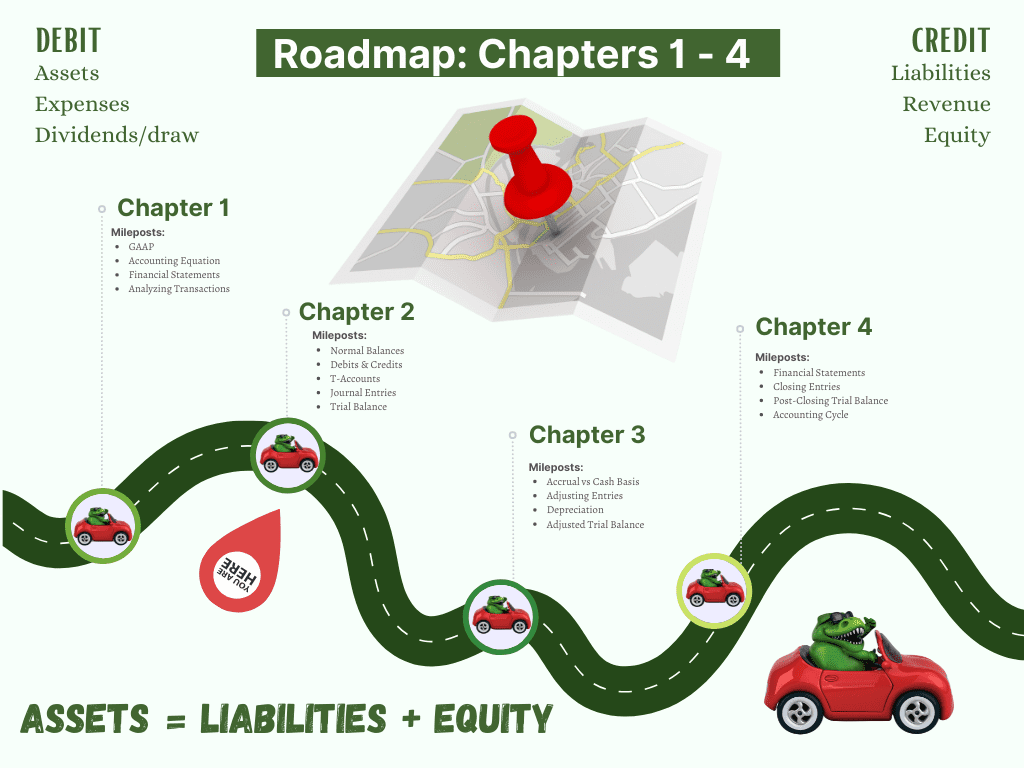

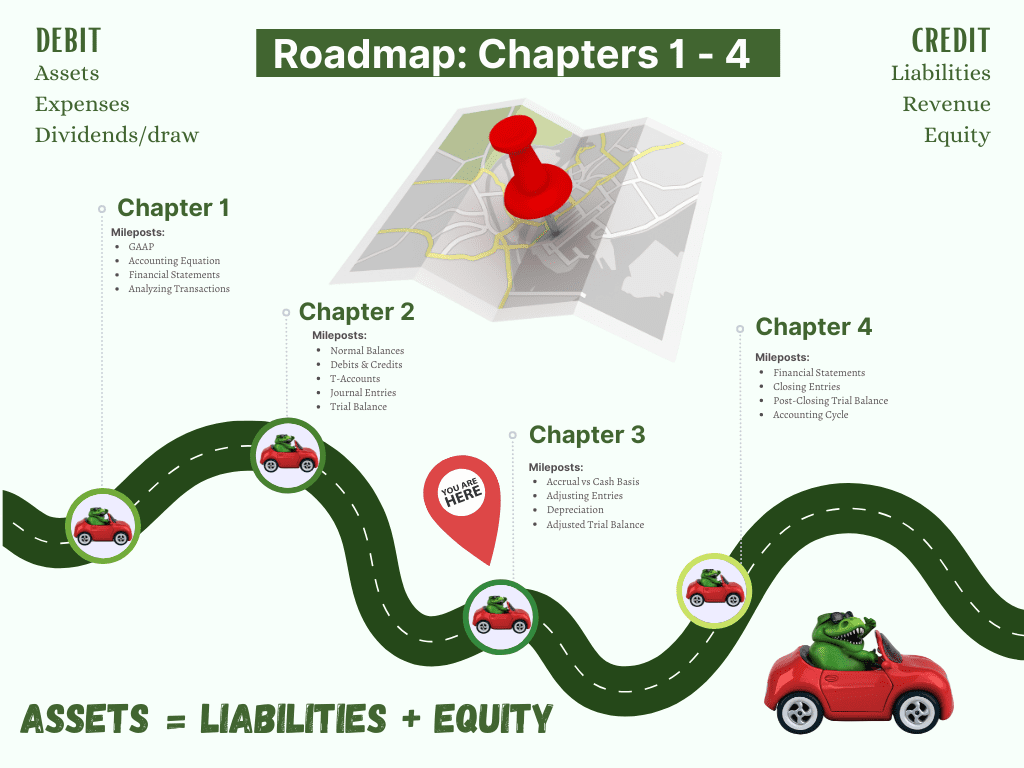

In Chapter Two of most accounting textbooks, the spreadsheet method or Accounting Equation method of recording transactions is replaced with T-Accounts and Journal Entries.

T-Accounts reinforce the concept of accounts increasing and decreasing different accounts. Building on that knowledge, Journal Entries are introduced, and become the method for analyzing transactions that will be used for all transactions moving forward in accounting classes.

Method 2: Transaction Analysis Using T-Accounts

What is a T-Account?

T-Accounts are simplified versions of accounts used to track accounting transaction. A T-Account contains an account name, a debit side (left), and a credit side (right). Each account in a company’s Chart of Accounts is assigned its own T-Account. Accounting textbooks often use T-Accounts to help students understand how increasing and decreasing accounts works when analyzing accounting transactions.

Learn more about T-Accounts by watching this video:

To use T-Accounts or Journal Entries to track transactions, you’ll need to understand Normal Balances and the rules of Debit and Credit.

What are Normal Balances in Accounting?

A Normal Balance in Accounting is the expected balance (debit or credit) of each type of account. The Normal Balance of an account determines whether an account increases on the debit (left) side or the credit (right side) of the account.

Knowing whether to debit or credit an account depends on the Type of Account and that account’s Normal Balance.

An account’s Normal Balance is based on the Accounting Equation and where that account is in the equation. We increase and decrease accounts by debiting them or crediting them according to the account type.

Normal Balances by Account Types

Normal Debit Balance:

Assets, Dividends (or Owner’s Withdrawals), Expenses

Increase by Debit, Decrease by Credit

Normal Credit Balance:

