What is a Merchandising Business?

A merchandising business is a business that purchases goods and re-sells the goods to its customers. Examples of merchandising businesses are Amazon and Wal-mart. A non-profit can also have a merchandising business where it receives donated goods and sells them to customers. Examples of non-profit merchandising businesses are Habitat for Humanity’s ReStore and the Goodwill and Salvation Army thrift stores.

Accounting for Merchandising Business

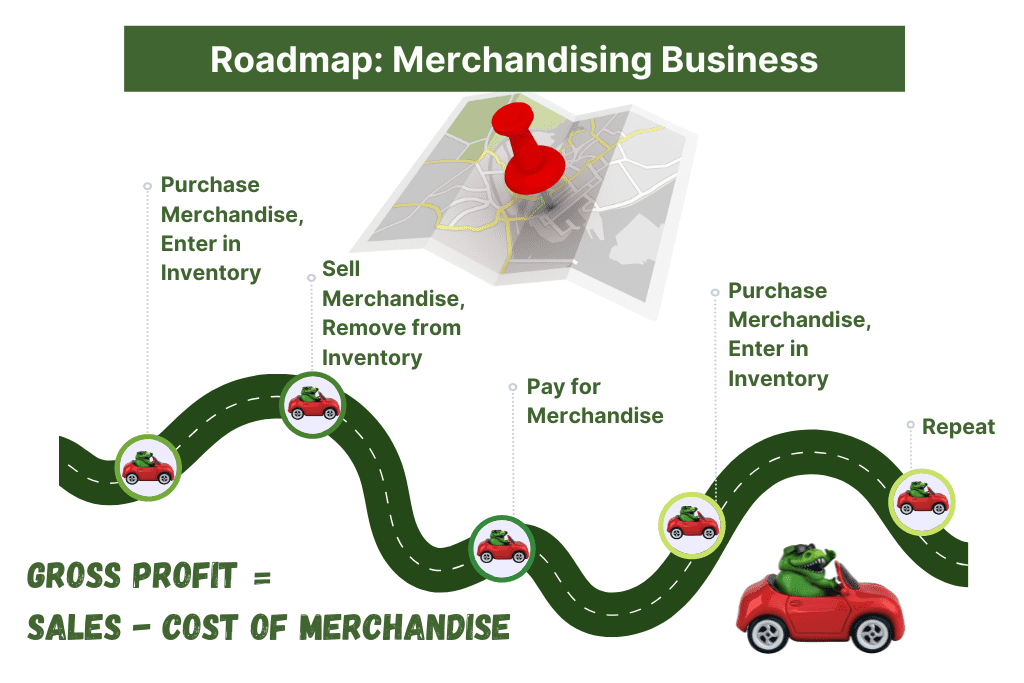

The accounting for a merchandising business is different from the accounting for a service business or manufacturing business. Merchandising businesses must accurately track the cost of the merchandise purchased for resale and the inventory of the goods. Accounting transactions for a merchandising business track sales transactions and purchase and inventory transactions. An important financial measurement for merchandising businesses is gross profit.

What is Gross Profit in a Merchandising Business?

Gross Profit is a key measurement for a merchandising business that compares revenue (sales of goods) and the cost of purchasing the goods for re-sale (cost of merchandise sold). Because the cost of merchandise sold amount directly impacts profits, it is an amount that needs careful and accurate tracking.

For an overview and example of accounting for a merchandising business, watch this video:

Emotional Support Dinosaur (ESD): noun A highly-specialized species of dinosaur imbued with the innate ability to comfort accounting students during the learning of confusing accounting topics.

Dictionary of completely made up things

Chart of Accounts for a Merchandising Business

For merchandising businesses, additional accounts are needed to capture important financial information. The typical accounts that may need to be added to the Chart of Accounts for a merchandising business are:

| Merchandise Inventory | Asset |

| Estimated Returns Inventory | Asset |

| Customer Refunds Payable | Liability |

| Cost of Merchandise Sold | Expense |

| Delivery Expense | Expense |

Accounting for Purchase Transactions in a Merchandising Business

In a merchandising business, tracking purchases and tracking and valuing inventory are critical to the success of the business. Careful control of the cost of merchandise directly impacts the profit of a business. Protecting inventory from theft, loss, spoilage, and damage impacts the cost of merchandise. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business.

For an introduction to inventory, check out this article:

One of the first considerations for a merchandising business is to make a decision on how inventory will be tracked and valued. A business can use either a perpetual inventory method or a periodic inventory method.

