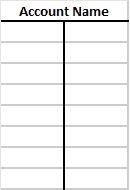

A T-Account is a simplified version of a Ledger account. A T-account is shaped like the letter T and has a debit (left) column and a credit (right) column. It is used as a visual way to demonstrate increasing and decreasing accounts in accounting.

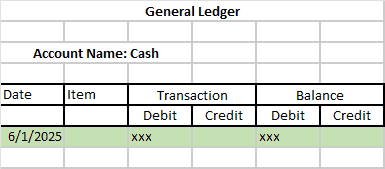

A Ledger has more details than a T-Account. It has columns for the date of a transaction, any special notations (Item), a debit and credit column (like the T-Account), and a running balance for the account.

T-Accounts are used in accounting education as a visual way to show the impact of business transactions on individual accounts. Because the ledger contains more details (date, item, balance), it is the preferred method.

What is the Difference Between a Journal and a Ledger?

To learn about the difference between a journal and a ledger in accounting, watch this video:

-

How to Know What to Debit and What to Credit in Accounting

If you’re not used to speaking the language of accounting, understanding debits and credits can seem confusing at first. In this article, we will walk through step-by-step all the building

-

How to Analyze Accounting Transactions, Part One

The first four chapters of Financial Accounting or Principles of Accounting I contain the foundation for all accounting chapters and classes to come. It’s critical for accounting students to get

-

What is an Asset?

An Asset is a resource owned by a business. A resource may be a physical item such as cash, inventory, or a vehicle. Or a resource may be an intangible

-

Difference Between Depreciation, Depletion, Amortization

In this article we break down the differences between Depreciation, Amortization, and Depletion, discuss how each one is used, and what the journal entries are to record each. The main

-

What are Closing Entries in Accounting? | Accounting Student Guide

What is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to reset the balances of temporary accounts to zero and

-

What is a Liability?

A Liability is a financial obligation by a person or business to pay for goods or services at a later date than the date of purchase. An example of a