Financial Statements offer great insights into the financial health and operating efficiency of businesses and organizations. The reports are used both internally and externally. Internally, financial statements are used for decision-making, developing plans and strategies, and mapping the future of the company. Externally, the reports are used by bankers, creditors, and investors to make decisions on granting credit or making investments. The reports are also used by government agencies.

What is Financial Statement Analysis?

Financial Statements on their own provide some valuable information about a company, but the real insights come from comparing information over time and from calculating key ratios to better understand the relationship of the numbers being reported.

What is the Purpose of Financial Statement Analysis?

Financial Statement Analysis seeks to uncover the story behind the numbers. Let’s look at it from the perspective of a hospital stay.

While you are in the hospital, a nurse stops by regularly to take your vital signs–your temperature and pulse. One reading of the thermometer gives only one part of the picture. If your temperature is normal, there’s nothing to worry about. But, with subsequent temperature checks, the nurse notices your temperature is rising. This is a cause for concern. If your temperature wasn’t checked regularly, no one would have known there was a problem until it was out of control.

Financial Statement Analysis acts in much the same way. By checking different numbers and the relationships of those numbers, we gain insight into the financial condition of the business. We can also use Financial Statement Analysis to compare our business over time and to compare it to other businesses in the same industry.

What Does Financial Statement Analysis Measure?

Financial Statement Analysis looks at three different critical areas of a business: Liquidity, Solvency, and Profitability. Each dimension looks at the information from a different perspective. Bringing all three perspectives together gives a clearer picture of the business that would not be gained just by looking at the financial statements on their own.

Liquidity

Liquidity measures how easily and quickly a business can turn its assets into cash to meet its short-term obligations. For example, does it have enough cash in the bank to make payroll?

Solvency

Solvency measures whether a company can meet its long-term obligations. Does it have enough cash, accounts receivable, and inventory to generate the cash needed to pay debts and interest?

Profitability

Profitability measures whether a company can generate adequate cash to pay its day-to-day expenses, meet its long-term obligations, and have cash left for dividends to stockholders.

Methods of Analyzing Financial Statements

The techniques used to analyze a company’s performance are divided into two categories:

- Analytical Methods

- Financial Ratios

Analytical Methods

Horizontal Analysis

Horizontal Analysis is used to compare the same items (for example, Cash or Revenue) across two or more time periods (months, quarters, years.) It is used to track the increase or decrease of the balance of the account compared to another time period. It tracks both the amount of the increase or decrease and the percentage of the increase or decrease. The amount of the change is divided by previous period to determine the percent of the increase or decrease.

| 2025 | 2024 | +/- | ||

| Revenue | 10,000 | 8,000 | 2,000 | 25% |

| Cost of Goods Sold | 5,000 | 3,000 | 2,000 | 67% |

| Gross Profit | 5,000 | 5,000 | 0 | 0% |

| Expenses | ||||

| Automobile Expense | 1,000 | 800 | 200 | 25% |

| Insurance Expense | 1,000 | 1,000 | 0 | 0% |

| Wages Expense | 2,500 | 3,000 | (500) | (17)% |

| Total Expenses | 4,500 | 4,800 | (300) | ( 6)% |

| Net Income | 500 | 200 | 300 | 105% |

Vertical Analysis

Vertical Analysis is used to show the relationship of one item to another item (for example, Expenses compared to Revenue.)

In an Income Statement, Expenses are compared to Revenue to determine the percent of revenue each item represents.

| Revenue | 10,000 | 100% | |

| Cost of Goods Sold | 5,000 | 50% | |

| Gross Profit | 5,000 | 50% | |

| Expenses | |||

| Automobile Expense | 1,000 | 10% | |

| Insurance Expense | 1,000 | 10% | |

| Wages Expense | 2,500 | 25% | |

| Total Expenses | 4,500 | 45% | |

| Net Income | 500 | 5% |

In this example, Cost of Goods Sold is 50% of Revenue, meaning that every dollar in Revenue has 50 cents of Cost to purchase or manufacture the product. Gross Profit is 50% of Revenue. All other expenses are 45% of each Revenue dollar. Net Income is 5% of Revenue.

