Filling out 1099-NEC forms (formerly 1099-MISC forms) for your subcontractors can be a hassle. Learn how to get this task done with free or low-cost options.

If you use subcontractors or independent service providers to complete work for your small business, the IRS requires you to prepare and submit a 1099-NEC (formerly 1099-MISC) for any unincorporated businesses or individuals who received $600 or more in nonemployee compensation. The forms are required to be filled out and sent out by January 31st to any independent entities who meet the income threshold. An additional copy needs to be submitted to the IRS by January 31st along with a summary form called a Form 1096. Forms can be submitted electronically or as paper returns.

What is an IRS 1099-NEC form?

A 1099-NEC form is used to report money your business paid to “nonemployees.” Some examples are:

- Hiring a plumber to make a repair in your office building.

- Hiring an accountant to do your taxes.

- Hiring a marketing consultant to manage your social media.

- Hiring a cleaning service to clean your office.

A 1099-NEC form reports these expenses for any subcontractor or independent contractor who received $600 or more from you. If a business you hire is a corporation, you don’t need to provide a 1099-NEC.

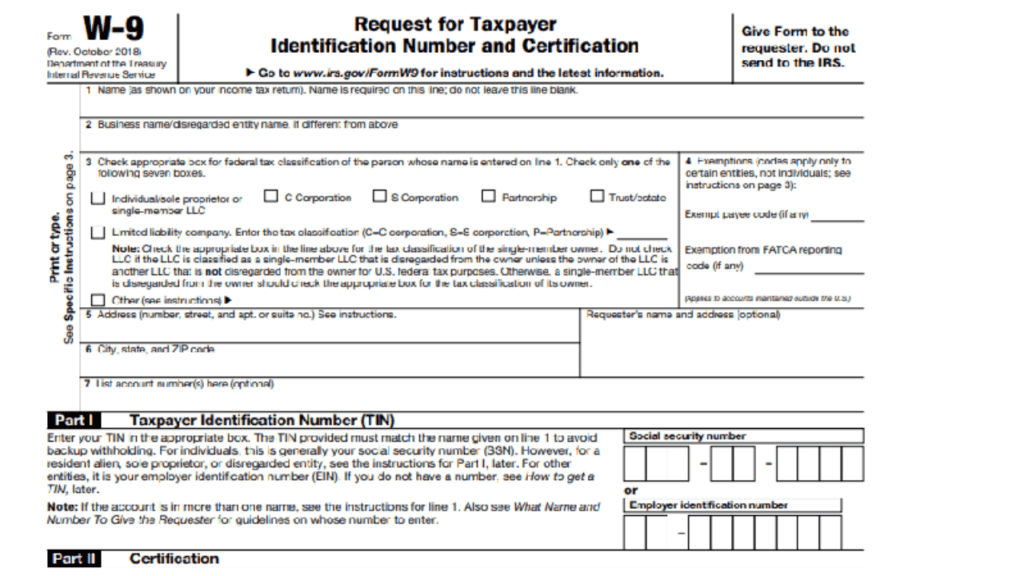

How Do You Know if a Subcontractor is Incorporated or Not?

Whenever you are doing business with a new vendor, it’s important to have that vendor fill out a Form W-9. The W-9 captures the name, address, Employer Identification Number (EIN) or Social Security Number (SSN), and legal form of the business (sole proprietor, partnership, LLC, Corporation.) This gives you everything you need to know to determine whether the business or individual should get a 1099.

W9s are available directly from the IRS as both a printable form or a fillable form.

W9 Form

Get the form here:

https://www.irs.gov/pub/irs-pdf/fw9.pdf

W9 Instructions

https://www.irs.gov/pub/irs-pdf/iw9.pdf

The best practice is to have your vendors fill out their form before you pay them. In some industries, it is common for fly-by-night operators to refuse to fill out the form or to “disappear into the night” when it comes time to receive a 1099. (They are trying to avoid paying taxes.) By requiring the form be returned before payment can be issued, you can ensure that your business is compliant with the requirements for issuing 1099s.

If you do not have a Form W-9 for some or all of your vendors, you’ll need to contact them to have them fill one out. There are penalties for not filing, late-filing, or incorrectly filing your 1099s so as a business owner this is a very important task.

Complete IRS instructions for all 1099 Forms including 1099-NEC.

https://www.irs.gov/pub/irs-pdf/i1099gi.pdf

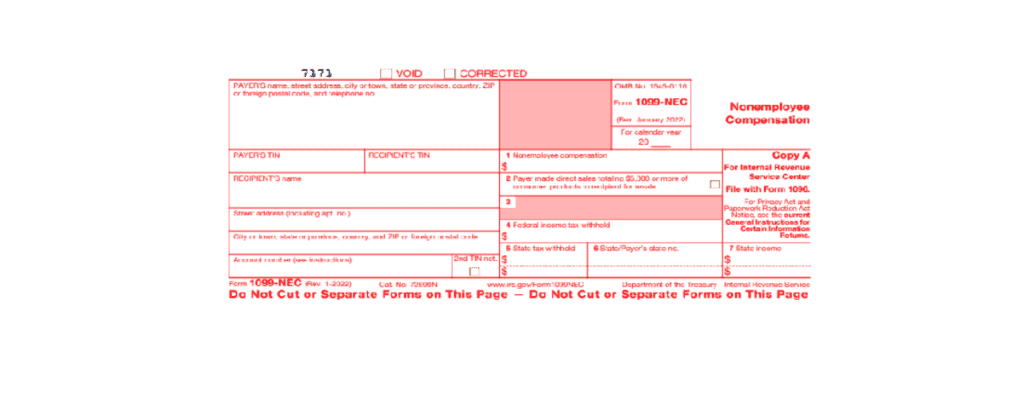

What Information is Reported on 1099-NEC?

