The accounting cycle is a process used by accountants to record, classify, and summarize financial transactions of a business. It is an essential component of financial accounting, which helps companies keep track of their financial health, prepare financial statements, and make informed business decisions.

Explore the accounting cycle step-by-step to give you a better understanding of this important process.

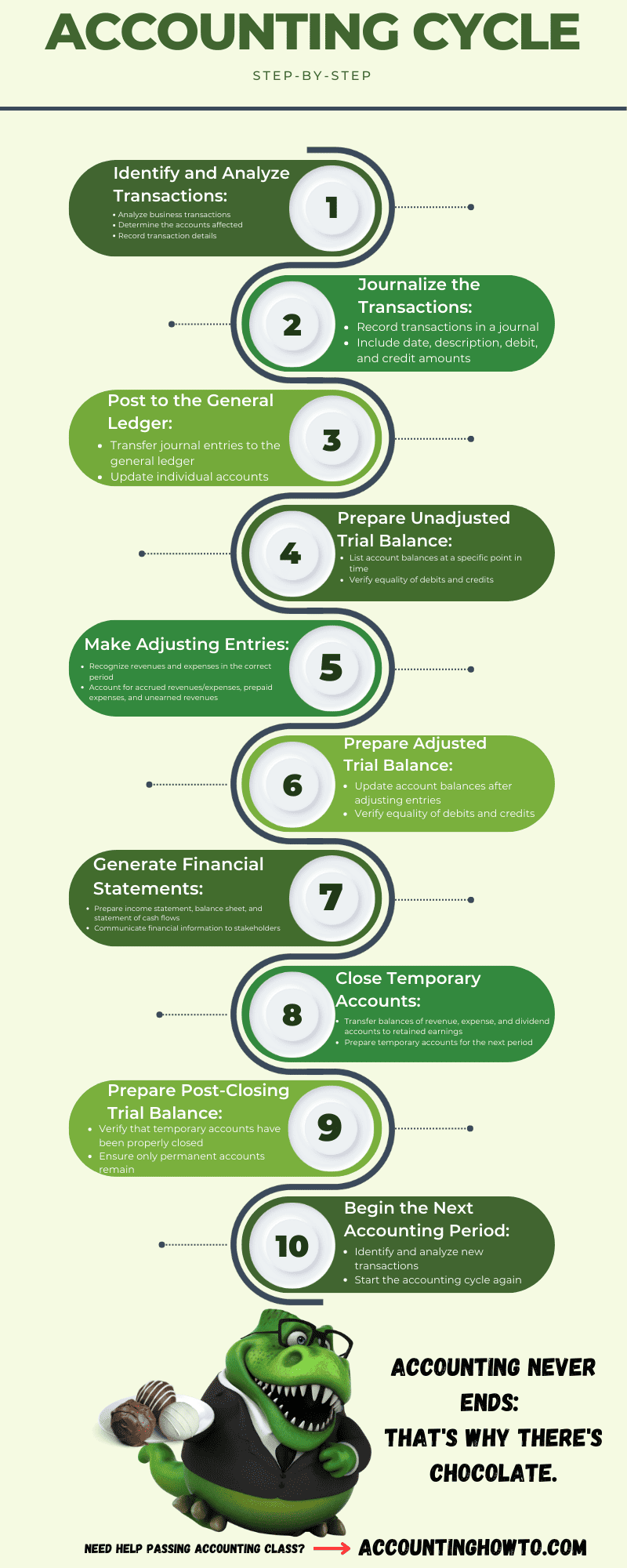

- Identifying Transactions: The first step in the accounting cycle is to identify transactions that are relevant to the business. Transactions can include sales, purchases, expenses, and other financial activities. Each transaction must be analyzed to determine how it should be recorded in the company’s books.

- Recording Transactions: Once transactions have been identified, the next step is to record them in the company’s accounting system. This typically involves creating journal entries that include the date of the transaction, the accounts affected, and the dollar amount. Journal entries must be accurate, complete, and consistent to ensure that financial statements are reliable.

- Posting to the Ledger: After journal entries have been created, they must be posted to the appropriate accounts in the general ledger. The general ledger is a record of all the company’s accounts, including assets, liabilities, equity, revenues, and expenses. Posting to the ledger involves transferring the debit and credit amounts from the journal entries to the corresponding accounts in the ledger.

- Preparing a Trial Balance: Once all transactions have been recorded and posted to the general ledger, a trial balance can be prepared. A trial balance is a summary of all account balances and is used to ensure that debits and credits are equal. If debits and credits do not balance, errors must be identified and corrected before financial statements can be prepared.

- Adjusting Entries: After the trial balance has been prepared, adjusting entries may need to be made to ensure that account balances are accurate. Adjusting entries typically involve accruals, deferrals, and estimates that are not recorded in the normal course of business. Examples of adjusting entries include recording depreciation on fixed assets, recognizing unearned revenue, and recording bad debt expense.

- Preparing Financial Statements: Once all transactions have been recorded, posted, and adjusted, financial statements can be prepared. Financial statements include the balance sheet, income statement, and cash flow statement, which provide information about the company’s financial position, performance, and cash flows. These statements must be prepared in accordance with generally accepted accounting principles (GAAP).

- Closing Entries: The final step in the accounting cycle is to prepare closing entries. Closing entries are used to transfer the balances of revenue and expense accounts to the company’s retained earnings account, which is a component of equity. This process resets revenue and expense accounts to zero and prepares the accounts for the next accounting period.

The accounting cycle is a critical process for businesses to accurately record and report their financial transactions. By following the steps outlined above, businesses can ensure that their financial statements are accurate and reliable, which is essential for making informed business decisions.