In the Balance Sheet, on each side of the accounting equation [Assets = Liabilities + Equity], the individual accounts are compared to the total for that category. Each Asset account is compared to total Assets. Each Liability account and Equity account is compared to total Liabilities and Shareholders’ Equity.

| Assets | ||

| Cash | 40,000 | 50% |

| Accounts Receivable | 20,000 | 25% |

| Inventory | 20,000 | 25% |

| Total Assets | 80,000 | 100% |

| Liabilities | ||

| Accounts Payable | 4,000 | 5% |

| Note Payable | 16,000 | 20% |

| Total Liabilities | 20,000 | 25% |

| Stockholders’ Equity | ||

| Common Stock | 20,000 | 25% |

| Retained Earnings | 40,000 | 50% |

| Total Stockholders’ Equity | 60,000 | 75% |

| Total Liabilities and Stockholders’ Equity | 80,000 | 100% |

Common-Sized Statements

Common-Sized Statements are used to compare two businesses side by side or to compare one business against industry averages. Businesses can be vastly different in volume and amount of transactions making it difficult to make comparisons. Common-Sized Statements seek to equalize the two businesses by only looking at percentages.

| Company 1 | Company 2 | |

| Revenue | 100% | 100% |

| Cost of Goods Sold | 50% | 45% |

| Gross Profit | 50% | 55% |

| Expenses | ||

| Automobile Expense | 10% | 8% |

| Insurance Expense | 10% | 6% |

| Wages Expense | 25% | 20% |

| Total Expenses | 45% | 34% |

| Net Income | 5% | 21% |

Company 2 spends less of its revenue on a percentage basis on Cost of Goods Sold and less on Wages, giving it a higher Net Income percentage.

Financial Methods Used for Financial Analysis

Using ratios as methods for Financial Analysis give insights to various key components of a business, highlighting areas that are functioning well, areas that need improvement, and areas critical to success in a particular industry. A ratio compares one item to another item.

For example, in a business with high levels of Accounts Receivable, focusing on ratios specific to the Accounts Receivable process helps to manage that process with a higher degree of accuracy to better understand the efficiency and effectiveness of policies and processes.

Download the free Ratio Formulas for Financial Statement Analysis pdf by clicking here.

Analyzing Liquidity

Liquidity ratios measure a company’s ability to convert current assets like Accounts Receivable and Inventory into cash. A business with high liquidity is better able to pay its bills, negotiate for better pricing on inventory or materials, and grow the business more quickly than a business with lower liquidity.

Liquidity ratios look at three broad areas:

- Current Position–how easily can a business pay its current bills.

- Accounts Receivable–how quickly does a company turn its Accounts Receivable into cash.

- Inventory–how quickly does a company turn its Inventory into Accounts Receivable or Cash.

Current Position Analysis

Working Capital

Working Capital looks at the relationship between Current Assets (Cash, Accounts Receivable, Inventory) and Current Liabilities (Accounts Payable, Short-term Notes Payable, Wages Payable). It asks the question “Can the company’s Current Assets cover the company’s immediate bills, its Current Liabilities?”

Working Capital = Current Assets – Current Liabilities

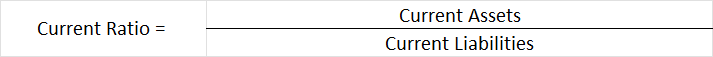

Current Ratio

Current Ratio is Working Capital expressed as a ratio:

Like Working Capital, the Current Ratio measures a company’s ability to pay its current bills.

