The Statement of Cash Flows is one of the major financial statements. The focus of the Statement of Cash Flows is on the movement of cash through the business. It breaks cash into three categories:

- Cash flows from Operating activities

- Cash flows from Investing activities

- Cash flows from Financing activities

Statement of Cash Flows shows where the cash came from and where it went. It answers questions like:

- How much cash came into the business?

- Was it cash from operating the business (for example, customers paying us) or did it come from investing (selling an asset) or financing activities (taking out a business loan).

- How much cash went out of the business? Was it cash we used to pay our employees and our suppliers? Or, was the cash used to make a loan payment or to purchase an asset?

- And most importantly, do we have more or less cash than we started with?

What are Sources and Uses of Cash?

Sources of cash are those activities that bring cash into a business–sale of products, sale of assets, issuing stock. Sources increase cash.

Uses of cash are those activities that send cash out of a business–paying employees, purchasing inventory, making loan payments, paying dividends. Uses decrease cash.

The Statement of Cash Flows categorizes sources and uses of cash by those arising from Operating activities, Investing activities, or Financing activities.

What is Cash Flow from Operating Activities?

Cash Flow from Operating activities stems from the day-to-day transactions of a business, those activities that keep the lights on, employees working, and goods flowing. Activities are divided into Sources and Uses of cash.

Sources:

- Selling products

- Selling services

Uses:

- Payroll expenses

- Purchasing inventory

- Paying taxes

- Paying utilities

What is Cash Flow from Investing Activities?

Cash Flow from Investing activities stems from the purchase or sale of big ticket items like fixed assets or other investments of a business. Activities are divided into Sources and Uses of cash.

Sources:

- Selling property, plant, and equipment assets

- Selling other investments

Uses:

- Buying property, plant, and equipment assets

- Buying other investments

What is Cash Flow from Financing Activities?

Cash Flow from Financing activities comes from those activities a business engages in to fund various parts of the business using debt or equity. Activities are divided into Sources and Uses of cash.

Sources:

- Issuing long-term liabilities like bonds

- Selling stock

Uses:

- Paying dividends to stockholders

- Repaying long-term liabilities like bonds

- Repurchasing common stock (treasury stock)

Why is the Statement of Cash Flows Important?

The Statement of Cash Flows provides critical information about a company’s most important asset: Cash. It shows whether a business can:

- Generate enough cash from operations to meet operational expenses like payroll, purchasing inventory, and paying rent.

- Maintain its operating capacity, and expand capacity as needed.

- Pay dividends to stockholders.

- Meet financial obligations like making payments on existing loans or repaying bonds.

- Invest in new equipment or update factories.