Liabilities, Capital (or Owner’s Equity), Revenue

Increase by Credit, Decrease by Debit

To reinforce your understanding of Normal Balances, watch this video:

What are the Rules of Debit and Credit

The Rules of Debit and Credit are based on the Normal Balances of each type of account (Assets, Liabilities, Equity, Revenue, and Expenses).

The rule of Debits says that if an account has a Normal Debit Balance, the account increases by on the debit (left) side and decreases on the credit (right) side.

The rule of Credits says that if an account has a Normal Credit Balance, the account increases on the credit (right) side and decreases on the debit (left) side of the account.

For a stronger understanding of debits and credits, watch this video:

For an in depth look at how to debit and credit accounts, see this article:

Transaction Analysis Using T-Accounts

To demonstrate analyzing transactions using T-Accounts, we’ll use the same transactions we used for the Accounting Equation spreadsheet but this time we’ll use T-Accounts to track the changes in our accounts.

Examples of Accounting Transactions

| On June 1 of the current year, Joe Smith established a business to manage rental property. He completed the following transactions during June: |

| 1. Opened a business bank account with a deposit of $55,000 from personal funds. |

| 2. Purchased office supplies on account, $3,300. |

| 3. Received cash from fees earned for managing rental property, $18,300. |

| 4. Paid rent on office and equipment for the month, $8,300. |

| 5. Paid creditors on account, $2,290. |

| 6. Billed customers for fees earned for managing rental property, $30,800. |

| 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800. |

| 8. Paid office salaries, $7,300. |

| 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050. |

| 10.Withdrew cash for personal use, $13,800. |

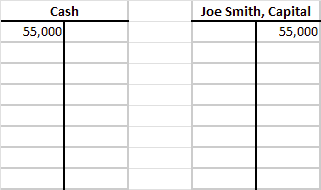

Transaction 1. Opened a business bank account with a deposit of $55,000 from personal funds.

