In Financial Accounting, the focus is on accounting that reports the profitability and financial health of the business. In Managerial or Cost Accounting, the focus shifts to understanding the details behind the numbers, and using those numbers to improve the profitability and operations of the company.

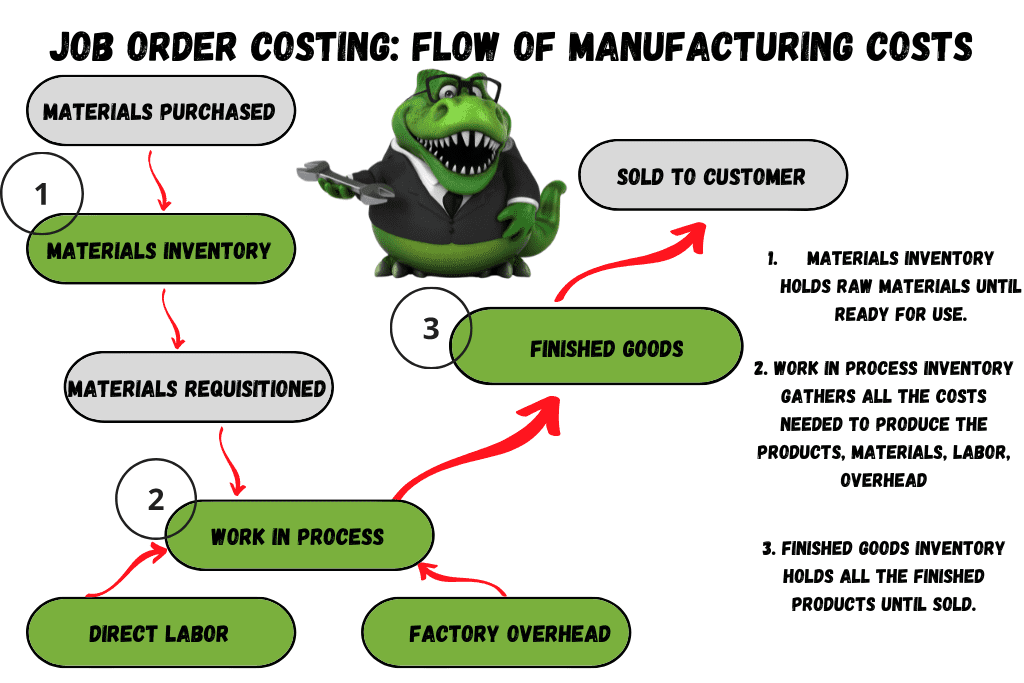

How Costs Flow through a Manufacturing Business

Costs in a manufacturing business increase as raw materials flow through the business. The costs related to manufacturing begin when raw materials are purchased. Those raw materials costs are collected in the Materials Inventory or Raw Materials Inventory account.

The costs stay in Raw Materials Inventory until the materials are requisitioned for producing products. When materials are requisitioned, the costs move out of Raw Materials Inventory and into Work in Process (WIP) Inventory.

In Work in Process Inventory more costs are added as labor costs are incurred. Added to Raw Materials costs and Direct Labor costs are Factory Overhead costs. Factory Overhead costs are those costs for running the factory–supervisor salaries, indirect materials (items such as glue, nails, and paint), factory rent, factory depreciation, and electricity.

When goods in Work in Process are finished, the costs are moved into Finished Goods Inventory. Finished Goods Inventory value is based on all the costs incurred in making the product–Raw Materials, Direct Labor, and Factory Overhead. The costs are held in Finished Goods until the product is sold to the customer.

At the point the product is sold, the costs move out of Finished Goods Inventory and in to Cost of Goods Sold.

Job Order Costing

Job order costing is a cost accounting system used to track and accumulate costs for individual customized products or services. It is typically employed by companies that produce unique, custom-made, or specialized products or provide services that vary in nature and scope. Job order costing provides a means to determine the cost of each specific job or project, enabling businesses to accurately price their products or services and assess profitability.

Key features of job order costing include:

- Unique Jobs or Projects: Job order costing is used when products or services are distinct and produced according to specific customer requirements. Each job or project is treated as a separate cost object.

- Direct Cost Accumulation: Direct costs, such as direct materials and direct labor, are directly assigned to each job or project based on the actual usage or time spent. These costs can be easily traced to specific jobs.

