A contra account is an account used to offset the balance in a related account. When the main account is netted against the contra account, the contra account reduces the value of the main account while preserving the original balance of the main account. Examples of contra accounts include:

- Accumulated Depreciation

- Allowance for Doubtful Accounts

- Owner’s Withdrawals

What are the Five Types of Contra Accounts?

Just as there are five types of accounts in accounting, there are five types of contra accounts as well. The following chart shows the five types of regular accounts and the five types of contra accounts that are related to the main account types:

| Main Account Type | Contra Account Type |

| Assets | Contra Assets |

| Liabilities | Contra Liabilities |

| Equity | Contra Equity |

| Revenue | Contra Revenue |

| Expense | Contra Expense |

What is a Contra Asset?

A contra asset is paired with an asset account to reduce the value of the account without changing the historical value of the asset. Examples of contra assets include Accumulated Depreciation and Allowance for Doubtful Accounts. Unlike an asset which has a normal debit balance, a contra asset has a normal credit balance because it works opposite of the main account.

What is Accumulated Depreciation?

Accumulated Depreciation is a contra asset that pairs with Fixed Assets. Accumulated Depreciation acts as a subaccount for tracking the ongoing depreciation of an asset. A Fixed Asset is a Long-term Asset used by a company to create revenue. Examples of Fixed Assets are Vehicles, Equipment, and Buildings. Fixed Assets lose value over time. That loss of value is called Depreciation. Each year of an asset’s life, another year of Depreciation Expense is recorded. The offset to the Depreciation Expense account is Accumulated Depreciation.

Accumulated Depreciation Example:

A delivery van is purchased by a business to use in delivering product and picking up materials. The cost of the delivery van is $50,000. The company paid cash for the van. The delivery van has an estimated useful life of 5 years. The company uses Straight-Line Depreciation to track the loss of value of the asset over time. No salvage value is expected at the end of the van’s useful life.

Original Journal Entry to Record Purchase of Van:

| Delivery Van | 50,000 | |

| Cash | 50,000 |

Adjusting Journal Entry to Record Year 1 Depreciation:

Straight Line Depreciation = (Cost – Salvage) / Useful Life = ($50,000 – 0) / 5 = $10,000 per year

| Depreciation Expense | 10,000 | |

| Accumulated Depreciation | 10,000 |

When the first year of depreciation is posted to the accounts, the Fixed Asset section of the Balance Sheet now looks like this:

| Delivery Van | 50,000 |

| Accumulated Depreciation | (10,000) |

| Net Book Value | 40,000 |

Adjusting Journal Entry to Record Year 2 Depreciation:

| Depreciation Expense | 10,000 | |

| Accumulated Depreciation | 10,000 |

When the second year of depreciation is posted to the accounts, the Fixed Asset section of the Balance Sheet now looks like this:

| Delivery Van | 50,000 |

| Accumulated Depreciation | (20,000) |

| Net Book Value | 30,000 |

The purpose of the Accumulated Depreciation account is to track the reduction in the value of the asset while preserving the historical cost of the asset.

What is Allowance for Doubtful Accounts?

The Allowance for Doubtful Accounts is used to track the estimated bad debts a company my incur without impacting the balance in its related account, Accounts Receivable. An estimate of bad debts is made to ensure the balance in the Accounts Receivable account represents the real value of the account. Allowance for Doubtful Accounts pairs with the Bad Debts Expense account when doing adjusting journal entries.

Allowance for Doubtful Accounts Example:

A company has an Accounts Receivable balance of $85,000. Of that amount, it is estimated that 1% of that amount will become bad debt at some point in the future. This means that the $85,000 balance is overstated compared to its real value. At this point, it isn’t known which accounts will become uncollectible so the Accounts Receivable balance isn’t adjusted. Instead, an adjusting journal entry is done to record the estimated amount of bad debt.

