A single-step income statement and a multi-step income statement differ in the amount of categorizing of financial information found on the report. A single-step income statement shows Revenues and Expenses, and calculates Net Income. A multi-step income statement adds a sections for costs of goods sold and groups expenses into additional categories.

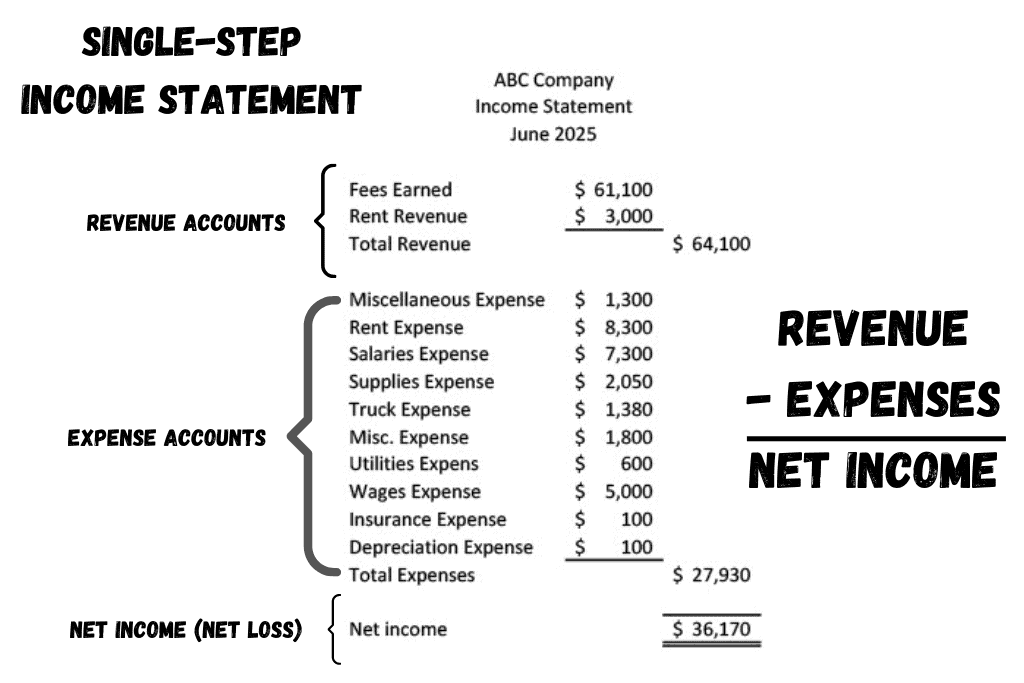

What is a Single-step Income Statement?

A single-step income statement separates financial information into broad categories: Revenue and Expenses. It is a simplified income statement suitable for smaller businesses and those that do not need to track cost of goods sold or cost of merchandise sold. The single-step income statement shows a listing of revenue accounts and expense accounts, and shows the difference between the two (profit or loss).

Here is an example of a single-step income statement:

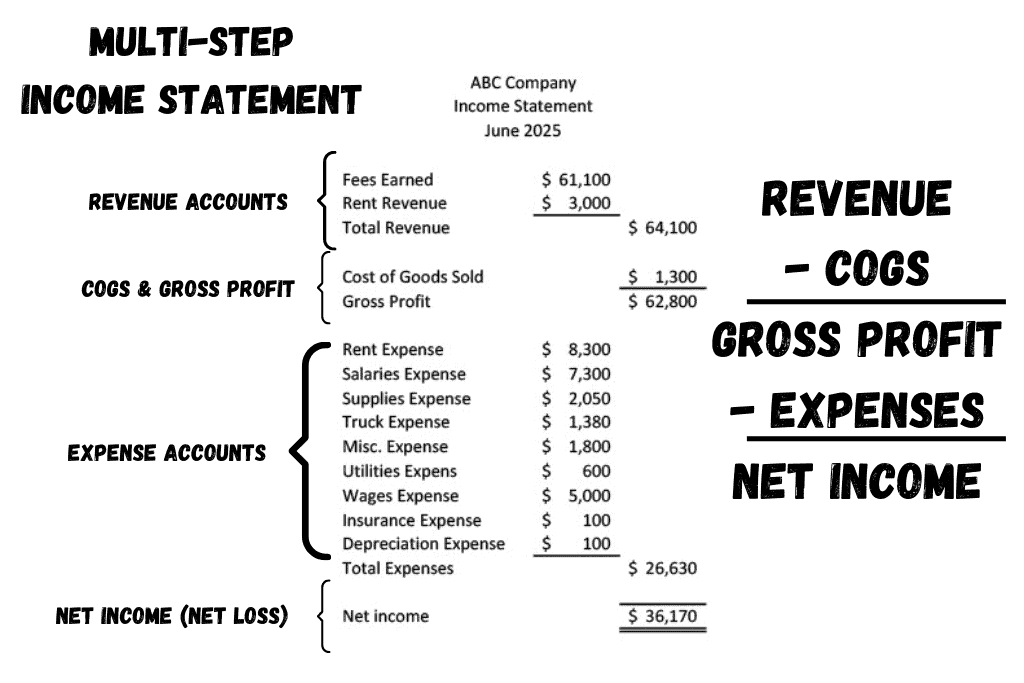

What is a Multi-step Income Statement?