- Indirect Cost Allocation: Indirect costs, also known as overhead costs, are allocated to jobs using predetermined allocation rates or cost drivers. These costs include overhead expenses that cannot be directly traced to a specific job but are incurred to support the overall production or service provision.

- Job Cost Sheet: A job cost sheet is prepared for each job or project, which records all the direct and indirect costs associated with that particular job. It serves as a central record to track the costs and calculate the total cost of the job.

The job order costing process typically involves the following steps:

- Estimation: Cost estimates are made before beginning each job or project, taking into account the anticipated direct and indirect costs.

- Job Initiation: A job order is issued when a customer places an order for a specific product or requests a unique service.

- Direct Cost Accumulation: Direct materials and direct labor costs are directly assigned to the job as they are incurred. This may involve tracking the materials used and the labor hours spent on each job.

- Indirect Cost Allocation: Overhead costs are allocated to the job using an appropriate allocation base, such as direct labor hours or machine hours. This allocation is done to distribute indirect costs fairly among the different jobs.

- Job Cost Calculation: The total cost of the job is calculated by adding the direct and allocated indirect costs. This information is then used for pricing decisions, determining profitability, and evaluating job performance.

Job order costing is commonly used in industries such as construction, custom manufacturing, printing, furniture production, and professional services like architectural firms or consulting companies. It allows businesses to accurately track the costs of customized jobs, assess their profitability, and make informed decisions regarding pricing, resource allocation, and production efficiency.

Overview of How Costs Flow through Job Order Costing

Manufacturing Inventory Accounts Explained

Manufacturing inventory accounts are used to track and record the costs associated with the manufacturing process. These accounts provide information about the various stages of production and the value of inventory at each stage. The main manufacturing inventory accounts include:

- Raw Materials Inventory: This account tracks the cost of materials and components that have been purchased but have not yet been used in the production process. It includes items such as raw materials, parts, and supplies that are directly consumed in the manufacturing process.

- Work in Process (WIP) Inventory: The WIP inventory account represents the value of partially completed products at various stages of the production process. It includes the costs of raw materials, direct labor, and manufacturing overhead that have been incurred but are not yet completed products. This account captures the costs associated with converting raw materials into finished goods.

- Finished Goods Inventory: The finished goods inventory account represents the value of completed products that are ready for sale but have not yet been sold. It includes the costs of raw materials, direct labor, and manufacturing overhead that have been incurred to produce the finished products. This account reflects the value of inventory that is available for sale to customers.

These manufacturing inventory accounts are interconnected and provide valuable information for financial reporting, cost control, and decision-making. They are often reconciled and adjusted at the end of an accounting period to accurately reflect the value of inventory on the balance sheet.

It’s important to note that the specific accounts used may vary depending on the accounting system and industry. For example, in some cases, separate accounts may be maintained for different categories of raw materials, such as direct materials and indirect materials. Similarly, the WIP inventory may be classified into different stages or departments based on the production process. The accounting treatment and valuation of inventory can also be influenced by the chosen cost flow assumption, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

Overall, manufacturing inventory accounts are essential for tracking and managing the costs associated with the production process, monitoring inventory levels, and determining the financial position of a manufacturing company. They provide crucial information for evaluating profitability, assessing inventory turnover, and making informed decisions regarding production, pricing, and inventory management.

Raw Materials Inventory

Raw materials inventory refers to the stock of materials, components, or supplies that a company holds in its storage or warehouse before they are used in the production process. Raw materials are the basic inputs or resources required to manufacture or produce finished goods.

Here are some key points about raw materials inventory:

- Definition: Raw materials inventory includes items such as raw materials, components, parts, subassemblies, or supplies that are directly used in the manufacturing or production process. These materials have not yet undergone any transformation or processing and are in their original state.

- Types of Raw Materials: The specific types of raw materials included in the inventory depend on the nature of the company’s operations and the industry it operates in. Examples of raw materials can include metals, chemicals, plastics, wood, textiles, electronic components, and any other materials specific to the production of the company’s products.

- Purchasing and Receiving: Raw materials inventory is acquired through the purchasing process. When materials are ordered from suppliers, the inventory is increased upon receipt and inspection of the materials. Proper controls and documentation, such as purchase orders, receiving reports, and quality checks, are typically in place to ensure the accuracy and quality of the materials received.

