The key to understanding how accounting works is to understand the concept of Normal Balances.

What are Normal Balances?

In accounting, a Normal Balance is the expected balance for a specific account type. The expected or normal balance determines whether an account is increased or decreased on the left side (debit) or the right side (credit.)

The first part of knowing what to debit and what to credit in accounting is knowing the Normal Balance of each type of account. The Normal Balance of an account is either a debit (left side) or a credit (right side). It’s the column we would expect to see the account balance show up.

If an account has a Normal Debit Balance, we’d expect that balance to appear in the Debit (left) side of a column. If an account has a Normal Credit Balance, we’d expect that balance to appear in the Credit (right) side of a column.

Each account type (Assets, Liabilities, Equity, Revenue, Expenses) is assigned a Normal Balance based on where it falls in the Accounting Equation. We also assign a Normal Balance to the account for Owner’s Withdrawals or Dividends so we can track how much an owner has withdrawn from the business or how much has been paid to Stockholders for Dividends.

What are the Normal Balances of each type of account?

Each account type has a normal balance. That normal balance is what determines whether to debit or credit an account in an accounting transaction.

The five account types tracked are:

Those account types are assigned to either the left or right side of the accounting equation:

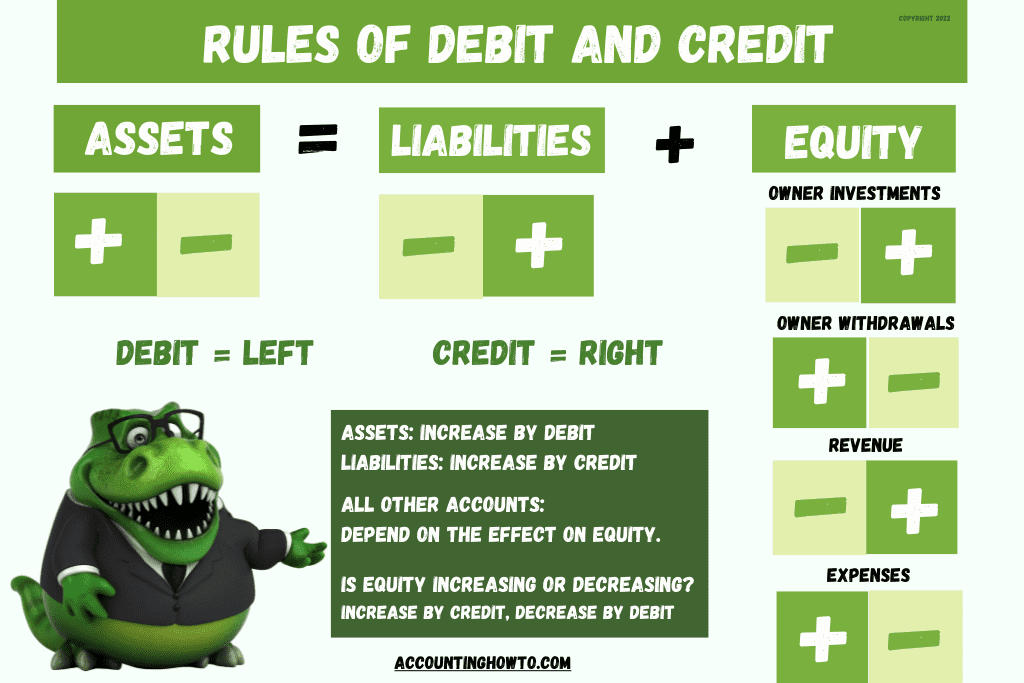

Assets = Liabilities + Equity

Assets (what a company owns) are on the left side of the Accounting Equation. That’s the Debit side (debit means left).

Liabilities (what a company owes to third parties like vendors or banks) are on the right side of the Accounting Equation. That’s the Credit side (credit means right).

Equity (what a company owes to its owner(s)) is on the right side of the Accounting Equation. That’s the Credit side (credit means right).

For the moment, let’s ignore the entire Equity section and just focus on Assets and Liabilities.

Based on the rules of debit and credit (debit means left, credit means right), we can determine that Assets (on the left of the equation, the debit side) have a Normal Debit Balance.

Liabilities (on the right of the equation, the credit side) have a Normal Credit Balance.

If an account has a Normal Debit Balance, it increases on the debit side and decreases on the credit side.