When a business owners invests cash into their business, two accounts are impacted. First, the business now has Cash. Cash is an Asset. Assets have a Normal Debit Balance. We increase Assets on the debit (left) side. Second, the owner now has Equity in the business. Equity accounts have a Normal Credit Balance. We increase Equity on the credit (right) side. Here’s what that looks like using T-Accounts. (Notice there are no + or – signs. The debit or credit indicates whether the account is increasing or decreasing.)

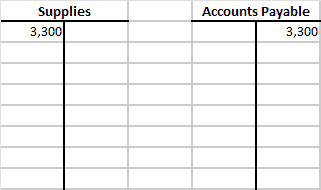

Transaction 2. Purchased office supplies on account, $3,300.

As with the spreadsheet version of this transaction, we are purchasing Supplies (asset), rather than Supplies Expense, and tracking changes in our inventory of Supplies at the end of the month. Supplies is an Asset. Assets have a Normal Debit Balance. Assets increase on the debit (left) side. We aren’t paying cash for the Supplies, we will pay for them later. That means the other side of our transaction is Accounts Payable. Accounts Payable is a Liability. Liabilities have a Normal Credit Balance. Liabilities increase on the credit (right) side.

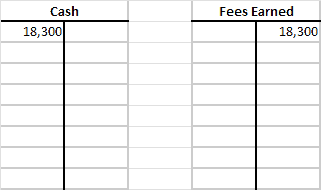

Transaction 3. Received cash from fees earned for managing rental property, $18,300.

Here, we are charging our customers for property management. We are receiving cash. Cash is an Asset. Assets have a Normal Debit Balance. We increase on the debit (left) side. Our revenue account is called Fees Earned. Revenue accounts have a Normal Credit Balance. We increase on the credit (right) side.

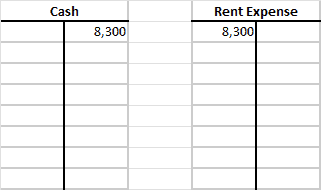

Transaction 4. Paid rent on office and equipment for the month, $8,300.

In this transaction we are paying our rent. When we pay a bill we have less cash. Cash is an Asset. An Asset has a Normal Debit Balance. Assets increase on the debit (left) side, and so they decrease on the credit (right) side. We are paying rent so our account is Rent Expense. Rent Expense is an Expense account. Expenses have a Normal Debit Balance. We increase expenses on the debit (left) side.

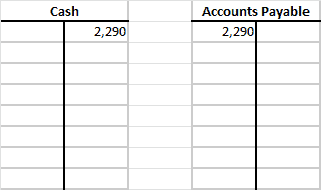

Transaction 5. Paid creditors on account, $2,290.

In Transaction 2, we purchased Supplies on account, increasing our Accounts Payable balance by crediting it. Now, we are paying part of that bill. Our Cash is decreasing. Cash is an Asset. It has a Normal Debit Balance. It increases on the debit side, and decreases on the credit side. Accounts Payable is a Liability. A Liability has a Normal Credit Balance. It increases on the credit (right) side and decreases on the debit (left) side. Here, we are showing that our Liability is now less–we no longer owe $3,300. (We’ll update the balance once all the transactions are done, but the balance is $3,300 – $2,290 = $1,010.)

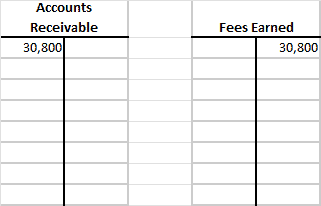

Transaction 6. Billed customers for fees earned for managing rental property, $30,800.

Here again, we have sales to our customers for property management. In this case, we didn’t receive cash. We are billing our customers and they will pay us later. Since we will be “receiving” the money, the account we use is Accounts Receivable. Accounts Receivable is an Asset. An Asset has a Normal Debit Balance. Assets increase on the debit side. We also have revenue. Our revenue account (according to our Chart of Accounts) is called Fees Earned. Revenue has a Normal Credit Balance. Revenue increases on the credit side.