- Storage and Tracking: Raw materials inventory is stored in designated areas within the company’s facilities. Adequate storage conditions are maintained to protect the materials from damage, deterioration, or theft. Inventory management systems or software may be used to track the quantities, locations, and movements of raw materials within the inventory.

- Cost and Valuation: Raw materials inventory is recorded at cost, which includes the purchase price of the materials, transportation or shipping costs, and any other costs directly attributable to bringing the materials to the storage location. The valuation of raw materials inventory is based on the lower of cost or net realizable value, considering factors such as obsolescence, spoilage, or market conditions.

- Usage and Replenishment: As the production process progresses, raw materials are issued from the inventory to be used in manufacturing. The quantity of materials used is recorded, and the corresponding costs are transferred to the work in process or production accounts. Replenishment of the raw materials inventory occurs through new purchases or additional deliveries from suppliers to maintain adequate stock levels.

Effective management of raw materials inventory is essential for ensuring smooth production operations, minimizing disruptions, and controlling costs. Companies aim to strike a balance between having enough inventory to meet production demands without excessive holding costs or the risk of obsolete or perishable materials. Accurate inventory tracking and regular monitoring of raw materials usage and replenishment are crucial for efficient production planning and cost management.

Work in Process Inventory

Work in process inventory, also known as WIP inventory, refers to the inventory of partially completed products in a manufacturing or production process. This type of inventory is an essential aspect of accounting for manufacturing and production businesses as it helps to determine the cost of goods sold.

In simpler terms, work in process inventory is the value of raw materials, labor, and overhead that have been used to create unfinished goods. These goods are not yet ready to be sold as they require additional work before they can be considered finished products.

Here’s a closer look at work in process inventory, including how it’s calculated and why it’s important for businesses:

Work in process inventory refers to any partially completed products that are still undergoing the manufacturing or production process. This type of inventory includes any raw materials, labor, and overhead costs that have been incurred in the production process up to the point that the goods are still considered unfinished.

For example, consider a furniture manufacturer that produces custom tables. Work in process inventory for this business might include partially finished tables that have been sanded and stained, but still need legs attached and a final finish applied.

Finished Goods Inventory

Finished goods inventory refers to the stock of completed and fully manufactured products that a company holds before they are sold to customers. It represents the final stage of the production process, where the goods are ready for distribution and consumption.

Here are some key points about finished goods inventory:

- Definition: Finished goods inventory consists of products that have undergone all required manufacturing or production processes, including assembly, packaging, quality control, and any other necessary operations. These goods are in their final form and are ready to be sold to customers.

- Types of Products: The specific types of finished goods included in the inventory depend on the nature of the company’s operations and the industry it operates in. It can encompass various consumer goods, industrial products, electronics, clothing, furniture, food items, or any other finished products that the company produces.

- Production Completion: When goods are completed and meet the required quality standards, they are moved from the work in process or production accounts to the finished goods inventory. This transfer represents the conversion of raw materials and labor into finished products.

- Storage and Tracking: Finished goods inventory is typically stored in designated warehouses or distribution centers. The inventory is organized, labeled, and tracked using inventory management systems or software to monitor quantities, locations, and movements. This facilitates efficient order fulfillment and inventory control.

- Cost and Valuation: Finished goods inventory is recorded at cost, which includes all direct costs (e.g., direct materials, direct labor) and allocated indirect costs (e.g., factory overhead) associated with producing the goods. The valuation of finished goods inventory is based on the lower of cost or net realizable value, considering factors such as market demand, pricing, and potential obsolescence.

- Sales and Distribution: When customer orders are received, the goods are selected from the finished goods inventory for packaging, shipping, and delivery. The quantity and cost of goods sold are recorded, and the corresponding revenue is recognized in the sales accounts. Replenishment of finished goods inventory occurs through the production and completion of additional units.

For more on how costs and goods move through the inventory of a factory, watch this video:

Manufacturing Costs Explained

Manufacturing costs are generally divided into three segments: Direct Materials, Direct Labor, and Factory Overhead. Factory Overhead includes the indirect costs involved in producing a product. Examples of Factory Overhead include depreciation on factory equipment, supervisors’ salaries, and maintenance.

