What is a Bond?

A bond is a loan from investors to a borrower. When a corporation or government wants to raise money, one option is to issue a bond. The borrower receives cash in exchange for paying interest on the funds and paying back the loan at a later date. For the borrower, a bond is a liability, an obligation to pay. For the investor, a bond is an asset, cash that will be received at a later date.

Why are Bonds Issued?

Bonds are issued by corporations and governments to fund various projects or cover expenses. Corporations and governments have the option to borrow funds from banks, but often the restrictions placed by banks make bank loans a less attractive form of financing. The bond market is less restrictive making it more attractive to entities looking to finance activities.

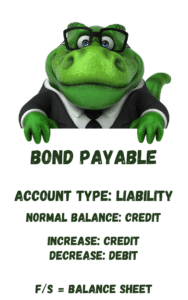

What Type of Account is Bonds Payable?

Bonds Payable is a liability. It has a normal credit balance. It increases on the credit side and decreases on the debit side. Since bonds are multi-year loans, Bonds Payable is usually listed as a long-term liability. It appears in the Long-term Liability section of the Balance Sheet.

Bond Terminology

Because of the special nature of bonds, specific terms are used to describe the various aspects of the bond agreement.

- Coupon or Contract Rate–the interest rate assigned to the bond at time of issue

- Face Value–amount of principal to be paid at maturity

- Market Rate–the interest rate other similar bonds are earning, bonds can sell at a different interest rate than the coupon rate

- Market Value–what an investor is willing to give for a bond

- Bond Issuer–the corporation or government borrowing money from investors

- Payment Frequency–how often the bond issuer will pay interest to the bond holder

- Maturity–the date the bond will be repaid in full

- Yield to Maturity (YTM)–the total amount of the bond principal plus all interest payments if the bond is held the full length of time

- Rating–a grade given to a bond based on creditworthiness of the bond and the issuer

- Callable Bonds–a bond that can be repaid before maturity and interest payments stopped

Common Types of Bonds

Different types of bonds are available from different types of issuers. Some common types of bonds include:

- Treasury Bills, Notes, and Bonds–issued by U.S. Department of Treasury to help fund government borrowing needs, different maturity lengths depending on type

- Savings Bonds–issued by U.S. Department of Treasury to help fund government borrowing needs

- Agency Bonds–issued by government agencies or government-sponsored agencies, for example, Federal Housing Administration (FHA) or Small Business Administration (SBA)

- Municipal Bonds–issued by states, cities, counties to raise funds for schools, roads, and infrastructure

- Corporate Bonds–issued by corporations to fund growth or increase working capital or capacity

Proceeds from Issuing Bonds

When a corporation issues bonds, the amount received (the proceeds) depends on several factors:

- Face Value of the bond, meaning the amount that will be paid at maturity

- Interest Rate of the bond, also called the contract rate or the coupon rate

- Market Rate of Interest on similar bonds being offered

What is the Market Rate of Interest?

The Market Rate of Interest, also called the effective rate of interest, relates to the interest rates of other similar bonds being offered and what investors are willing to accept as an interest rate. Other corporations and governments are also offering bonds to invest in and the market rate of interest reflects that competitive nature of the market.

