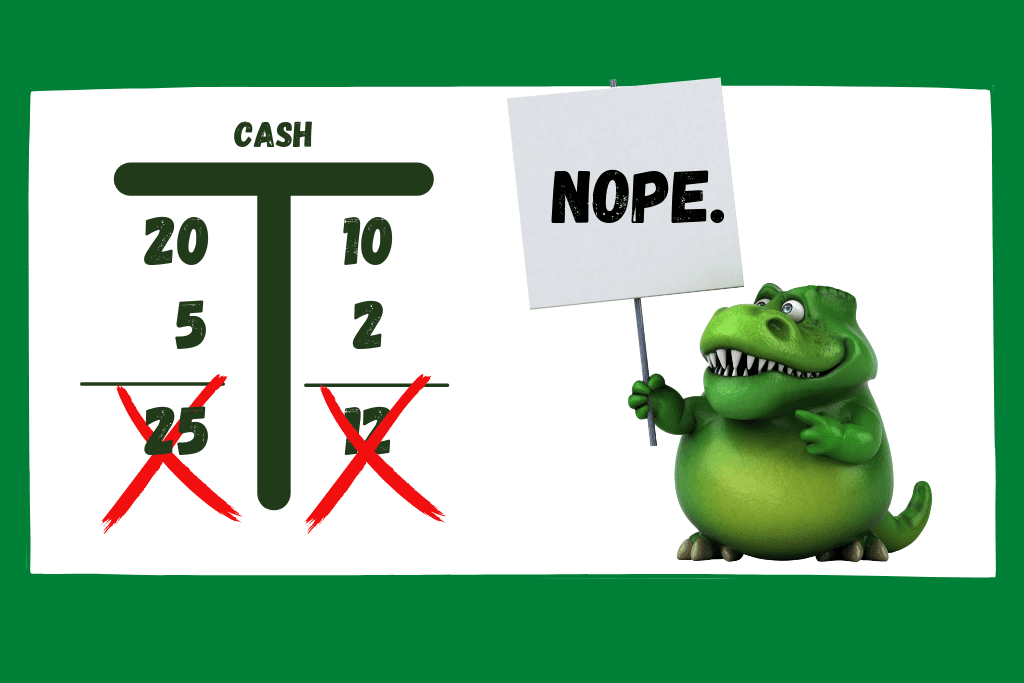

How To Calculate T-Account Balances

When all transactions are posted to T-Accounts, the balance of the accounts is calculated. To calculate the balance for each account, follow these steps for each account.

- Add all the amounts in the debit column.

- Add all the amounts in the credit column.

- Find the difference between the two.

- If the debit column is higher than the credit column, the balance is recorded on the debit side.

- If the credit column is higher than the debit column, the balance is recorded on the credit side.

The totals of the debit column and the credit column are not recorded in each column, only the final balance is recorded.

For additional practice using T-Accounts, watch this video:

-

So You Want to Start a Nonprofit…Consider This

Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. Here are key points to consider before embarking

-

Tax Liability Accrual Explained

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with accounting

-

Nonprofit Monthly Financial Close Process Overview

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. This process ensures that financial statements are prepared, reviewed,

-

Navigating Payroll Taxes for Nonprofits: Responsibilities and Compliance

Payroll taxes are the taxes that employers withhold from their employees’ wages and are required to remit to the appropriate government agencies. They include various taxes that fund government programs,

-

Understanding Form 990: Transparency and Accountability for Nonprofits

Form 990 is a reporting document filed by tax-exempt organizations in the United States with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance,

-

Financial Disclosures for Affiliated Nonprofit Organizations

Disclosures related to revenue sharing, consolidated financial statements, noncontrolling interests, and related party transactions in the context of affiliated organizations within a nonprofit are crucial for transparency and accurate financial