One of the most confusing chapters in your first accounting class is the bad debts and allowance for doubtful (uncollectible) accounts chapter. Here, we will break it down step by step and provide some helpful resources to make this concept easier to understand.

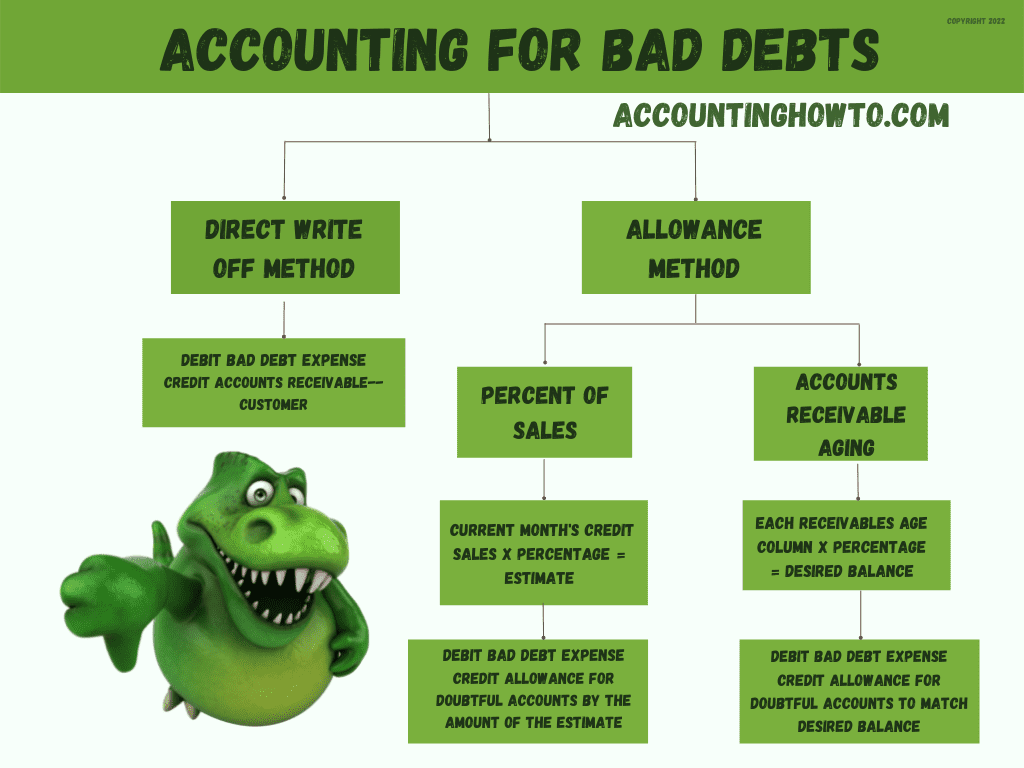

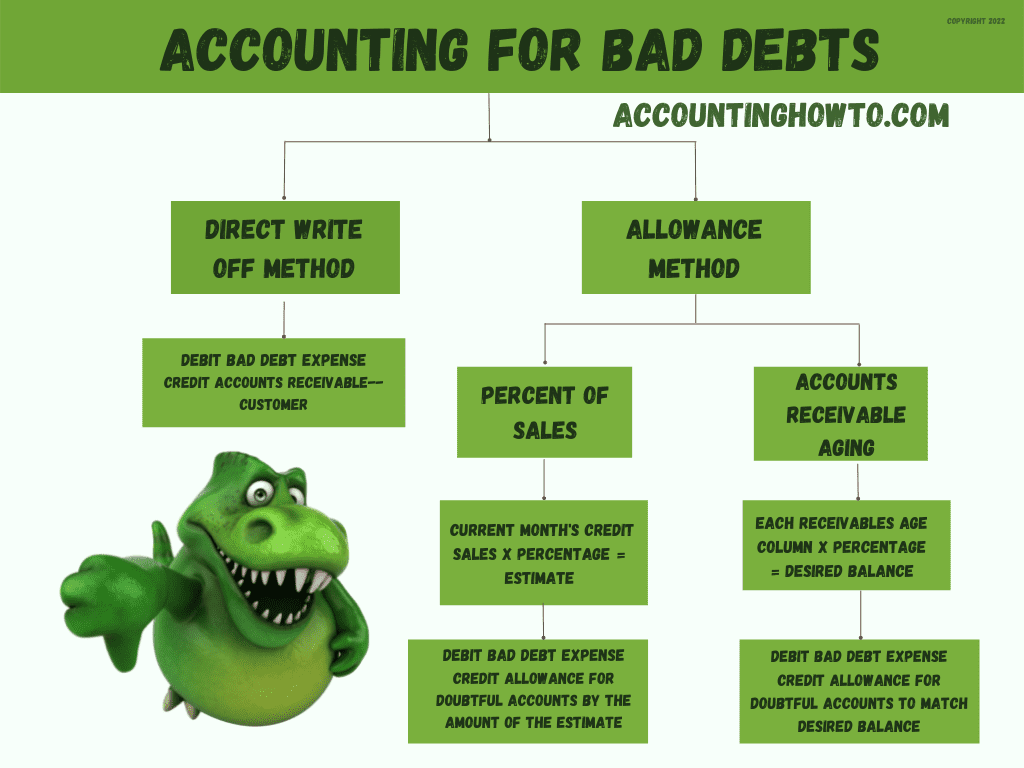

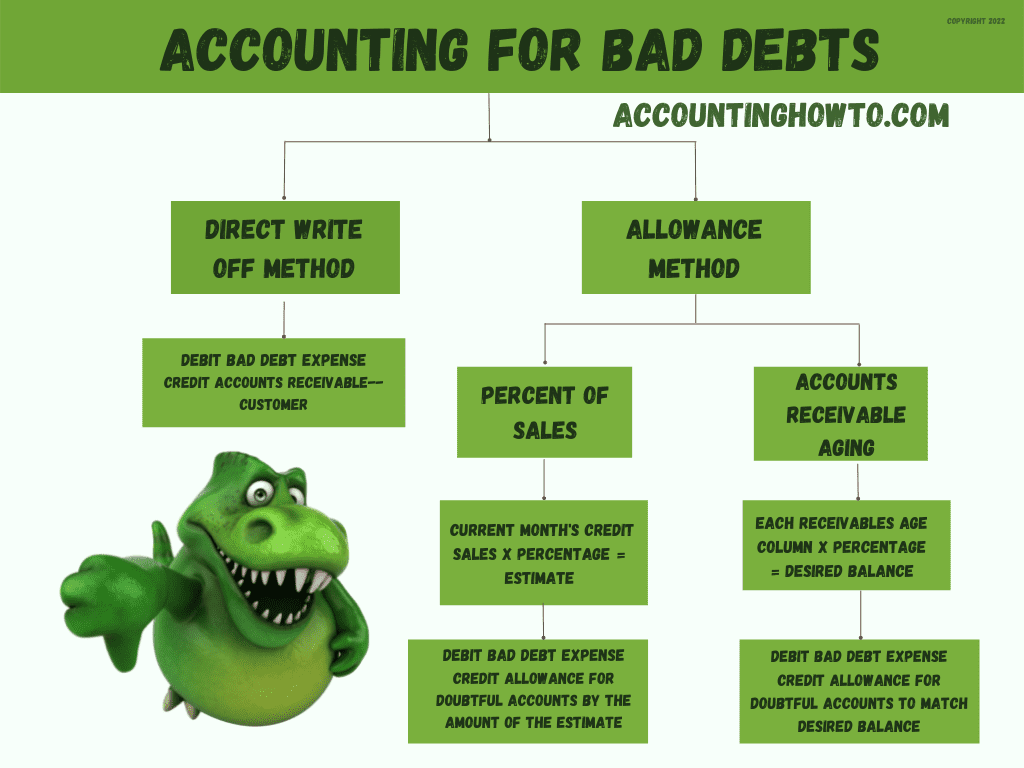

- When a business grants credit to its customers, it runs the risk of the customer not paying the bill. Specific accounting rules apply to how a business records bad debts or potential bad debts. If a company is smaller and has a small number of customers who buy on credit (accounts receivable), the business is able to use the Direct Write Off Method.

- Larger businesses with more customers buying on credit (accounts receivable) have a higher risk of bad debts. Because the amount may be significant, that business will use the Allowance Method. The Allowance Method is an estimate of the company’s risk of not getting paid. Using the Allowance Method, a company will make a choice on how to determine the estimate.

- Two common methods used to estimate the possible bad debts are Percentage of Sales and Accounts Receivable Aging. This estimated amount is used to create an adjusting journal entry each month to record the potential amount of bad debts. A contra asset called Allowance for Doubtful Accounts is used to track the estimate.