Direct Materials

Direct materials refer to the raw materials or components that are directly and visibly incorporated into a finished product. These materials are used in the manufacturing or production process and can be easily identified and quantified in the final product. Direct materials are a specific type of direct cost in managerial accounting and are crucial for calculating the cost of goods sold (COGS).

Here are a few key characteristics of direct materials:

- Physical Incorporation: Direct materials are physically transformed or incorporated into the finished product. They become an integral part of the product and can be identified and measured in the final output.

- Tracing and Tracking: Direct materials can be easily traced and assigned to a specific product or production process. Their usage and consumption can be accurately measured and monitored.

- Significance: Direct materials typically represent a substantial portion of the total cost of a product. The cost of direct materials can have a significant impact on the profitability and pricing decisions of a company.

Examples of direct materials vary depending on the industry and the specific product being manufactured. Here are a few examples across different sectors:

- Manufacturing Industry: For a furniture manufacturer, direct materials may include wood, fabric, screws, upholstery foam, springs, and varnish.

- Food Industry: In a bakery, direct materials could consist of flour, sugar, butter, eggs, yeast, and other ingredients used in the production of bread or pastries.

- Construction Industry: Direct materials in construction could include cement, steel, bricks, wiring, pipes, and other materials that are directly used in building structures.

Direct materials are typically accounted for in the product’s bill of materials (BOM) or recipe, which lists all the necessary materials and their quantities required to manufacture a specific product. By accurately tracking and managing direct materials, companies can determine their material costs, control inventory, ensure efficient production, and calculate the accurate cost of goods sold.

Direct Labor

Direct labor refers to the wages, salaries, and benefits of employees who are directly involved in the production or manufacturing process of a product or the delivery of a service. These employees directly contribute to the creation or completion of a specific product or service and can be easily identified with the final output. Direct labor is a type of direct cost in managerial accounting and is essential for determining the total cost of goods sold (COGS).

Here are some key features of direct labor:

- Direct Involvement: Direct labor includes the efforts of employees who directly work on the production or service delivery process. They are involved in tasks such as assembling, manufacturing, operating machinery, testing, packaging, or providing hands-on services.

- Tracing and Measurement: Direct labor can be accurately traced and measured for a particular product or service. The time and labor expended by these employees can be quantified and assigned to the specific cost object.

- Cost Incurrence: Direct labor costs arise from the payment of wages, salaries, and related benefits to employees engaged in the direct production or service activities. These costs are directly associated with the labor required to bring the product or service to completion.

Examples of direct labor vary across industries and businesses. Here are a few examples:

- Manufacturing Industry: In an automobile manufacturing plant, direct labor would include assembly line workers, machine operators, welders, and quality control inspectors who directly contribute to the production of cars.

- Service Industry: In a restaurant, direct labor would encompass the chefs, cooks, waiters, and bartenders who are directly involved in food preparation, serving customers, and delivering the dining experience.

- Construction Industry: Direct labor in construction involves the workers on the construction site, such as carpenters, plumbers, electricians, and masons, who directly contribute to the building process.

Direct labor costs are typically tracked based on hours worked or production units completed. By accurately accounting for direct labor costs, businesses can determine the labor component of the total cost of a product or service, assess labor productivity, allocate costs to different cost objects, and evaluate the efficiency of their labor utilization.

Factory Overhead

Factory overhead is a term used in accounting to describe the indirect costs of operating a manufacturing plant or factory. These costs are incurred during the production process but are not directly associated with the production of a specific product. Instead, they are the costs associated with running and maintaining the factory or plant.

There are several types of costs that fall under the umbrella of factory overhead, including:

- Indirect materials: These are materials that are used in the manufacturing process but are not directly included in the product. For example, cleaning supplies, lubricants, and other small tools.

- Indirect labor: This refers to the wages and benefits paid to workers who do not directly work on the production line. This includes maintenance workers, supervisors, and other support staff.

- Factory utilities: These are the costs associated with operating the factory, including electricity, water, gas, and other utilities.

- Depreciation: This is the gradual loss of value of assets over time. In the case of a factory, this includes the depreciation of machinery and equipment used in the manufacturing process.

- Rent and property taxes: The cost of leasing or owning a factory building and the associated property taxes are also included in factory overhead.

All of these costs are essential for running a manufacturing plant or factory, but they cannot be directly attributed to the production of a specific product. As a result, they are considered indirect costs and are included in the factory overhead.

