Although you do not need to know accounting to use QuickBooks, FreshBooks, Xero or other accounting software, knowing the basics of how accounting works can make using software easier and provide more accurate information and reports for running your business.

Developing an understanding of accounting fundamentals doesn’t require you to take a college class or spend hours reading accounting textbooks. It’s more a matter of knowing the most important factors and tasks that impact your user experience with accounting software. By user experience, we mean–less frustration and headaches, more valuable information to run your business.

At the fundamental, basic level, if you understand the following, you can function well with accounting software:

- The purpose of accounting

- The structure of accounting

- The types of accounts used to track information

- The types of specialized accounts found in accounting software

Introduction to Financial Statements

The purpose of accounting is to provide information that can be used to measure the health and progress of a business. To track how a business is doing, we use reports called financial statements. Each financial statement gives a different perspective on the business.

The two most important financial statements are the Income Statement (also called a Profit and Loss Statement or a P&L) and the Balance Sheet. Two additional financial statements are the Statement of Owner’s Equity (or the Statement of Partners’ Equity or Stockholders’ Equity) and the Statement of Cash Flows.

What is an Income Statement (Profit and Loss)?

The Income Statement compares how much you sold (revenue) to how much it cost you to run the business (cost of goods and expenses). If your revenue is greater than your expenses, you have a profit. If your expenses are greater than your revenue, you have a loss.

What is a Balance Sheet?

The Balance Sheet compares what you own (assets) to what you owe (liabilities). The difference between the two [Assets – Liabilities] is your equity or net worth in the business. If your Assets are greater than your Liabilities, you have equity or net worth. If your Liabilities are greater than your Assets, you have negative equity or negative net worth.

What is a Statement of Owner’s Equity?

The Statement of Owners’ Equity or Stockholders’ Equity shows the changes in equity over a period of time (a month or a year). It is showing whether equity increased or decreased. It tells a business owner whether their investment in their business is making them money.

In olden times, the Statement of Owner’s Equity was used like a worksheet to calculate the changes in equity. With accounting software, this calculation is done automatically in the background so most small business owners will never even know it exists.

What is a Statement of Cash Flows?

The Statement of Cash Flows shows what happened with cash–where did it come from and where did it go. It categorizes any transactions that involved cash into three categories: Operating, Investing, and Financing.

Operating cash flows include funds received from customers to pay their bills (accounts receivable), funds paid out for materials, wages, and other operating expenses.

Investing cash flows include funds received from interest, dividends, or stock sales, funds paid out to build a new factory or buy a new vehicle.

Financing cash flows include funds borrowed from a bank or funds paid to a bank for a loan payment.

The Statement of Cash Flows provides vital information for larger businesses to show how cash is moving through the organization.

For small businesses, it’s less useful. It provides some good information about what happened in the past, but for small businesses, information about cash flow for the present and future (forecasting) is much more important.

For a more in depth look at financial statements, watch this video:

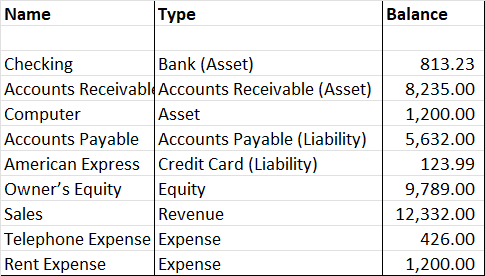

What is a Chart of Accounts?

The structure of accounting is the Chart of Accounts. The Chart of Accounts lists out the different account names we will use to track our transactions. The way the Chart of Accounts is setup determines where information will be tracked on the financial statements.

Here is a sample chart of accounts:

This is where many do-it-yourself software setups go wrong. Choosing the wrong account type can create a mess. Let’s see if we can prevent that!

Account Types

In accounting, there are five main types of accounts:

- Assets

- Liabilities

- Equity or Capital

- Revenue or Income

- Expenses

Assets

Assets are what a company owns. Examples of assets are Cash, Accounts Receivable, Inventory, Vehicles, Equipment, and Buildings. Assets are used by a business to create revenue. For example, cash is used to by inventory. Inventory is sold to create revenue.