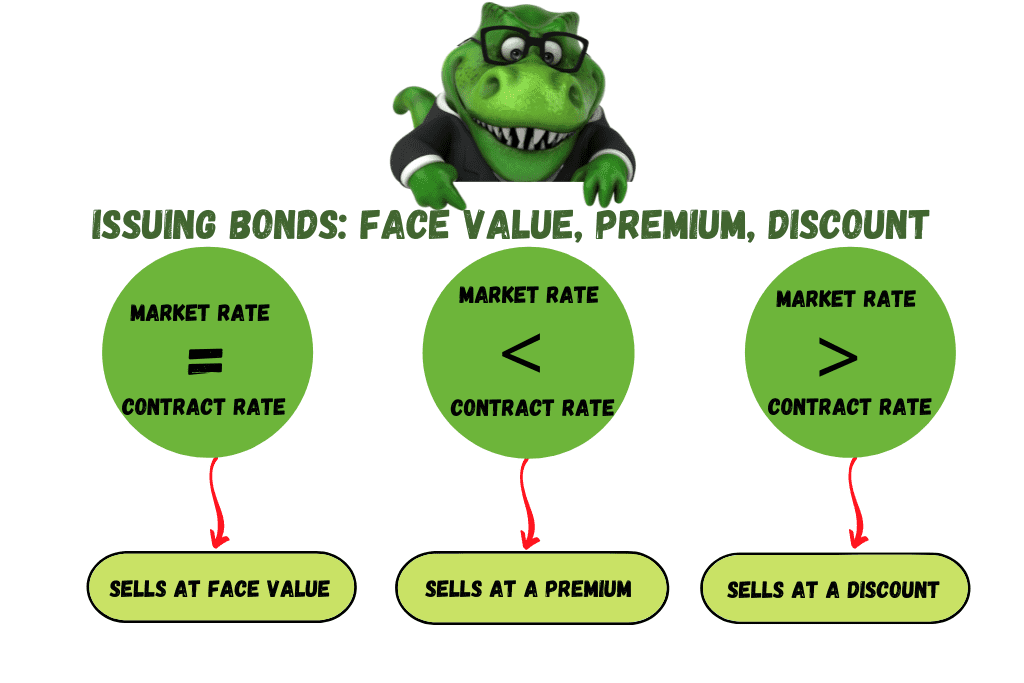

Contract Rate vs Market Rate

When a bond is issued it is assigned a contract or coupon rate. This rate may vary from the market rate of interest–what other similar bonds are offering for an interest rate and what investors are willing to accept for an interest rate.

For a bond to be an attractive investment, it must be competitive with similar bonds from other organizations. When investors look to buy bonds being issued by corporations or governments, they are looking at the entire landscape of options. They are also looking at the current and future economic conditions.

Corporations and governments adjust the interest rate by using discounts and premiums. Because this can be hard to keep straight, let’s look at it from a more familiar angle.

Let’s say you have a highly collectible item for sale. Maybe it’s a Terrance the T-Rex action figure. Everyone wants one, but they can be hard to find. You put an advertisement on a local online marketplace saying you have a Terrance the T-Rex action figure for sale for $100.

If there are a only a couple of people with a Terrance the T-Rex action figure for sale and they are all selling for $100, you will likely get a full-price offer. Someone will be willing to meet your price. (Sell at face value.)

But what if you are the only person in the country to have a Terrance the T-Rex action figure for sale? The demand for the item, exceeds the supply of the item. Now you can offer your Terrance the T-Rex action figure for more than your original intended price. Potential investors are willing to pay more than you are asking because the supply is limited and all the cool kids want a Terrance the T-Rex action figure. (Sell at premium.)

But, alas, as so often happens, seemingly overnight, the market for Terrance the T-Rex action figures dries up. People have moved on to other things. (Sorry, Terrance.) Suddenly, your Terrance the T-Rex action figure is worth far less than $100. Now, potential investors will be looking to pay less than what you wanted to get. The market has shifted. (Sell at discount.)

Now, back to the world of bonds. The fluctuations of the market rate (the interest rate investors are able to get in the market) makes a bond more or less attractive.

If the market rate equals the contract rate on a bond, the bond is selling at face value. You offered the bond for 5% interest, the market rate is 5%, no discount or premium is needed to make the bond more attractive to investors.

If the market rate is less than the contract rate on a bond, the bond sells at a premium. The interest earned on the bond is more than the market rate of interest. The investment is worth more because it will pay a higher interest rate than other similar bonds.

If the market rate is more than the contract rate on a bond, the bond sells at a discount. The interest earned on the bond is less than the market rate of interest. The investment is worth less because it will pay a lower interest rate than other similar bonds.

The market rate and the contract rate effect the accounting entries to record the issuing of the bond. If a bond is issued at a discount or a premium, the discount or premium is amortized (spread out) over the life of the bonds. Discounts and Premiums are adjustments to Interest Expense for the issuer of the bond. Discounts increase Interest Expense. Premiums decrease Interest Expense.

Issuing Bonds at Face Value

When the market rate equals the contract rate for a bond, no discount or premium applies. Bonds are issued at 100%. For example, if the market rate is 5% and the contract rate is 5% on a $100,000 bond, the bond will sell for face value or 100%, no more, no less.