The information you will need to fill out the 1099-NEC includes:

- Your business name and address

- Your business Employer Identification Number (EIN) or if you are a sole proprietor, your Social Security Number (SSN). (If you don’t have an EIN, you can get one here. It’s free and prevents you having to use your SSN on forms like these. Any U.S. business can get one, regardless of whether it has employees.)

- Your vendor or subcontractor’s Name, EIN or SSN, the amount paid to them, and any taxes you withheld from that amount (uncommon, this will usually be left blank.)

How Do You Create Form 1099-NEC?

A variety of options exist for creating Form 1099-NEC. Some options are free and others are low-cost. Here are some options to consider.

- Free Paper Forms

The cheapest way to prepare 1099s is to order free forms from the IRS. Order forms here: https://www.irs.gov/forms-pubs/order-products.

- There may be delays in receiving the forms in time to meet the deadline.

- If you don’t have accounting software, using these forms will require creating a template to print the forms, or fill them out manually.

- You may be able to get 1099 forms from your local library or a CPA, accountant, or bookkeeper in your area.

- Note: don’t use the sample 1099-NEC form from the internet. The red copy A needs to be scannable by the IRS and the sample form will not be if it’s printed.

- Purchase Paper Forms

- You’ll receive them more quickly.

- Work with most accounting software.

- Some paper forms come as a kit that includes software.

This brand of form works with accounting software or by creating your own template. (I’ve used it with QuickBooks and it worked well for me.) Check out current pricing on Amazon: https://amzn.to/331OBu9

- Use a 1099 Online Software Service

- Integrates with accounting software including QuickBooks Online and Desktop, Sage, Freshbooks, and Xero.

- Works well without accounting software, too. You manually enter your details.

- Depending on the company, pricing may be a base price + per form pricing or flat cost per form.

- Here’s an IRS-approved service I’ve used in my accounting practice that’s worked well (not an affiliate, just a fan):

- Accounting software

- Most major accounting software packages include a 1099 module.

- Information pulls directly from payment data into the 1099.

- Options are available to electronically file reports to IRS and to email or mail reports to subcontractors.

- Cost varies depending on the number of forms. Usually a base price plus a per form price over a certain number of forms.

- Use Your Payroll Company’s Service

- If you already use a payroll company to process your payroll, most payroll companies also offer a 1099 service as well.

- If you have your payroll company issue checks to subcontractors, the information is readily available for the payroll company to issue the 1099 forms.

- If your payroll company doesn’t issue checks for you to subcontractors, you’ll need to provide W-9 information and amounts paid.

- Accountant/Bookkeeper

- Your accountant, bookkeeper, or tax preparer is able to create and file the forms for you, too.

- If you have accounting software, the information can be pulled directly to fill out the forms.

Recommended Method for Completing 1099-NEC Forms

- If you already have accounting software, complete forms using the software, file electronically, and let the software do its job. The cost is small compared to the headaches of chasing forms and moving data around.

- If you don’t have accounting software, use a service like https://www.tax1099.com/.

- If you don’t have accounting software, and you’d like to explore your options, start here: https://quickbooks.grsm.io/1099

This blog may contain affiliate links. When you purchase something using an affiliate link, we receive a small commission which helps to keep our blog and YouTube channel going. We appreciate the support.

-

How to Create 1099-NEC Forms – Free and Low-Cost Options (2022)

Filling out 1099-NEC forms (formerly 1099-MISC forms) for your subcontractors can be a hassle. Learn how to get this task done with free or low-cost options. If you use subcontractors

-

What is Equity in Accounting and Finance?

In Accounting and Finance, Equity represents the value of the shareholders’ or business owner’s stake in the business. Equity accounts have a normal credit balance. Equity increases on the credit

-

Understanding Financial Statements | Accounting Student Guide

What is a Financial Statement? Financial Statements are a set of reports summarizing the activities of a business or organization. Much like a series of x-rays shows different views of

-

What is Treasury Stock?

Treasury Stock represents a corporation’s stocks that were previously issued and sold to shareholders. The corporation reacquires the stock by purchasing the stock from shareholders. Treasury Stock reduces the number

-

What is Stockholders’ Equity?

Stockholders’ Equity is the difference between what a corporation owns (Assets) and what a corporation owes (Liabilities). Stockholders’ Equity is made up of Contributed Capital and Earned Capital. Contributed Capital

-

What is Paid in Capital?

What is Contributed or Paid-in Capital? Contributed Capital is also called Paid-in Capital. It includes any amounts “contributed” or “paid in” by investors or stockholders through purchasing of stocks or