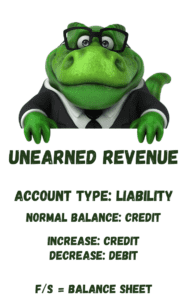

Unearned Revenue is a Liability. It represents cash received by the company that cannot yet be considered earned revenue. Until the revenue is earned the cash received is a liability. If the company does not deliver the goods or services, the funds will be due back to the customer. A Liability has a normal credit balance. A Liability increases on the credit side and decreases on the debit side. When the revenue is earned, an adjusting entry is completed to move the funds out of Unearned Revenue and into a revenue account. Unearned Revenue is listed on the Balance Sheet in the Current Liabilities section.

What is an Example of Unearned Revenue?

A cabinetmaker contracts with a customer to build a custom conference room table for $10,000. The cabinetmaker requires a 50% down payment before work begins. Because the cabinetmaker has not done any of the work yet, the customer deposit cannot be considered revenue under accrual based accounting rules. The following journal entry records the receipt of cash and the liability incurred.

| Cash | 5,000 | |

| Unearned Revenue | 5,000 |

At the end of the month, it is determined that 25% of the work is completed. Of the $10,000, $2,500 can now be considered as earned revenue. An adjusting journal entry is done to move $2,500 from Unearned Revenue to Revenue:

| Unearned Revenue | 2,500 | |

| Revenue | 2,500 |

This leaves $2,500 in Unearned Revenue [$5,000 – $2,500].

At the end of the second month, the entire job is completed. The customer pays the remaining amount of $5,000 for a total payment of $10,000. At this point, the remainder of the revenue needs to be reported as being earned. In the previous adjusting journal entry $2,500 of revenue was earned. $2,500 remained unearned. Fifty percent has had no transaction recorded (the amount the customer did not make a deposit for).

| Cash | 5,000 | |

| Unearned Revenue | 2,500 | |

| Revenue | 7,500 |

Total Cash received = $10,000

Total Revenue earned = $10,000

Balance in Unearned Revenue = 0

What Other Account Names are Also Unearned Revenue?

Other Account Names used for Unearned Revenue items include:

- Unearned Rent Revenue

- Deferred Revenue

- Customer Deposits

- Advance Payments

- Unearned Subscriptions

- Unearned Income

- Legal Retainers

To learn more about liabilities, check out this article:

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a

-

What is Revenue?

Revenue is the income generated by a business in the normal course of operations. It represents the sale of goods and services to customers or clients. For a non-profit organization,