Issuing Bonds at a Discount

When the market rate is greater the contract rate for a bond, the bond is less valuable and it sells at a discount. Bonds are issued at less than 100%. For example, if the market rate is 5% and the contract rate is 4% on a $100,000 bond, the bond will sell for less than face value, stated as a percentage less than 100. For example, 96% or 94%.

Issuing Bonds at a Premium

When the market rate is less than the contract rate for a bond, the bond is more valuable and it sells at a premium. Bonds are issued at more than 100%. For example, if the market rate is 4% and the contract rate is 5% on a $100,000 bond, the bond will sell for more than face value, stated as a percentage greater than 100. For example, 102% or 104%.

Accounting for Bonds Payable

When bonds are issued at more or less than face value, a premium or discount is used to track the difference between face value and the cash that changes hands in the transaction. Let’s look at an example.

A $1,000 bond is issued. If it sells at face value, the issuing corporation or government receives 100% or $1,000. If the bond sells at a 2% discount, the issuer receives 98% or $980. If the bond sells at a 2% premium, the issuer receives 102% or $1020. The discount or premium is used to track the difference between the market rate (the value compared to other similar bonds available) and the contract rate (the rate assigned by the issuer).

Accounting for Bonds Issued at Face Value

When a bond sells for face value, no premium or discount is assigned. Building on the example above, let’s say our bond is $100,000, issued at 12% interest for 5 years on January 1, with interest being payable on June 30 and December 31 each year. The market rate is 12%. Because the market rate and the contract rate are equal, the bond is at a price of 100 (100% of the value is received.)

When the bond is issued, the following journal entry is prepared:

| Cash | 100,000 | |

| Bond Payable | 100,000 |

On June 30, the first interest payment is due on the bond. Interest paid is calculated:

Interest = Principal x Rate x Time

Interest = $100,000 x 12% x 6/12

Interest = $6,000

| Interest Expense | 6,000 | |

| Cash | 6.000 |

An interest payment will be recorded every six months until the bond is repaid.

Bond Redemption at Face Value

When the bond reaches its maturity date after five years, the principal is repaid. For a bond issued at face value, the journal entry is:

| Bond Payable | 100,000 | |

| Cash | 100,000 |

The liability is paid and this journal entry removes the liability from the Balance Sheet.

Accounting for Bonds Issued at a Discount

When a bond sells for less than face value, it sells at a discount. Building on the example above, let’s say our bond is $100,000, issued at 12% interest for 5 years on January 1, with interest being payable on June 30 and December 31 each year. The market rate is 13%. Because the market rate is greater than the contract rate, the bond is at a price less than 100.

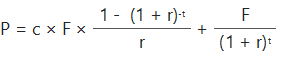

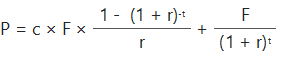

Because the calculation of bond premiums and discounts is outside of what is taught in Financial or Principles of Accounting, we’ll keep the math in the background. If you want to calculate it for yourself, here is the formula:

For the purposes of our example, we’ll say the bond sells at the discounted amount of $96,406. This is the amount of cash that will be received. The face value is recorded at $100,000. This is amount that will be due when the bond is paid. The difference between the two is the bond discount. Rather than adjusting the face value, the additional interest to be paid is subtracted from the cash.

When the bond is issued, the following journal entry is prepared:

| Cash | 96,406 | |

| Discount on Bonds Payable | 3,594 | |

| Bond Payable | 100,000 |

.

When this entry is posted to the accounts, the result on the Balance Sheet would be:

| Bond Payable | 100,000 |

| Discount on Bonds Payable | (3,594) |

| Bond Carrying Value | 96,406 |

The account Discount on Bonds Payable is a contra account. A contra account works the opposite of its related account. The related account is Bonds Payable. Bonds Payable is a liability. It has a normal credit balance. It increases with a credit and decreases with a debit. Discount on Bonds Payable is a contra liability. It has a normal debit balance. It increases on the debit side and decreases on the credit side. The overall effect of Discount on Bonds Payable is to reduce the balance of Bonds Payable without changing the main balance of the account.

