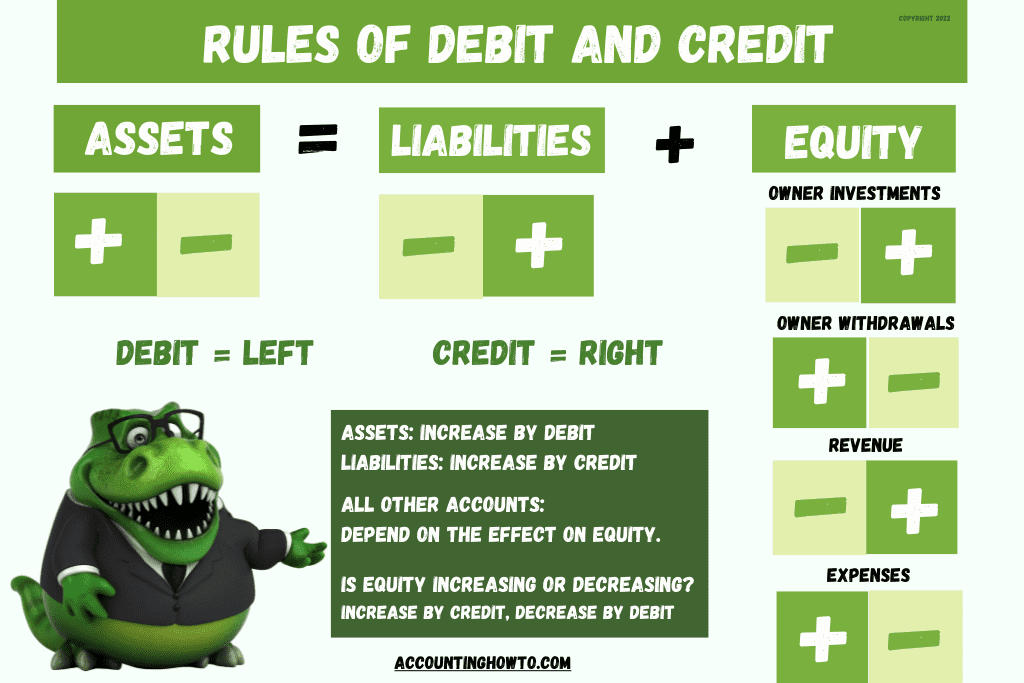

Using Double-entry Accounting, every business transaction impacts at least two accounts. Those accounts are increasing or decreasing. In accounting, rather than using positive and negative numbers to record the increases and decreases, we use debits and credits. Debits represent the left side of an account. Credits represent the right side of an account. Some accounts are increased on the debit side and some are increased on the credit side. Which side an account increases on depends on where it falls in the Accounting Equation: Assets = Liabilities + Equity.

Assets are on the left side of the equation. The left side of the equation is the Debit side. Asset accounts like cash and inventory increase by debit and decrease by credit.

Liabilities are on the right side of the equation. The right side of the equation is the Credit side. Liability accounts like Accounts Payable and Loan Payable increase on the Credit side and decrease on the Debit side.

Equity is on the right side of the equation. The right side of the equation is the Credit side. Equity increases on the Credit side and decreases on the Debit side.

Equity is more complex than Assets or Liabilities because Equity increases and decreases come from different types of transactions.

When an owner invests money in a business, the owner’s equity increases. When and owner takes money out of the business, the owner’s equity decreases.

When a business has revenue (sells to its customers), it increases equity.

When a business has expenses, it decreases equity.

Let’s look at an example:

Terrance Inc is a new business opening up a store selling dinosaur shampoos and skin conditioners.

- The owner, Terrance “T-Account” Rex invests $10,000. Terrance’s equity in the business increases by $10,000. To increase equity we credit it.

- A month goes by and Terrance decides he wants to take some of his cash back out of the business to buy a new motorbike. He writes himself a check for $2,000. His equity is decreasing so we debit it.

- In the first month of business, Terrance Inc sells $20,000 of product to customers. This revenue increases the value of the business and Terrance’s equity increases. An increase to equity is done by crediting the account.

- Terrance Inc incurred $6,000 of expenses in the first month. Expenses decrease equity. When equity decreases, we debit it.

- At the end of the first month, the equity account shows that Terrance’s ownership value in the business is: 0 [Beginning Balance]+ $10,000 [Owner’s Investment] – $2,000 [Owner’s Withdrawal] + $20,000 [Revenue from Sales] – $6,000 [Expenses] = $22,000

With accounts related to Equity (Investments, Withdrawals, Revenue, and Expenses), we debit and credit the accounts based on the effect on Owner’s Equity.

This means if an account increase equity (investments, revenue), we credit it. If an account decreases equity (withdrawals, expenses), we debit it.

What Does Debit and Credit Mean in Accounting?

In accounting, Debit means the left side of an account and Credit means the right side of an account. We increase and decrease accounts by debiting them or crediting them. Knowing whether to debit or credit an account depends on the Type of Account and that account’s Normal Balance. An account’s Normal Balance is based on the Accounting Equation and where that account is in the equation.

The account types are Asset, Liability, Equity, Dividends, Revenue, Expense. To increase an Asset, Dividend, or Expense account, we debit. To decrease those accounts, we credit. To increase an Equity (Capital), Revenue, or Liability account, we credit. To decrease those accounts, we debit.

For more information about the Accounting Equation, check out this video:

What are Debits and Credits Used for in Accounting?

Think of debits and credits as pulling the levers to make changes in an account. If you debit an asset, you are telling your accounting system to increase it. If you credit an asset, you are telling your accounting system to decrease it.

Let’s use your checking account as an example. Let’s deposit some money into the account. That means the balance is increasing.

- What type of account is it? A bank account is an Asset.

- What is the Normal Balance of an Asset? An Asset has a Normal Debit Balance.

- Are we increasing the Asset or decreasing the Asset? We are increasing.

- How do you increase an Asset? By debiting it.

Now, let’s say we withdraw some cash from the account. The balance is decreasing.

- What type of account is it? A bank account is an Asset.

- What is the Normal Balance of an Asset? An Asset has a Normal Debit Balance.

- Are we increasing the Asset or decreasing the Asset? We are decreasing.

- How do you decrease an Asset? By crediting it.

To reinforce your understanding of Debits and Credits, watch this video:

Debits and Credits Step by Step

- For each transaction, determine what accounts are impacted. (Example: Cash and Product Sales)

- For each account, determine if the account is increasing or decreasing. (Example: Cash is increasing and Product Sales is increasing.)

- What type of accounts are these? (Example: Cash is an Asset. Product Sales is a Revenue.)

- What is the Normal Balance for those accounts? (Assets have Normal Debit balance and Revenue has Normal Credit balance)

- To increase the Asset called Cash, debit it. To increase the Revenue called Product Sales, credit it.

- Record the journal entry using the journal entry structure.

- Post to the T-Accounts or Ledgers.

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a