What is Accounts Receivable (Trade Receivable)?

When a business grants credit to a customer, the customer is able to buy from the business “on account.” The customer gets the merchandise or service now and pays for the merchandise or service later. The amount due from the customer is tracked using an account called Accounts Receivable. The Accounts Receivable balance on the Balance Sheet is made up of all the individual customers and customer invoices currently outstanding. Accounts Receivable has the account type of Asset. It has a normal debit balance. As sales on account are made to customers, the Accounts Receivable balance increases. As customers pay their accounts, Accounts Receivable is decreased.

To learn more about Accounts Receivable, watch this video:

When is a Debt Considered Uncollectible?

When a business grants credit to its customers, there are times when a customer is unable to or refuses to pay an invoice. A determination may be made by the company that the debt is uncollectible. Debts may be considered uncollectible or “bad debts” for a variety of reasons, among them:

- Customer declares bankruptcy

- Customer refuses to pay

- Customer can’t be located

- Fraud on the part of the customer

- Poor documentation to prove debt exists

- Unsuccessful attempts to collect the debt

- Age of the invoice

How to Write-off a Bad Debt

A company can write-off a bad debt by using either the Direct Write-off Method or the Allowance for Doubtful Accounts Method. This can only be done by businesses operating under an accounting method called Accrual Accounting. Businesses operating under Cash Basis Accounting method are not able to take bad debt deductions.

The Direct Write-off Method is only used by businesses with few Accounts Receivable accounts. This method does not conform to Generally Accepted Accounting Principles so it is not used for businesses with larger amounts and numbers of Accounts Receivable.

What is the Difference Between the Direct Write-off Method and the Allowance Method?

The main difference between the Direct Write-off Method and the Allowance Method is the timing of when bad debt expense is recorded. Under the Direct Write-off Method, bad debts are written off at the time a debt is determined to be uncollectible.

For example, a business receives notification of a customer’s bankruptcy. Under the Allowance Method, potential bad debts are estimated monthly based on current month’s sales or current month’s outstanding Accounts Receivable.

The Allowance Method complies with the Generally Accepted Accounting Principle of matching revenues with related expenses.

To learn more about how Bad Debts are written-off, watch this video:

The main difference between the Direct Write-off Method and the Allowance Method is the timing of when bad debt expense is recorded.

Companies use either the Direct Write-off Method or the Allowance Method for managing bad debts. The method chosen determines the account treatment. This infographic shows how to determine the journal entries needed based on the method chosen.

When is the Direct Write-off Method Used?

The Direct Write-off Method is used by smaller companies and those with only a few receivables accounts. Because it does not conform to GAAP, larger companies and those companies with many receivables accounts cannot use this method. Accounts are written-off at the time the debt is determined to be uncollectible.

Examples of businesses that could potentially use the Direct Write-off Method are businesses that don’t usually offer credit, receiving all or most payments at the time of sale: restaurants, grocery stores, online businesses. Because the risk of bad debts is minimal, a business does not have to estimate future bad debts.

What is the Journal Entry for Direct Write-off of a Bad Debt?

When an account is determined to be uncollectible, a company will do a journal entry to debit (increase) Bad Debts Expense (or Uncollectible Accounts Expense) and credit (decrease) Accounts Receivable for the specific customer.

Example: Kleen-Dyno purchases dinosaur shampoo from our company Terrance Co. On June 1, Kleen-Dyno purchased $5,000 of merchandise from us. On November 15, after multiple attempts on our part to collect the funds due, Kleen-Dyno has indicated it will never pay the bill. At this point, Terrance Co. will do the following journal entry:

| Bad Debts Expense | 5,000 | |

| Accounts Receivable — Kleen Dyno | 5,000 |

The impact of the entry on the account records is:

Income Statement: an increase of expenses and a decrease of profits

Balance Sheet: a decrease in assets and a decrease in equity

What is the Journal Entry for Direct Write-off Method When a Customer Pays a Bad Debt?

When a customer pays an invoice that was previously written-off under the Direct Write-off Method, the debt must first be re-instated in the accounting records. Once re-instated, a payment can be applied to the re-instated invoice amount.