Perpetual vs Periodic Inventory

Under a perpetual inventory method, businesses typically scan merchandise as it comes into the warehouse, scan it as it leaves the warehouse, scan it as it comes into the store, and scan it when it goes through the cash register and out of the store. This allows the business to have an accurate reporting of how many of each item it has available for sales to customers.

Under a periodic inventory method, a business tracks inventory once a month or once a year (periodically) by taking a physical count of all merchandise. The value of the inventory is compared to the previous inventory number and what was purchased. The difference between what was on hand, what was purchased, and what is remaining, provides the amount of inventory sold. Because this method does not provide up-to-date business information, this method is only used by businesses with small amounts of inventory.

For a deeper understanding of Perpetual Inventory and Periodic Inventory methods, watch this video:

Every sales transaction for a merchandising business consists of both a sales transaction and an expense/inventory transaction. For example: a business sells a product to a customer on account. The selling price is $10. The purchase price (cost of merchandise) is $5. The sale is recorded like this:

| Accounts Receivable | 10 | |

| Sales Revenue | 10 | |

| Cost of Merchandise Sold | 5 | |

| Inventory | 5 |

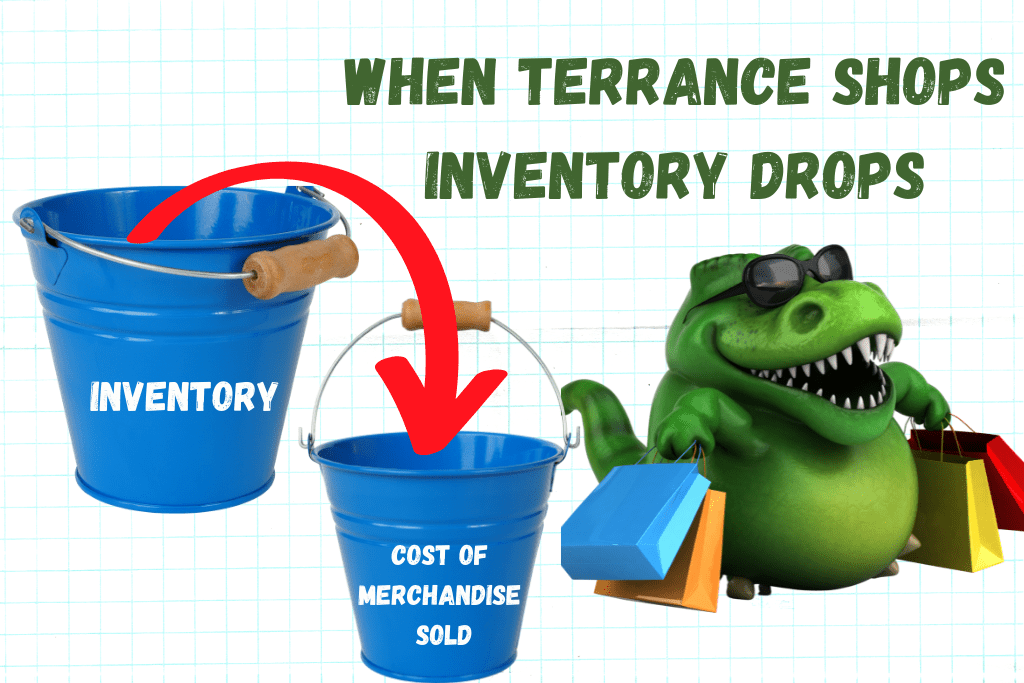

The first part of the journal entry records the sale to the customer. The second part of the transaction moves the merchandise out of inventory and into an expense. In accounting, merchandise is held in inventory until it is sold. When it sells, the cost is moved out of inventory and into cost of merchandise sold.

Because you can’t sell from an empty shelf, we’ll start out our step-by-step accounting transaction discussion with the purchasing and inventory side of a merchandising business. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method.

Merchandise Business: Purchases Transactions

Two standard journal entries can be used to record the purchase of merchandise. The only difference is how the company pays for the merchandise–now or later.

Let’s say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece.

In the first transaction, the company pays for the merchandise in cash.

| Merchandise Inventory | 500 | |

| Cash | 500 |

In the second transaction, the company purchased the merchandise on account (paying later).

| Merchandise Inventory | 500 | |

| Accounts Payable | 500 |

The only difference between the transactions is the method of payment.

Often, a vendor or supplier will offer payment terms that can impact the cost of the merchandise.

What are Payment Terms on an Invoice or Bill?

Each invoice or bill from a vendor specifies when the vendor expects to be paid.