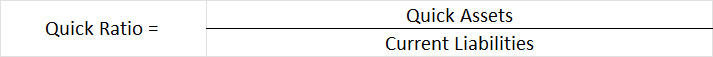

Quick Ratio (or Acid-Test Ratio)

The Quick Ratio looks at only those assets that are already cash or can be very quickly turned into cash. For the purposes of most accounting classes, Quick Assets are considered to be Cash and Accounts Receivable. Inventory is ignored since it takes longer to turn to cash.

Accounts Receivable Analysis

Accounts Receivable is a critical area of a business. Bad debts and slow-paying customers mean that cash isn’t available for current bills or for buying new inventory. The following ratios give a glimpse into a company’s efficiency in collecting its receivables.

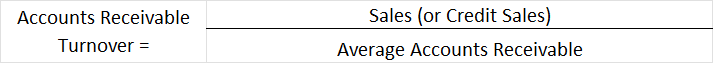

Accounts Receivable Turnover

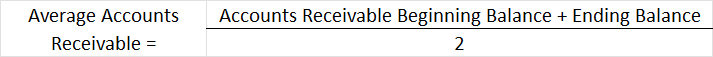

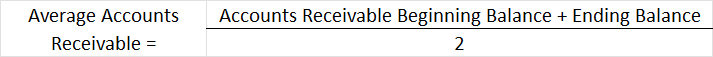

Accounts Receivable Turnover ratio measures the length of time it takes on average to collect an invoice. To calculate this ratio, the first step is to determine Average Accounts Receivable which is done by taking the average of the beginning balance in Accounts Receivable for the period in question and the ending balance in Accounts Receivable.

The Average Accounts Receivable becomes the denominator for the ratio. The numerator is either Sales (Revenue) or Credit Sales. Credit sales are those sales that the company waits to receive payment on (Accounts Receivable). Because Credit Sales are rarely separated in a financial statement, Net Sales [Sales – Returns – Discounts] can be used in its place.

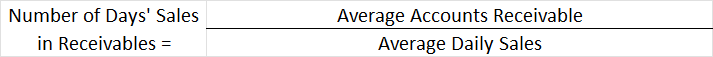

Number of Days’ Sales in Receivables

Number of Days’ Sales in Receivables measures how many days of Sales are tied up in Receivables. If a business operates mostly on cash payment sales, it has access to cash more quickly. If a business operates mostly on credit sales, it is important to know how much of Sales has not yet been paid. A higher number of days’ sales in receivables means less cash available for other uses.

To calculate Number of Days’ Sales in Receivables, Average Accounts Receivable needs to be calculated first. This is done by adding the beginning balance for the period to the ending balance for the period and dividing by two. This becomes the numerator.

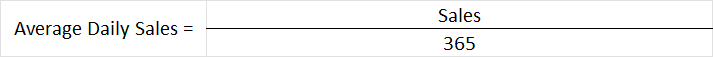

The second step is to determine the average daily sales number. When we take our sales for the year and divide that by 365 days, we can see what our daily sales number is. This number becomes the denominator for the Number of Days’ Sales in Receivables ratio.

When the two numbers are compared, it offers an insight into how quickly credit sales turn into cash.

Download the free Ratio Formulas for Financial Statement Analysis pdf by clicking here.

Inventory Analysis

Inventory is another critical area for businesses to manage. Too much inventory leads to too much cash being tied up and unavailable for other purpose (like payroll.) Too little inventory leads to lost sales and disappointed customers.

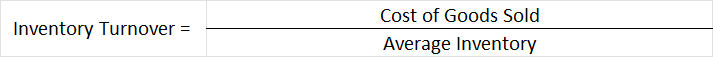

Inventory Turnover

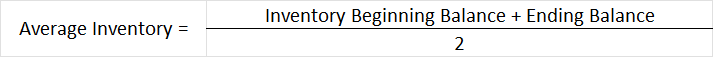

The Inventory Turnover ratio looks at how quickly inventory is sold. To calculate this ratio, first calculate Average Inventory:

This becomes the denominator in the ratio.