Example: Kleen-Dyno decides that Terrance Co.’s dinosaur shampoo is the only shampoo that works for their Dinosaur Wash stations. The company decides to pay Terrance Co. for the old invoice so it can order more product. Terrance Co. does the following journal entry to reinstate the amount owed:

| Accounts Receivable — Kleen Dyno | 5,000 | |

| Bad Debts Expense | 5,000 |

The impact of the entry on the account records is:

Income Statement: an decrease of expenses and an increase of profits

Balance Sheet: an increase in assets and an increase in equity

Once the account is re-instated, Terrance Co. will receive the payment against the invoice:

| Cash | 5,000 | |

| Accounts Receivable — Kleen Dyno | 5,000 |

The impact of the entry on the account records is:

Income Statement: no impact

Balance Sheet: an equal swap between two assets

Why is the Direct Write-off Method Unacceptable Under GAAP?

Generally Accepted Accounting Principles (GAAP) require companies with a large amount of receivables to estimate future uncollectible amounts at the end of each current accounting period. Because the risk to the business is relative to the number of accounts and the amount of cash tied up in receivables, larger companies cannot take a “wait and see” approach to capturing potential bad debts. GAAP requires these larger companies to follow the Matching Principle–matching expenses (or potential expenses) to the same accounting period where the revenue is earned. The Direct Write-off Method only captures an expense when a company determines a debt to be uncollectible.

To understand the differences between Cash Basis and Accrual Basis, watch this video:

What is the Matching Principle?

The Matching Principle requires that revenues and their related expenses be recorded in the same accounting period. As an example, Terrance Co. sells $10,000 of merchandise in June. The merchandise was purchased from the supplier in May for $5,000. The revenue of $10,000 and the expense of $5,000 should be reported in June, the month when the revenue is reported as earned. The Matching Principle is the foundation of Accrual Based Accounting.

What is the Allowance Method?

The Allowance Method for Doubtful or Uncollectible Accounts is used to estimate future bad debts based on current month revenues. Using past performance data, a company can estimate that a certain percentage of current sales can reasonably expect to become bad debts. To conform to the Matching Principle, the company records that potential bad debt in the same month that the related revenue is recorded.

Why is the Allowance Method Used?

At the time revenue is recorded, a company does not yet know which accounts will prove to be uncollectible. We don’t want to record any reduction in the Accounts Receivable account so we use a related contra account called Allowance for Doubtful Accounts or Allowance for Uncollectible Accounts to track the estimate. By using the contra account, we can preserve the true Accounts Receivable balance while also recognizing that some portion of that balance is overvalued because of potential bad debt.

On the Balance Sheet here is how that is reported:

| Accounts Receivable | $10,000 |

| Less Allowance for Doubtful Accounts | (500) |

| Net Realizable Value | $ 9,500 |

What we are showing on the Balance Sheet is the full value of Accounts Receivable and the realistic value of what we expect to collect of that amount. This ties in to the GAAP rule of Conservatism–accurately representing the value of accounts including potential losses on the financial statements.

What is a Contra Account?

To learn more about contra accounts and how they are used in accounting, watch this video:

How Do You Write-off Bad Debt Using the Allowance Method?

Because the Allowance for Doubtful Accounts is based on an estimated amount, a company chooses a method to use in making that estimate. The two most common methods taught in accounting classes are:

- Aging of Accounts Receivable Method

- Percent of Sales Method

The Aging of Accounts Receivable Method focuses on the Balance Sheet (Assets). The Percent of Sales Method focuses on the Income Statement (Revenue). Either method conforms to GAAP.

The method chosen to calculate the estimated amount of the Allowance for Doubtful Accounts determines the accounting treatment, as detailed in the infographic below:

Percent of Sales = Adjust to Amount of Estimate

Aging of Accounts Receivable = Adjust to Desired Balance

How to Use the Aging of Accounts Receivable Method for Bad Debts

Under the Aging of Accounts Receivable Method, a company creates an estimate of bad debts based on the age of outstanding invoices. This estimate is based on a company’s Aging of Accounts Receivable report. An Accounts Receivable Aging Report separates outstanding invoices into columns based on the age of the invoices.

Here is an example of an Accounts Receivable Aging Report:

| Accounts Receivable Aging | ||||

| January 20xx | Current | Past Due | ||

| Customer | 1 – 30 Days | 31- 60 Days | 61 – 90 Days | 90 + Days |

| ABC Co | 3000 | |||

| DEF Inc | 10000 | 5000 | ||

| GHI Ltd | 500 | 2000 | ||

| JKL Inc | 500 | 2500 | 4700 | 10000 |

| Total Due | 11000 | 7500 | 6700 | 13000 |

A company uses the Accounts Receivable Aging Report to determine the amount of the estimate for Allowance for Doubtful Accounts. A percentage is applied to each column based on the company’s previous experience with bad debts. More recent invoices have a lower chance of becoming bad debts. Older invoices have a higher chance of becoming bad debts. The percentages are applied to each column to determine the total estimate for the current month.