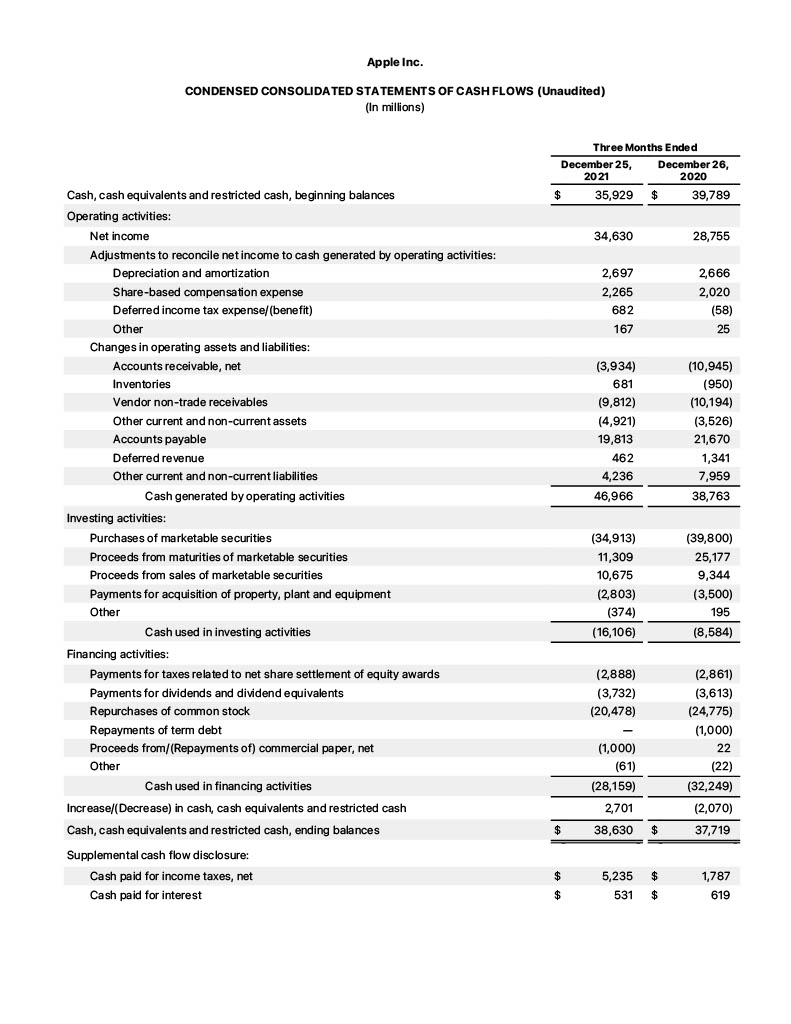

Statement of Cash Flows Example

The following image shows a Statement of Cash Flows for Apple Inc.

How is Cash Flow from Operating Activities Calculated?

Cash Flow from Operating activities is calculated using one of two methods:

- The Indirect Method

- The Direct Method

What is the Indirect Method of Calculating Cash Flows from Operations?

The Indirect Method looks at changes to cash by analyzing changes in non-cash balance sheet accounts. For example, a change in Accounts Receivable (a non-cash asset) means that cash is either increasing or decreasing during a particular period of time (month, quarter, year.)

| Accounts Receivable | Balance on Jan 1 | Balance on Dec 31 |

| 15,000 | 20,000 |

This method starts with Net Income for the period, then adds or subtracts non-cash items to determine which transactions impacted cash.

| Subtract | Add |

| Increases in Accounts Receivable | Decreases in Accounts Receivable |

| Increases in Inventory | Decreases in Inventory |

| Increases in Prepaid Expenses | Decreases in Prepaid Expenses |

| Decreases in Accounts Payable | Increases in Accounts Payable |

| Decreases in Income Tax Payable | Increases in Income Tax Payable |

| Decreases in Accrued Expenses Payable | Increases in Accrued Expenses Payable |

In the Accounts Receivable example above, the balance in Accounts Receivable increased by $5,000. An increase in Accounts Receivable is subtracted from Net Income.

When all the adjustments to Net Income have been analyzed and reported, the amount remaining will show an increase or decrease overall to cash from operating activities.

In the Apple Inc. example above, the company is using the Indirect Method to calculate cash flow from operations. The company is comparing the changes in various non-cash balance sheet accounts, then adding or subtracting using the rules from the table above.

What is the Direct Method of Calculating Cash Flows from Operations?

The Direct Method of calculating cash flows reports cash amounts by determining where the sources and uses of cash in this way:

- Cash received from customers

- Cash payments for merchandise

- Cash payments for operating expenses

- Cash payments for interest

- Cash payments for income taxes

All payments of cash are subtracted from cash received to arrive at net cash flow from operating activities.

The Statement of Cash Flows and Accounting Software

The Statement of Cash Flows is complicated to prepare manually. The good news is that accounting software makes the process much simpler. When accounts are set up, the accounts are assigned to different categories that tie to the Statement of Cash Flows. This means, when properly setup, the Statement of Cash Flows becomes as easy as running any other report.

For more information and examples about the Statement of Cash Flows, watch this video:

-

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

Understanding Financial Statements | Accounting Student Guide

What is a Financial Statement? Financial Statements are a set of reports summarizing the activities of a business or organization. Much like a series of x-rays shows different views of

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

What is Stockholders’ Equity?

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital

-

What is Paid in Capital?

What is Contributed or Paid-in Capital? Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or

-

What is the Difference Between Debt Financing and Equity Financing?

When businesses needs funds to expand or grow the business, that capital can come from three sources: Funds from profits Funds from debt Funds from equity Funding business growth from