You can think of the Discount on Bonds Payable as a holding tank for interest expense. The interest expense is only incurred and recorded due to the passing of time. Discount on Bonds Payable is interest whose time has not yet come. Over the course of the bond’s life, we move the interest from the Discount for Bonds Payable into Interest Expense.

When a bond is issued at a discount, there are two parts to the interest. The first is the interest paid to the purchaser of the bond. The second is the amortization of the bond discount (where interest expense is moved out of Discount on Bonds Payable and into Interest Expense.)

Let’s look at the interest paid to the issuer first. This is the same as when a bond is issued at face value.

On June 30, the first interest payment is due on the bond. Interest paid is calculated:

Interest = Principal x Rate x Time

Interest = $100,000 x 12% x 6/12

Interest = $6,000

| Interest Expense | 6.000 | |

| Cash | 6,000 |

An interest payment will be recorded every six months until the bond is repaid at maturity.

Amortizing a Bond Discount

The second part of the interest to be recorded is the moving of part of the Discount on Bonds Payable into Interest Expense. This could be done once a year as an adjusting entry or combined with the semi-annual interest payments.

The Amortization of a Bond Discount is usually calculated using the GAAP-required Effective Interest Rate Method. Accounting textbooks for Financial Accounting or Principles of Accounting use the straight-line method. The straight-line method is allowed under GAAP, if the amount doesn’t differ significantly.

In our example, the Discount on Bonds Payable using straight-line method of amortization and recording the discount as a yearly adjusting entry would look like this:

One Year of Bond Discount Amortization = Total Discount / years

One Year of Bond Discount Amortization = 3,594 / 5 = $718.80

| Interest Expense | 718.80 | |

| Discount on Bonds Payable | 718.80 |

If the amortization of the Discount on Bonds Payable is recorded instead at the time of each semi-annual interest payment, the entry would look like this:

Semi-annual Bond Discount Amortization = Total Discount / number of payments

Semi-annual Bond Discount Amortization = $3,594 / 10 (5 years x 2 payments per year) = $359.40 per interest payment.

| Interest Expense | 6,359.40 | |

| Discount on Bonds Payable | 359.40 | |

| Cash | 6,000.00 |

When this entry is posted to the accounts, the effect on the Balance Sheet is this (rounded):

| Bonds Payable | 100,000 |

| Discount on Bonds Payable | (3,594) |

| Bond Carrying Amount | 96,406 |

As the Discount on Bonds Payable is amortized, it decreases. The Bond Carrying Amount will increase until at maturity the carrying value is equal to the face value.

Accounting for Bonds Issued at a Premium

When a bond sells for more than face value, it sells at a premium. Building on the example above, let’s say our bond is $100,000, issued at 12% interest for 5 years on January 1, with interest being payable on June 30 and December 31 each year. The market rate is 11%. Because the market rate is less than the contract rate, the bond is at a price greater than 100.

Because the calculation of bond premiums and discounts is outside of what is taught in Financial or Principles of Accounting, we’ll keep the math in the background. If you want to calculate it for yourself, here is the formula:

For the purposes of our example, we’ll say the bond sells at the premium amount of $103,769. This is the amount of cash that will be received. The face value is recorded at $100,000. This is amount that will be due when the bond is paid. The difference between the two is the bond premium. Rather than adjusting the face value, the reduced interest to be paid is added to the cash.

When the bond is issued, the following journal entry is prepared:

| Cash | 103,769 | |

| Premium on Bonds Payable | 3,769 | |

| Bond Payable | 100,000 |

.

When this entry is posted to the accounts, the result on the Balance Sheet would be:

| Bonds Payable | 100,000 |

| Premium on Bonds Payable | 3,769 |

| Bond Carrying Amount | 103,769 |

The account Premium on Bonds Payable is an adjunct account. An adjunct account works the same as its related account. It is an addition to its related account. It supplements it.

The related account is Bonds Payable. Bonds Payable is a liability. It has a normal credit balance. It increases with a credit and decreases with a debit.

Premium on Bonds Payable is an adjunct liability. It has a normal credit balance. It increases on the credit side and decreases on the debit side.