Calculating factory overhead is essential for determining the total cost of producing a product. By including all indirect costs associated with the manufacturing process, a company can accurately determine the total cost of each product and make informed decisions about pricing and profitability.

For more about manufacturing costs, watch this video:

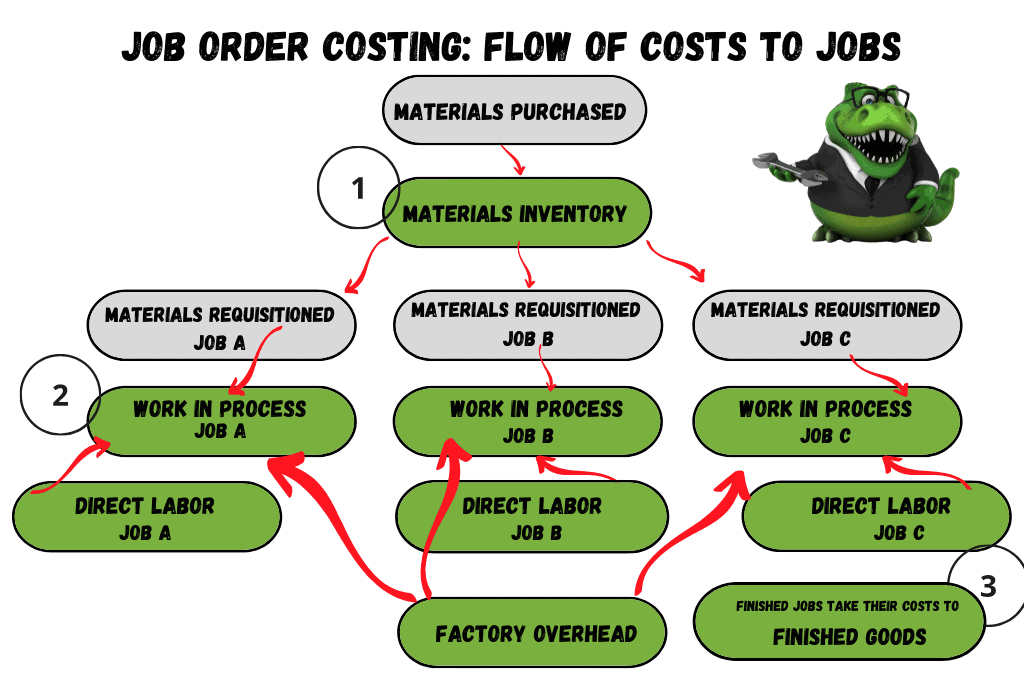

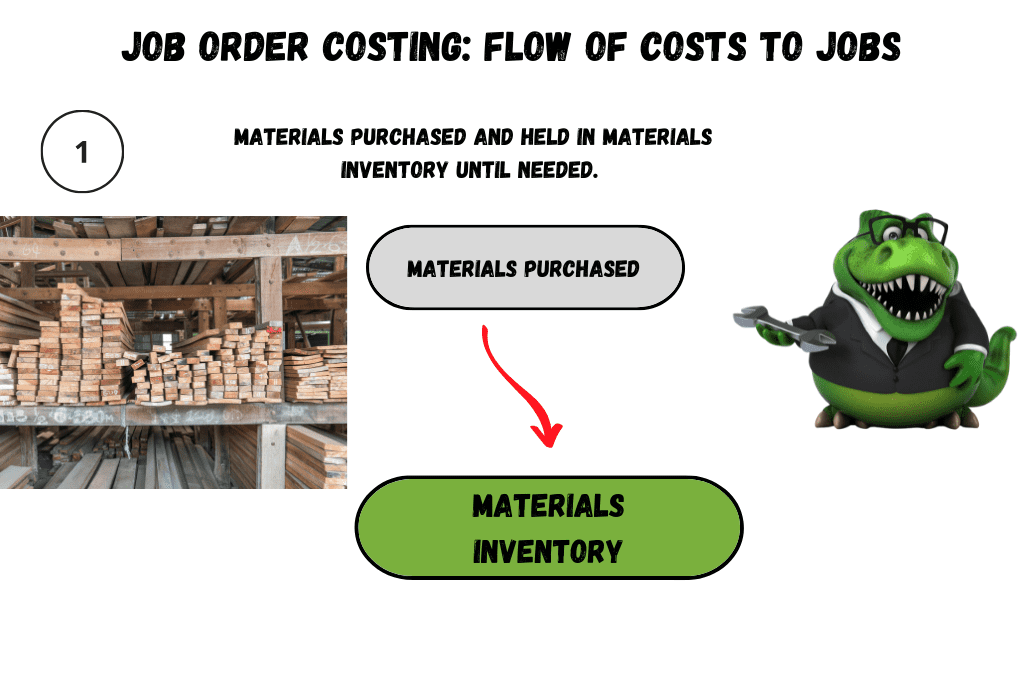

Step One

Materials purchased and held in Raw Materials Inventory until needed.