Here’s an example of applying percentages to the Accounts Receivable Aging Report:

| Accounts Receivable Aging | |||||

| January 20xx | Not Past Due | Past Due | |||

| Customer | 1 – 30 Days | 31- 60 Days | 61 – 90 Days | 90 + Days | Total |

| ABC Co | 3000 | ||||

| DEF Inc | 10000 | 5000 | |||

| GHI Ltd | 500 | 2000 | |||

| JKL Inc | 500 | 2500 | 4700 | 10000 | |

| Total Due | 11000 | 7500 | 6700 | 13000 | 38,200 |

| Estimated Percent Uncollectible | 1% | 3% | 10% | 30% | |

| Uncollectible Accounts Estimate | 110 | 225 | 670 | 3900 | 4905 |

What is the Journal Entry for Aging of Accounts Receivable Method?

Under the Aging of Accounts Receivable Method, the estimate is updated at the end of each accounting period so it is based on the most recent Accounts Receivable Aging Report. Because the balance in Accounts Receivable is changing regularly as new invoices are created and other invoices are paid, the amount in the Allowance for Doubtful Accounts will always be adjusted to change the balance to the desired amount based on the newest information.

The following examples show journal entries based on different balances in the Allowance for Doubtful Accounts.

What is the Journal Entry if the Balance in Allowance for Doubtful Accounts is Zero?

If the balance in the Allowance for Doubtful Accounts is zero, in the case above, the journal entry recorded to bring the account to its desired balance is:

| Bad Debts Expense | 4,905 | |

| Allowance for Doubtful Accounts | 4,905 |

When this entry is posted in the Allowance for Doubtful Accounts account, the balance will now be a credit balance of $4,905–the desired balance.

On the Balance Sheet, the Net Realizable Value of Accounts Receivable shows the true value of Accounts Receivable by using the Allowance for Doubtful Accounts to track that value.

| Accounts Receivable | $38,200 |

| Less Allowance for Doubtful Accounts | (4,905) |

| Net Realizable Value | $33,295 |

What is the Journal Entry if the Balance in Allowance for Doubtful Accounts is a Credit?

If the Allowance for Doubtful Accounts has a balance from the previous month, the journal entry will be done for the difference between the current balance and the desired balance.

If the Allowance for Doubtful Accounts has a current credit balance of $4,000 and the desired balance is $4,905, a journal entry is done for the difference. $4,905 – $4,000 = $905. In the Allowance for Doubtful Accounts, the balance is now $4,000 + $950 = $4,905 (the desired balance.)

On the Balance Sheet, we can see that the desired balance of $4,905 is reflected in the new balance of the account.

| Accounts Receivable | $38,200 |

| Less Allowance for Doubtful Accounts | (4,905) |

| Net Realizable Value | $33,295 |

What is the Journal Entry if the Balance in Allowance for Doubtful Accounts is a Debit?

If the balance in the Allowance for Doubtful Accounts is a debit balance, adjust the balance of the account by doing a journal entry to bring the balance to the desired balance. If the account has a current debit balance of $100 and the desired balance is a credit balance of $4,905, the balance needs to be credited by $100 to bring the debit balance to zero, and then credited by $4,905 to increase the balance to the desired balance, a total of $5,005:

| Bad Debts Expense | 5,505 | |

| Allowance for Doubtful Accounts | 5,505 |

When the Allowance for Doubtful Accounts account has a debit balance, it means that the original estimate did not match up with the reality of what happened with Bad Debts. Because it was an estimate, we can simply make a journal entry to true up the account. When making an adjustment to the account when it has a debit balance, take the balance and add it to the desired balance to determine the journal entry amount.

On the balance sheet, the Allowance account will reflect the desired balance once the account balance is updated with the journal entry.

| Accounts Receivable | $38,200 |

| Less Allowance for Doubtful Accounts | (4,905) |

| Net Realizable Value | $33,295 |

How to Write-off Bad Debts Using the Aging of Accounts Receivable Allowance Method

When a specific account is determined to be uncollectible, a company will write-off the amount using a journal entry:

| Allowance for Doubtful Accounts | 500 | |

| Accounts Receivable–XYZ Co. | 500 |

At the end of the month, a new Aging of Accounts Receivable estimate will be calculated as before and the Allowance for Doubtful Accounts will be updated again to reflect the desired balance.