If an account has a Normal Credit Balance, it increases on the credit side and decreases on the debit side.

Let’s move to the Equity section. Equity is on the right side of the Accounting Equation. The right side is the credit side so Equity has a Normal Credit Balance.

Tracking Changes in Equity

Every transaction that happens in a business has an impact on the owner’s Equity, their value in the business.

- If a business makes a profit, the owner has a more valuable business.

- If the business has a loss, the owner has a less valuable business.

- If the owner puts in more of their personal funds (investment into the business), their equity in the business increases.

- If the owner takes out money from the business (owner’s withdrawal), their equity in the business decreases.

When we set aside Assets and Liabilities for a moment and focus just on the equity portion of the Accounting Equation, Normal Balances are determined by the effect of a transaction on Equity. Is Equity increasing or decreasing?

We can track the changes in the owner’s equity by using an Expanded Accounting Equation:

Assets = Liabilities + ((Beginning Equity + (Investments – Dividends + Revenue – Expenses))

The rest of the accounts to the right of the Beginning Equity amount, are either going to increase or decrease owner’s equity.

We said:

- An Investment of cash by the owner increases Equity. Equity has a Normal Credit Balance. Equity increases on the Credit side.

- Paying out a Dividend or an Owner’s Withdrawal decreases Equity. Equity has a Normal Credit Balance. Equity decreases on the Debit side.

- Revenue increases Equity. Equity has a Normal Credit Balance. Equity increases on the Credit side.

- Expenses decrease Equity. Equity has a Normal Credit Balance. Equity decreases on the Debit side.

What is the Normal Balance for Owner’s Withdrawals or Dividends?

When we’re talking about Normal Balances for Dividends (Owner’s Withdrawals), we assign a Normal Balance based on the effect on Equity.

Dividends decrease Equity. Equity has a Normal Credit Balance. We decrease Equity by a Debit.

We want to specifically keep track of Dividends in a separate account so we assign it a Normal Debit Balance. The effect on Equity is to decrease it. Consider Dividends to be a sub-account of Equity.

What is the Normal Balance for Revenue Accounts?

When we’re talking about Normal Balances for Revenue accounts, we assign a Normal Balance based on the effect on Equity. Revenue increases Equity. Equity has a Normal Credit Balance. We increase Equity by a Credit. Because of the impact on Equity (it increases), we assign a Normal Credit Balance.

What is the Normal Balance for Expense Accounts?

When we’re talking about Normal Balances for Expense accounts, we assign a Normal Balance based on the effect on Equity. Expenses decrease Equity. Equity has a Normal Credit Balance. We decrease Equity by a Debit. Because of the impact on Equity (it decreases), we assign a Normal Debit Balance.

To further understand how Normal Balances relate to the effect on Equity, watch this video:

Which Accounts Have a Normal Debit Balance? Which Accounts Have a Normal Credit Balance?

Let’s recap which accounts have a Normal Debit Balance and which accounts have a Normal Credit Balance. Then, I’ll give you a couple of ways to remember which is which.

Normal Debit Balance:

Assets, Dividends (or Owner’s Withdrawals), Expenses

Increase by Debit, Decrease by Credit

Normal Credit Balance:

Liabilities, Equity, Revenue

Increase by Credit, Decrease by Debit

To reinforce your understanding of Normal Balances, watch this video:

Is There an Easy Way to Remember Normal Balances for Accounts?

Here are two methods for remembering which accounts have Normal Debit or Normal Credit Balances. Choose the one that works best for you!

After Eating Dinner, Let’s Read Ebooks

| Debit | Credit | ||

| After | Assets | + | – |

| Eating | Expenses | + | – |

| Dinner | Dividends | + | – |

| Let’s | Liabilities | – | + |

| Read | Revenue | – | + |

| Ebooks | Equity | – | + |

DEALER

| Debit | Credit | |

| Dividends | + | – |

| Expenses | + | – |

| Assets | + | – |

| Liabilities | – | + |

| Equity | – | + |

| Revenue | – | + |

The usual approach to learning accounting is to have students memorize the rules of debit and credit, but the more useful approach is to help students understand the “why” behind Normal Balances and debits and credits. Once you understand the “why”, accounting makes much more sense. With every transaction you analyze, ask yourself “What is the effect on equity?”

To reinforce your understanding of how transactions effect equity, watch this video:

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a