Here are some common payment terms and what they mean:

| Due on Receipt | Vendor wants payments as soon as the goods are received. |

| COD | Cash on Delivery–payment must be made at the time of delivery. |

| Net 30 | Full amount of the invoice is due in 30 days. |

| Net 15 | Full amount of the invoice is due in 15 days. |

| 2% 10, net 30 | If invoice is paid within 10 days, a 2% discount can be taken, otherwise the invoice is due in full in 30 days. |

| 1% 15, net 20 | If invoice is paid within 15 days, a 1% discount can be taken, otherwise the invoice is due in full in 20 days. |

| Payment in Advance | Payment is due before merchandise ships. |

| Deposit | A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc.) |

For the purposes of this article, we will focus on the discounts offered. When a vendor offers a discount to a merchandising business, that discount (when taken) reduces the cost of the merchandise.

In the original entry, Terrance Inc. purchased 100 Terrance Action Figures for $5 each.

| Merchandise Inventory | 500 | |

| Accounts Payable | 500 |

If the vendor selling the items to Terrance Inc. offered a 2% discount if paid within 10 days, the discount is used to reduce the cost of the merchandise.

To calculate the amount of the discount:

invoice amount x discount percent = discount [$500 x 2% = $10]

The total amount of the invoice after the discount is applied is $490 [$500 – $10].

There are two ways to account for this difference in the cost of the merchandise:

- Gross method

- Net method

Many accounting textbooks say that since companies “always” take discounts, use the net method. In the real world, companies “sometimes” take discounts. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available.

Let’s look at our transaction using the gross method:

The transaction is recorded at the full amount of the invoice at the time of purchase:

| Merchandise Inventory | 500 | |

| Accounts Payable | 500 |

At the time of payment, if it’s during the discount period, the following transaction is recorded to pay the invoice:

| Accounts Payable | 500 | |

| Merchandise Inventory | 10 | |

| Cash | 490 |

The full amount of the invoice (reduced by debiting) from Accounts Payable to show the bill is paid in full. Because the discount has been applied, Cash being paid out is less than the full amount of the invoice. We reduce Cash (reduced by crediting). Originally, we recorded the cost of our Merchandise Inventory as $500. The discount reduced that by $10. Now, our total cost of Merchandise Inventory is $490 [$500 – $10].

Let’s look at our transaction using the net method:

The transaction is recorded at the discounted amount of the invoice at the time of purchase:

| Merchandise Inventory | 490 | |

| Accounts Payable | 490 |

At the time of payment, if it’s during the discount period, the following transaction is recorded to pay the invoice:

| Accounts Payable | 490 | |

| Cash | 490 |

If the invoice is not paid during the discount period, an adjustment needs to be made to record the lost discount. This adds the cost of the discount taken back to the cost of the Merchandise Inventory.

| Accounts Payable | 490 | |

| Merchandise Inventory | 10 | |

| Cash | 500 |

For a more in depth understanding of Gross vs. Net Methods, watch this video:

Accounting for Purchases Returns and Allowances

At times, due to errors in ordering or fulfilling orders or due to defects in merchandise, a customer may need to return merchandise to the seller. When this happens, an accounting transaction is recorded to show the change in the transaction.

In our previous example, Terrance Inc. purchases on account 100 Terrance Action Figures for $5 each. Assuming the company uses the Gross Method of entering bills, the journal entry would be:

| Merchandise Inventory | 500 | |

| Accounts Payable | 500 |

Now, let’s say 10 of the Terrance Action Figures were missing when the box was opened. Terrance Inc. notifies the supplier that the order was short by 10. The supplier issues a credit memo to Terrance Inc. for $50 [10 action figures x $5 each]. Terrance Inc. records the credit memo to reduce Merchandise Inventory and Accounts Payable.

| Accounts Payable | 50 | |

| Merchandise Inventory | 50 |

The total amount due to the supplier is $450 [$500 – $50]. Terrance Inc.’s inventory is reduced by value of the missing 10 action figures.

When it’s time to pay the bill, Terrance Inc. will record the following journal entry:

| Accounts Payable | 450 | |

| Cash | 450 |

For large businesses that expect high amounts of returns, the company can set up a Purchase Returns Allowance account. It designates an amount of expected returns and sets it aside in an allowance account, much like the Allowance for Doubtful Accounts.

For an overview and more examples for Purchase Transactions in a Merchandise Business, watch this video:

Of course, the purpose of purchasing merchandise for a merchandising business is to sell the merchandise to customers. Next, we’ll cover the sales transactions needed to record both the sales side of transactions and the inventory and expense side.

