In accounting, Cost of Merchandise Sold is an account used to track the costs associated with the purchase of products for resale in a merchandising or retail business. Cost of Merchandise Sold does not include general or overhead costs for the business, such as rent, insurance, and office support.

Cost of Merchandise Sold is an expense account. It has a normal debit balance. It increases on the debit side and decreases on the credit side.

In accounting software, Cost of Merchandise Sold has an account type called Cost of Goods Sold rather than an expense. This signifies to the software that this account will be used to calculate Gross Profit.

What is Gross Profit?

Gross Profit is the difference between Revenue and Cost of Merchandise Sold. It shows how much a company has to spend to purchase the products compared to the selling price of the product.

For example, if an item sells for $10 and the cost of purchasing or manufacturing that item is $7, the company has a gross profit of $3 [$10 – $7 = $3]

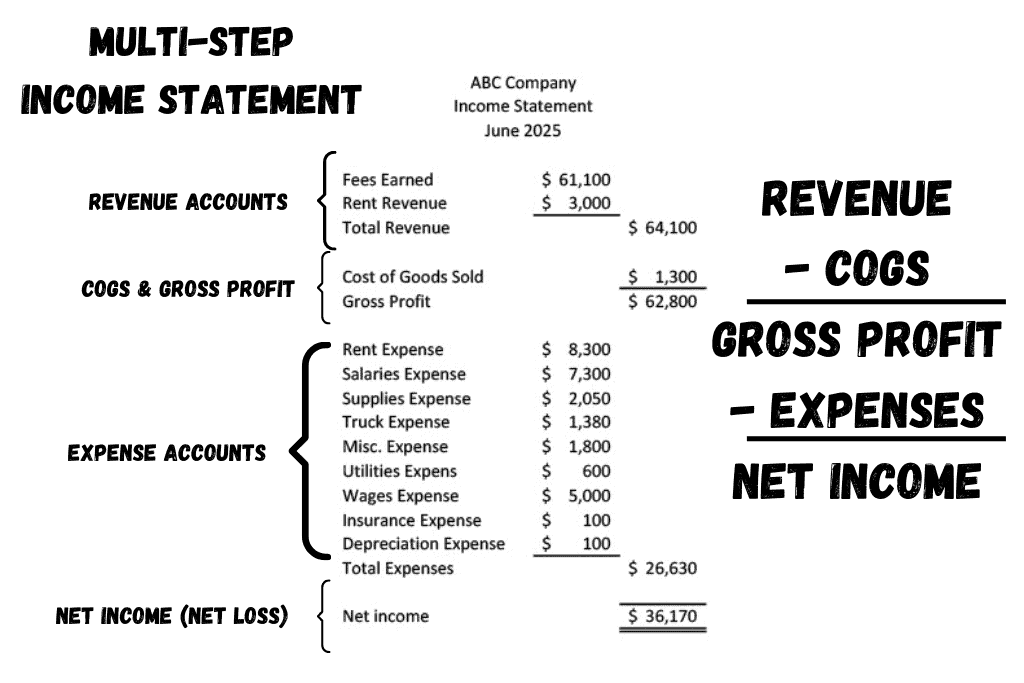

Gross Profit is carefully tracked and managed to measure how much profit in a business comes from purchasing and selling a product. It is reported in a multi-step income statement in this format:

| Revenue | 10,000 | |

| Cost of Merchandise Sold | 7,000 | |

| Gross Profit | 3,000 | |

| Expenses: | ||

| Rent Expense | 1,800 | |

| Insurance Expense | 500 | |

| Total Expenses | 2,300 | |

| Net Income | 700 |

What is Net Income?

In a business, Net Income is the difference between Revenue and Expenses. When the difference is positive (revenues are greater than expenses), the business has a profit or Net Income. When the difference is negative (expenses are greater than revenues), the business has a loss or Net Loss.

What is the Difference Between Gross Profit and Net Income?

Gross Profit is the difference between what a product or service is sold for (selling price or Revenue) and what it costs the company to make or purchase products for sale to customers (Cost of Good Sold.) Net Income is the difference between Gross Profit and the Operating Expenses of a business.

For example, the following company has Revenues of $64,100 and Cost of Goods Sold of $1,300. The difference between the two is Gross Profit. [$64,100 – $1,300 = $62,800] Gross Profit measures the profitability of the product or service being sold to customers. It ignores all the other expenses involved in running a business.

Those other expenses are listed below Gross Profit and represent all the general operating costs of running a business. When total of all the operating expenses are subtracted from Gross Profit, this gives the Net Income or Profit for the business during that period of time.

Gross Profit = Revenue – Cost of Goods Sold or Cost of Merchandise Sold

Net Income = Gross Profit – Expenses

What Does Net Income Mean?

When a company has Net Income, it means the company is operating at a profit (revenue is greater than expenses.) When a company has a Net Loss, it means the company is operating at a loss (expenses are greater than revenue.)

For more about Merchandising (Retail) businesses, including step-by-step journal entries, check out this Accounting Student Guide:

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a

-

What is Revenue?

Revenue is the income generated by a business in the normal course of operations. It represents the sale of goods and services to customers or clients. For a non-profit organization,