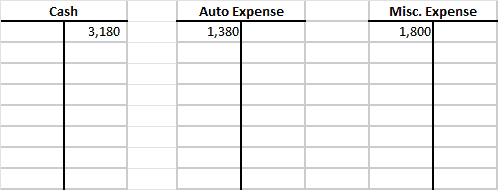

Transaction 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800.

Our multi-part transaction includes three accounts. Our Cash is decreasing by a total of $3,180. Cash is an Asset. Assets have a Normal Debit Balance. Assets increase on the debit side, and decrease on the credit side. We have two different expense accounts, Auto Expense and Miscellaneous Expense. Expenses are Expense accounts. Expenses have a Normal Debit Balance. Expenses increase on the debit side.

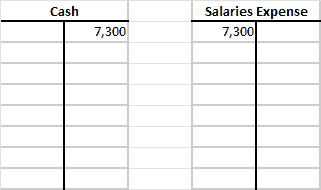

Transaction 8. Paid office salaries, $7,300.

Here, we are paying our employees so our Cash is decreasing by $7,300. Cash is an Asset. Assets have a Normal Debit Balance. Assets increase on the debit (left) side, and decrease on the credit (right) side. Salaries Expense is an Expense account. Expenses have a Normal Debit Balance. Expenses increase on the debit (left) side.

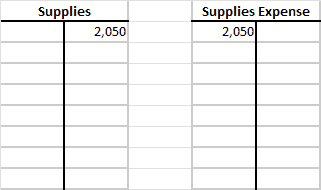

Transaction 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050.

We started out with $3,300 of supplies (Transaction 2). We have used $2,050 worth of supplies. We are decreasing Supplies (asset) and increasing Supplies Expense. (When we do the final totals down below, our balance in Supplies (asset) will be $1,250.) Supplies is an Asset. An Asset has a Normal Debit Balance. Assets increase on the debit (left) side, and decrease on the credit (right) side. Supplies Expense is an Expense. Expenses have a Normal Debit Balance. Expenses increase on the debit (left) side.

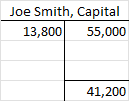

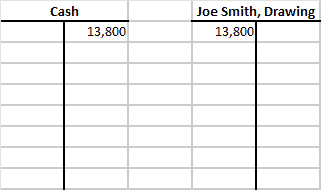

Transaction 10. Withdrew cash for personal use, $13,800.

Here, the owner is taking out some of their Equity. Our Cash is decreasing. The owner’s Equity is decreasing. Because we want to keep track of what the owner has withdrawn separately from their main Equity account, we are using a Drawing (or Withdrawal or Dividend) account to track that amount. Cash is an Asset. An Asset has a Normal Debit Balance. We increase Assets on the debit side, and decrease on the credit side. For the Drawing account, Drawing is an Equity account. The impact it has on the owner’s Equity is to decrease it. Equity has a Normal Credit Balance. We increase Equity on the credit (right) side, and decrease Equity on the debit (left) side.

When we debit Joe Smith, Drawing, what we are really doing is decreasing Equity. We treat the Drawing account as though it’s a separate type of account, saying it has a Normal Debit Balance. We increase withdrawals on the debit side. But the overall effect is a decrease in Equity.

If we weren’t keeping track of owner withdrawals in a separate account, using the main Equity account instead, here’s what that would look like:

The overall impact on Joe Smith, Capital is the same. The owner put $55,000 in and took $13,800 out. But because owner withdrawals are treated differently for tax purposes we want to track withdrawals separately.