Liabilities

Liabilities are what a company owes to others. Examples of liabilities are Accounts Payable, Loans or Notes Payable, and Bonds Payable. Liabilities are a way of financing the operations of a business. For example, a company buys inventory and pays for it 30 days after it purchases the inventory (Accounts Payable). This gives the company time to sell the inventory before it has to pay for the inventory.

Equity or Capital

Equity is what a company owes to its owners. For example, if an owner invests personal funds to start a business, the owner now has increased equity or ownership in the business. If a business sells stock, the stockholders are granted ownership rights in the company.

Think of equity in terms of owning a house. If you paid $200,000 for a house (an asset) and the bank holds a mortgage on the house (a liability) of $175,000, your equity in the house is $25,000 [$200,000 – $175,000].

Equity works the same in a business. Assets – Liabilities = Equity. When Assets increase or Liabilities decrease, Equity increases. As you pay down your mortgage, your equity goes up.

Revenue or Income

Revenue comes from a business selling something to its customers. For a retail store, revenue comes from buying products and then selling those products to customers. For a manufacturing business, revenue comes from making a product and then selling it to customers. For a service business (like a pet sitter), revenue comes from delivering that service to customers (looking after your cat while you are on vacation.)

Expenses

Expenses are those costs a business incurs in the making of revenue. To run a factory, you need to purchase electricity, labor, equipment, and insurance, and you need to have a building to operate out of. If you are running a retail store, you need to purchase items to sell to your customers.

For a more in depth look at the Chart of Accounts, check out this video:

Additional Account Types Used in Accounting Software

In accounting software, there are additional specialized accounts that tell the software to activate modules for various purposes. In addition to the five main types of accounts listed above, accounting software also uses these types of accounts:

- Bank (an asset account)

- Accounts Receivable (an asset account)

- Fixed Asset (an asset account)

- Accounts Payable (a liability account)

- Credit Card (a liability account)

- Loan or Long Term Liability (liability accounts)

- Cost of Goods Sold (an expense account)

The purpose of the additional account types is to notify the software that you have some specific items to track and to run reports about. Let’s look at each one:

Bank

When you choose “Bank” as the account type in your accounting software, you are telling it you need to track items like deposits made and checks written on your bank account. This module will also allow for bank feeds to be set up (the bank sends your transactions into your software), bank reconciliations (to make sure your records and the banks records agree), and for dashboard information to give you fast insights on what your cash balance is.

Accounts Receivable

An Accounts Receivable account type tells the software you will be issuing invoices to your customers who will pay at a later date. Most smaller businesses have an Accounts Receivable account so this is generally already created when the software company setup process is done.

Multiple Accounts Receivable accounts could be setup if there was a specific need for it, but this would be unusual for a smaller business.

The Accounts Receivable account type allows for the running of an Accounts Receivable Aging Report to show what invoices are still open (not paid) and how old those invoices are. It also allows for creation of customer statements.

Fixed Asset

A Fixed Asset type of account is used for assets like vehicles, buildings, furniture, and equipment. By choosing Fixed Asset as the type of account, it is telling your software this is an asset that may need to be depreciated. This means you can track:

- The cost of the asset.

- Whether it was purchase new or used.

- When the asset was purchased.

- Where the asset was purchased from.

- Any identifying information (Vehicle Identification Number, Serial Number)

- A description of the item (Ford F350, Hobart Mixer, Hyster Forklift)

- The location of the asset (warehouse, storage room, garage)

- When the warranty expires.

- When the item was sold, traded, or scrapped.

A Fixed Asset item report can be run to show you a list of all your assets. This is helpful in keeping track of all the assets the company owns, and being able to make sure none of them go missing.

Accounts Payable

An Accounts Payable account type tells the software you will be entering invoices (bills) from your vendors or supplies and you will pay those bills at a later date. Most smaller businesses have only one Accounts Payable account so this is generally already created by default when the software company setup process is done.

The Accounts Payable account type allows for the running of an Accounts Payable Aging Report to show what invoices (bills) are still open (not paid) and how old those invoices are.

