Sales and Use Taxes are treated differently by taxing authorities and in accounting. Understanding the how sales tax and use tax are different, but similar is an important accounting concept to master.

What is Sales Tax

Sales Taxes are consumption taxes, meaning that the taxes are levied based on purchases (consumption) of goods and services. Taxes are collected by businesses as part of the sales process. The funds are held in trust by the business and then submitted on a regular schedule to the governing agency responsible for collecting the taxes. Both states and local governments can charge sales taxes.

What is Use Tax?

Like Sales Taxes, Use Taxes are consumption taxes, meaning that the taxes are levied based on purchases or uses of goods and services. The difference between sales and use tax is that use tax is employed when sales tax has not been paid through normal purchase transactions. For use tax, the consumer is reporting the purchase and paying the tax, rather than the merchant collecting and paying the the tax.

For example, if you live in a state that has sales tax, but you purchase goods in person or online from another state and don’t pay sales tax at the time of sale, your home state will assess a use tax for those goods. The end result is that you pay the same amount in use tax that you would have paid in sales tax if you had purchased the goods in your own state.

Accounting for Sales Tax

When a business sells to a customer, it charges the customer the selling price of the goods, and adds on the sales tax due on those goods. Periodically, the business reports the amount of sales and sales tax to the taxing agency and remits the sales tax due.

For the purposes of accounting classes, it is assumed that each transaction is recorded using a journal entry. In practice, the information is collected through the cash register or invoices, and the total sales and sales tax are summarized daily.

How is the Amount of Sales Tax Due Tracked?

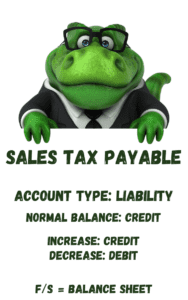

Sales Tax is collected in the Sales Tax Payable account. Sales Tax Payable is a liability account. A liability account has a normal credit balance. It increases on the credit side and decreases on the debit side.

Example of Sales Tax

My sidekick, Terrance “the T-Account” Rex lives in Maine. Maine has a state sales tax of 5.5%. Terrance purchases some candy from the local convenience store. He pays $75.00 for the candy. (Don’t judge. He’s a big guy with a big appetite.) Here is the journal entry the store owner makes to record the purchase:

| Cash | 79.13 | |

| Sales Revenue | 75.00 | |

| Sales Tax Payable | 4.13 |

When it’s time for the store owner to pay sales tax (based on a state-determined schedule–month, quarter, year), the store owner makes the following journal entry:

| Sales Tax Payable | 4.13 | |

| Cash | 4.13 |

Example of Use Tax

Terrance orders a case of his favorite candy from a store in New Hampshire. The candy company charges Terrance $225 for the candy and ships it to him. Terrance did not pay sales tax because New Hampshire doesn’t have sales tax. Instead, Terrance will now report the purchase and pay the equivalent amount of use tax that he would have paid if he purchased the candy in Maine. [$225 x 5.5%] Here is the journal entry to record the payment of use tax:

| Use Tax Expense | 12.38 | |

| Cash | 12.38 |

For more about Terrance and how he became a sidekick for Accounting How To, check out his bio here:

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a

-

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

Is Accounts Payable an Asset, Liability, Revenue, or Expense?

Accounts Payable is a Liability. It represents the purchase of goods or services that a company has not yet paid for. The company has created an obligation to pay. A

-

Understanding Financial Statements | Accounting Student Guide

What is a Financial Statement? Financial Statements are a set of reports summarizing the activities of a business or organization. Much like a series of x-rays shows different views of

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

Is Unearned Revenue an Asset, Liability, Revenue, or Expense?

Unearned Revenue is a Liability. It represents cash received by the company that cannot yet be considered earned revenue. Until the revenue is earned the cash received is a liability.