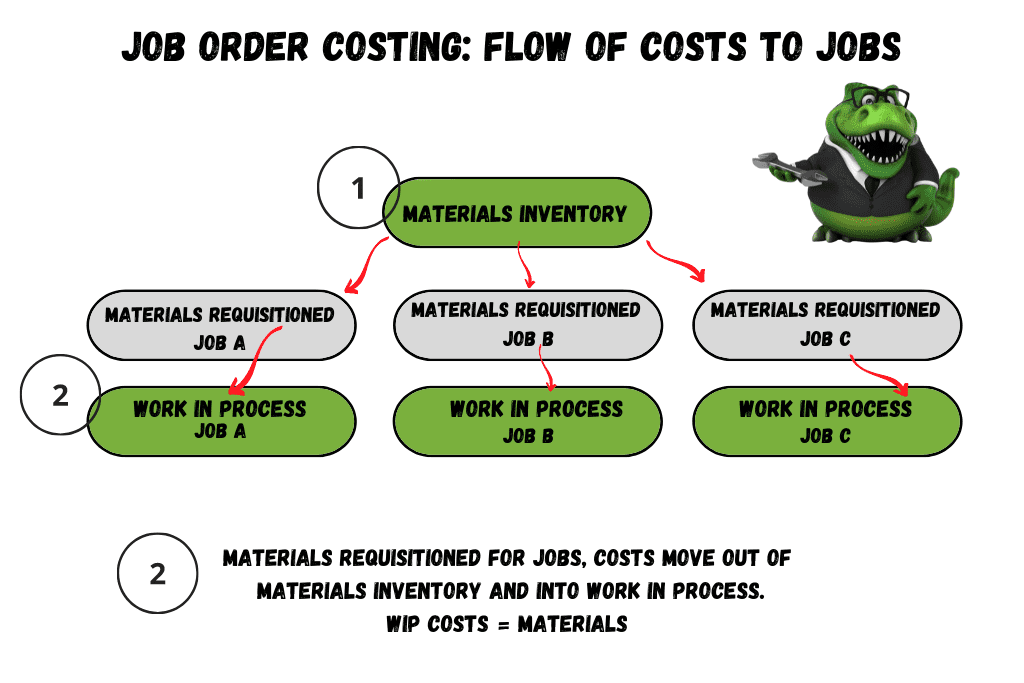

Step Two

Materials are requisitioned for specific jobs. The costs of the materials move out of Raw Materials Inventory and into the Work in Process Inventory account.