The overall effect of Premium on Bonds Payable is to increase the balance of Bonds Payable without changing the main balance of the account.

You can think of the Premium on Bonds Payable as a holding tank for reducing interest expense. The reduction in interest expense is only incurred and recorded due to the passing of time. Premium on Bonds Payable is interest expense reduction whose time has not yet come.

Over the course of the bond’s life, we move the interest reduction from the Premium for Bonds Payable into Interest Expense. The overall impact on the Interest Expense account is to reduce it.

When a bond is issued at a premium, there are two parts to the interest. The first is the interest paid to the purchaser of the bond. The second is the amortization of the bond premium (where interest expense is reduced and Premium on Bonds Payable is amortized over time.)

Let’s look at the interest paid to the issuer first. This is the same as when a bond is issued at face value.

On June 30, the first interest payment is due on the bond. Interest paid is calculated:

Interest = Principal x Rate x Time

Interest = $100,000 x 12% x 6/12

Interest = $6,000

| Interest Expense | 6.000 | |

| Cash | 6,000 |

An interest payment will be recorded every six months until the bond is repaid at maturity.

Amortizing a Bond Premium

The second part of the interest to be recorded is the moving of part of the Premium on Bonds Payable into Interest Expense as a reduction to interest. This could be done once a year as an adjusting entry or combined with the semi-annual interest payments.

The Amortization of a Bond Premium is usually calculated using the GAAP-required Effective Interest Rate Method. Accounting textbooks for Financial Accounting or Principles of Accounting use the straight-line method. The straight-line method is allowed under GAAP, if the amount doesn’t differ significantly.

In our example, the Premium on Bonds Payable using straight-line method of amortization and recording the discount as a yearly adjusting entry would look like this:

One Year of Bond Discount Amortization = Total Discount / years

One Year of Bond Discount Amortization = 3,769 / 5 = $753.80

| Premium on Bonds Payable | 753.80 | |

| Interest Expense | 753.80 |

If the amortization of the Premium on Bonds Payable is recorded instead at the time of each semi-annual interest payment, the entry would look like this:

Semi-annual Bond Premium Amortization = Total Premium / number of payments

Semi-annual Bond Premium Amortization = $3,769 / 10 (5 years x 2 payments per year) = $376.90 per interest payment.

| Interest Expense | 5.623.10 | |

| Premium on Bonds Payable | 376.90 | |

| Cash | 6,000.00 |

When this entry is posted to the accounts, the effect on the Balance Sheet is this (rounded):

| Bonds Payable | 100,000 |

| Discount on Bonds Payable | (3,594) |

| Bond Carrying Amount | 96,406 |

As the Premium on Bonds Payable is amortized, it decreases. The Bond Carrying Amount will decrease until at maturity the carrying value is equal to the face value.

Bond Redemption

When the bond matures, the liability is paid. If the full amount of time has passed and all discounts or premiums are amortized in full, the journal entry is:

| Bonds Payable | 100,000 | |

| Cash | 100,000 |

In some cases, the bond is set up as a callable bond. A callable bond can be paid off before the maturity date. This is similar to paying off your mortgage early. In both cases, the interest being paid is reduced. If a bond is callable, the redemption amount is stated in the bond indenture. When the bond is redeemed, it may be redeemed at a gain or a loss. Any remaining premium or discount is reduced. The face value is reduced. And a gain or loss on redemption of bond is recorded.

Because the topic of bonds is complex, this article is meant to give an overview of bonds for accounting students learning Financial Accounting. It is not a comprehensive resource for bonds and the accounting treatment of specific bond transactions. Please consult an accounting or financial professional who is familiar with your specific situation.

-

What is the Difference Between Debt Financing and Equity Financing?

When businesses needs funds to expand or grow the business, that capital can come from three sources: Funds from profitsFunds from debtFunds from equity Funding business growth from profits means

-

Bonds Payable | Accounting Student Guide

What is a Bond? A bond is a loan from investors to a borrower. When a corporation or government wants to raise money, one option is to issue a bond.

-

What is an Adjunct Account?

An adjunct account is an account that adds to the value another account without impacting the balance in the main account. The combination of the balance in the main account