Allowance for Doubtful Accounts = Accounts Receivable x 1% = $85,000 x .01 = 850

| Bad Debt Expense | 850 | |

| Allowance for Doubtful Accounts | 850 |

When the adjusting entry is posted to the accounts, the Accounts Receivable section of the Balance Sheet will look like this (assuming no previous balance in the allowance account):

| Accounts Receivable | 85,000 |

| Allowance for Doubtful Accounts | (850) |

| Net Book Value | 84,150 |

The purpose of the Allowance for Doubtful Accounts is to track the reduction in the value of the asset while preserving the historical value of the asset.

What is a Contra Liability?

A contra liability is an account used to reduce the amount of a liability without changing the balance in the associated liability account. Examples of contra liability accounts include Discount on Bonds Payable and Discount on Notes Payable.

Discount on Bonds Payable Example:

When companies raise funds by issuing a bond, the bond is a liability the company will need to repay. If a bond is issued at a discount, the discount reduces the amount that will be paid when the bond matures. It decreases the liability. The maturity value or face value of the bond is recorded at the full amount. The discount is recorded separately. Here is the journal entry to record the issuance of a discounted bond:

| Cash | 24,000 | |

| Discount on Bonds Payable | 1,000 | |

| Bonds Payable | 25,000 |

When the entry is posted to the accounts, in the Liability section of the Balance Sheet, the following would show:

| Bond Payable | 25,000 |

| Discount of Bond Payable | (1,000) |

| Net Book Value | 24,000 |

What is a Contra Equity Account?

A contra equity account is an account used to reduce the value in an equity account without changing the balance of the associated equity account. Examples of contra equity accounts include Owner’s Draw or Owner’s Withdrawal and Treasury Stock.

Owner’s Draw Example:

A business owner invests $25,000 from personal funds into their new business. The journal entry to record the initial investment is:

| Cash | 25,000 | |

| Owner Name, Equity | 25,000 |

Three months later, the business owner withdraws $5,000 from the business. The journal entry to record the withdrawal is:

| Owner Name, Withdrawals | 5,000 | |

| Cash | 5,000 |

When the entries are posted to the accounts, in the Equity section of the Balance Sheet this is what that looks like:

| Owner’s Name, Equity | 25,000 |

| Owner’s Withdrawals | (5,000) |

| Total Owner’s Equity | 20,000 |

The purpose of the Owner’s Withdrawal account is to track the amounts taken out of the business without impacting the balance of the original equity account.

What is a Contra Revenue Account?

A contra revenue account is an account used to reduce the balance in a revenue account without changing the balance of the associated revenue account. Examples of contra revenue accounts include Sales Returns and Sales Discounts.

Sales Returns Example:

A customer purchases 12 items for $20 per item on account. The original sales portion of the transaction is below:

| Accounts Receivable | 240 | |

| Sales Revenue | 240 |

The customer returns 2 of the items. The sales portion of the the return is below:

| Sales Returns | 24 | |

| Accounts Receivable | 24 |

When the transactions are posted to the accounts, the Income Statement shows the following (assuming there are no other transactions):

| Sales Revenue | 240 |

| Sales Returns | (24) |

| Net Sales Revenue | 216 |

The purpose of the Sales Returns account is to track the reduction in the value of the revenue while preserving the original amount of sales revenue. Tracking returns is an important metric for a business. A rise in returns may signal a business problem.

What is a Contra Expense Account?

A contra expense account is an account used to reduce the amount of an expense without changing the balance in the main expense account. Examples of contra expense accounts include Purchase Returns, Purchase Discounts, and Advertising Reimbursements.

Advertising Reimbursements Example:

A company receives rebates for advertising it does on behalf of brands it carries in its stores. For example, a grocery store displays advertisements for a national brand in its weekly flyer. The national brand gives the grocery store cash, reducing the overall cost of printing the flyer.