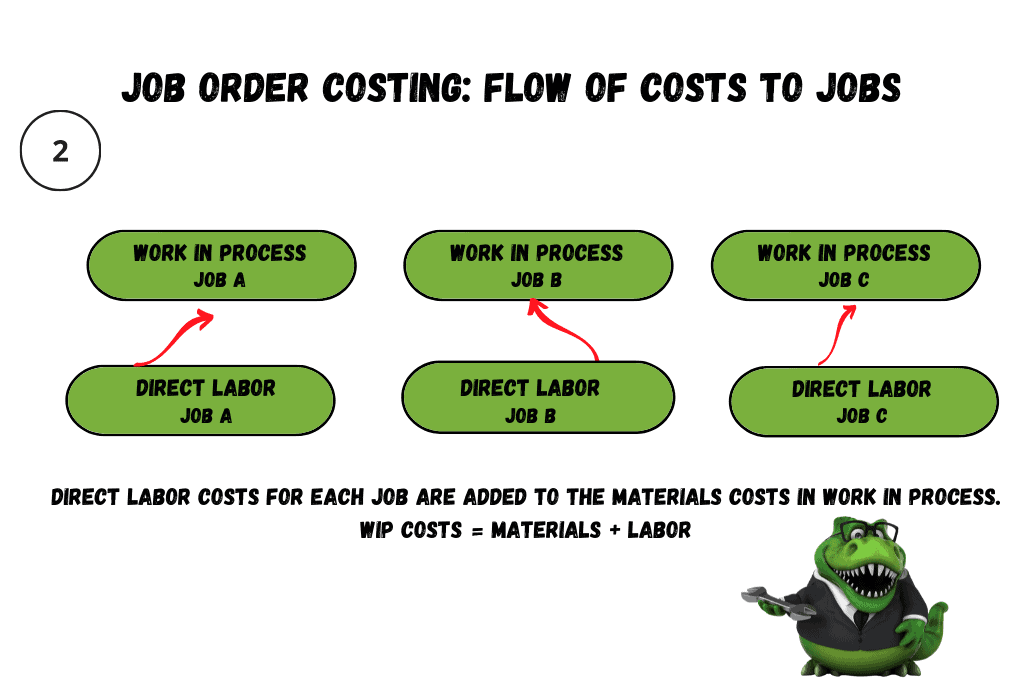

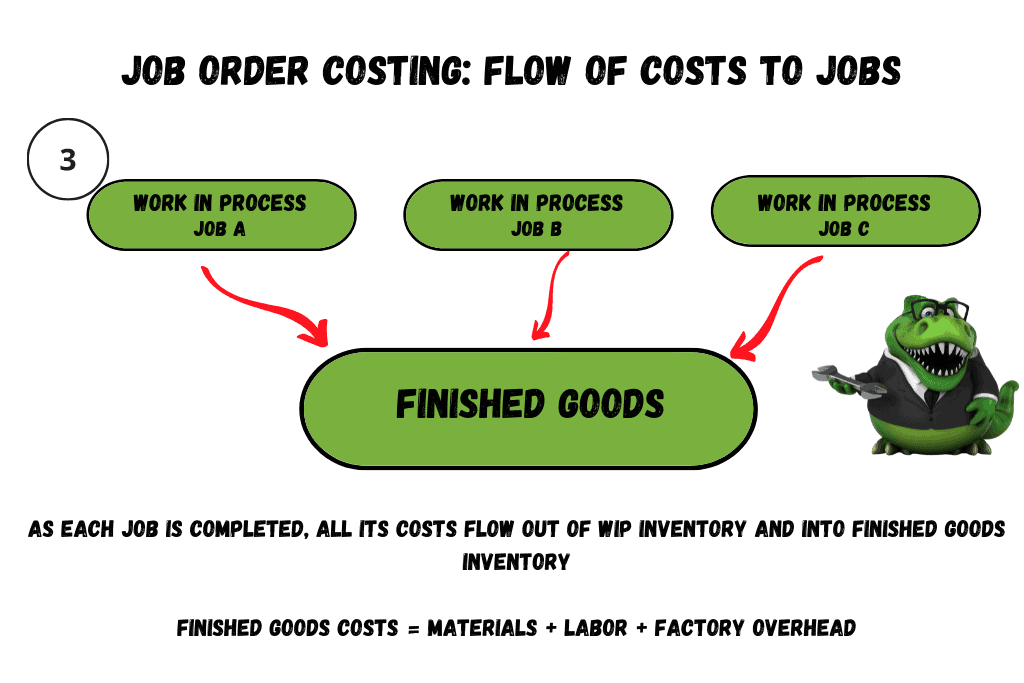

Step Three

Direct Labor costs for each specific job are added to the material costs (from Step 2) in Work in Process.