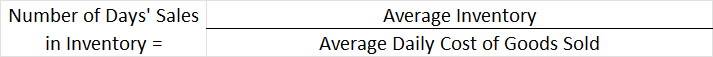

Number of Days’ Sales in Inventory

Number of Days’ Sales in Inventory measures the amount of potential sales sitting in inventory. It is useful to help understand whether a company has the inventory to fulfill its immediate sales and to determine if inventory is available for future sales.

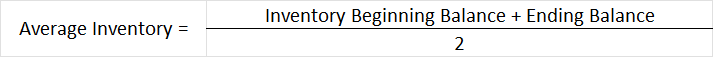

To calculate the ratio, first calculate Average Inventory:

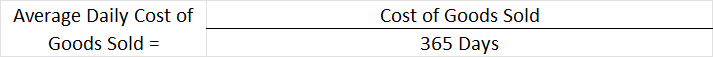

This becomes the numerator. Second, calculate Average Daily Cost of Goods Sold by taking total cost of goods sold for the period and dividing it by 365 to calculate one day’s Cost of Goods Sold.

This becomes the denominator to calculate the ratio.

Download the free Ratio Formulas for Financial Statement Analysis pdf by clicking here.

Analyzing Solvency

Solvency measures a company’s ability to pay its long-term debts like Notes and Bonds. It measures whether a company will be able to pay the loans and bonds at maturity, and whether the company will be able to make interest payments on those long-term liabilities.

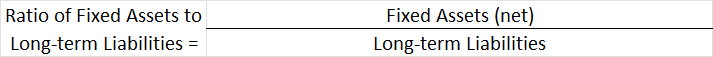

Ratio of Fixed Assets to Long-term Liabilities

Ratio of Fixed Assets to Long-term Liabilities ratio measures a company’s margin of safety in meeting its obligations. Does the company have enough Fixed Assets that, if sold, it would be able to cover its long-term liabilities? Fixed Assets for the numerator are net of accumulated depreciation [Fixed Assets – Accumulated Depreciation = Net Fixed Assets]

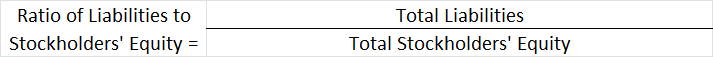

Ratio of Liabilities to Stockholders’ Equity

The Ratio of Liabilities to Stockholders’ Equity measures how much of the business is financed by debt vs. by equity. A higher level of liabilities means the stockholders have less equity. A lower level of liabilities means the stockholders have more equity.

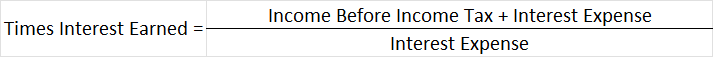

Times Interest Earned

Times Interest Earned ratio measures whether a company will be able to make its interest payments if earnings decrease.

When calculating Income Before Income Tax, Interest Expense has been deducted from the amount. [Revenue – Expenses including Interest Expense = Income Before Income Tax] By adding Interest Expense back to Income Before Income Tax, we can see how much earnings in total are available to pay interest.

If a business has a loss, the ratio will show that a negative amount is available to pay interest. If a company has interest payments higher than earnings available to pay them, its a signal that the company may default on payments.

Analyzing Profitability

Usually with accounting, when we talk about profitability of a company, we are talking about whether the company itself is profitable. Do Revenues exceed Expenses? When we are talking about Financial Statement Analysis and profitability, we also want to know if the owners and investors are making a profit on their investment in the company. Those investors may be a sole proprietor or stock owners in a corporation.

Download the free Ratio Formulas for Financial Statement Analysis pdf by clicking here.

Asset Turnover

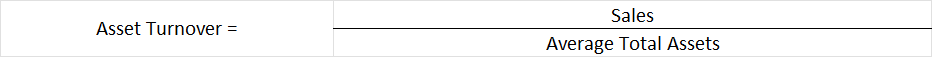

Asset Turnover ration measures whether a company’s assets are being efficiently used in generating sales. If a company has worn out machinery that is down for repairs, it isn’t making the company any money.