A multi-step income statement separates financial information into additional categories beyond the single-step income statement.

Where a single-step income statement shows Revenue and Expenses, a multi-step income statement adds additional information. It is suitable for any business, but is particularly useful for businesses that need to track cost of goods sold or cost of merchandise sold.

The multi-step income statement shows a listing of revenue accounts, cost of goods sold or cost of merchandise sold accounts, and operating expense accounts. It shows the relationship between Revenue and Cost of Goods Sold and the difference between the Gross Profit and Net Income.

Here is an example of a multi-step income statement:

The multi-step income statement is also useful for further categorizing expenses by dividing them into groups of related accounts.

For example, Selling Expenses are grouped together (Commissions Expense, Marketing Expense, Sales Salaries) and Administrative Expenses are grouped together (Office Rent, Office Salaries, Insurance).

This additional categorization gives important information about where funds are being used in a business and what areas incur costs.

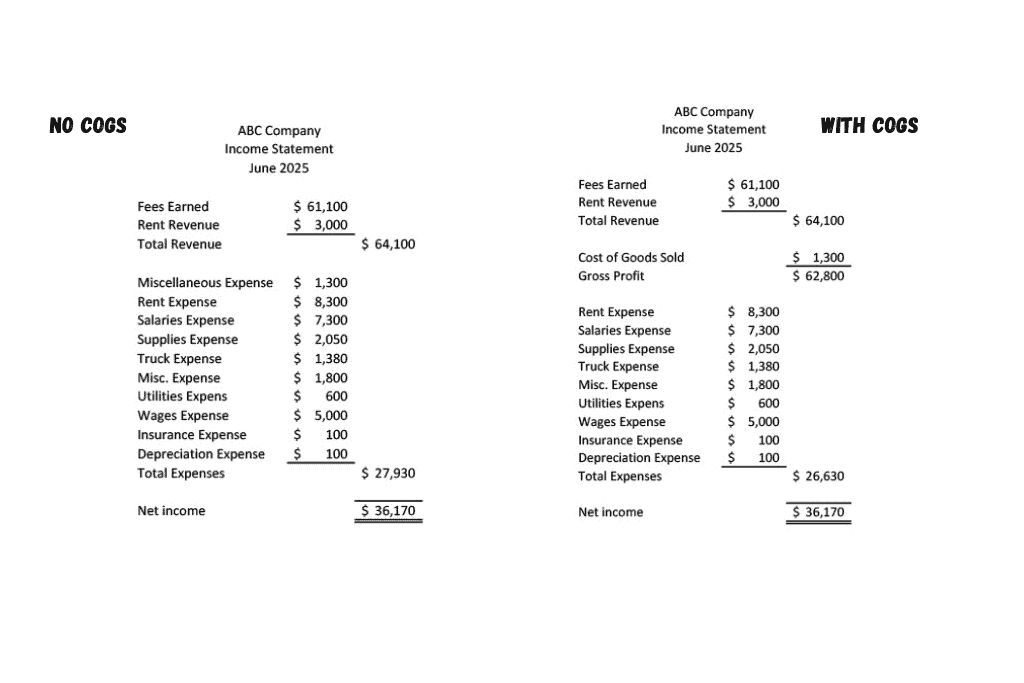

Income Statement Explained with Examples

Examples of a single-step income statement and a multi-step income statement are shown below for a side by side comparison:

For more details and resources for understanding Income Statements, watch this video:

-

What is Managerial Accounting?

Managerial Accounting is a specific branch of accounting designed to support business managers and owners by providing data to help the company with strategic planning, measuring company performance, evaluating results,

-

What is a Statement of Owner’s Equity

The Statement of Owner’s Equity is one of the four major financial statements. The function of the Statement of Owner’s Equity is to show changes in the value of equity

-

What is a Statement of Shareholders’ Equity?

The Statement of Shareholders’ Equity is one of the four major financial statements. The function of the Statement of Shareholders’ Equity is to show changes in the value of equity

-

What is the Accounting Equation?

Before you can understand debits and credits, you’ll need a little background on the structure of accounting. It all starts with the Accounting Equation. The Accounting Equation is the foundation

-

What is Owner’s Draw (Owner’s Withdrawal) in Accounting?

Owner’s Draw or Owner’s Withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Business owners may use

-

What is Double-Entry Accounting?

Double-entry Accounting is an accounting system that tracks two or more parts of every business transaction. It is based on the Accounting Equation [Assets = Liabilities + Equity]. The equation