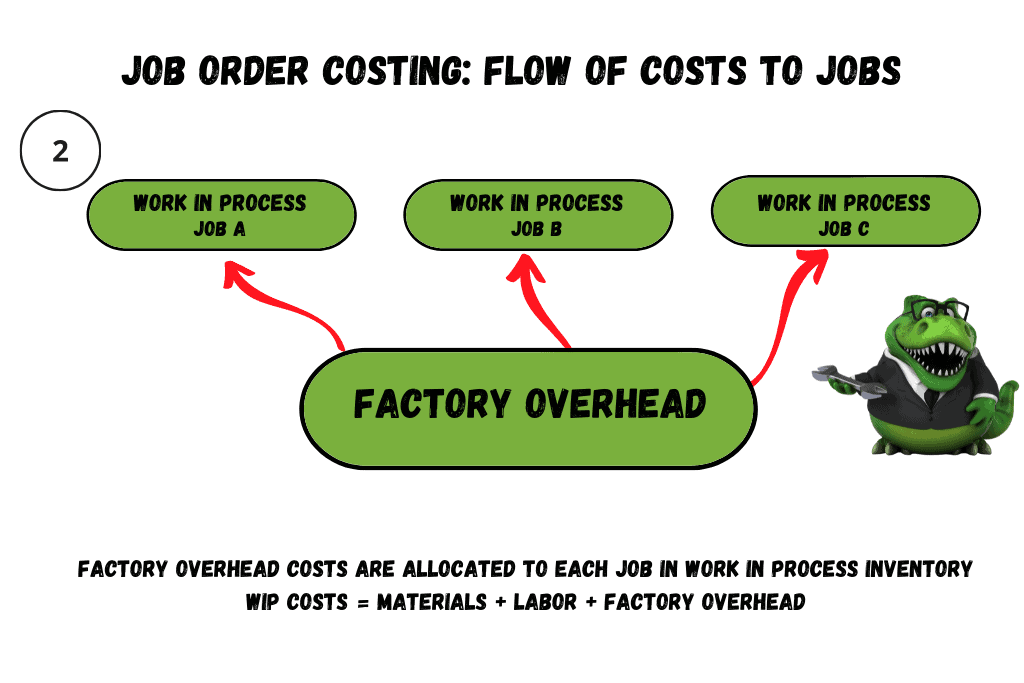

Step 4

Factory Overhead costs are allocated to each job.

Step 5

As each job is completed, all its associated costs flow out of Work in Process Inventory and into Finished Goods Inventory.

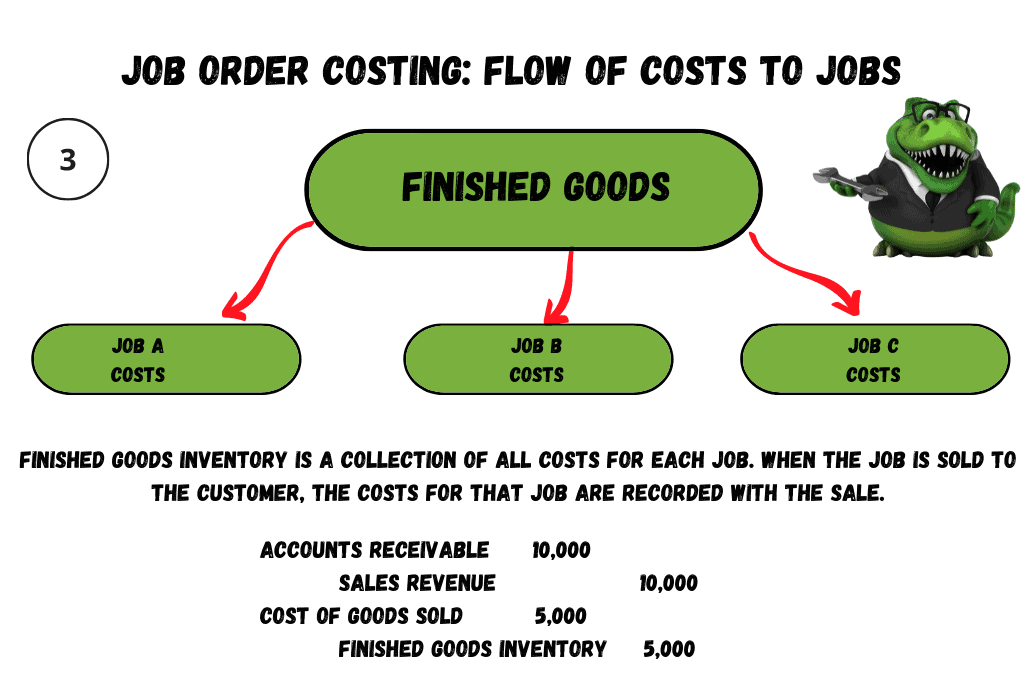

Step 6

Finished Goods Inventory is a collection of all costs for each specific job. When the job is sold to the customer, the costs for that job are reduced from Finished Goods Inventory and moved into Cost of Goods Sold. At the same time, the sale is recorded as revenue.