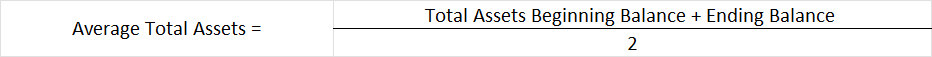

To calculate the ratio, first calculate Average Total Assets by adding the beginning total assets balance to the ending total assets balance and dividing by two.

This becomes the denominator for the ratio.

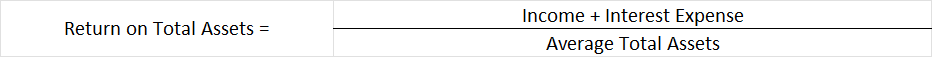

Return on Total Assets

Return on Total Assets measures the profitability of assets. It uses Net Income and the cost of any financing costs from the assets to determine profitability.

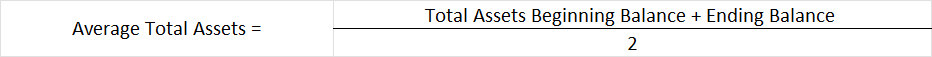

To calculate the ratio, first calculate Average Total Assets by adding the beginning total assets balance to the ending total assets balance and dividing by two.

This becomes the denominator for the ratio. For the numerator, take Net Income and add back Interest Expense.

Return on Stockholders’ Equity

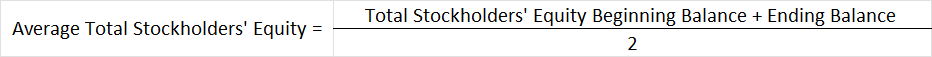

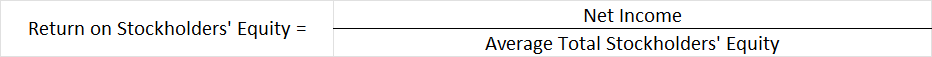

Return on Stockholders’ Equity measures how much profit can be related to the investments of stockholders. To calculate the ratio, first calculate Average Total Stockholders’ Equity by adding the beginning stockholders’ equity to the ending stockholders’ equity and divide by two.

This becomes the denominator for the ratio. The numerator is Net Income.

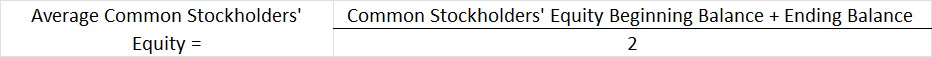

Return on Common Stockholders’ Equity

Return on Common Stockholders’ Equity measures how much profit can be related to the investments of Common stockholders. To calculate the ratio, first calculate Average Total Common Stockholders’ Equity by adding the beginning Common stockholders’ equity to the ending Common stockholders’ equity and divide by two.

This becomes the denominator for the ratio. The numerator takes Net Income and subtracts any Preferred Stock dividends that were paid out.

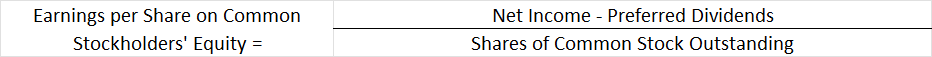

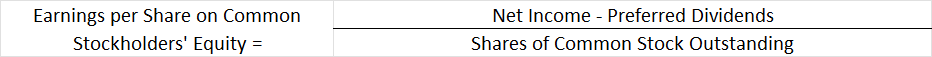

Earnings per Share on Common Stockholders’ Equity

Earnings per Share measures how much in earnings can be related on a per share basis to the investments of Common Stockholders. It subtracts any Preferred Dividends paid from Net Income and divides by the total number of Common Stock shares outstanding.

Download the free Ratio Formulas for Financial Statement Analysis pdf by clicking here.

