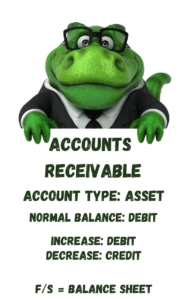

Accounts Receivable is an Asset. It represents the sale of goods or services to a company’s customers or clients on account. The company has given additional time to the customer to pay the bill. An Asset has a normal debit balance. An Asset increases on the debit side and decreases on the credit side. Accounts Receivable amounts are generally received within 30 days, based on the terms the company sets for payment. Accounts Receivable is listed on the Balance Sheet in the Current Assets section.

What is an Example of Accounts Receivable?

A company sells $10,000 of Consulting Fees on account to a customer. The terms of the sale are that the customer must make a payment in full in 30 days. The journal entry to record the purchase is:

| Accounts Receivable | 10,000 | |

| Consulting Fees Revenue | 10,000 |

When 30 days have passed, the customer pays the company the full amount due. The journal entry to record the receipt of payment is:

| Cash | 10,000 | |

| Accounts Receivable | 10,000 |

The amount in the Accounts Receivable account is decreased to show the customer no longer owes this money to the company. The bill has been satisfied.

What is the Difference Between Accounts Payable and Accounts Receivable?

Accounts Payable is used for purchases from vendors and suppliers. Accounts Receivable is used to record sales to customers or clients. Accounts Payable is a liability, an obligation to pay. Accounts Receivable is an asset, a promise from a customer that the business will receive cash.

To learn more about Accounts Payable, check out this article:

-

So You Want to Start a Nonprofit…Consider This

Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. Here are key points to consider before embarking

-

Tax Liability Accrual Explained

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with accounting

-

Nonprofit Monthly Financial Close Process Overview

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. This process ensures that financial statements are prepared, reviewed,

-

Navigating Payroll Taxes for Nonprofits: Responsibilities and Compliance

Payroll taxes are the taxes that employers withhold from their employees’ wages and are required to remit to the appropriate government agencies. They include various taxes that fund government programs,

-

Understanding Form 990: Transparency and Accountability for Nonprofits

Form 990 is a reporting document filed by tax-exempt organizations in the United States with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance,

-

Financial Disclosures for Affiliated Nonprofit Organizations

Disclosures related to revenue sharing, consolidated financial statements, noncontrolling interests, and related party transactions in the context of affiliated organizations within a nonprofit are crucial for transparency and accurate financial