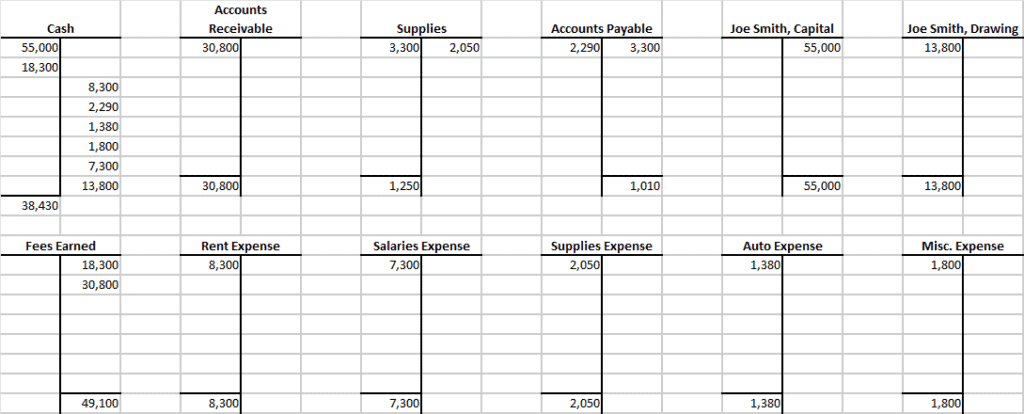

T-Accounts Including All Transactions

As we work through the transactions, each separate transaction is posted to the T-Account. When all the transactions for the month have been entered, we calculate the balance for each account. We do this by finding the difference between the debit column and the credit column. The balance goes on the side with the larger number. Let’s look at the Cash account more closely because it’s the one students have problems with most often.

Debit column: $55,000 + $18,300 = $73,300

Credit column: $8,300 + 2,290 + $1,380 + $1,800 + $7,300 + $13,800 = $34,870

$73,300 – $34,870 = $38,430

The debit column is higher than the credit column so the balance is a debit. Record that at the bottom of the debit column. Balances are never recorded on each side of the account. Only the final balance is recorded.

If you would like to walk through this example in video format, watch the video below.

Download the spreadsheet here.

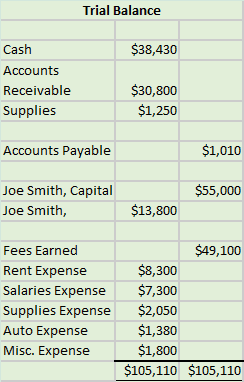

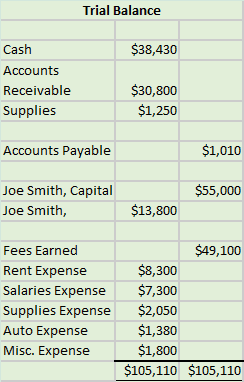

Once all of the T-Accounts are summed and the balance recorded in the appropriate column, we check to make sure all the transactions are in balance. We do that using a report called a Trial Balance.

What is a Trial Balance?

A Trial Balance is a report used after transactions are posted to accounts to check whether debits equal credits. The Trial Balance takes the balances from T-Accounts or account ledgers and records them in worksheet form. The columns are added and if debits and credits have been recorded for each transaction, the debit column will equal the credit column.

To learn more about Trial Balances, watch this video:

In the Trial Balance below, our balances from the T-Accounts are transferred to the report. Debit balances are entered in the debit (left) column. Credit balances are entered in the credit (right) column. The two columns are added up. The total debits should equal the total credits.

What to Do if the Trial Balance Doesn’t Balance?

The purpose of a Trial Balance is to catch errors before moving on through the accounting process. If the Trial Balance doesn’t balance, it means there is an error. The best way to uncover the error is to walk backwards through the work. Take these steps:

- Re-add the columns in the Trial Balance. Sometimes, it’s just an adding mistake.

- Check each individual balance against the T-Account balance. Is the amount correct? Are debit balances in the T-Account transferred to the debit column of the Trial Balance?

- If the balances are transferred correctly, go to the individual T-Accounts and re-check the balance.

- If those balances are all correct, then the problem is in the original transaction entries. Take each transaction one by one to see if there is a debit for every credit.

- Hack #1–The 9 Trick: Find the difference between the debit and credit column in the Trial Balance. Is the difference evenly divisible by 9? If so, the error is likely a transposition error (you entered 450 when you meant 540.) Example: Debit column = $10,250, Credit column = $12,050 Difference between the columns $12,050 – $10,250 = $1,800. $1,800 is evenly divisible by 9. Look for an entry with a transposition.

- Hack #2–The 2 Trick: Find the difference between the debit and credit column in the Trial Balance. Is the difference evenly divisible by 2? If so, the most likely case is that a number is on the wrong side. A debit that should be a credit or a credit that should be a debit. Example: Accounts Payable balance is entered on the debit side of the Trial Balance or a transaction was entered with two debits rather than a debit and a credit.