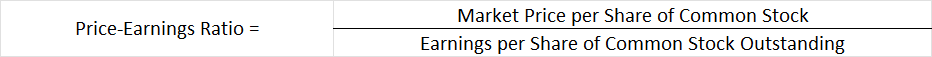

Price-Earnings Ratio

Price Earnings Ratio measures the market price of Common Stock shares compared to earnings per share to determine the prospect of future earnings of the company. It shows how much an investor might pay for a stock to receive $1 of earnings.

To calculate the ratio, first calculate Earnings per Share on Common Stockholders’ Equity. This becomes the denominator for the ratio.

The market price of a share of Common Stock is the numerator. The Market Price is the price of a share of common stock if an investor bought it today.

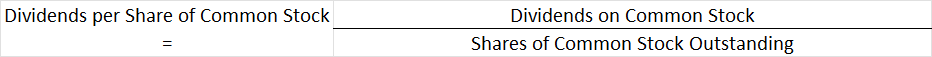

Dividends per Share

Dividends per Share measures how much in dividends a company is paying out on a per share basis. To calculate the ratio, take the total dividends paid on Common Stock and divide by the total number of shares currently outstanding.

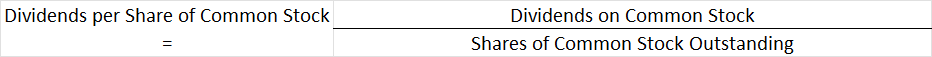

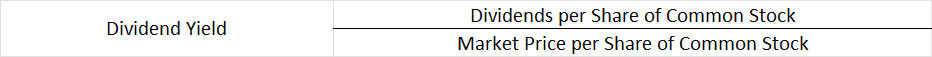

Dividend Yield

Dividend Yield measures the rate of return to common stockholders in dividends. It is a useful ratio for investors who are looking for income (dividends) from their investment.

To calculate the ratio, first calculate dividends per share by taking the total dividends paid on Common Stock and dividing by the total number of shares outstanding.

This becomes the numerator of the ratio. Then, divided by the Market Price per share of common stock.

Industry Specific Measurements

In addition to the ratios discussed, businesses can apply other measurements particular to their industry. For example, hotel chains may look at occupancy rates per hotel and chain-wide to look for trends or determine the cost of empty rooms. A restaurant may focus on food costs, number of seats, and how quickly seats turnover.

Download the free Ratio Formulas for Financial Statement Analysis pdf by clicking here.

What is Financial Statement Analysis Used For?

The power of Financial Statement Analysis does not lie in any one number or ratio. Rather, by analyzing liquidity, solvency, and profitability from different viewpoints, a clearer picture of the financial condition of a business can be gained. This is useful for investors looking to purchase stock, for banks determining whether to make a loan, and for owners and managers of the business digging into the numbers to gain insights to strengthen and grow the business.

To gain a better understanding of Financial Statements, check out this Accounting Student Guide:

-

So You Want to Start a Nonprofit…Consider This

Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. Here are key points to consider before embarking

-

Tax Liability Accrual Explained

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with accounting

-

Nonprofit Monthly Financial Close Process Overview

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. This process ensures that financial statements are prepared, reviewed,

-

Navigating Payroll Taxes for Nonprofits: Responsibilities and Compliance

Payroll taxes are the taxes that employers withhold from their employees’ wages and are required to remit to the appropriate government agencies. They include various taxes that fund government programs,

-

Understanding Form 990: Transparency and Accountability for Nonprofits

Form 990 is a reporting document filed by tax-exempt organizations in the United States with the Internal Revenue Service (IRS). It provides detailed information about the organization’s financial activities, governance,

-

Financial Disclosures for Affiliated Nonprofit Organizations

Disclosures related to revenue sharing, consolidated financial statements, noncontrolling interests, and related party transactions in the context of affiliated organizations within a nonprofit are crucial for transparency and accurate financial