Allowance for doubtful accounts is a contra asset account that is used to offset the accounts receivable account. It represents an estimate of the amount of accounts receivable that a company believes will not be collected from its customers.

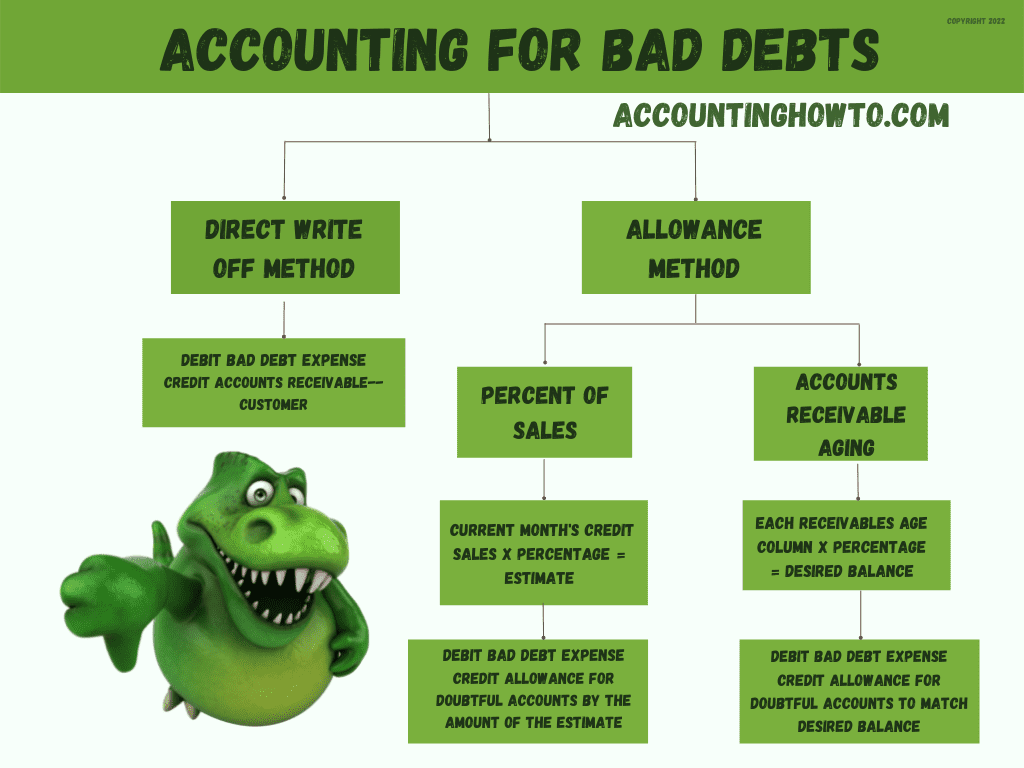

The allowance for doubtful accounts is created by estimating the percentage of accounts receivable that is expected to be uncollectible. There are two main methods used to estimate the allowance for doubtful accounts:

- Percentage of Sales Method: This method estimates the percentage of sales that will eventually become uncollectible. The company can look at its historical bad debt experience and use that percentage to estimate the allowance for doubtful accounts. For example, if a company has historically experienced bad debts equal to 2% of sales, it may estimate the allowance for doubtful accounts as 2% of its current sales.

- Aging of Accounts Receivable Method: This method involves analyzing the outstanding accounts receivable and estimating the percentage of those receivables that will eventually become uncollectible based on the length of time they have been outstanding. The older the account, the less likely it is to be collected. This method requires the company to categorize its accounts receivable by the number of days they have been outstanding.

Once the allowance for doubtful accounts has been estimated, it is recorded on the balance sheet as a contra asset account. When an account is deemed uncollectible, the company writes it off against the allowance for doubtful accounts. This reduces the accounts receivable balance and the allowance for doubtful accounts balance.

It is important for companies to regularly review and update their estimates for the allowance for doubtful accounts to ensure that it accurately reflects the company’s bad debt experience and current economic conditions.