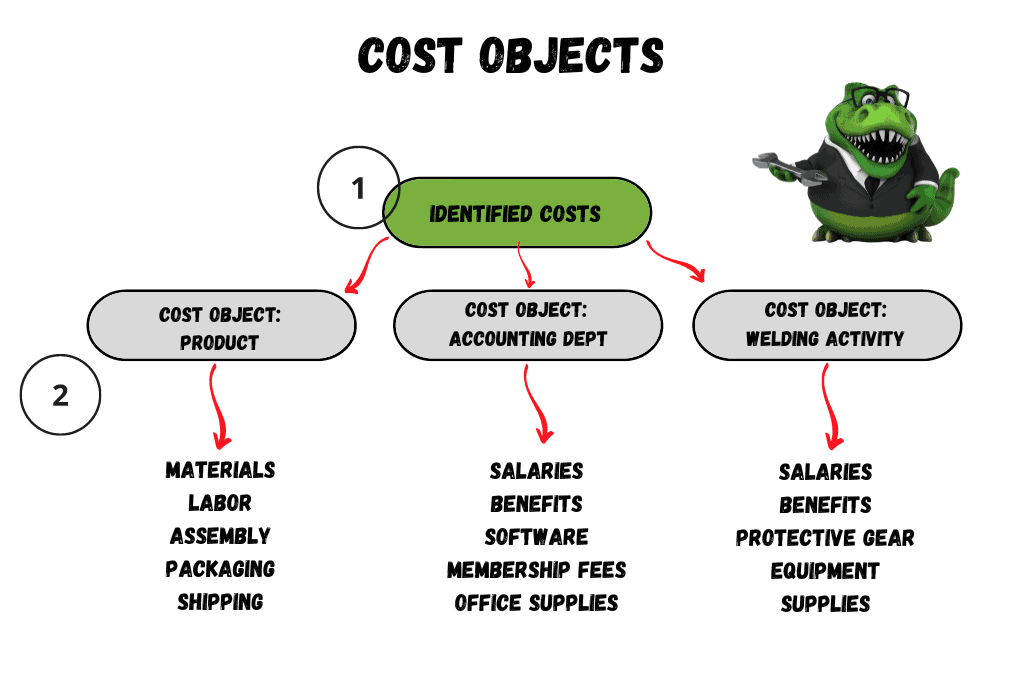

In Managerial or Cost Accounting, costs are first identified and then assigned to the part of the business that incurs the cost, the part of the business that makes those costs necessary. Cost objects are like buckets where we collect the costs associated with different parts of the business.

Collecting and assigning costs to specific parts of the business, helps us understand where costs are incurred. We can look at how efficient or profitable different parts of the business are, or what price we need to sell our products at to make them profitable.

For example, if a company manufactures two products, one that requires steel and one that does not, the cost of the steel is applied to the product requiring steel. If a company manufactures a product that needs welding, the cost of paying the welders can be assigned to that product. We wouldn’t assign the cost to the product that doesn’t use steel.

A cost object can be a product or service (manufacturing a car or a toy, pet sitting, dental cleanings), a department (sales department, accounting department), or an activity (welding, shipping.)

Determining what the cost objects are for a business is part of the managerial accounting function of a business. Those cost objects will vary depending on the business and what costs are needed to run that business.

Making Decisions Based on Cost Objects

When owners or managers of a business understand the real costs of manufacturing a product or having an in-house department (like accounting or marketing) or an activity (like welding or maintenance), the information can be used to make decisions:

- How can we reduce the cost of materials?

- How can we reduce the cost of labor?

- How can increasing efficiency impact the profit on a product?

- How can reducing waste or expenses in one area impact the overall financial health of the business?

- Is it less expensive to outsource accounting and/or payroll?

- Do we have areas of the business where we should be increasing costs? (More production workers, more efficient machinery, software that eliminates data entry.)

By drilling down into the details, cost objects help us understand the business from an operational level, rather than just looking at the “top line” (revenue) or the “bottom line” (net profit). Small tweaks in areas where costs are incurred can have a large impact on the big picture of how a business succeeds.