Merchandise Business: Sales Transactions

In manual accounting in a merchandising business, there are two parts to every sales transaction:

- Recording the Sale to the Customer as either a cash payment or an Accounts Receivable.

- Moving the sold merchandise out of Merchandise Inventory and into Cost of Merchandise Sold.

To illustrate how this is done, we’ll use the following example:

Terrance Inc. sells 20 Terrance Action Figures to Dino-Mart Toy Store for $10 a piece. The action figures cost Terrance Inc. $5 a piece.

Cash Sales in a Merchandising Business

If Dino-Mart pays cash for the merchandise, the following journal entry is made to record the sale:

| Cash | 200 | |

| Sales Revenue | 200 |

The second part of the journal entry, records the expense of the merchandise sold and removes it from inventory. [Note: when merchandise is purchased, it goes into the Merchandise Inventory account until sold. When it’s sold, the expense is recorded. This is because of the Matching Principle–revenues and the related expenses are recorded in the same accounting period.]

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

The complete journal entry is as follows:

| Cash | 200 | |

| Sales Revenue | 200 | |

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

Sales on Account in a Merchandising Business

If a customer buys merchandise on account (paying later), the journal entry changes slightly to reflect the future payment.

| Accounts Receivable | 200 | |

| Sales Revenue | 200 | |

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

Sales Discounts in a Merchandising Business

When customers buy on account, some businesses encourage early payment by offering a sales discount. Sales discounts terms are the same as the purchase discounts previously discussed in this article. The seller’s discount is on the sales side of the transaction Company 1. The purchaser’s discount is on the purchase side of the transaction in Company 2. The seller determines the discount being offered.

Here are some common payment terms and what they mean:

| Due on Receipt | Vendor wants payments as soon as the goods are received. |

| COD | Cash on Delivery–payment must be made at the time of delivery. |

| Net 30 | Full amount of the invoice is due in 30 days. |

| Net 15 | Full amount of the invoice is due in 15 days. |

| 2% 10, net 30 | If invoice is paid within 10 days, a 2% discount can be taken, otherwise the invoice is due in full in 30 days. |

| 1% 15, net 20 | If invoice is paid within 15 days, a 1% discount can be taken, otherwise the invoice is due in full in 20 days. |

| Payment in Advance | Payment is due before merchandise ships. |

| Deposit | A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc.) |

If Terrance Inc. offers a 2% discount if paid within 10 days to Dino-Mart, the discount is used to reduce the amount of the sale. Think about it like this. If you shop a back-to-school sale and you pay $10 for a $20 shirt, the revenue to the store is $10, not $20. That’s similar to a sales discount.

Here is the journal entry that was recorded for the original sale of merchandise to Dino-Mart:

| Accounts Receivable | 200 | |

| Sales Revenue | 200 | |

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

Dino-mart pays its bill within 10 days and takes the sales discount. To calculate the amount of the discount:

invoice amount x discount percent = discount [$200 x 2% = $4]

The total amount of the payment after the discount is applied is $196 [$200 – $4].

When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount:

| Cash | 196 | |

| Sales Discount | 4 | |

| Merchandise Inventory | 100 |

Sales Discount is a contra revenue account. The net effect of the Sales Discount account is to reduce revenue without changing the balance of the main account Sales Revenue. (For more about how contra accounts work, check out this article: https://accountinghowto.com/contra-account/)

On the income statement, the revenue section will show this:

| Sales Revenue | 200 | |

| Less Sales Discounts | 4 | |

| Net Sales | 196 |

For an overview and more examples of Sales Transactions in a Merchandising Business, watch this video:

Freight: FOB Destination vs FOB Shipping Point

Whenever purchases and sales of merchandise are involved, freight and shipping costs become a factor in calculating the cost and selling prices of the merchandise. The terms of the purchase or sale determine when ownership of the goods passes between seller and buyer and who pays the cost of shipping. The two methods generally used are FOB Destination or FOB Shipping Point.

What Does FOB Mean?

F.O.B. is an abbreviation for Free on Board. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport.

For the purposes of accounting class, we keep the transactions simple. Be aware, though, that international shipping is complex and the determination of who pays shipping and when ownership passes will be determined in the agreement made between the buyer and seller.

What is FOB Destination?

Under FOB Destination, ownership of the merchandise passes to the buyer when it is delivered. The seller pays the shipping costs. That delivery point could be a warehouse, an auto dealership, or your mailbox. Until that merchandise is safely delivered, the seller owns it. If the merchandise is damaged on its way, the damage belongs to the seller.

Accounting for FOB Destination

When the terms of the sale indicate FOB Destination, the seller records the cost as Delivery Expense or Freight Out.