Credit Card

An account type of Credit Card works similarly to a Bank account type. It tells the software you will need to track credit card charges and payments, and you will receive a statement to reconcile the account. The Credit Card account type allows for the setting up a direct feed from the credit card company or bank to eliminate the need for data entry of credit card charges. A credit card is a current liability account since it will be paid within one year’s time or less.

Loan or Long Term Liability

An account type of Loan or Long Term Liability tells the software this is an amount the company needs to re-pay, and also that you need to track the balance of the amount owed and the interest being paid on that loan.

A loan can be either a current liability or a long-term liability depending on how long the repayment period is. For loans that will be repaid within the next 12 months, classify it as a current liability. For loans that will be repaid over a period longer than 12 months, classify it as a long term liability.

When entering a loan payment, the principal and the interest are always separated out. The interest is an expense. The principal payment reduces the amount owed on the loan.

Cost of Goods Sold

When you specify an expense as a Cost of Goods Sold account type, you are telling the software that you want to track the cost of purchasing raw materials to create a product or purchasing goods for resale.

The Cost of Goods Sold account type allows for a more detailed income statement. It separates the cost of creating or purchasing your product from all the other expenses (insurance, fuel, rent).

This means can carefully track an important measurement–gross profit (the difference between what it costs you to create or purchase your product vs. what your customer pays for it.)

Cash Basis vs Accrual Basis

One important detail in setting up accounting software is the choice between cash basis or accrual basis. When a business is formed, a determination is made regarding the method that will be used to record revenue and expenses.

Cash Basis

Under the Cash Basis of accounting, revenues are recorded in the month when cash is received. Expenses are recorded in the month when cash is paid. This method can be used by many small businesses and keeps the recordkeeping simple.

Accrual Basis

Under the Accrual Basis of accounting revenues are recorded in the month when earned, regardless of when cash is received. Expenses are recorded in the month the expenses are incurred, but more specifically, expenses are “matched” to the revenue that’s earned.

This means if revenue is earned in March, the expenses that go with earning March’s revenue should also be recorded in March. For example, a company makes a product in February and sells it (earns revenue) in March. The materials and labor costs being paid out in February belong in the month of March.

The accrual method is required to be used by any businesses that have to follow Generally Accepted Accounting Principles (GAAP).

Confusing, right? Learn more about the differences between cash basis and accrual basis by watching this video:

How to Know Whether Your Business Uses Cash or Accrual Method

For existing businesses, the easiest way to determine if your business is using the cash or accrual method of accounting is to look at your tax return. Your tax preparer will have checked off one box or the other. If your business sells to customers on account (they pay later) or you enter bills from vendors and pay them later, this is accrual accounting.

For a new business, it’s important to talk to your accountant to help you make the decision as to which method to use. It impacts when and how profits are counted as taxable income.

With accounting software, this distinction is less important because reports can be run on a cash basis or on an accrual basis.

When the company file is set up correctly in accounting software, it makes the information being captured far more accurate and useful for running the business.

If the accounting software is setup correctly in the beginning, the vast majority of transactions will be standard entries–invoices to customers, bills from vendors, payroll, bank deposits and checks.

The information that is pulled together from all the day-to-day transactions provides accurate financial statements to use to manage and grow your business.

Next Steps

For additional practical accounting education, check out these books on Amazon:

A fast and easy accounting education for small business owners and entrepreneurs who need to understand the real world workings of accounting for small businesses, including understanding financial statements, improving cash flow, and staying out of trouble. Includes simple examples to teach important accounting concepts.

Small business owners often lack one critical skill in running a business: an understanding of cash flow. Without that understanding, the business can easily end up with more cash going out than coming in. The result of that cash flow crisis leaves business owners struggling to keep the business afloat. Discover the four causes of cash flow problems. Real world, practical, do-able action steps are offered to help business owners diagnose and fix the business problems that lead to cash flow difficulties.

-

How to Create 1099-NEC Forms – Free and Low-Cost Options (2022)

Filling out 1099-NEC forms (formerly 1099-MISC forms) for your subcontractors can be a hassle. Learn how to get this task done with free or low-cost options. If you use subcontractors

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a

-

What is Revenue?

Revenue is the income generated by a business in the normal course of operations. It represents the sale of goods and services to customers or clients. For a non-profit organization,