How to Use the Percent of Sales Method for Bad Debts

Under the Percent of Sales Method, credit sales (not cash sales) are multiplied by a percent to arrive at the estimate for bad debts. That percentage will be based on the company’s past experience with uncollectible accounts. For example, if total credit sales for the month are $100,000 and it is estimated that 1% of a percent of those sales will be uncollectible, the Allowance for Doubtful Accounts amount for that month would be $100,000 x .01 = 1,000. This calculation is done each month based on the current month’s credit sales and the total accumulates in the Allowance account. This is different from the Aging of Accounts Receivable Method where we did a journal entry to bring the balance in the account to the desired balance. Under Percent of Sales, we increase the account by the percent of sales each month for that month’s credit sales. The account is reduced (debited) when specific bad debts are identified and written off.

What is the Journal Entry for Percent of Sales Method for Bad Debts

In the example above, the credit sales of $100,000 was multiplied by the estimated percent of 1% for a $1,000 estimated bad debt expense for the current month. The journal entry to record that amount is:

| Bad Debts Expense | 1,000 | |

| Allowance for Doubtful Accounts | 1,000 |

How to Write-off Bad Debts Using the Percent of Sales Allowance Method

When a specific account is determined to be uncollectible, a company will write-off the amount using a journal entry:

| Allowance for Doubtful Accounts | 500 | |

| Accounts Receivable–XYZ Co. | 500 |

If the balance in Allowance for Doubtful Accounts from the previous month was zero, the new balance would be reflected on the balance sheet here:

| Accounts Receivable | $438,200 |

| Less Allowance for Doubtful Accounts | (1,000) |

| Net Realizable Value | $437,200 |

If the balance in Allowance for Doubtful Accounts from the previous month had an existing credit balance of $4,000, the new amount would be added to the previous balance reflected on the balance sheet here:

| Accounts Receivable | $438,200 |

| Less Allowance for Doubtful Accounts | (5,000) |

| Net Realizable Value | $433,200 |

If the balance in Allowance for Doubtful Accounts from the previous month had an existing debit balance of $100, the new amount would be added to the previous balance (100 debit + 500 credit = credit balance of 400) reflected on the balance sheet here:

| Accounts Receivable | $438,200 |

| Less Allowance for Doubtful Accounts | (400) |

| Net Realizable Value | $437,800 |

Tips & Tricks

- Is the company using the Direct Write-off Method or the Allowance Method?

- If using the Direct Write-Off Method: debit Bad Debt Expense, credit Accounts Receivable-Customer.

- If using the Allowance Method, is the company using Percent of Sales or Accounts Receivable Aging to determine the estimate?

- If Percent of Sales, take the current months’ credit sales (not cash sales) x the estimated percentage to determine the estimate. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts by the amount of the estimate.

- If Account Receivable, use the Accounts Receivable Aging report column totals x percent assigned to the column, total those amounts. Adjust the balance to match the desired balance by debiting or crediting Bad Debt Expense and Allowance for Doubtful Accounts [Allowance for Doubtful Accounts balance +/- X = amount of the estimate]

-

What is a Contra Account?

A contra account is an account used to offset the balance in a related account. When the main account is netted against the contra account, the contra account reduces the

-

What is the Difference Between the Direct Write-off Method and the Allowance Method?

The main difference between the Direct Write-off Method and the Allowance Method in accounting for bad debt is the timing of when bad debt expense is recorded. Under the Direct

-

What is the Direct Write-off Method for Bad Debts?

The direct write-off method for bad debts is a method used by smaller companies with few receivables. Debts are written-off at the time the debt is determined to be uncollectible.

-

What is the Allowance Method for Bad Debts?

The Allowance Method for Doubtful or Uncollectible Accounts is used to estimate future bad debts based on current month revenues. Using past performance data, a company can estimate that a

-

How to Use the Aging of Accounts Receivable Method for Bad Debts

Under the Aging of Accounts Receivable Method for accounting for bad debts, a company creates an estimate of bad debts based on the age of outstanding invoices. This estimate is

-

How to Use the Percent of Sales Method for Bad Debts

Under the Percent of Sales Method for tracking bad debts, credit sales (not cash sales) are multiplied by a percent to arrive at the estimate for bad debts. That percentage