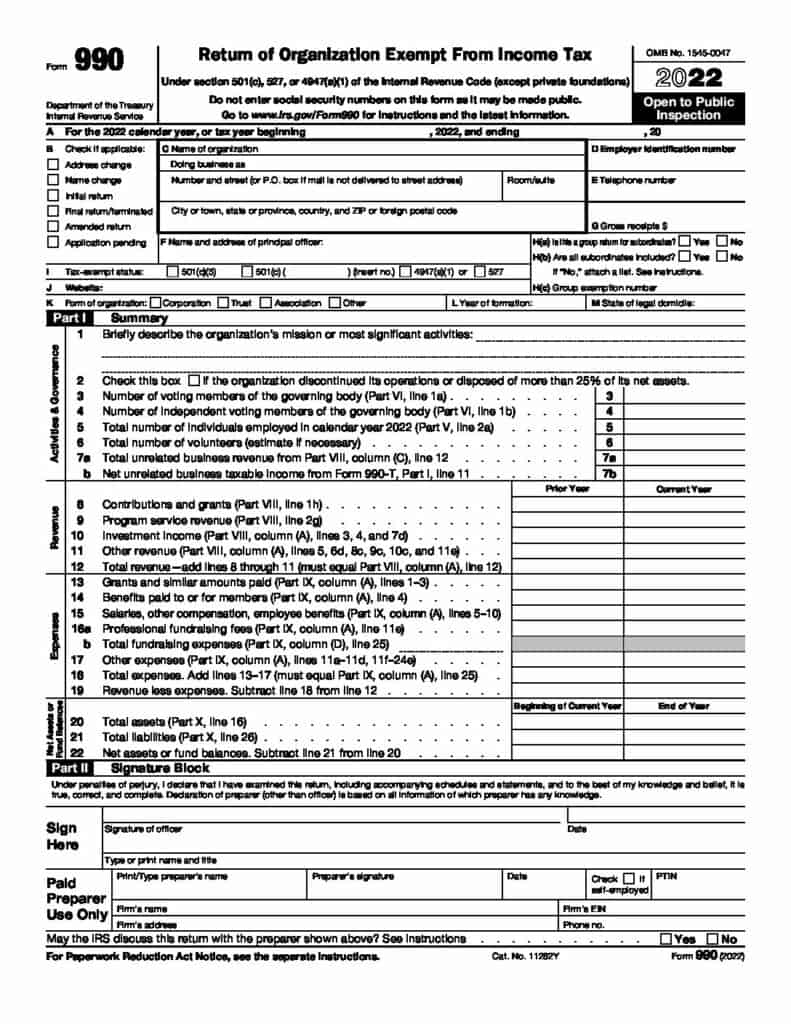

Setting up the chart of accounts for a nonprofit can be a complex task, but it can be made easier by using Form 990 mapping. Form 990 is the annual tax return that nonprofit organizations must file with the Internal Revenue Service (IRS). Form 990 includes a list of financial statement line items, which can be used as a guide to create the chart of accounts.

Setting Up the Chart of Accounts for a Nonprofit Using Form 990 Mapping

To set up the chart of accounts using Form 990 mapping, follow these steps:

- Obtain a copy of the Form 990 for your organization.

- Review the financial statement section of the Form 990 to identify the line items that are applicable to your organization.

- Create a list of accounts that correspond to each line item on the Form 990.

- Set up the chart of accounts in the accounting software, using the list of accounts you created.

- Test the chart of accounts by running financial reports to ensure that the accounts are properly set up and that the financial statements are accurate.

What are the Benefits of Form 990 Mapping?

Form 990 mapping can offer several benefits for nonprofit organizations, including:

- Time-saving: Form 990 mapping can save time by providing a pre-established chart of accounts that is specifically tailored to the organization’s activities, and that follows the IRS requirements.

- Consistency: By following a standardized chart of accounts, nonprofit organizations can ensure consistency in their financial reporting from year to year. This can help prevent errors and discrepancies in financial statements.

- Compliance: Form 990 mapping ensures that the chart of accounts is compliant with the IRS regulations and requirements, reducing the risk of penalties or legal issues for the organization.

- Transparency: Having a well-organized chart of accounts through Form 990 mapping can increase transparency and make it easier for stakeholders to understand the organization’s finances.

- Reporting: The chart of accounts established through Form 990 mapping can simplify the process of preparing and filing Form 990, as the accounts are already aligned with the IRS reporting requirements.

Using Form 990 mapping can save time and ensure that the chart of accounts is properly set up for a nonprofit organization. It is important to periodically review the chart of accounts to ensure that it is up to date and accurately reflects the financial activities of the organization.