- Hack #3–There’s No Crying in Accounting: Often the first reaction to a Trial Balance that doesn’t balance is frustration. Perhaps some weeping and wailing. It’s frustrating to get so far only to find out you don’t balance. Take a moment. Then, work back through the steps to find the problem. This is part of the checks and balances that keep accounting records accurate. Better to find out there’s a problem now, rather than getting all the way through the accounting cycle and having a bigger mess to sort out. You’ll be okay. I promise.

Method 3: Transaction Analysis Using Journal Entries

Once students become familiar with the Accounting Equation and how to increase and decrease accounts using T Accounts, accounting textbooks introduce Journal Entries and how to record transactions in that format.

A journal entry is the mechanism used to indicate which accounts to increase and decrease. This is the method of recording transactions we will use moving forward through all the rest of the chapters and any accounting classes you take beyond this. I call this “Big Kid Accounting.”

What is a Journal Entry in Accounting?

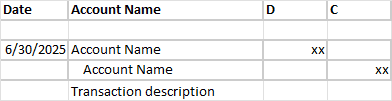

A Journal Entry is a method of recording increases and decreases to accounts, detailing the accounts being impacted, and the debits and credits needed to record business transactions in accounting.

Journal Entries use a standard format to record transactions. That format includes the date of the transaction, the accounts being impacted by the transaction, columns for entering debits or credits, and a description line to enter the reason for the transaction. The credit portion of the journal entry is indented to make reading a long line of transactions easier.

If you need to refresh your knowledge of journal entries, watch this video:

Click here to download the accompanying free spreadsheet.

For this segment on using Journal Entries to record accounting transactions, the same sample transactions are used:

Examples of Accounting Transactions

| On June 1 of the current year, Joe Smith established a business to manage rental property. He completed the following transactions during June: |

| 1. Opened a business bank account with a deposit of $55,000 from personal funds. |

| 2. Purchased office supplies on account, $3,300. |

| 3. Received cash from fees earned for managing rental property, $18,300. |

| 4. Paid rent on office and equipment for the month, $8,300. |

| 5. Paid creditors on account, $2,290. |

| 6. Billed customers for fees earned for managing rental property, $30,800. |

| 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800. |

| 8. Paid office salaries, $7,300. |

| 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050. |

| 10.Withdrew cash for personal use, $13,800. |

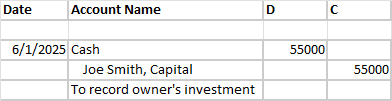

Transaction 1. Opened a business bank account with a deposit of $55,000 from personal funds.

When a business owners invests cash into their business, two accounts are impacted. First, the business now has Cash. Cash is an Asset. Assets have a Normal Debit Balance. We increase Assets on the debit (left) side. Second, the owner now has Equity in the business. Equity accounts have a Normal Credit Balance. We increase Equity on the credit (right) side. Here’s what that looks like using a Journal Entry:

Show Me How video:

(Notice there are no + or – signs. The debit or credit indicates whether the account is increasing or decreasing.)

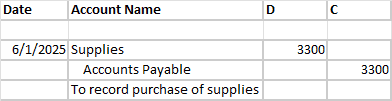

Transaction 2. Purchased office supplies on account, $3,300.

As with the spreadsheet and T-Account version of this transaction, we are purchasing Supplies (asset), rather than Supplies Expense, and tracking changes in our inventory of Supplies at the end of the month.

Supplies is an Asset. Assets have a Normal Debit Balance. Assets increase on the debit (left) side. We aren’t paying cash for the Supplies, we will pay for them later. That means the other side of our transaction is Accounts Payable. Accounts Payable is a Liability. Liabilities have a Normal Credit Balance. Liabilities increase on the credit (right) side.

Here’s the journal entry to record this transaction:

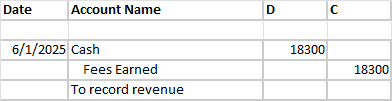

Transaction 3. Received cash from fees earned for managing rental property, $18,300.

Here, we are charging our customers for property management. We are receiving cash. Cash is an Asset. Assets have a Normal Debit Balance. We increase on the debit (left) side. Our revenue account is called Fees Earned. Revenue accounts have a Normal Credit Balance. We increase on the credit (right) side.