For example, let’s say on the previous transaction, the terms are FOB Destination. Shipping charges are $15.

| Accounts Receivable | 200 | |

| Sales Revenue | 200 | |

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

The seller will have an additional journal entry to record the cost of shipping:

| Delivery Expense | 15 | |

| Cash (or Accounts Payable) | 15 |

The buyer has no entry to make since the terms are FOB Destination, the seller incurs the cost.

What is FOB Shipping Point?

Under FOB Shipping Point, ownership of the merchandise passes to the buyer when it is shipped. The buyer pays the shipping costs. That shipping point could be a post office, a UPS pickup, or a cargo ship. Once that merchandise is shipped, the buyer owns it. If the merchandise is damaged on its way, the damage belongs to the buyer.

Accounting for FOB Shipping Point

When the terms of the sale indicate FOB Shipping Point, the buyer records the cost as Merchandise Inventory. Shipping increases the cost of the purchase of that inventory.

For example, let’s say on the previous transaction, the terms are FOB Shipping Point. Shipping charges are $15. The original transaction for the purchase would be:

| Merchandise Inventory | 200 | |

| Accounts Payable | 200 |

The buyer will have an additional journal entry to record the cost of shipping:

| Merchandise Inventory | 15 | |

| Cash (or Accounts Payable) | 15 |

The seller has no entry to make since the terms are FOB Shipping Point, the buyer incurs the cost.

For more explanation and examples explaining the difference between FOB Destination and FOB Shipping Point, watch this video:

Accounting for Sales Taxes

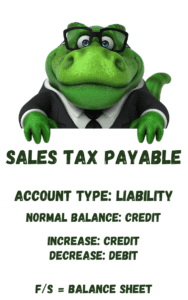

In states where sales taxes are collected, a merchandise business collects sales tax at the time of the sale. The amount of the tax is added to the sale. The tax collected is a liability for the merchandising business because the taxes are being held in trust for the taxing authority.

Using our previous example, let’s say Terrance Inc. is located in a state that charges 5% sales tax.

Here’s the original transaction with no sales tax:

| Accounts Receivable | 200 | |

| Sales Revenue | 200 | |

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

Here’s how the transaction changes when 5% sales tax is collected:

| Accounts Receivable | 210 | |

| Sales Revenue | 200 | |

| Sales Tax Payable | 10 | |

| Cost of Merchandise Sold | 100 | |

| Merchandise Inventory | 100 |

The Sales Revenue for this transaction hasn’t changed. Sales Tax collected is not revenue for the company. Accounts Receivable increases because the customer owes sales tax and is paying it to the company. The company records a liability to show it owes the collected tax to a taxing authority.

When the company pays the sales tax to the taxing authority, the following entry would be made:

| Sales Tax Payable | xx | |

| Cash | xx |

For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/

What is a Trade Discount?

A trade discount is a discount granted by wholesalers to government agencies or other businesses. A wholesaler generally does not sell directly to the public. Wholesalers have a published list price for their merchandise, but often offer special discounts to businesses and government agencies that buy in larger quantities. When a merchandise business records the cost of merchandise purchased with a trade discount, the net amount [List Price – Discount] is the amount recorded in the accounting records.

For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. The list price is $10, with a trade discount of 50%. The cost to Terrance Co. is $5 per action figure [$10 – 50%]. If Terrance Co. is ordering 100,000 Terrance Action Figures, this represents a significant cost savings.

-

Accounting for a Merchandising Business | Accounting Student Guide

What is a Merchandising Business? A merchandising business is a business that purchases goods and re-sells the goods to its customers. Examples of merchandising businesses are Amazon and Wal-mart. A

-

What is Cash Over and Short?

Cash Over and Short is an income statement account used to track differences in cash collections from what is expected and what is actual. It is used in businesses that

-

What is the Difference Between Periodic and Perpetual Inventory?

For a merchandising business, one of the most important success factors is the management of inventory. Because the cost and tracking of inventory is so critical, decisions made about inventory

-

What is the Difference Between a Single-step and a Multi-step Income Statement?

A single-step income statement and a multi-step income statement differ in the amount of categorizing of financial information found on the report. A single-step income statement shows Revenues and Expenses,

-

What is Inventory?

Inventory is an accounting of items owned by a business that will either be sold to customers or converted from raw materials into items that will be sold to customers.

-

What is Cost of Goods Sold?

In accounting, Cost of Goods Sold is an account used to track the costs associated with the manufacture of a product, including cost of raw materials, direct labor, packaging, and