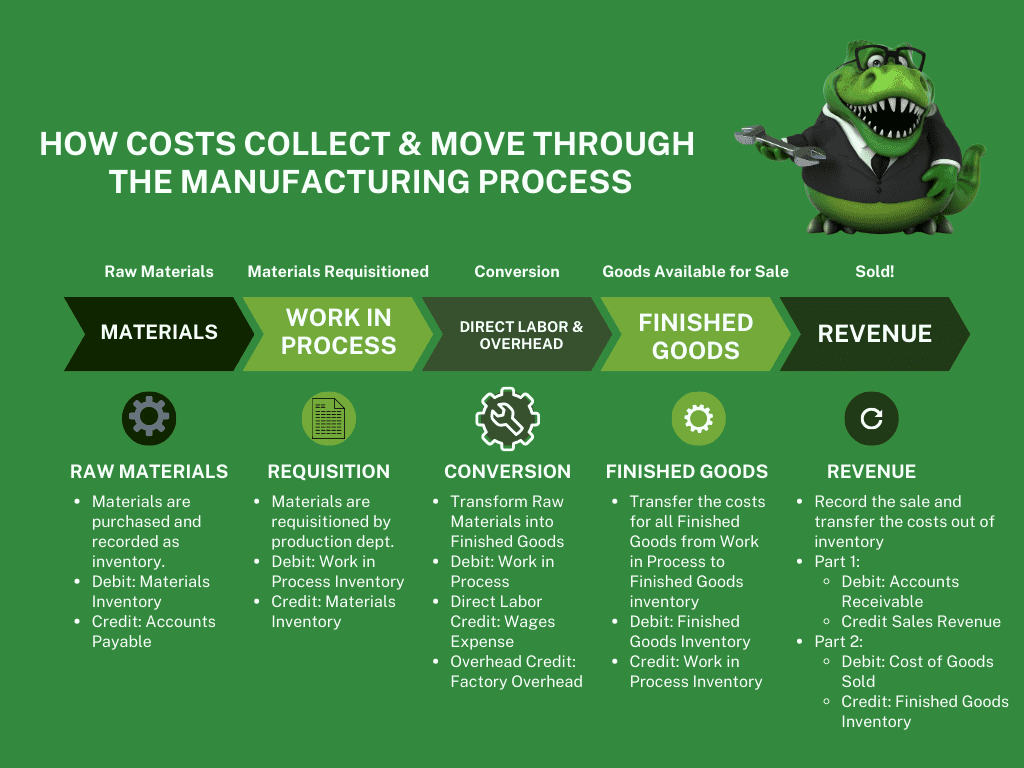

In a manufacturing business, the cost flow process starts with the raw materials, which are the basic materials used to produce goods. The raw materials are usually stored in a warehouse until they are needed for production. Once the raw materials are required for production, they are issued from the warehouse and transferred to the production department. The cost of the raw materials is recorded in the materials inventory account.

After the raw materials are issued, they are used in the production process to make a product. The production process may involve different stages, and each stage incurs additional costs. These costs are known as conversion costs, which include direct labor and manufacturing overhead.

Direct labor costs are the wages paid to workers who are directly involved in the production process. These workers may include machine operators, assemblers, and inspectors. Direct labor costs are recorded in the labor cost account.

Manufacturing overhead costs are indirect costs that are associated with the production process, such as rent, utilities, and depreciation. These costs are usually incurred by the manufacturing department and are allocated to products using a predetermined rate. The manufacturing overhead costs are recorded in the manufacturing overhead account.

As production progresses, the partially completed goods are moved to the work in process inventory account. The work in process inventory account reflects the costs associated with the partially completed goods, including the cost of the raw materials used, the direct labor incurred, and the manufacturing overhead allocated to the product.

Once production is complete, the finished goods are transferred to the finished goods inventory account. The finished goods inventory account reflects the total cost of the finished products, including the cost of the raw materials used, the direct labor incurred, and the manufacturing overhead allocated to the product.

Finally, when the finished goods are sold, the cost of goods sold account is used to record the cost of the goods that were sold. The cost of goods sold includes the total cost of the finished goods, including the cost of the raw materials used, the direct labor incurred, and the manufacturing overhead allocated to the product.

This flow chart shows how costs flow through a manufacturing business from raw materials to sales. It is important to keep track of all costs incurred during the manufacturing process to accurately calculate the cost of goods sold and to ensure that the business is profitable.

- Raw Materials: The manufacturing process begins with the purchase of raw materials, such as wood, steel, or plastic.

- Direct Materials: The raw materials are then moved to the production area where direct materials are added to the product. Direct materials are those materials that are specifically used to produce the final product, such as nuts, bolts, or fabric.

- Direct Labor: Once the direct materials are added, the product is then assembled or manufactured using direct labor. Direct labor is the cost of the workers who directly contribute to the production of the final product, such as machine operators or assembly line workers.

- Manufacturing Overhead: In addition to direct materials and labor, manufacturing overhead costs are incurred during the manufacturing process. Manufacturing overhead includes indirect costs, such as rent, utilities, and equipment depreciation.

- Work in Process: As the product is being manufactured, it moves through different stages of completion. At each stage, the product is considered to be a work in process (WIP).

- Finished Goods: Once the product is complete, it is considered to be finished goods. The cost of the finished goods includes the direct materials, direct labor, and manufacturing overhead costs that were incurred during the manufacturing process.

- Sales Revenue: The revenue from the sale of the finished goods is recorded as sales revenue.

- Cost of Goods Sold: When the finished goods are sold, the cost of goods sold (COGS) is recorded. The COGS includes the cost of the direct materials, direct labor, and manufacturing overhead that were used to produce the finished goods.