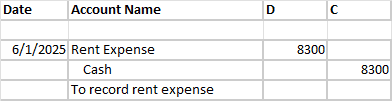

Transaction 4. Paid rent on office and equipment for the month, $8,300.

In this transaction we are paying our rent. When we pay a bill we have less cash. Cash is an Asset. An Asset has a Normal Debit Balance. Assets increase on the debit side, and so they decrease on the credit side. We are paying rent so our account is Rent Expense. Rent Expense is an Expense account. Expenses have a Normal Debit Balance. We increase expenses on the debit side.

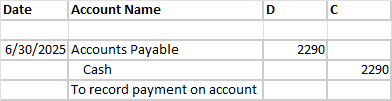

Transaction 5. Paid creditors on account, $2,290.

In Transaction 2, we purchased Supplies on account, increasing our Accounts Payable balance by crediting it. Now, we are paying part of that bill. Our Cash is decreasing. Cash is an Asset. It has a Normal Debit Balance. It increases on the debit side, and decreases on the credit side. Accounts Payable is a Liability. A Liability has a Normal Credit Balance. It increases on the credit side and decreases on the debit side. Here, we are showing that our Liability is now less–we no longer owe $3,300. (We’ll update the balance once all the transactions are done, but the balance is $3,300 – $2,290 = $1,010.)

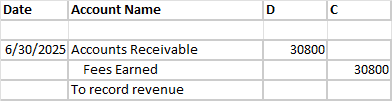

Transaction 6. Billed customers for fees earned for managing rental property, $30,800.

Here again, we have sales to our customers for property management. In this case, we didn’t receive cash. We are billing our customers and they will pay us later. Since we will be “receiving” the money, the account we use is Accounts Receivable. Accounts Receivable is an Asset. An Asset has a Normal Debit Balance. Assets increase on the debit side. We also have revenue. Our revenue account (according to our Chart of Accounts) is called Fees Earned. Revenue has a Normal Credit Balance. Revenue increases on the credit side.

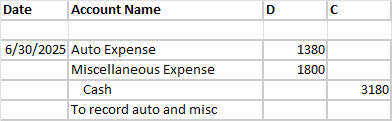

Transaction 7. Paid automobile expenses for the month, $1,380, and miscellaneous expenses, $1,800.

Our multi-part transaction includes three accounts. We call this a Compound Entry. Our Cash is decreasing by a total of $3,180. Cash is an Asset. Assets have a Normal Debit Balance. Assets increase on the debit side, and decrease on the credit side. We have two different expense accounts, Auto Expense and Miscellaneous Expense. Expenses are Expense accounts. Expenses have a Normal Debit Balance. Expenses increase on the debit side.

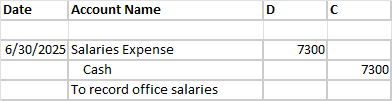

Transaction 8. Paid office salaries, $7,300.

Here, we are paying our employees so our Cash is decreasing by $7,300. Cash is an Asset. Assets have a Normal Debit Balance. Assets increase on the debit side, and decrease on the credit side. Salaries Expense is an Expense account. Expenses have a Normal Debit Balance. Expenses increase on the debit side.

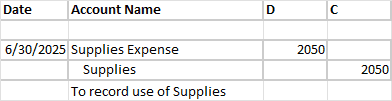

Transaction 9. Determined that the cost of supplies on hand was $1,250; therefore, the cost of supplies used was $2,050.

We started out with $3,300 of supplies (Transaction 2). We have used $2,050 worth of supplies. We are decreasing Supplies (asset) and increasing Supplies Expense. (When we do the final totals down below, our balance in Supplies (asset) will be $1,250.) Supplies is an Asset. An Asset has a Normal Debit Balance. Assets increase on the debit side, and decrease on the credit side. Supplies Expense is an Expense. Expenses have a Normal Debit Balance. Expenses increase on the debit side.

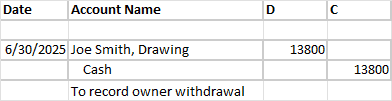

Transaction 10. Withdrew cash for personal use, $13,800.