When the company pays the cost of having the flyer printed, a journal entry is done.

| Advertising Expense | 1500 | |

| Accounts Payable | 1500 |

When the national brand pays the store, this entry is done:

| Cash | 500 | |

| Advertising Reimbursements | 500 |

On the Income Statement in the Expense section, the Advertising Expense and the offset account appear:

| Advertising Expense | 1500 |

| Advertising Reimbursements | (500) |

| Net Advertising Expense | 1000 |

The purpose of a contra expense account is to record a reduction in an expense without changing the balance in the main account.

What is the Effect of Contra Accounts to the Balance of Related (Paired) Account?

The following table shows examples of contra accounts, the related account, and the effect each has on the balance of the related account:

| Contra Account | Related Account | Effect on Related Account |

| Accumulated Depreciation | Fixed Asset | decrease |

| Allowance for Doubtful Accounts | Accounts Receivable | decrease |

| Discount on Notes Payable | Notes Payable | decrease |

| Discount on Bonds Payable | Bonds Payable | decrease |

| Owner’s Draw/Withdrawals | Owner’s Equity | decrease |

| Treasury Stock | Capital Stock | decrease |

| Sales Discounts | Revenue | decrease |

| Sales Allowances | Revenue | decrease |

| Sales Returns | Revenue | decrease |

| Purchase Discounts | Purchases | decrease |

| Purchase Returns | Purchases | decrease |

| Advertising Reimbursements | Advertising Expense | decrease |

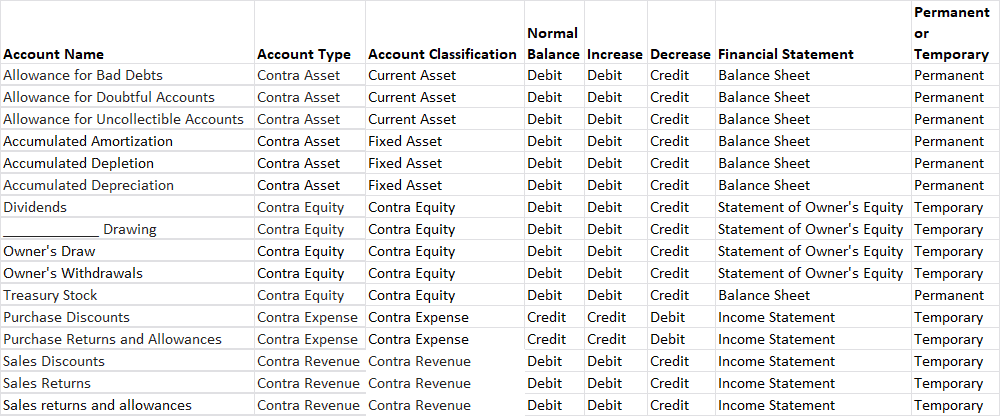

Chart of Accounts Listing of Typical Contra Accounts:

For a overview of Contra Accounts, watch this video:

What is the Difference Between a Contra Account and an Adjunct Account?

Adjunct accounts add to the value of the related account. Contra accounts subtract from the value of a related account.

For more information about Adjunct Accounts, check out this article: https://accountinghowto.com/adjunct

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

Adjusting Journal Entries | Accounting Student Guide

When all the regular day-to-day transactions of an accounting period are completed, the next step is to check on the balances of certain accounts to see if those balances need

-

What is a Contra Account?

A contra account is an account used to offset the balance in a related account. When the main account is netted against the contra account, the contra account reduces the

-

How to Calculate Straight Line Depreciation

Straight-line Depreciation is used to depreciate Fixed Assets in equal amounts over the life of the asset. The basic formula to calculate Straight-line Depreciation is: (Cost – Salvage Value) /

-

How to Calculate Declining Balance Depreciation

Declining Balance Depreciation is an accelerated cost recovery (expensing) of an asset that expenses higher amounts at the start of an assets life and declining amounts as the class life

-

How to Calculate Units of Activity or Units of Production Depreciation

Units of Activity or Units of Production depreciation method is calculated using units of use for an asset. Those units may be based on mileage, hours, or output specific to