Here, the owner is taking out some of their Equity. Our Cash is decreasing. The owner’s Equity is decreasing. Because we want to keep track of what the owner has withdrawn separately from their main Equity account, we are using a Drawing (or Withdrawal or Dividend) account to track that amount. Cash is an Asset. An Asset has a Normal Debit Balance. We increase Assets on the debit side, and decrease on the credit side. For the Drawing account, Drawing is an Equity account. The impact it has on the owner’s Equity is to decrease it. Equity has a Normal Credit Balance. We increase Equity on the credit side, and decrease Equity on the debit side.

If you would like a video walkthrough of these journal entries, watch this video:

Once it has been determined which accounts are being increased or decreased, the next step is to post those transactions to the individual accounts. See the accompanying spreadsheet for step by step examples of how to post to accounts.

How to Post to Accounts

When a Journal Entry is made to record a transaction, that Journal Entry is then entered (posted) in the accounts being impacted. For example, Rent Expense is increased and Cash is decreased. The individual accounts each have a Ledger where transactions are entered. Individual transactions are entered and a running balance is tracked.

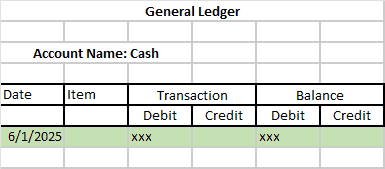

Here is an example of a ledger:

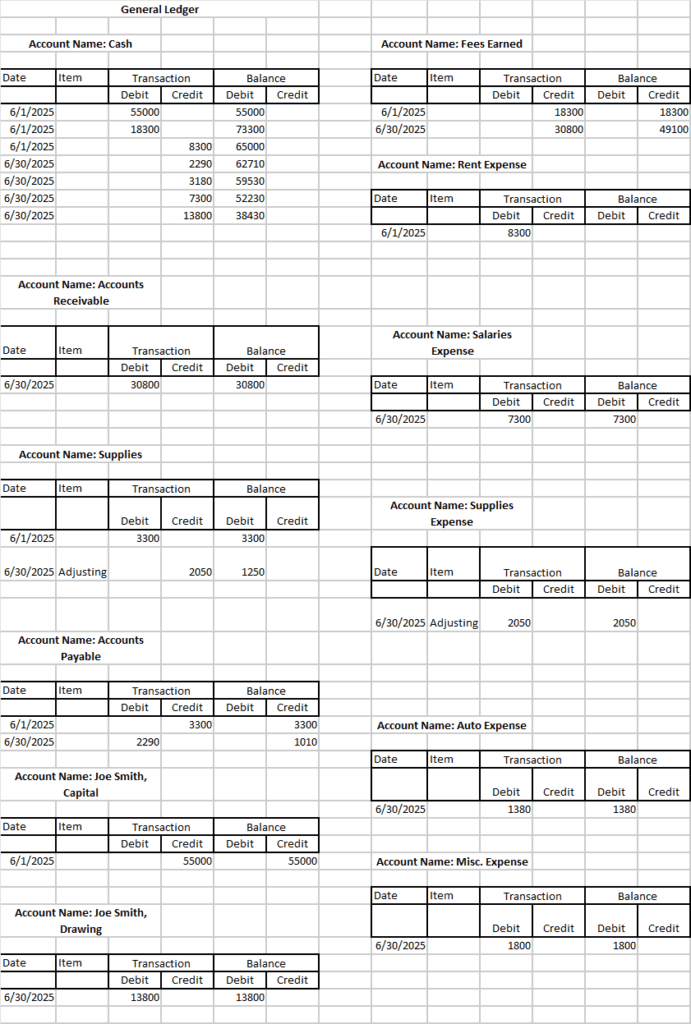

The Journal Entries are entered line by line into the Ledger and the balances are updated after each transaction. Here is the completed ledger for all transactions:

When all the transactions are posted to the ledger and the balances updated, it’s time to check to see if the Accounting Equation is in balance. We do this with a Trial Balance, just as we did after our T-Account version of these transactions. We take the balance from each account, grouping account types together (assets with assets, liabilities with liabilities, etc.), and we enter the balances into the Trial Balance. Here’s the completed Trial Balance:

And there you have it–how to analyze accounting transactions using three different methods from your accounting textbook. The journal entry format is the one you will use moving forward. It’s important that you get very comfortable with doing journal entries, there are lots more to come!

The next step in the accounting process is Adjusting Entries!

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a